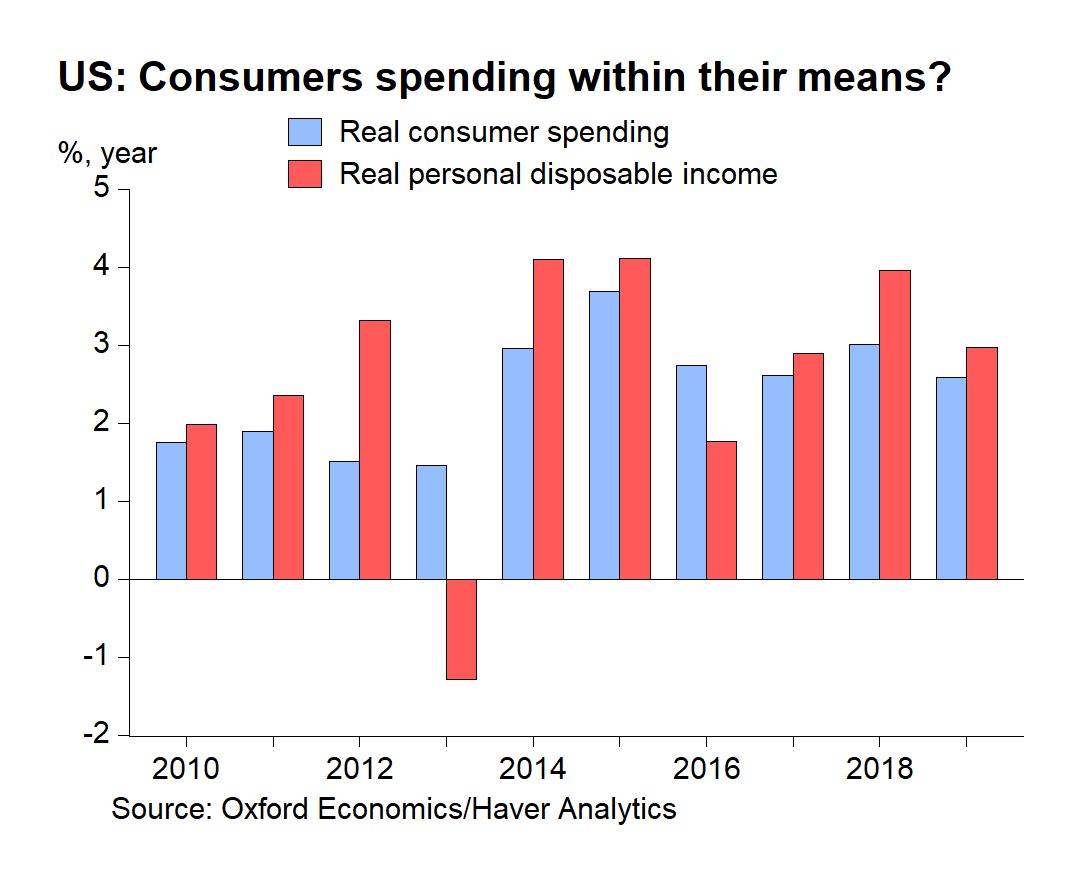

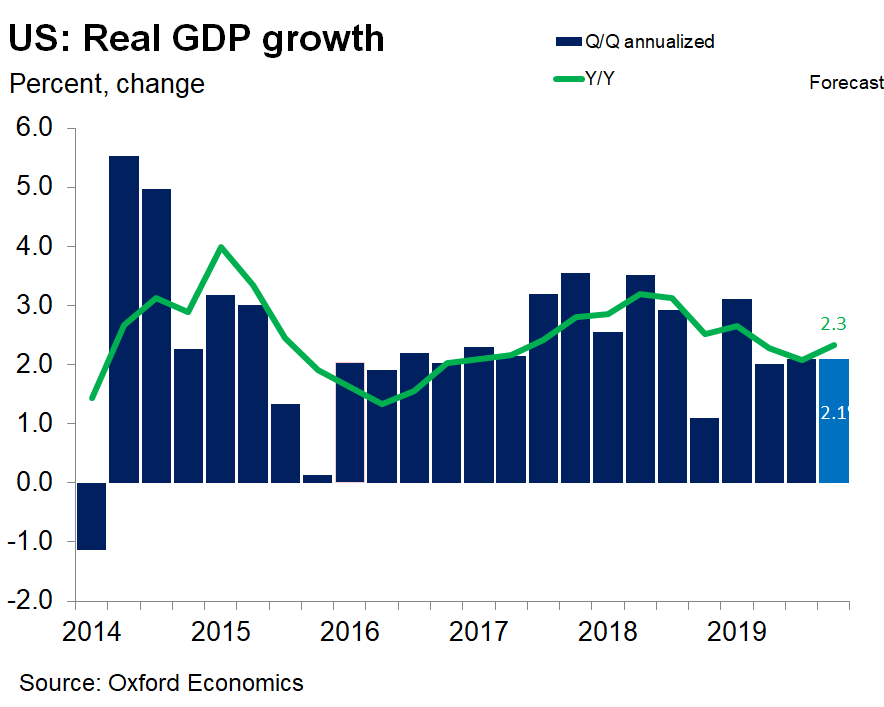

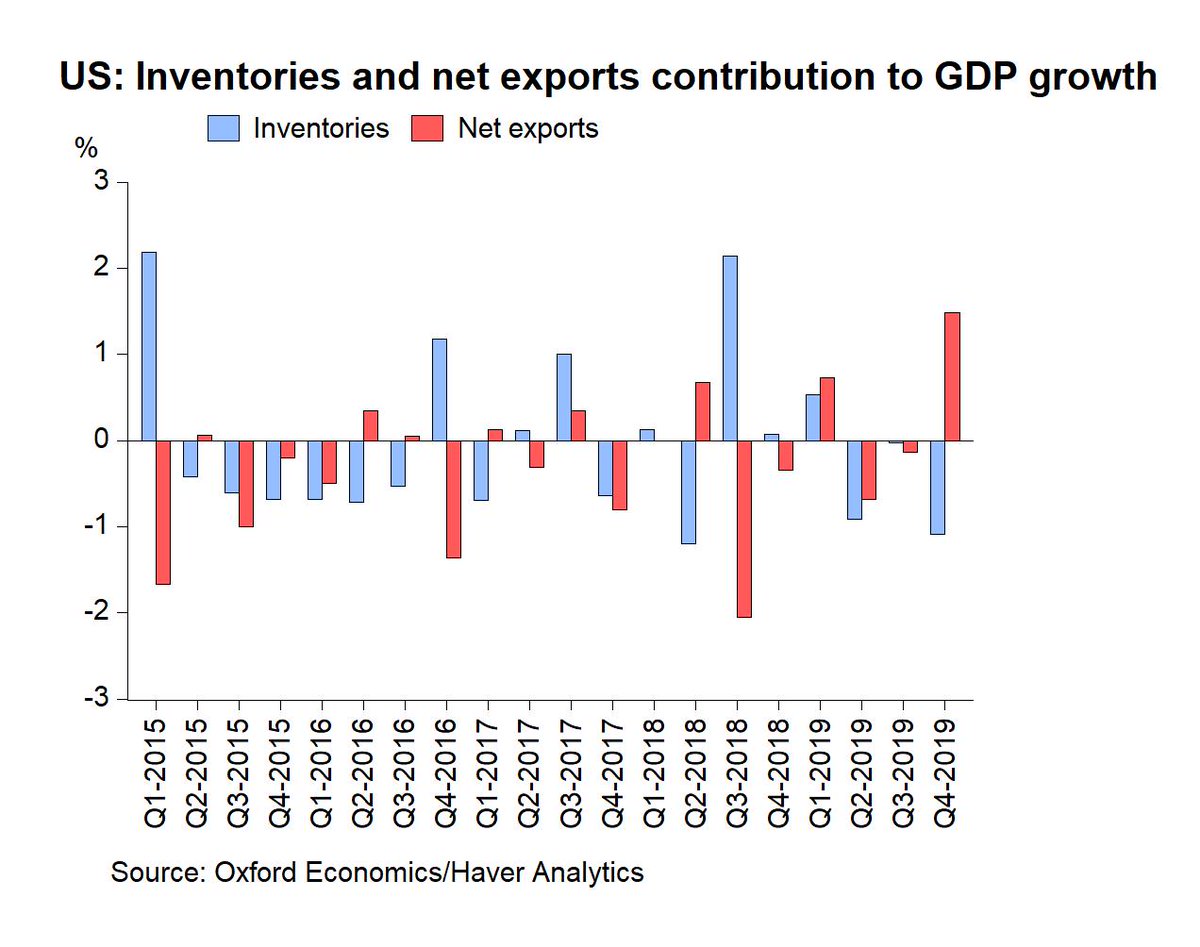

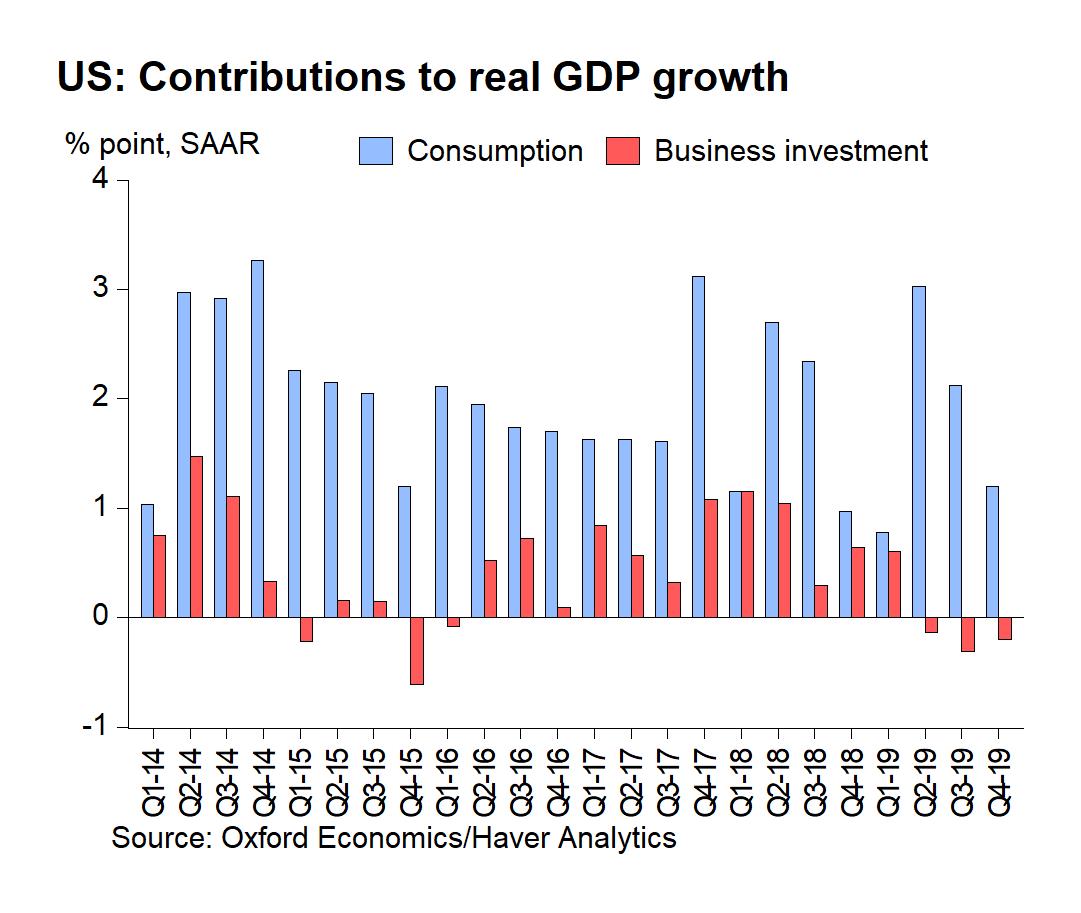

More than 70% of Q4 advance came from temporary collapse in imports, business investment subdued & consumers + cautious

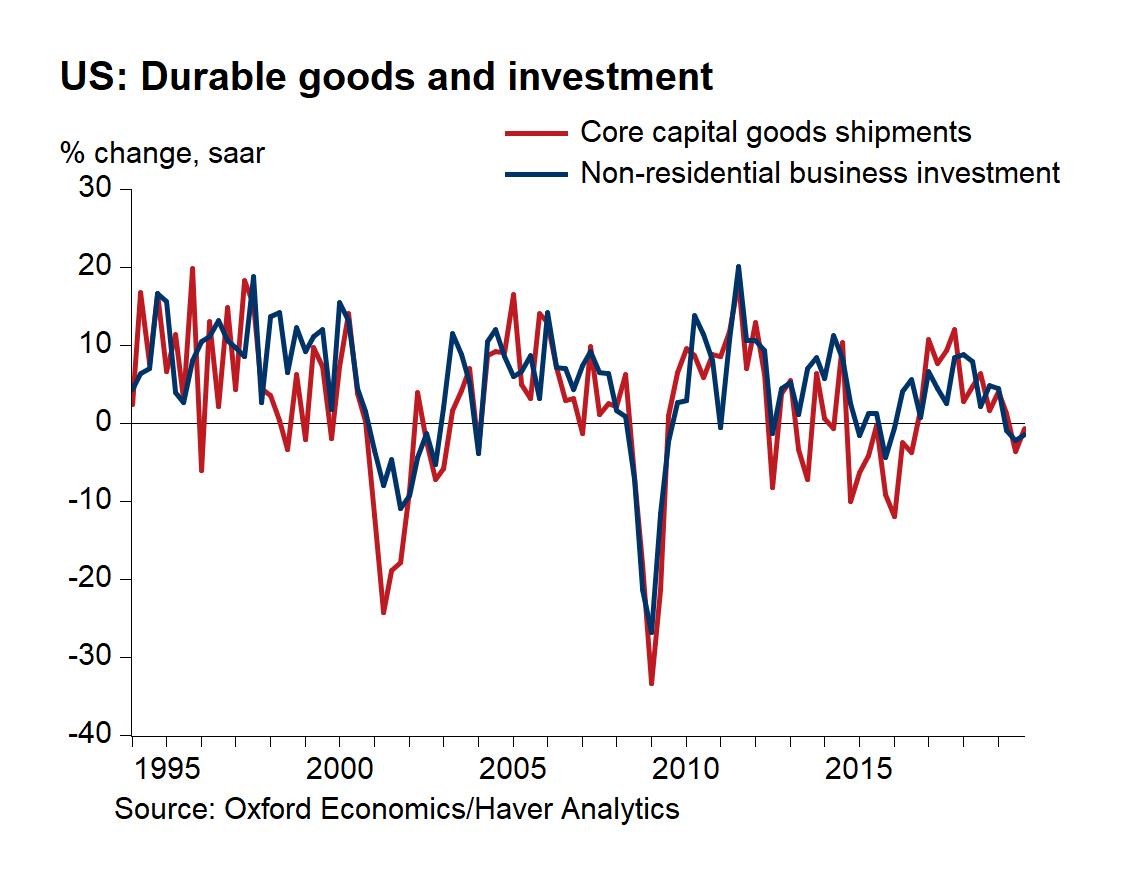

Biz facing worst outlook since '16 w/ lingering headwinds from global growth, #trade protectionism, policy uncertainty, dollar & energy

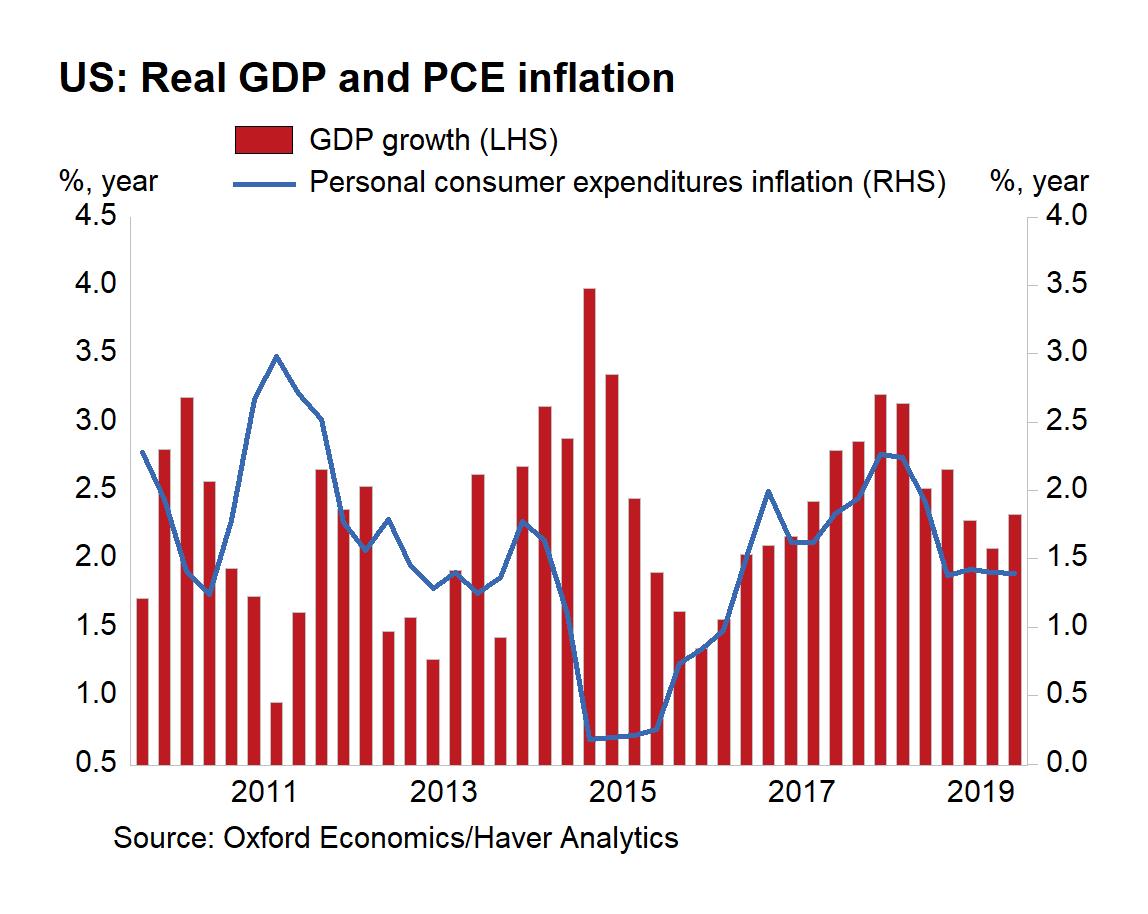

Persistent inflation undershoot, weakened inflation expectations & lingering softness in US econ activity will bolster case for additional mid-yr #Fed cut