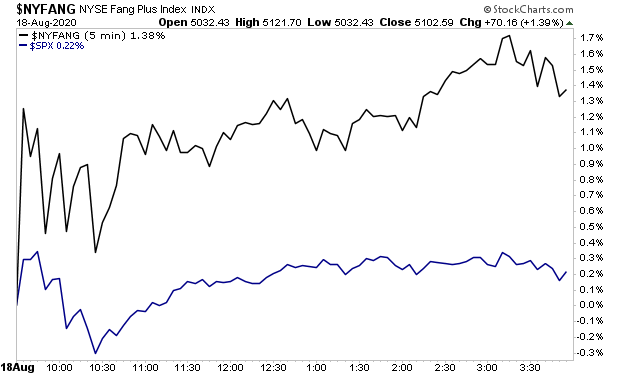

#swissbank #softbank #boj #norgesbank are large buyers of these stocks

Apple hit a market cap of $2 trillion, doubling in valuation in just over two years.

All of Apple’s second $1 trillion came in the past 21 weeks...

Investors have started seeing Apple's business less like other hardware makers and more like a software company, as indicated by Apple's quickly rising price-earnings ratio, which is now over 33

On March 23, the stock market’s nadir this year, the Federal Reserve announced aggressive new measures to calm investors.

Apple has also wielded another powerful tool to boost its valuation and enrich its investors and executives

The law saved it $43 billion in taxes on the move, according to the Institute on Taxation and Economic Policy.

@threadreaderapp

Unroll