For those who follow order books and see HUGE sellers at certain price levels and shy away because there are sellers;

Note: If there are no sellers there will be no buyers.

continued...

Note: If there are no sellers there will be no buyers.

continued...

When a fund wants to build a position in a stock, the fund manager wants to be able to buy "enough" of the stock at reasonable prices, without pushing the stock higher.

A big chunk offered in the market is a blessing for the deep pockets to enter into position.

A big chunk offered in the market is a blessing for the deep pockets to enter into position.

That is why when I see large amount of sellers at certain price (especially if it is a significant resistance on price charts) I'm more convinced that a breakout might be around the corner.

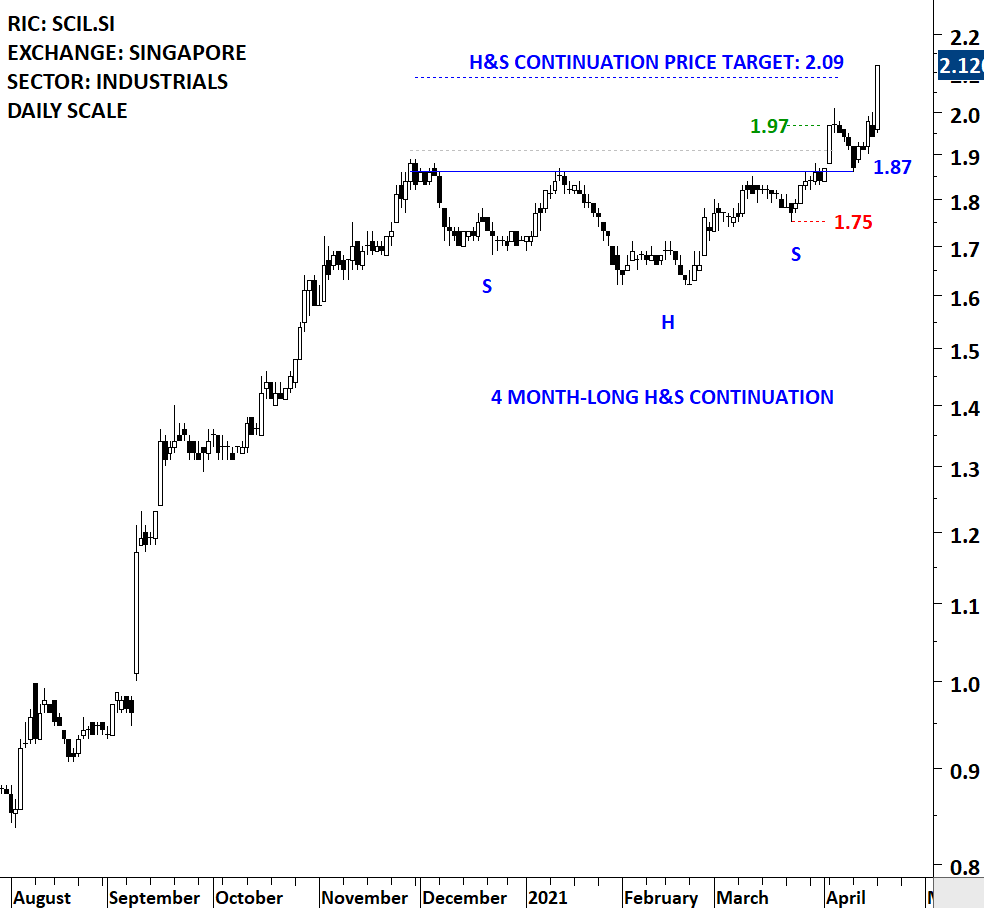

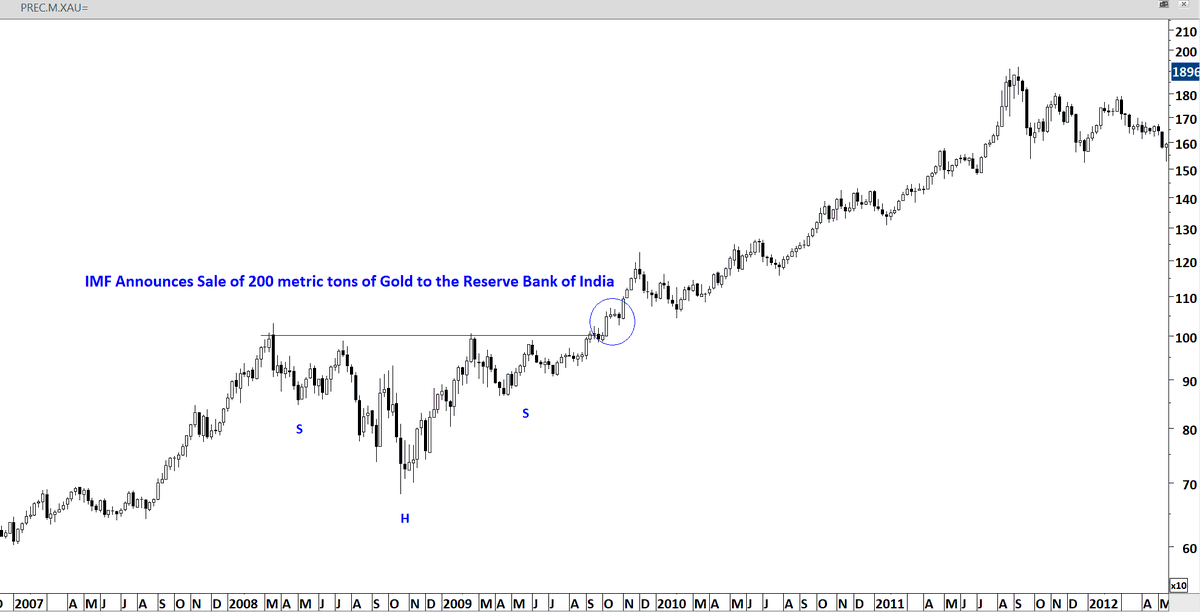

This is a great example for the above tweets. I remember how investors were worried about the IMF selling 200 metric tons of #GOLD back in 2009.

I guess #INDIA Central Bank was waiting for this block sale. And what a great decision... right at the breakout from H&S continuation

I guess #INDIA Central Bank was waiting for this block sale. And what a great decision... right at the breakout from H&S continuation

• • •

Missing some Tweet in this thread? You can try to

force a refresh