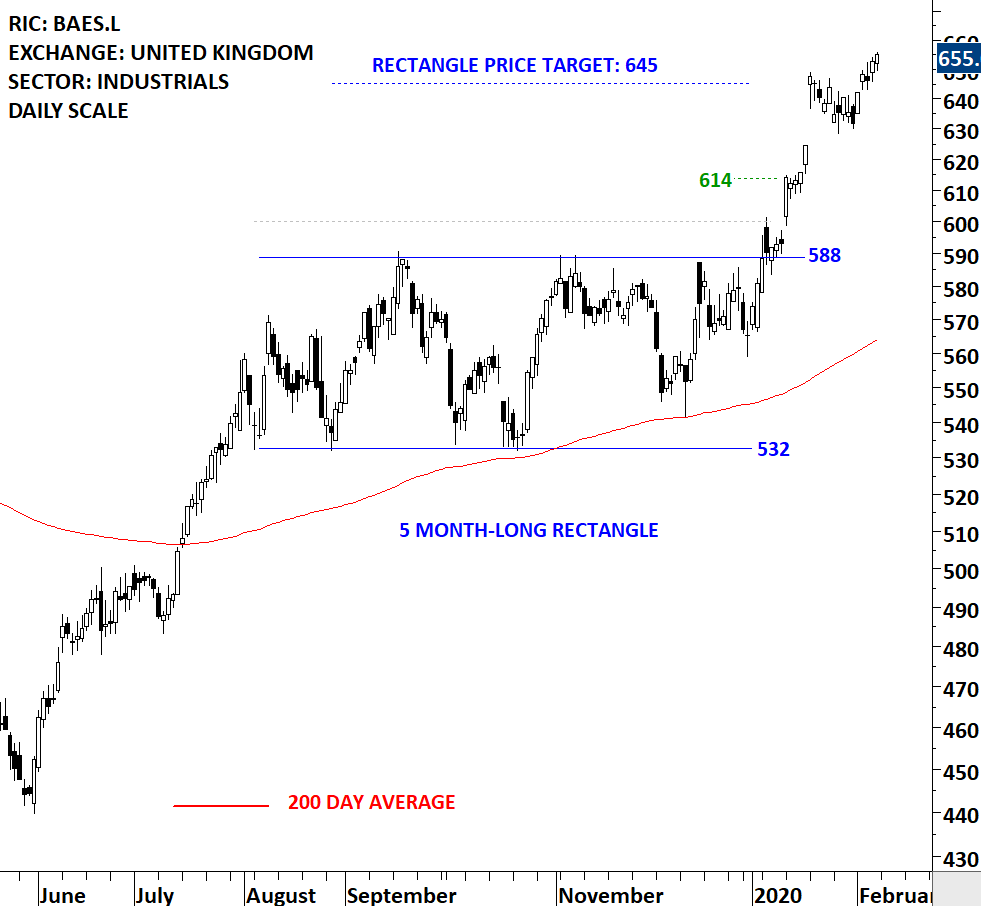

I like to combine classical charting signals with the trend filter (200-day average). A breakdown should take place below the 200-day average and a breakout should take place above the 200-day average.

I.e. breakdown of the neckline will also clear the 200-day average.

I.e. breakdown of the neckline will also clear the 200-day average.

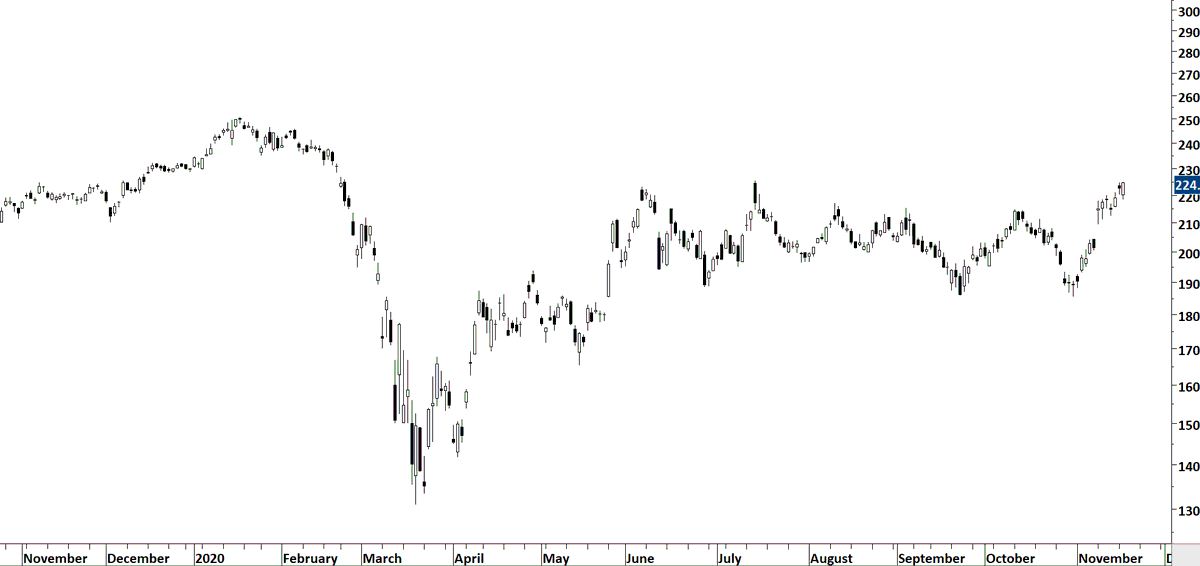

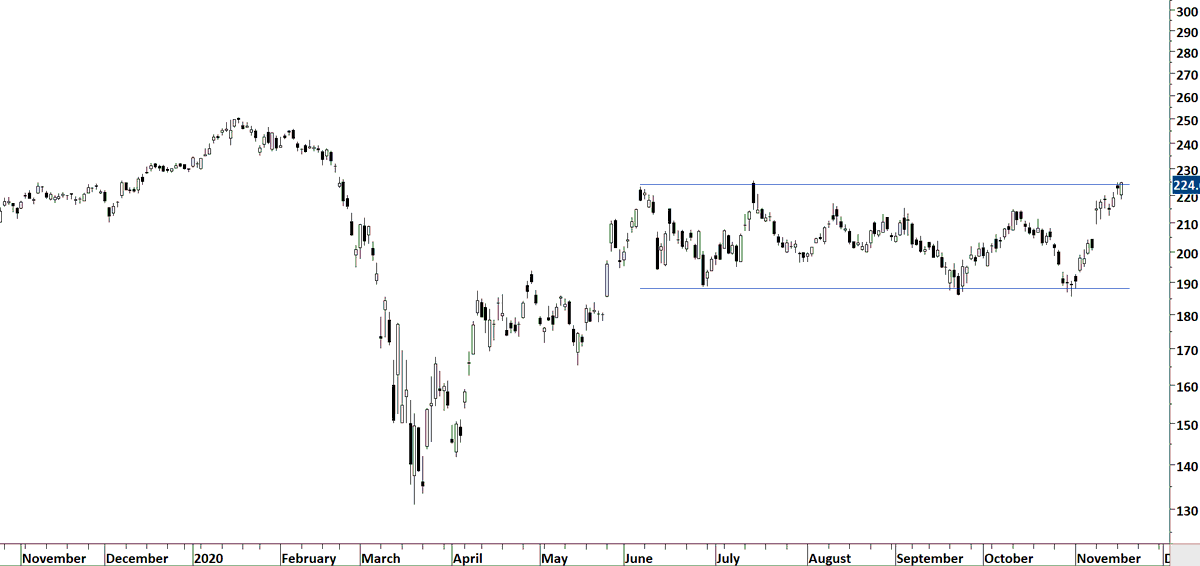

Here is a good example where the long-term trend dictated the direction of the breakout. Failure to complete the H&S top and breakdown below the 200-day average acted as a great long signal with the breach of right shoulder high.

Edwards & Magee in their book Technical Analysis of Stock Trends, discussed the H&S failure with this example from 1936. Classical chart patterns are timeless.

A short #educational #video on how to take advantage of a breakout signal on H&S top failure.

This week's #GLOBAL #EQUITY #MARKETS report featured H&S top failure #BREAKOUT #ALERT on $ITB

More >> blog.techcharts.net

More >> blog.techcharts.net

• • •

Missing some Tweet in this thread? You can try to

force a refresh