UPDATE ON MARKETS: With flareup of #COVID19 globally & many countries moving back into hard lockdown, #markets reacted. FTSE/JSE All Share contracted by further 4.7% during October, following 1.6% September decline. Another horrible month for Local Property stocks dropping 8.5%.

2/12

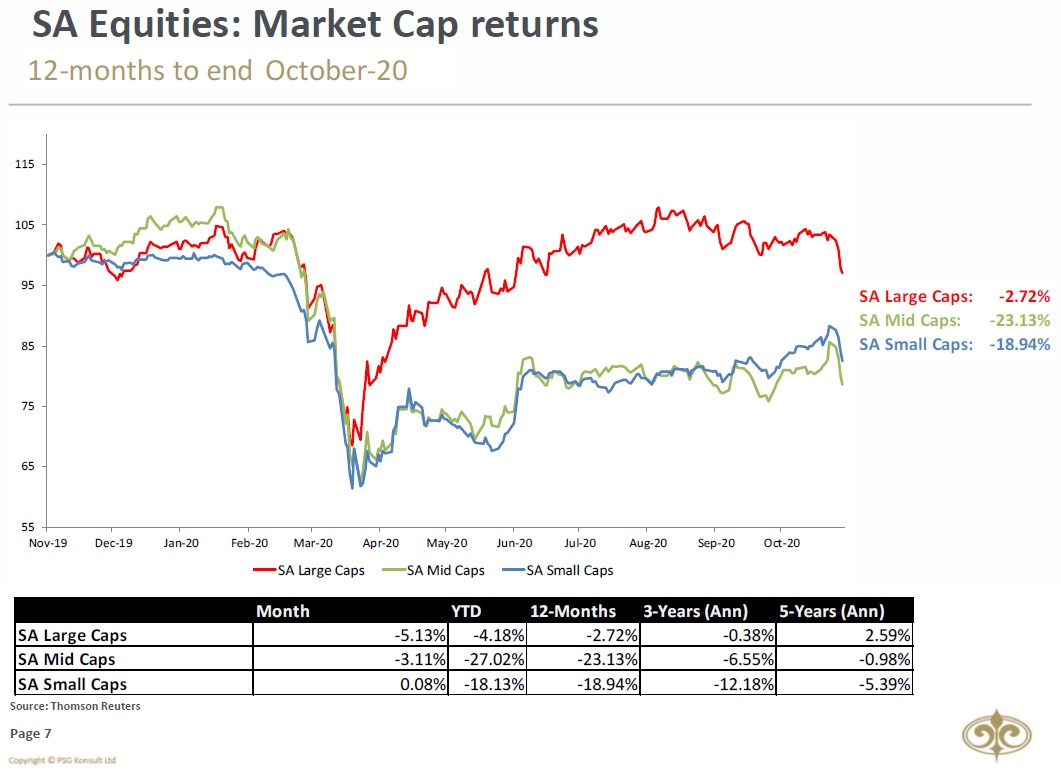

South African Small Caps were top performers for October, growing by 0.1% during the month. Mid Caps declined by 3.1% for the period, while Large Caps had a massive loss of 5.1% during October.

South African Small Caps were top performers for October, growing by 0.1% during the month. Mid Caps declined by 3.1% for the period, while Large Caps had a massive loss of 5.1% during October.

3/12

Although JSE was not left unscathed, it did outperform MSCI All Country World Market in USD. $JALSH however need quite a few more of these, with the YTD performance for the JSE in USD-terms at -19.98% versus the MSCI ACWI’s performance of -1.09%.

Although JSE was not left unscathed, it did outperform MSCI All Country World Market in USD. $JALSH however need quite a few more of these, with the YTD performance for the JSE in USD-terms at -19.98% versus the MSCI ACWI’s performance of -1.09%.

4/12

The #FearandGreed #SouthAfrica #Index moved back into EXTREME FEAR in October. For those followers who'd like to get more information on the Fear & Greed South African Index, can click here: oldoak.co.za/wp/index.php/2…

The #FearandGreed #SouthAfrica #Index moved back into EXTREME FEAR in October. For those followers who'd like to get more information on the Fear & Greed South African Index, can click here: oldoak.co.za/wp/index.php/2…

5/12

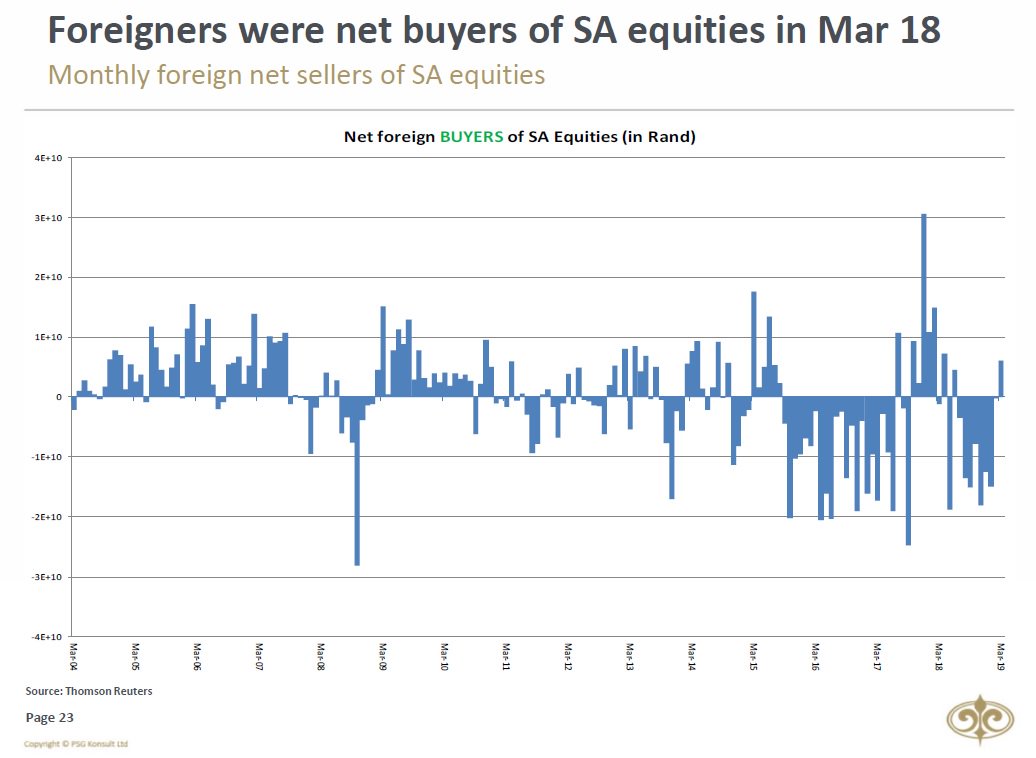

Foreigners were net sellers of SA Equities for 16 months in a row. Despite much higher relative yields, foreigners were also sellers of SA Bonds in October.

Foreigners were net sellers of SA Equities for 16 months in a row. Despite much higher relative yields, foreigners were also sellers of SA Bonds in October.

6/12

From a sectoral point of view, both the Resource- (-11.36%) and Financial sectors (-6.08%) were the biggest culprits. Thanks to #Naspers/#Prosus and #Multichoice, the Industrial Index ended the month in positive territory.

From a sectoral point of view, both the Resource- (-11.36%) and Financial sectors (-6.08%) were the biggest culprits. Thanks to #Naspers/#Prosus and #Multichoice, the Industrial Index ended the month in positive territory.

7/12

Added to my point above ☝️, without them (NPN, PRX & MCG), FTSE/JSE All Share would have lost more than 6% in October. As most fund managers use Capped Swix ALSI as benchmark, it is interesting to note the top 10 best & worst contributors for the month.

Added to my point above ☝️, without them (NPN, PRX & MCG), FTSE/JSE All Share would have lost more than 6% in October. As most fund managers use Capped Swix ALSI as benchmark, it is interesting to note the top 10 best & worst contributors for the month.

8/12

Rand enjoyed very strong month, improving by 3.1% against the USD. It gained 3.7% in October against Euro & 2.9% against GB Pound. Very interesting point to mention is also that $ZAR moved up to 3rd best performing #BRICS currency over 5yr rolling period in October.

Rand enjoyed very strong month, improving by 3.1% against the USD. It gained 3.7% in October against Euro & 2.9% against GB Pound. Very interesting point to mention is also that $ZAR moved up to 3rd best performing #BRICS currency over 5yr rolling period in October.

9/12

Most #commodities continued their September contraction in October. With #COVID19 lockdown restrictions being reintroduced in Europe and the UK, #BrentOil saw a massive decline (-7.6%) during the month. #Platinum (-4.61%) & #Palladium (-4.6%) however were not too far behind

Most #commodities continued their September contraction in October. With #COVID19 lockdown restrictions being reintroduced in Europe and the UK, #BrentOil saw a massive decline (-7.6%) during the month. #Platinum (-4.61%) & #Palladium (-4.6%) however were not too far behind

10/12

Although the SA General Equity Unit Trust Sector was less affected by the JSE decline in October, it still lost 3.42% of its value during the month. The SA Multi-Asset High Equity & Low Equity Sectors fell by 3.31 % & 1.11% respectively for the month.

Although the SA General Equity Unit Trust Sector was less affected by the JSE decline in October, it still lost 3.42% of its value during the month. The SA Multi-Asset High Equity & Low Equity Sectors fell by 3.31 % & 1.11% respectively for the month.

11/12

The US M2 Money Supply YoY growth rate AGAIN reached a new all-time high, for the fifth time in 2020, during September.

The US M2 Money Supply YoY growth rate AGAIN reached a new all-time high, for the fifth time in 2020, during September.

12/12 and final

The US Dollar Index is trading below its downward-sloping 200-day Moving Average, and above its 50-day Moving Average.

The US Dollar Index is trading below its downward-sloping 200-day Moving Average, and above its 50-day Moving Average.

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh