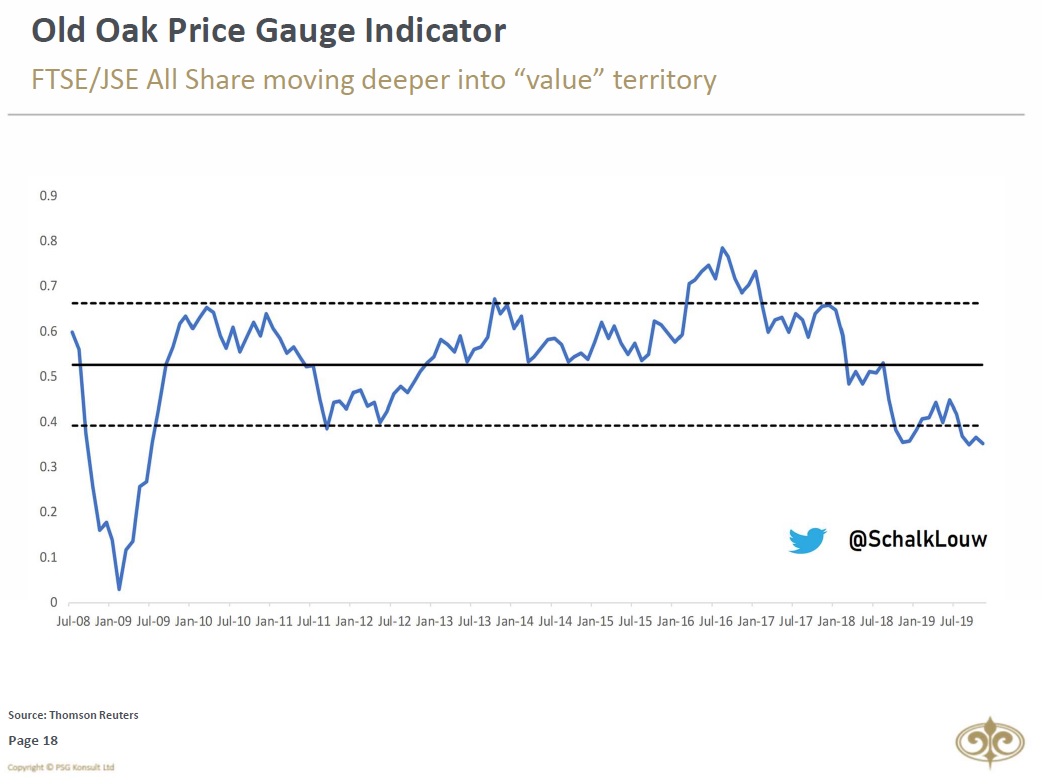

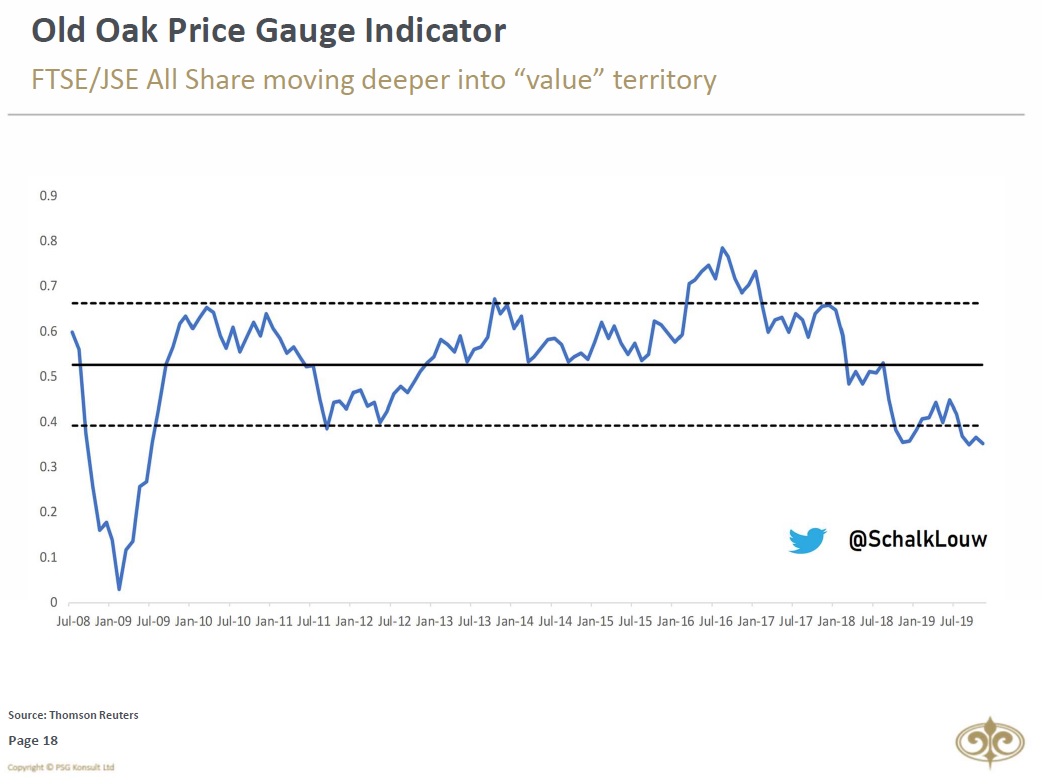

#PriceGauge indicator (using historic PE, DY & PB's ) on $JALSH reflects a fairly oversold Index. It historically gave a great indication on how cheap/expensive market can be perceived. The Indictor moved further into "VALUE" territory.

Keep Current with Schalk Louw | Mr Louwcal 🇿🇦

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!