1/ $FCAU accepted Honda in their European CO2 pool with #Tesla.

Some think it's bullish for $TSLA. In fact, it's neutral at best.

$TSLAQ

bloomberg.com/news/articles/…

Some think it's bullish for $TSLA. In fact, it's neutral at best.

$TSLAQ

bloomberg.com/news/articles/…

2/ FCA has bought all the credits from Tesla. Tesla couldn't have invited Honda to the pool alone.

Either FCA sells the excess credits that it committed itself to buy from Tesla to Honda, because it is now obvious that they don't need that many due to COVID, 500e and PSA next yr

Either FCA sells the excess credits that it committed itself to buy from Tesla to Honda, because it is now obvious that they don't need that many due to COVID, 500e and PSA next yr

3/ Or FCA agreed that Tesla and Honda cut a deal, but they get a pass on some of their obligations.

This could be marginally bullish for Tesla if they could sell these credits at a higher price, but I don't think that to be the case.

This could be marginally bullish for Tesla if they could sell these credits at a higher price, but I don't think that to be the case.

4/ Renault and Volvo have both announced that they have excess credits. PSA hasn't, but most probably they have, too. Possibly others.

Buyers are Merc and JLR. Prices should be low, or at least much lower than what FCA paid to Tesla.

See my earlier thread on the FCA-Tesla deal.

Buyers are Merc and JLR. Prices should be low, or at least much lower than what FCA paid to Tesla.

See my earlier thread on the FCA-Tesla deal.

5/ It could be seen as bullish that Honda doesn't comply on its own.

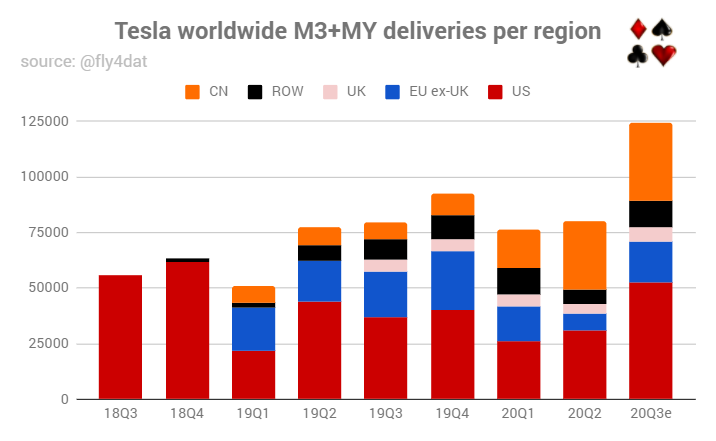

But Tesla alone can't sell credits in Europe until at least 2022. Also, Honda is tiny in Europe. If FCA couldn't sell to Merc, it means that Merc bought credits for much cheaper than what FCA could offer.

But Tesla alone can't sell credits in Europe until at least 2022. Also, Honda is tiny in Europe. If FCA couldn't sell to Merc, it means that Merc bought credits for much cheaper than what FCA could offer.

6/ FCA should have lots of excess credits from Tesla.

We might be able to get some insights from FCA's next 6-K or what.

We might be able to get some insights from FCA's next 6-K or what.

• • •

Missing some Tweet in this thread? You can try to

force a refresh