1/ While you were watching elections, #Tesla silently hasn't shipped more cars to Europe🇪🇺. 4 ships have departed so far (from SFO and SHA combined), which is, surprisingly, only slightly delayed vs 19Q4.

$TSLA $TSLAQ

$TSLA $TSLAQ

2/ There have been 8 ships to Europe in 19Q4. I don't see a reason why they couldn't send 4 more (or even more) this time, but there are no indications for that. 3 are more likely.

However, after 19Q3, "supply-constrained" Tesla started Q4 with 6.2k+ cars in inventory in Europe.

However, after 19Q3, "supply-constrained" Tesla started Q4 with 6.2k+ cars in inventory in Europe.

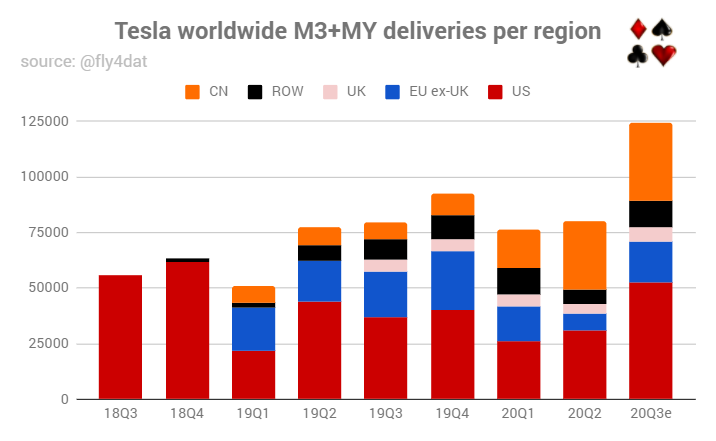

3/ That helped them deliver a record 30k+ M3's in 19Q4. With an estimated ~1.350 cars in inventory going into 20Q4, even 8 ships aren't enough to match 19Q4.

It remains a question why they don't send more ships. Supply should be ample. I dare to ask: demand?

It remains a question why they don't send more ships. Supply should be ample. I dare to ask: demand?

4/ Remember: close to 10k/wk could be made in Fremont, 3 ships (~10.7k cars) have been sent to Europe vs 5 in 19Q4. Shanghai can make 5k/wk, 7 will have been sent by next week and no word about a 3rd ship (and 7-7.5k LHD SR+ are in line with ~26-32k M3's in Q4 in EU).

5/ I've penciled in 30k M3's in Europe in Q4 2 months ago. I currently see this as an unlikely upper bound.

Again, production shouldn't be a constraint. With 20k+ inventory, 50+25=75k capacity QTD, even 40-50k to Europe shouldn't have been a problem. Unless there is a problem.

Again, production shouldn't be a constraint. With 20k+ inventory, 50+25=75k capacity QTD, even 40-50k to Europe shouldn't have been a problem. Unless there is a problem.

6/ Yes, sure, Europeans are waiting for Berlin-built M3s, for which the deadline has been pushed back to late 2021. Despite leasing very strong in Europe (company cars, tax and financing reasons, latter also for private buyers in many countries). Blah-blah.

7/ A few are waiting for the updated SR+ indeed (heat pump, chrome delete), coming in Q1 only. I don't think most follow these developments and bc of ending leases, I don't think this is material as SR+ is anyway ~25% of EU demand. Maybe 1-2k, generously.

8/ In and after 19Q4, I've estimated European run-rate demand for the M3 to be 16-18k/Q, all the rest coming from pent-up demand in 2019. Now that the European BEV market has grown by 100%+ since, and with the price cuts, I'm estimating it to be ~19-21k/Q with Q4 being stronger.

9/ But that is trending down now with competition having arrived and Model 3 aging. Without price cuts, Q1 will be difficult. But let's focus on Q4 first.

• • •

Missing some Tweet in this thread? You can try to

force a refresh