#unitedspirits #diageoindia

Q2fy21

Net sales declined 6.6%,sequentially improved over last quarter

Net sales declined 3.4% after adjusting for one off benefit of bulk scotch sales last yr

Prestige & above segment grew 1%

Popular segment sales declined 12.5 over last yr

#nifty

Q2fy21

Net sales declined 6.6%,sequentially improved over last quarter

Net sales declined 3.4% after adjusting for one off benefit of bulk scotch sales last yr

Prestige & above segment grew 1%

Popular segment sales declined 12.5 over last yr

#nifty

Priority sales declined 10% over last year,increased consumer prices & unfavorable state mix impacted demand

Gross margin down 42.1% over 284bps driven by contraction in Andhra pradesh & decline in south franchise business

Ebidta 270cr ,down 35.1%,Ebidta margin 12.6% down

Gross margin down 42.1% over 284bps driven by contraction in Andhra pradesh & decline in south franchise business

Ebidta 270cr ,down 35.1%,Ebidta margin 12.6% down

Ebidta margin affected by higher A&P investment to support rollout of 2 core brands, Mcdowells No.1 whiskey & Royal challenge

Interest cost 51 cr,12% higher compared to last year

PAT 128 cr, down 43%

#nifty #sensex #StockMarket #stocks @United_Spirits

Interest cost 51 cr,12% higher compared to last year

PAT 128 cr, down 43%

#nifty #sensex #StockMarket #stocks @United_Spirits

First half performance highlights

Net sales declined 29.7% ,marked improvement seen sequentially in 2nd quarter vs Q1fy21

Prestige & above segment sales declined 25%

Popular segment sales declined 31% & priority down 27%

Gross margin down 42% ,415 bps

Ebidta 192 cr,down 76%

Net sales declined 29.7% ,marked improvement seen sequentially in 2nd quarter vs Q1fy21

Prestige & above segment sales declined 25%

Popular segment sales declined 31% & priority down 27%

Gross margin down 42% ,415 bps

Ebidta 192 cr,down 76%

Ebidta margin 6% ,down 1191 bps due to negative impact of fixed cost deleverage, post adjustment for one off bulk scotch sales & restructuring costs,ebidta down 74%

Interest cost 101 crores

PAT down 87 crores

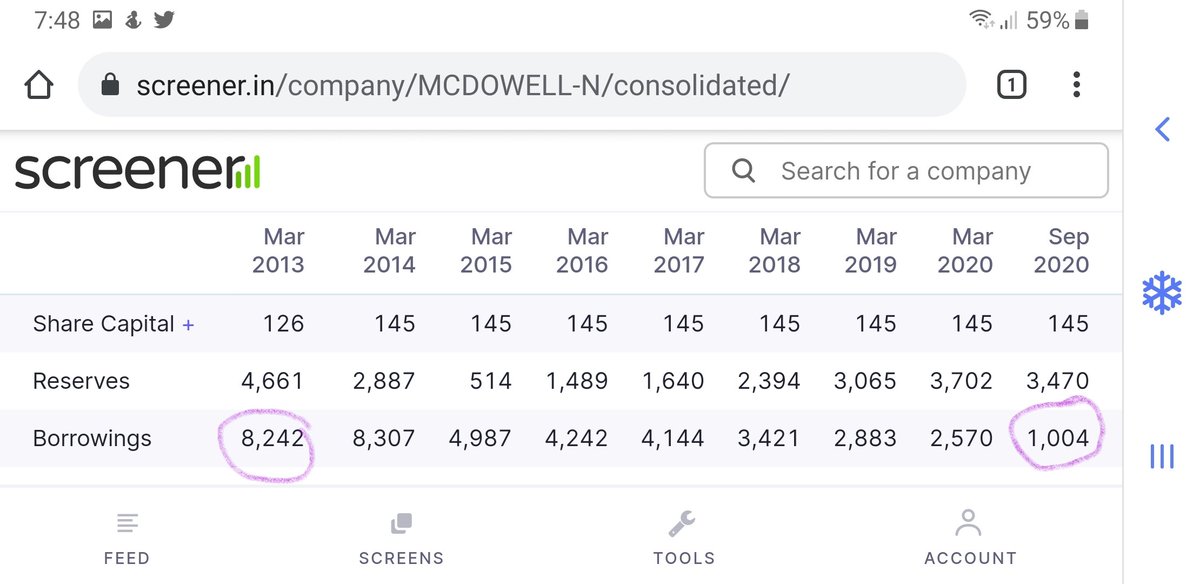

Operating cash flows strong,debt repayment of 780 cr

@United_spirits

Interest cost 101 crores

PAT down 87 crores

Operating cash flows strong,debt repayment of 780 cr

@United_spirits

#unitedspirits may be debt free in Fy22

May soon start giving dividends

Diageo dividend yield is 3.12%,good dividend paying history

#Nifty #sensex #StockMarket #stocks #markets

May soon start giving dividends

Diageo dividend yield is 3.12%,good dividend paying history

#Nifty #sensex #StockMarket #stocks #markets

• • •

Missing some Tweet in this thread? You can try to

force a refresh