1. #Bitcoin is just finishing up its current Four Year Cycle

Which means #BTC is just under two months away from confirming further exponential growth in this #Crypto Bull Market

Here's what you need to know...

Which means #BTC is just under two months away from confirming further exponential growth in this #Crypto Bull Market

Here's what you need to know...

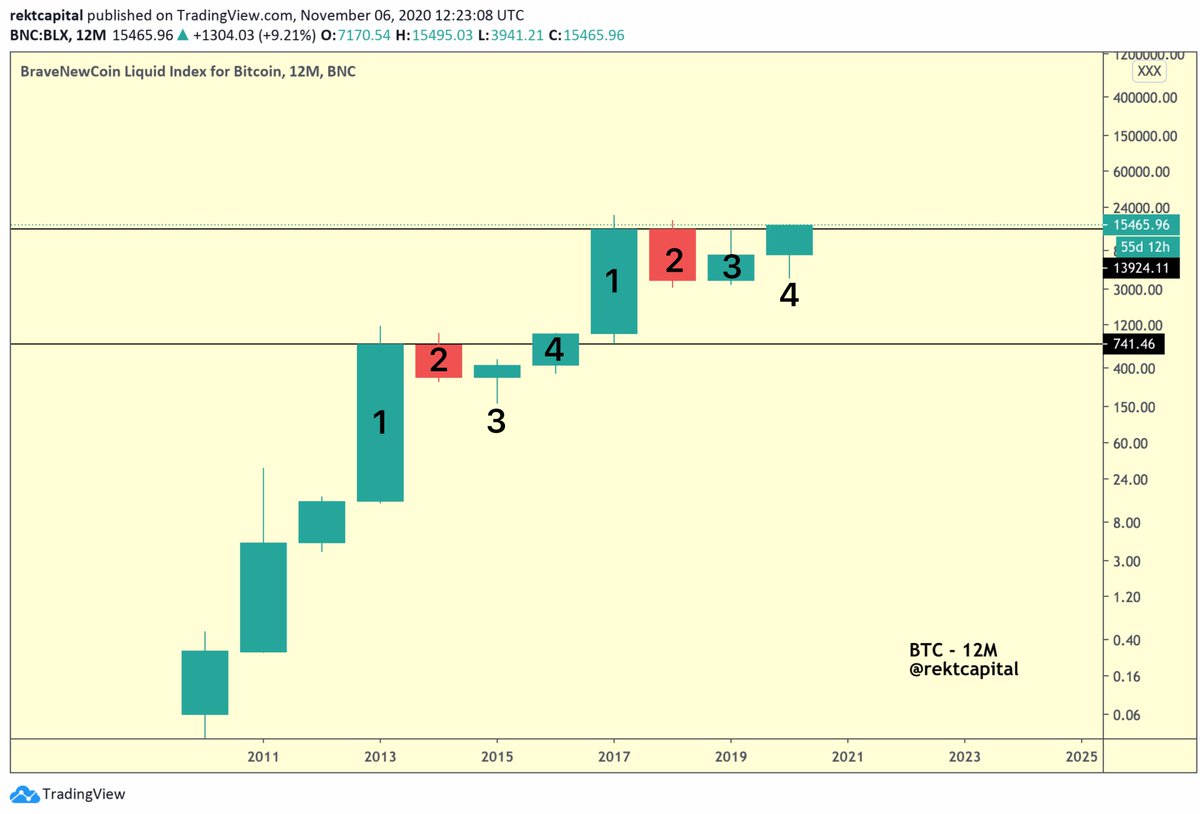

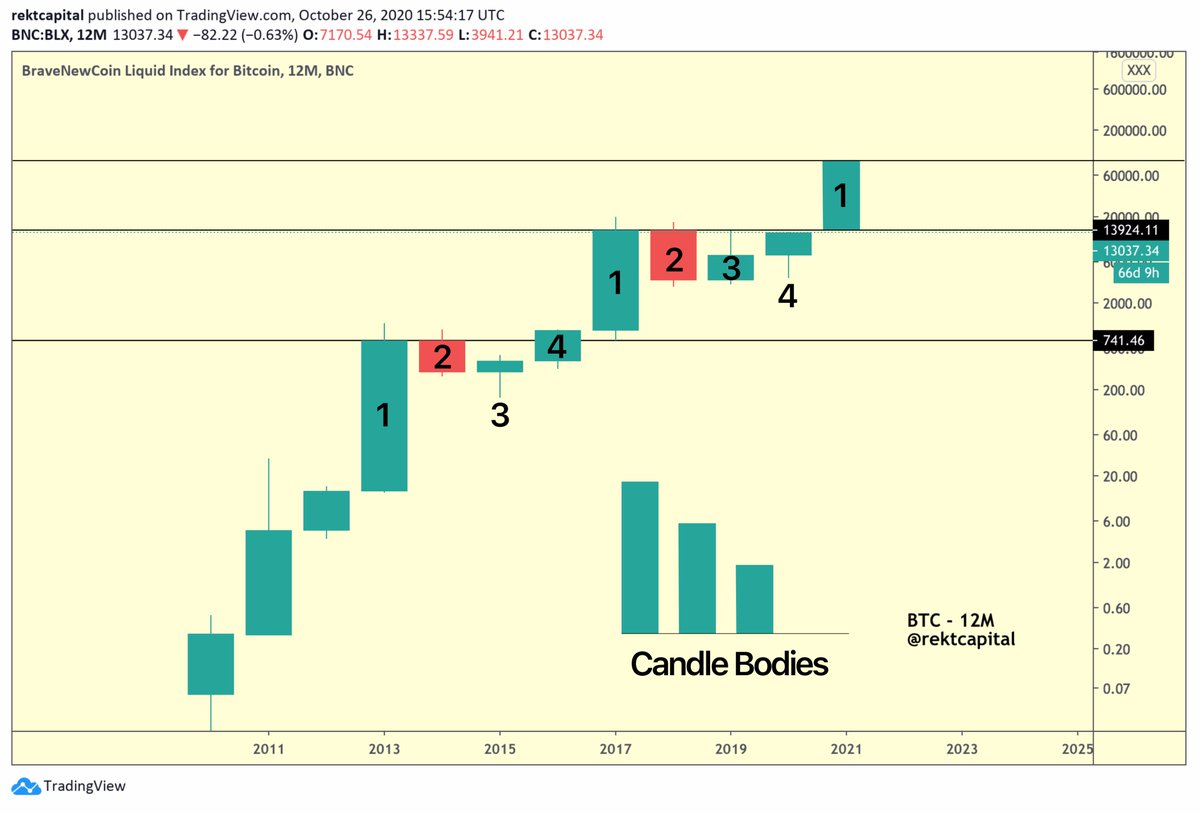

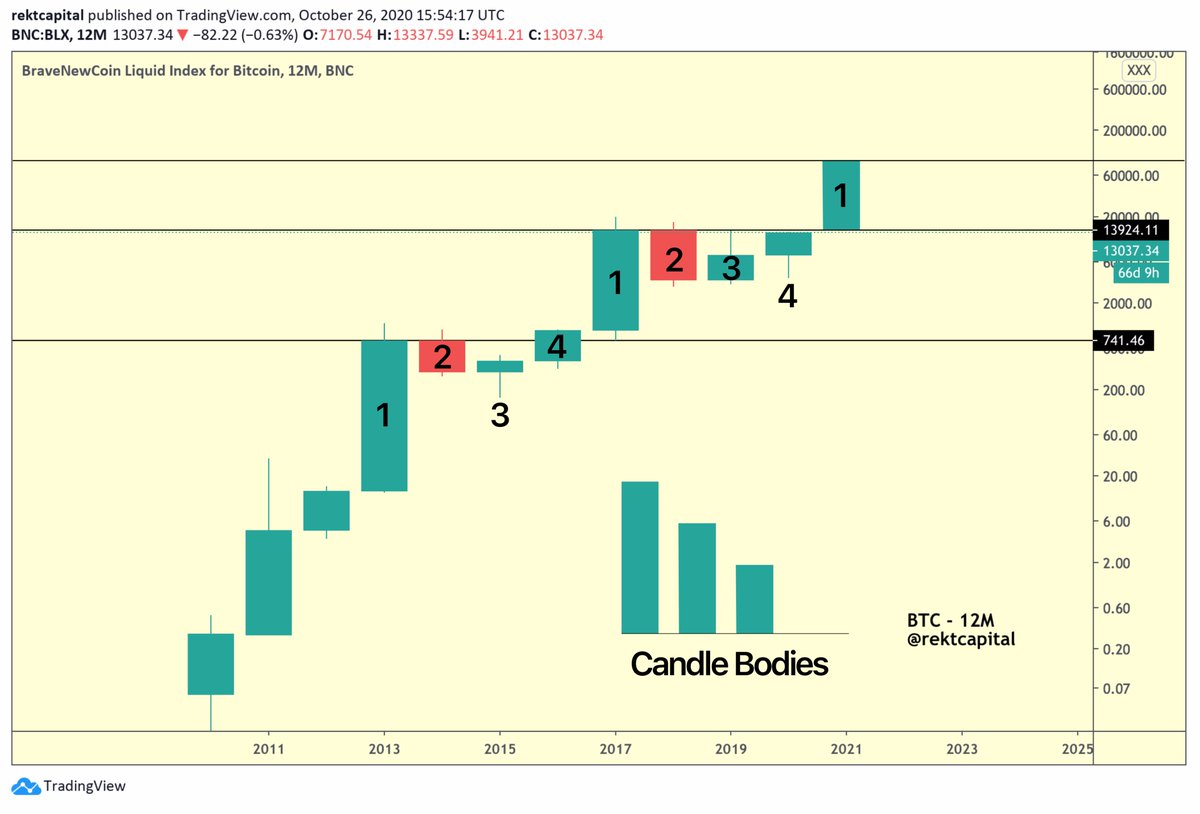

2. $BTC's price action behaves in Four Year Cycles

Each candle represents a year

Candle 1 ensures exponential growth where BTC breaks to a new ATH

Candle 2 is where BTC is in a Bear Market

Candle 3 is where BTC bottoms out

Candle 4 is where BTC recovers & begins a new trend

Each candle represents a year

Candle 1 ensures exponential growth where BTC breaks to a new ATH

Candle 2 is where BTC is in a Bear Market

Candle 3 is where BTC bottoms out

Candle 4 is where BTC recovers & begins a new trend

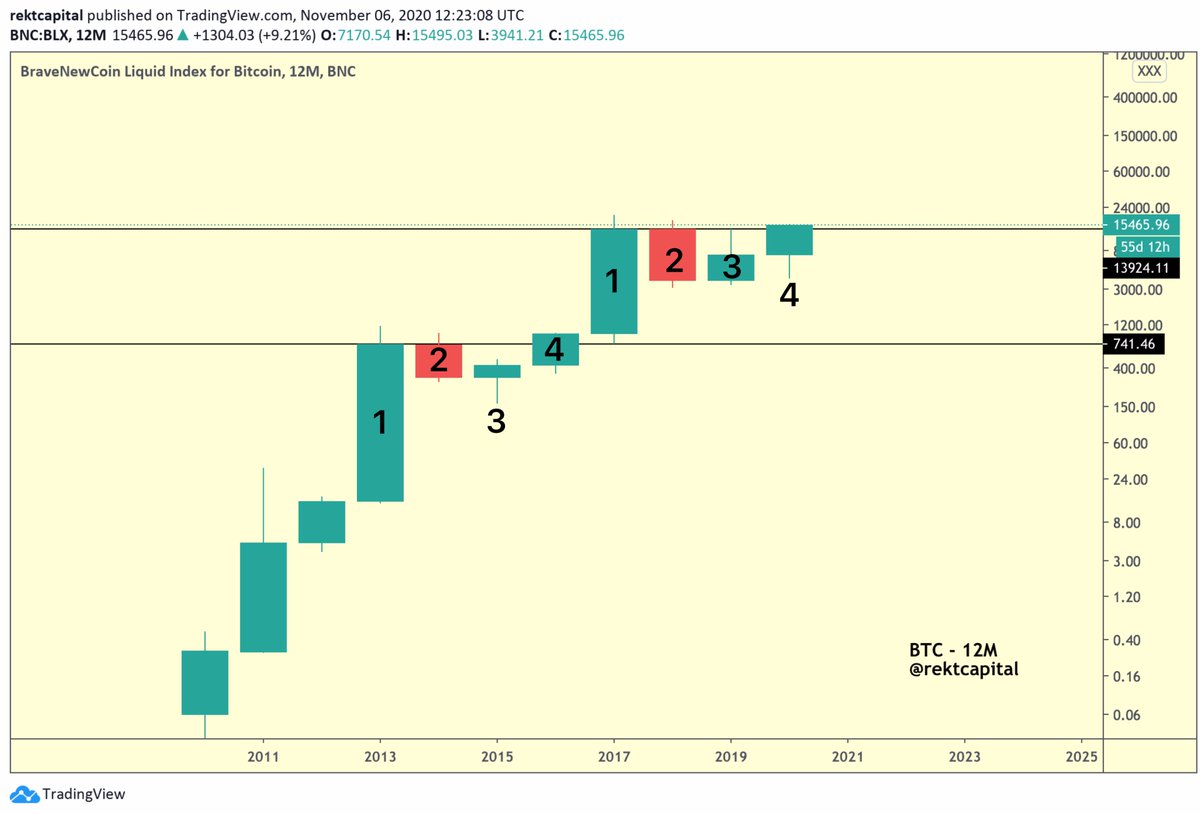

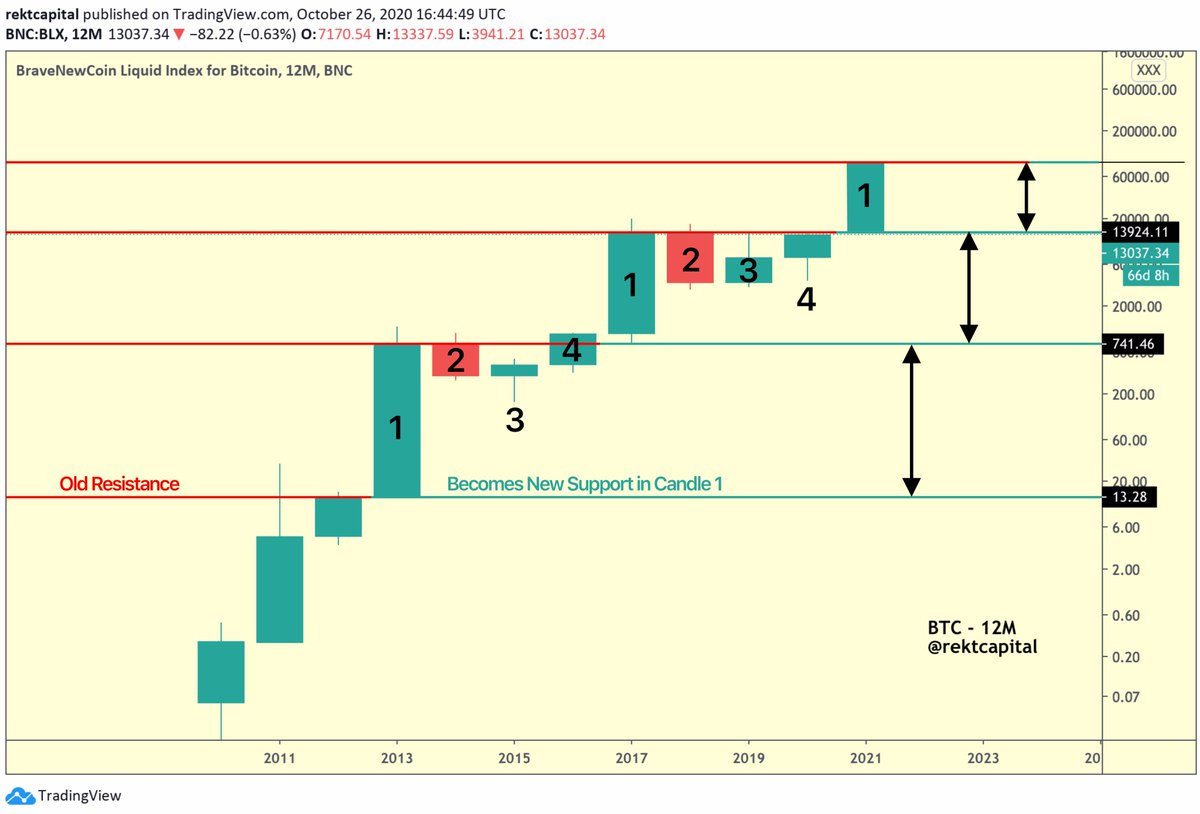

3. Candle 4 serves a crucial purpose in setting the stage for the new Four Year Cycle

Its primary aim is to eclipse the previous resistance that effectively prompted a bear market for BTC's price a few years earlier (i.e. “Candle 2”)

That resistance is ~$13,900

Its primary aim is to eclipse the previous resistance that effectively prompted a bear market for BTC's price a few years earlier (i.e. “Candle 2”)

That resistance is ~$13,900

4. Here's what needs to happen for the Four Year Cycle to continue to play out:

• BTC needs to twelve-month candle close above ~$13900 by the end of 2020 so as to precede an exponential Candle 1 in 2021

If #BTC closes above $13900 this year, BTC will rally to new ATH in 2021

• BTC needs to twelve-month candle close above ~$13900 by the end of 2020 so as to precede an exponential Candle 1 in 2021

If #BTC closes above $13900 this year, BTC will rally to new ATH in 2021

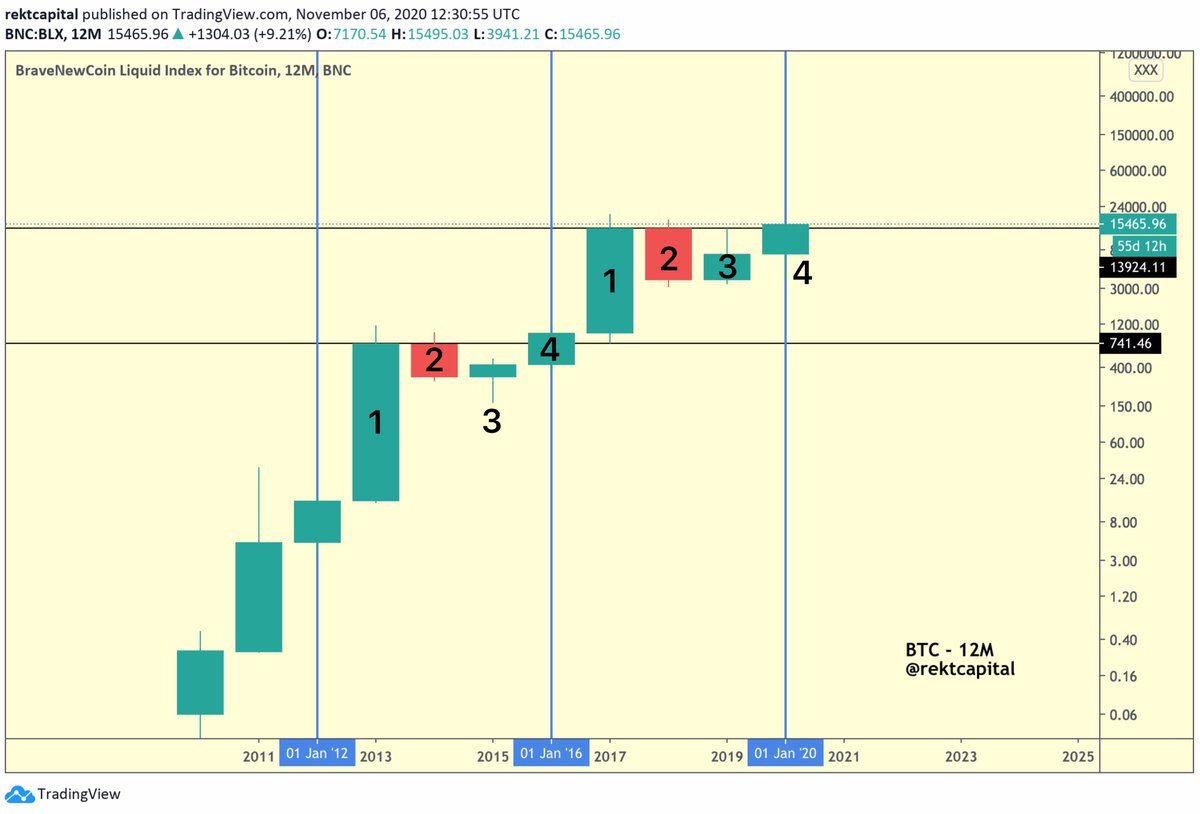

5. Historically, BTC Halvings have a tremendous effect on $BTC's price

BTC Halvings (blue) occupy a curious price positioning if we analyse them in the context of the 4 Year Cycle

Bitcoin Halvings tend to occur a year prior to Bitcoin’s exponential rallies to new All-Time Highs

BTC Halvings (blue) occupy a curious price positioning if we analyse them in the context of the 4 Year Cycle

Bitcoin Halvings tend to occur a year prior to Bitcoin’s exponential rallies to new All-Time Highs

6. If you find the information in this thread valuable, you should check out my newsletter which is dedicated to unbiased cutting-edge #Crypto insights

rektcapital.substack.com

rektcapital.substack.com

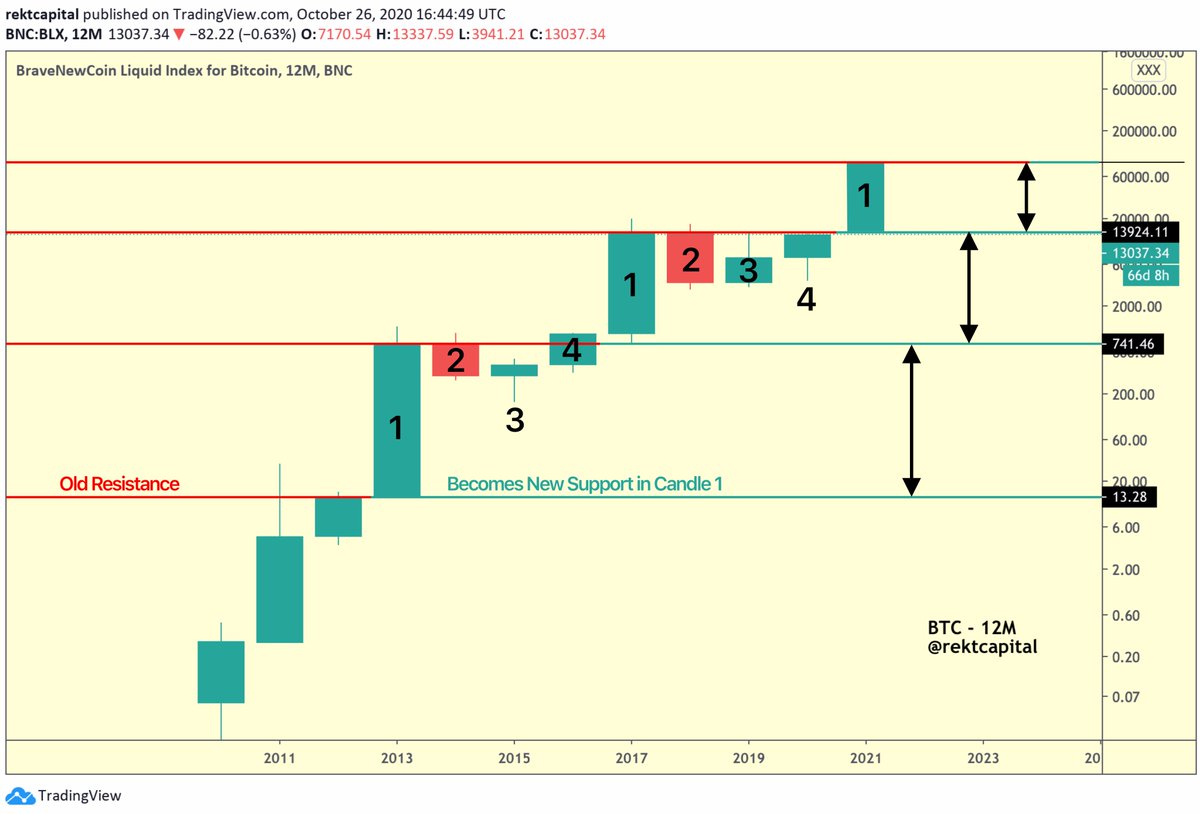

7. What could come next for #BTC, according to its Four Year Cycles?

• Might not break $20K in 2020

• Could top out at ~$17,000 in 2020

• Could attempt to test $13,9K as support in early 2021

• Followed by a break of $20,000 and New All Time High in 2021

• Might not break $20K in 2020

• Could top out at ~$17,000 in 2020

• Could attempt to test $13,9K as support in early 2021

• Followed by a break of $20,000 and New All Time High in 2021

8. There's a diminishing ROI on BTC investments after BTC breaks an old ATH

Black arrows showcase how the exponential "Candle 1s" are getting smaller over time

But if this diminishing rate of return on BTC rallies upon breaking old ATH continues to remain constant over time...

Black arrows showcase how the exponential "Candle 1s" are getting smaller over time

But if this diminishing rate of return on BTC rallies upon breaking old ATH continues to remain constant over time...

9. BTC could still rally up to ~5x upon breaking $20,000

BTC could rally exponentially to a new ATH of ~$90,000

But much like the Candle 1 candlesticks, upside wicks past crucial Four Year Cycle resistances (i.e. black levels) are also getting shorter & less volatile over time

BTC could rally exponentially to a new ATH of ~$90,000

But much like the Candle 1 candlesticks, upside wicks past crucial Four Year Cycle resistances (i.e. black levels) are also getting shorter & less volatile over time

10. This means #Bitcoin could very well overextend past $90,000 in the form of a volatile upside wick and even beyond the psychological level of $100,000 before finally rejecting into a new Bear Market in the following year

11. If you liked this thread, you'll probably really like my newsletter

Cutting-edge crypto market insights, straight to your inbox

Sign up:

rektcapital.substack.com/p/fouryearcycle

$BTC #BTC #Bitcoin

Cutting-edge crypto market insights, straight to your inbox

Sign up:

rektcapital.substack.com/p/fouryearcycle

$BTC #BTC #Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh