1. It's always fascinating to see different types of exotic derivatives in the crypto space. I was pretty interested to come across @RealHxro's TIX contracts which are crypto binary options. These are similar to vanilla options but the payouts and pricing are slightly different.

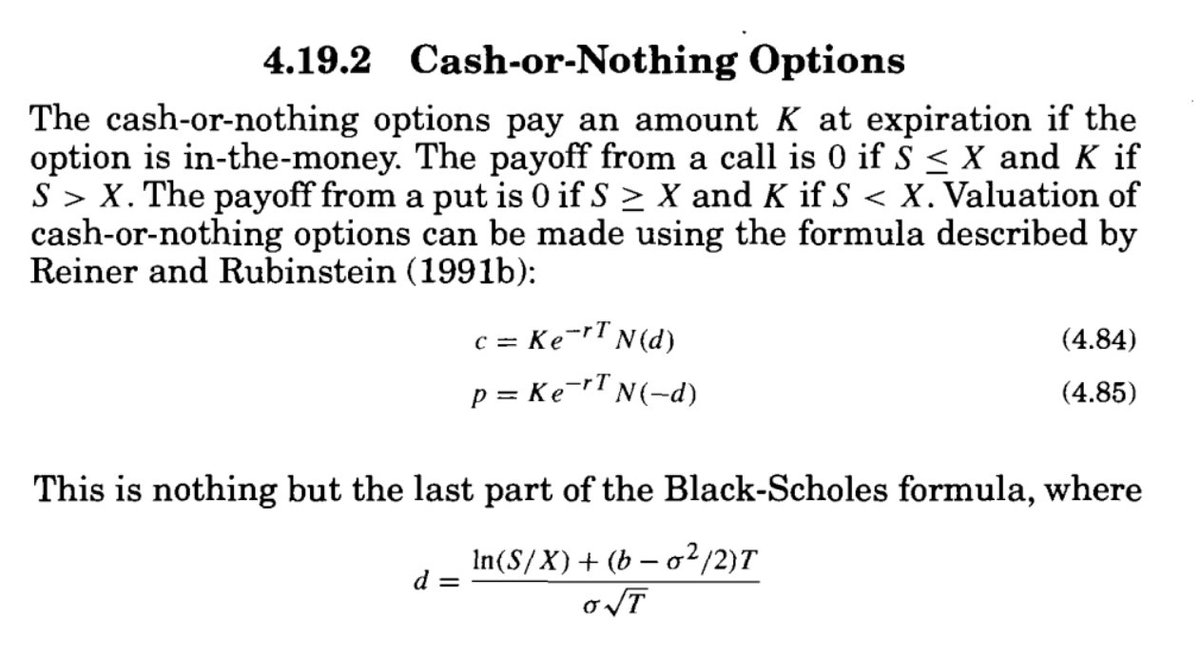

2. In this analysis I viewed TIX options as "cash-or-nothing binary options". For a call, this means that at expiry if spot > strike, then you get paid out a certain amount (the odds x the amount you bet). At maturity if spot ≤ strike, the payout is 0. Vice-versa for puts.

3. Here we can see the active TIX contracts. The odds represent the amount you get paid if the contract ends in the money (spot > strike). As an example, for the $20k call, if BTC > $20k on Dec. 25th/2020, then a $1 bet would turn into $5.741.

4. In other words, this contract is pricing in a ~17% (1/5.741) probability that BTC will be > $20k on Dec. 25th. Given cash-or-nothing options have a theoretical closed-form solution, we can approximate the market implied volatilities used to price these products.

5. Here we can see the estimated TIX IV plotted against the Deribit mark IV for strikes between $9k to $20k. It's cool to see the TIX IVs are somewhat in line with @DeribitExchange's vanilla option IVs - I expect this difference to narrow as we see more volume on the platform.

6. What do you folks think of this comparison? Should a binary option IV plot like this have a similar shape compared to a vanilla options IV curve? @MMKustermann @fb_gravitysucks @robbylevy

• • •

Missing some Tweet in this thread? You can try to

force a refresh