1/ Grab a cup of coffee (or tea)

A comprehensive, neighborhood-by-neighborhood review of #SARSCov2 prevalence/trends in the City of Toronto.

% positivity & cases, with weekly trends since Aug, AND:

*cross referenced with neighborhood census data*

The findings are incredible.

A comprehensive, neighborhood-by-neighborhood review of #SARSCov2 prevalence/trends in the City of Toronto.

% positivity & cases, with weekly trends since Aug, AND:

*cross referenced with neighborhood census data*

The findings are incredible.

2/ Note: even if you are not in Toronto/Canada, I think you will find this data/analysis compelling, and universally applicable re #SARSCov2/#COVID19 learning and public policy implications.

Toronto’s diversity (>51% visible minority) makes it an interesting case study.

Toronto’s diversity (>51% visible minority) makes it an interesting case study.

3a/ In this thread, I show/illustrate:

1. for Toronto’s 140 neighbourhoods (and groups of hoods, e.g. DT Core, Northwest), which have increasing/decreasing % pos & cases per 100k.

(Some peaked long before the Oct 10th restrictions. Others still increasing despite restrictions.)

1. for Toronto’s 140 neighbourhoods (and groups of hoods, e.g. DT Core, Northwest), which have increasing/decreasing % pos & cases per 100k.

(Some peaked long before the Oct 10th restrictions. Others still increasing despite restrictions.)

3b/

2. Using detailed census data from 2016, what neighbourhood characteristics/factors correlate (or do not correlate) with % pos / cases & their recent weekly trends (since Aug 30).

(Characteristics include industry employment, % low-income prevalence, and % visible minority)

2. Using detailed census data from 2016, what neighbourhood characteristics/factors correlate (or do not correlate) with % pos / cases & their recent weekly trends (since Aug 30).

(Characteristics include industry employment, % low-income prevalence, and % visible minority)

4a/ Data note/sources:

- Toronto began publishing weekly neighbourhood test % positivity and tests per 1,000 (weekly), and from population data, we can infer cases per 100,000, and their trends. toronto.ca/home/covid-19/…

- Toronto began publishing weekly neighbourhood test % positivity and tests per 1,000 (weekly), and from population data, we can infer cases per 100,000, and their trends. toronto.ca/home/covid-19/…

4b/ Data note/sources:

- for completeness, below are the neighbourhood dataset limitations/caveats from the Toronto #COVID19 tracker website. Note % pos & cases understated, but *directionally correct*.

- for completeness, below are the neighbourhood dataset limitations/caveats from the Toronto #COVID19 tracker website. Note % pos & cases understated, but *directionally correct*.

5/ Okay, let’s get started.

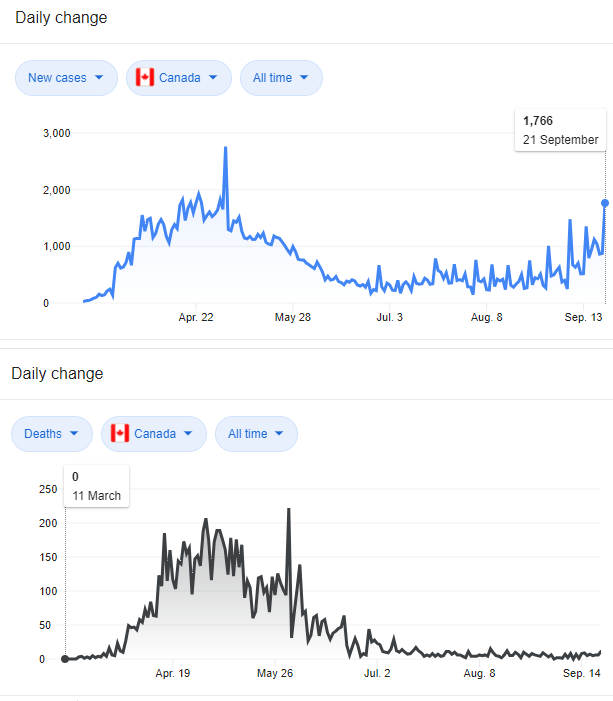

6/ Here is the overall picture in Toronto since August 30th. Overall rising cases and positivity.

(Toronto population ~2.73m people (per 2016 census))

(Toronto population ~2.73m people (per 2016 census))

7/ But what proportion of the city is experiencing an increase vs. a decrease in those metrics?

(defining a decreasing neighbourhood, somewhat arbitrarily, as one that experienced a two week in a row decline in % positivity AND cases per 100,000)

(defining a decreasing neighbourhood, somewhat arbitrarily, as one that experienced a two week in a row decline in % positivity AND cases per 100,000)

8/ 97 neighbourhoods, representing 2.0m people (73% of the pop.), are experiencing rising positivity and cases per 100,000, and account for 84% of new cases in the latest three weeks of this dataset (ending Oct 31st).

9/ Conversely, the other 43 neighbourhoods, representing 750k people (27% of the pop.), are experiencing flat/declining positivity and cases per 100,000, and account for just 16% of new cases in the latest three weeks.

10/ What if we cherry-picked a couple of example areas? Like the Downtown Core (“DTCore”)? How is it doing?

Here, %pos & cases/100k peaked at the end of *September*, well in advance of the Oct 10th restrictions. These 10 hoods have a total population of 300,000 (11% of the pop.)

Here, %pos & cases/100k peaked at the end of *September*, well in advance of the Oct 10th restrictions. These 10 hoods have a total population of 300,000 (11% of the pop.)

11/ Northwest Toronto (“NWT”), on the other hand, is fairing worse.

Some of the highest positivity rates and continued increases in % positivity (now >9%), despite the Oct 10th restrictions. 282k people (10% of pop., and 22% of recent new cases).

Some of the highest positivity rates and continued increases in % positivity (now >9%), despite the Oct 10th restrictions. 282k people (10% of pop., and 22% of recent new cases).

12/ What’s driving the differences? Detail later, but for now just note the following:

% of workforce in service industry (defined later):

NWT-72%

DTCore-41%

% of workforce in knowledge/work-from-home industries:

NWT-19%

DTCore-50%

Average Income

NWT-$28k

DTCore-$49k

% of workforce in service industry (defined later):

NWT-72%

DTCore-41%

% of workforce in knowledge/work-from-home industries:

NWT-19%

DTCore-50%

Average Income

NWT-$28k

DTCore-$49k

13/ So obviously we need to explore some of the neighbourhood specific socioeconomic/demographic factors and see how/if they correlate (not necessarily “causate”) to %positivity and case trends. I will focus mostly on workforce composition.

14a/ Workforce composition. The Toronto census data recorded # of people in 20 industry groups (see picture below).

I categorize the 20 into four “groups”:

1.Services

2.Knowledge/Work-From-Home (“WFH”)

3.Education

4.Healthcare

I categorize the 20 into four “groups”:

1.Services

2.Knowledge/Work-From-Home (“WFH”)

3.Education

4.Healthcare

14b/ Note that I subdivide Service into further “subgroups” into (i) Retail & Other, (ii) Foodservice & Accommodation, (iii) All Other Services. See picture again.

Industry legend source: www23.statcan.gc.ca/imdb/p3VD.pl?F…

Industry legend source: www23.statcan.gc.ca/imdb/p3VD.pl?F…

15/ How does the % of a neighbourhood’s workforce in a given industry “group” (i.e. Service or WFH) correlate with total positivity, maximum positivity, and cases per 100,000?

Well, here’s how (shown in table form here, and graphic form to follow):

Well, here’s how (shown in table form here, and graphic form to follow):

17/ We see

Service (i.e. community) type jobs strongly positively correlate to % positivity and total cases and knowledge/work-from-home jobs strongly negatively correlate to positivity and cases.

Perhaps it is no surprise, but the correlation levels/consistency is incredible.

Service (i.e. community) type jobs strongly positively correlate to % positivity and total cases and knowledge/work-from-home jobs strongly negatively correlate to positivity and cases.

Perhaps it is no surprise, but the correlation levels/consistency is incredible.

18/ Here is where it gets crazy…

19/ Let’s visually examine *trends* in positivity for neighbourhoods with the top 25 & 50 highest % and 25 & 50 lowest % of their workforces in either Service or Work-From-Home Industries, in this recent current “wave” (e.g. since August 30).

20/ This chart is incredible. The average positivity trend for the top 25 & 50 neighborhoods by % of workforce in the Services industries is a straight line up. And neighbourhoods with the lowest concentration of Services workers…positivity barely budges.

21/ Looking at it the opposite way...

i.e. Total % positivity of the neighbourhoods with the 25 & 50 highest vs. 25 & 50 lowest concentrations of knowledge/WFH workers. Neighbourhood % positivity barely budges for the highest concentrations of these workers.

i.e. Total % positivity of the neighbourhoods with the 25 & 50 highest vs. 25 & 50 lowest concentrations of knowledge/WFH workers. Neighbourhood % positivity barely budges for the highest concentrations of these workers.

22/ So what about those pesky bars and restaurants? With positivity correlating with Services workforces, doesn’t that mean bars and restaurants are the big culprit?

23/ Well, it appears somewhat.

BUT, of the three Services industry subgroups (foodservice/accom, retail & other, all other services), neighborhood concentration of foodservice/accom industry workers is the *LEAST* positively related to increasing % positivity:

BUT, of the three Services industry subgroups (foodservice/accom, retail & other, all other services), neighborhood concentration of foodservice/accom industry workers is the *LEAST* positively related to increasing % positivity:

24/ Quickly touching on % visible minorities and non-visible minorities.

Clearly visible minorities are struggling with #COVID19. The 50 neighbourhoods with the highest visible minority concentration account for 41% of the pop., but have 53% of cases since Aug 30, w/rising % pos

Clearly visible minorities are struggling with #COVID19. The 50 neighbourhoods with the highest visible minority concentration account for 41% of the pop., but have 53% of cases since Aug 30, w/rising % pos

25/ % visible minorities in a neighbourhood correlates with concentration of service workers in a neighbourhood, so as we have seen above, occupation could be the driving factor. I will leave it to the immunologists/virologists to comment on immune susceptibility differences.

26/ Moving on.. (and almost done)

27/ So it appears the task & health cost of containing #COVID19 thru lockdowns/societal restrictions *FALLS HEAVIEST* on lower-income neighbourhoods, with minorities and service workers, who *must* go out into society/community to earn a living, and who may be more susceptible.

28/ ...while we protect young, healthy, knowledge/”White-Collar/Work-From-Home workers (of which I am one) who, in the younger ages, are at far less risk of a bad #COVID19 outcome. I say shame on us (although I am trying not to express explicit opinion, rather give information)!

29/ Interestingly, this is *precisely* the dynamic going on that the nice folks behind the @gbdeclaration (@SunetraGupta, @MartinKulldorff, and Jay Bhattacharya) are trying to convey. Here is Dr. Kulldorf’s very eloquent quote from a recent interview:

30/ A topic not explored herein, which I may add later, is how / why peak positivity differ so widely across neighbourhoods. The Downtown Core peaked in September at 3.3%, while others are still rising. (but maybe I leave that one to the Ontario #COVID19 Science Table to answer.)

31/ And on that note, and lastly, in Toronto, 52 neighbourhoods with a total of 935k people, or 34% of the population, *peaked in prevalence in September* at an average positivity of *2.5%*, two-weeks *prior* to the Oct 10th restrictions taking effect.

32/ End thread.

If you made it to the end, thank you so much for reading and considering.

If you made it to the end, thank you so much for reading and considering.

• • •

Missing some Tweet in this thread? You can try to

force a refresh