#BurgerKing IPO Conference Notes📝🧵

@ipo_mantra @varinder_bansal @Maaachaaa69 @SanaSecurities @sahneydeepak @nimeshscnbc

@ipo_mantra @varinder_bansal @Maaachaaa69 @SanaSecurities @sahneydeepak @nimeshscnbc

2/ Indian Market

-Management has 2 decades of experience (From Canada to all other countries)

-They entered India 5-6 years ago which is a Brahmastra market for them due to young population advantage.

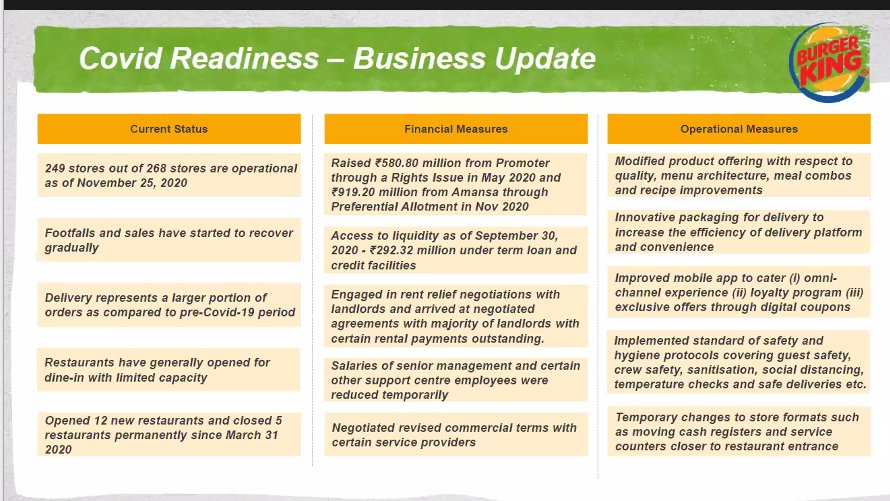

-They have 268 stores with 200 stores opened currently due to COVID.

-Management has 2 decades of experience (From Canada to all other countries)

-They entered India 5-6 years ago which is a Brahmastra market for them due to young population advantage.

-They have 268 stores with 200 stores opened currently due to COVID.

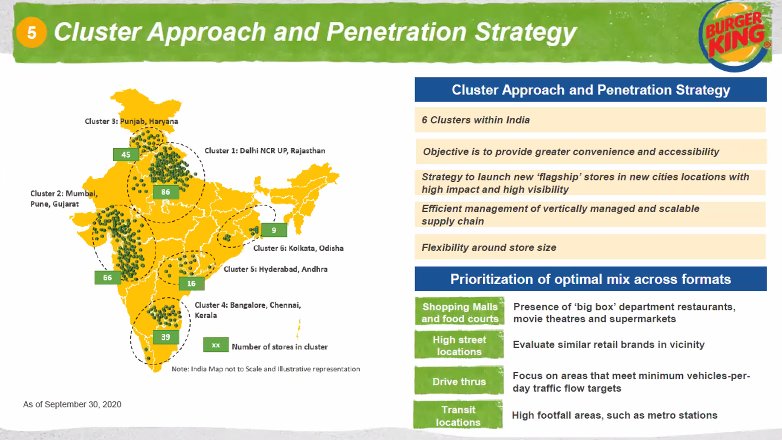

4/ Snapshot & Stores & Market

-55% stores in malls

-5% stores metro stations

-25% stores in streets

-When they entered India, they had huge competition, even before they commercialized, they checked taste till 12 months.

-55% stores in malls

-5% stores metro stations

-25% stores in streets

-When they entered India, they had huge competition, even before they commercialized, they checked taste till 12 months.

-They analyzed whole Indian veg &non-veg taste with respect to value & price

-They are leader in terms of value

-Indian Non-veg market also like to eat veg, they build up very extensive product portfolio keeping this in mind

-They are leader in terms of value

-Indian Non-veg market also like to eat veg, they build up very extensive product portfolio keeping this in mind

-Follow cluster approach which has benefits on cost side, it help them to grow structurally in specific markets, target to get 700 stores by Dec-26.

-700 stores are broken into yearly targets like next year they have plans to open 50 stores and incremetally they can even open 35 stores with respect to agreement given in the RHP.

-In past 5 years they have always been ahead of the target for what they had for years.

-In past 5 years they have always been ahead of the target for what they had for years.

-They believe that they are relatively new in India (5-6 years), restaurants are equally distributed in North, South & west markets. They grow across the country.

5/ Supply Chain

-They build supply chain from scratch, they negotiate directly with supplier once supplier is audited, they supply inventory to third party logistic provider.

-They build supply chain from scratch, they negotiate directly with supplier once supplier is audited, they supply inventory to third party logistic provider.

-India was 100th country for them to enter, they got no.1 rank in 100 countries in the sector in 2018, every quarter they audit all operations and centers.

6/ Technology Driven

-They integrated ARP system since day1, when food aggregators came to India, they were 1st to onboard them, they integrated aggressively with swiggy/zomato, loyalty program

-Build app with zero contact channel with many attractive offers to engage consumers

-They integrated ARP system since day1, when food aggregators came to India, they were 1st to onboard them, they integrated aggressively with swiggy/zomato, loyalty program

-Build app with zero contact channel with many attractive offers to engage consumers

-They innovated whole delivery system during COVID

-They were among the first one to start restaurants post COVID

-Liquidity and cost savings were the main focus during COVID

-Technology is key for them, post and pre covid, company has been investing in tech as utmost agenda.

-They were among the first one to start restaurants post COVID

-Liquidity and cost savings were the main focus during COVID

-Technology is key for them, post and pre covid, company has been investing in tech as utmost agenda.

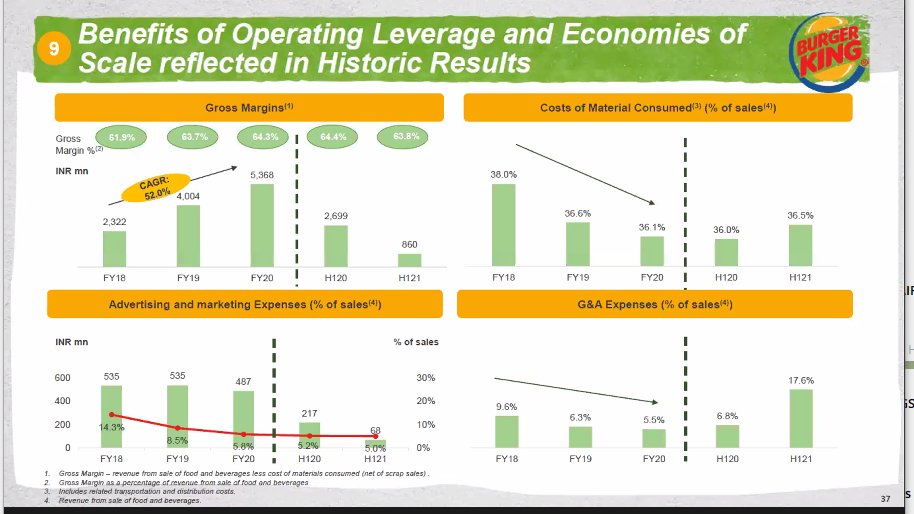

7/ Financials Update

-They expect to keep corporate cost at 5% ahead

-Company has been aggressively growing , revenues have been grown by 50% in past years, with 9% spending on advertisements and marketing.

-They expect to keep corporate cost at 5% ahead

-Company has been aggressively growing , revenues have been grown by 50% in past years, with 9% spending on advertisements and marketing.

-200 crs of gross debt, reasonable liquidity of 60 crs, with available balance money they should be able to get 700 stores target.

-Post IPO company will be zero debt company with cash on books

-Beverage sales is decent percentage of overall sale

-Post IPO company will be zero debt company with cash on books

-Beverage sales is decent percentage of overall sale

-6 month store EBITDA is 11%.

-This biz is high operating leverage biz, significant operating leverage will play out to achieve target of 700 stores

-Working capital

They have negative working capital to the tune of 24-25 days, Intention is to maintain cash levels

-This biz is high operating leverage biz, significant operating leverage will play out to achieve target of 700 stores

-Working capital

They have negative working capital to the tune of 24-25 days, Intention is to maintain cash levels

8/ Customer acquisition strategy

-As a brand, the personality catches youngsters with millennial

-They are in aggregator market, restaurants with modernize seatings ,family seating, individual seating.

-As a brand, the personality catches youngsters with millennial

-They are in aggregator market, restaurants with modernize seatings ,family seating, individual seating.

-World is moving more to meetings, they are analyzing customer demands and purposes.

-Market share

5% market share in last 5 years in chained restaurant line

-They have app which captures ticket level data & shows which product is getting traction & such other analysis.

-Market share

5% market share in last 5 years in chained restaurant line

-They have app which captures ticket level data & shows which product is getting traction & such other analysis.

9/ Geographical expansion

-North and west is major hold

-They have already gone to tier two towns like Indore, Bhopal, Amritsar, jalander etc

-They just follow their plan

-They will penetrate and leverage those markets by creating synergies from transportations etc

-North and west is major hold

-They have already gone to tier two towns like Indore, Bhopal, Amritsar, jalander etc

-They just follow their plan

-They will penetrate and leverage those markets by creating synergies from transportations etc

-Few months before covid they started building up stores in kolkata which is huge food market.

-As that time they will penetrate in other exisitng market

70% growth will come from exiting market and 30%from new market.

-As that time they will penetrate in other exisitng market

70% growth will come from exiting market and 30%from new market.

10/ Store closure

-Pre covid 3 stores were shut to reallocate and during covid they shut 5 stores and in total it is 8.

-Pre covid 3 stores were shut to reallocate and during covid they shut 5 stores and in total it is 8.

11/ Why to go public?

-They are in aggressive growth phase which will require capital, they feel confident about the future.

-They believe they have reached on a level to go public.

-They are in aggressive growth phase which will require capital, they feel confident about the future.

-They believe they have reached on a level to go public.

12/ Market Outlook

-First event is potential shift of unorganized to organized market.

-Second is is real estate market opening up

-First event is potential shift of unorganized to organized market.

-Second is is real estate market opening up

13/ Advantages

-Well funded

-Good structure

-Management capturing opportunities

-No supplier and vendor constraints, supply was available throughout the COVID

-Well funded

-Good structure

-Management capturing opportunities

-No supplier and vendor constraints, supply was available throughout the COVID

• • •

Missing some Tweet in this thread? You can try to

force a refresh