#Ajax 2019/20 accounts cover a season when the Eredivisie was ended early in April due to COVID-19. The KNVB decided to maintain league positions with Ajax leading, but no title was awarded. Eliminated at Champions League group stage. Some thoughts in the following thread.

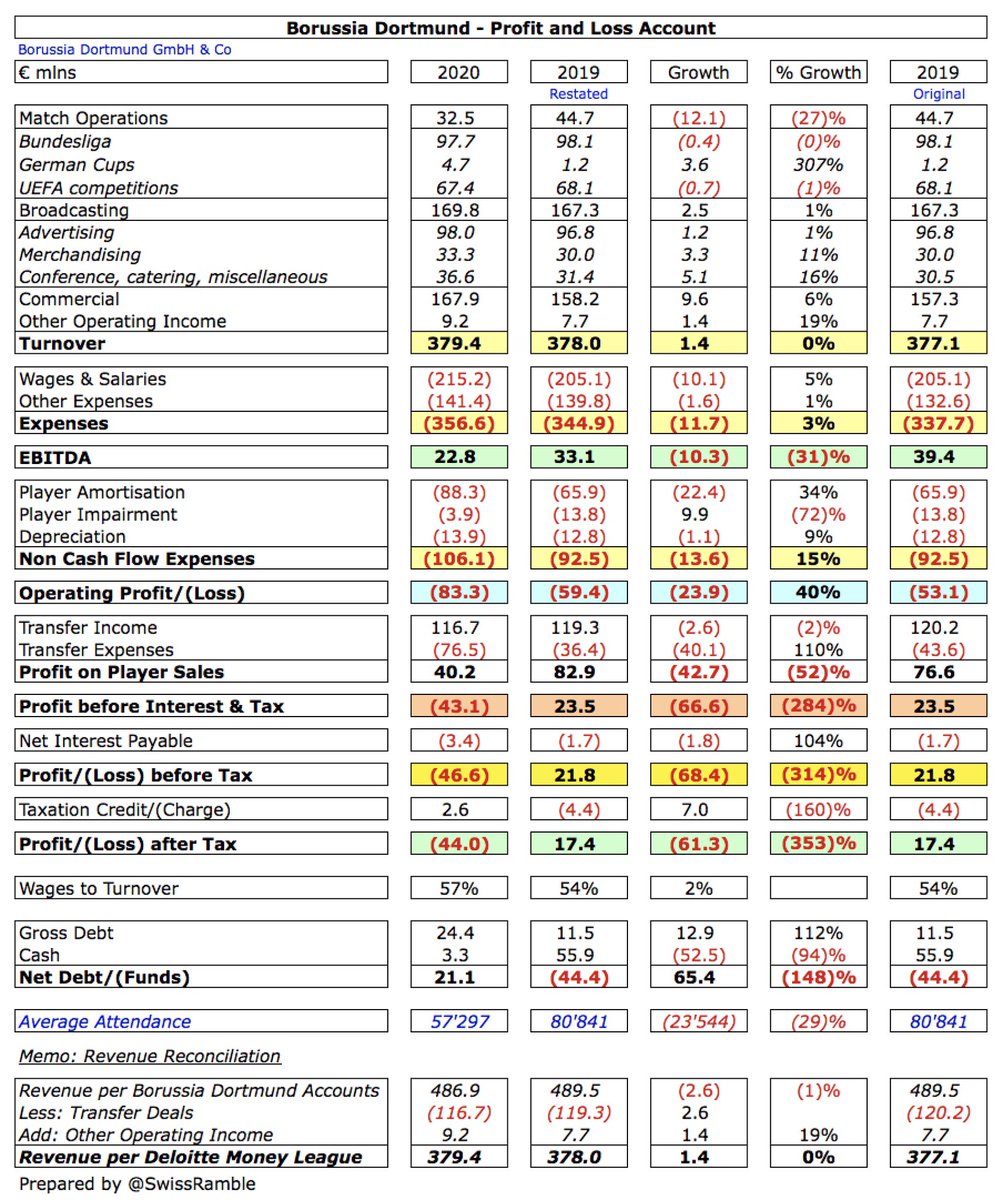

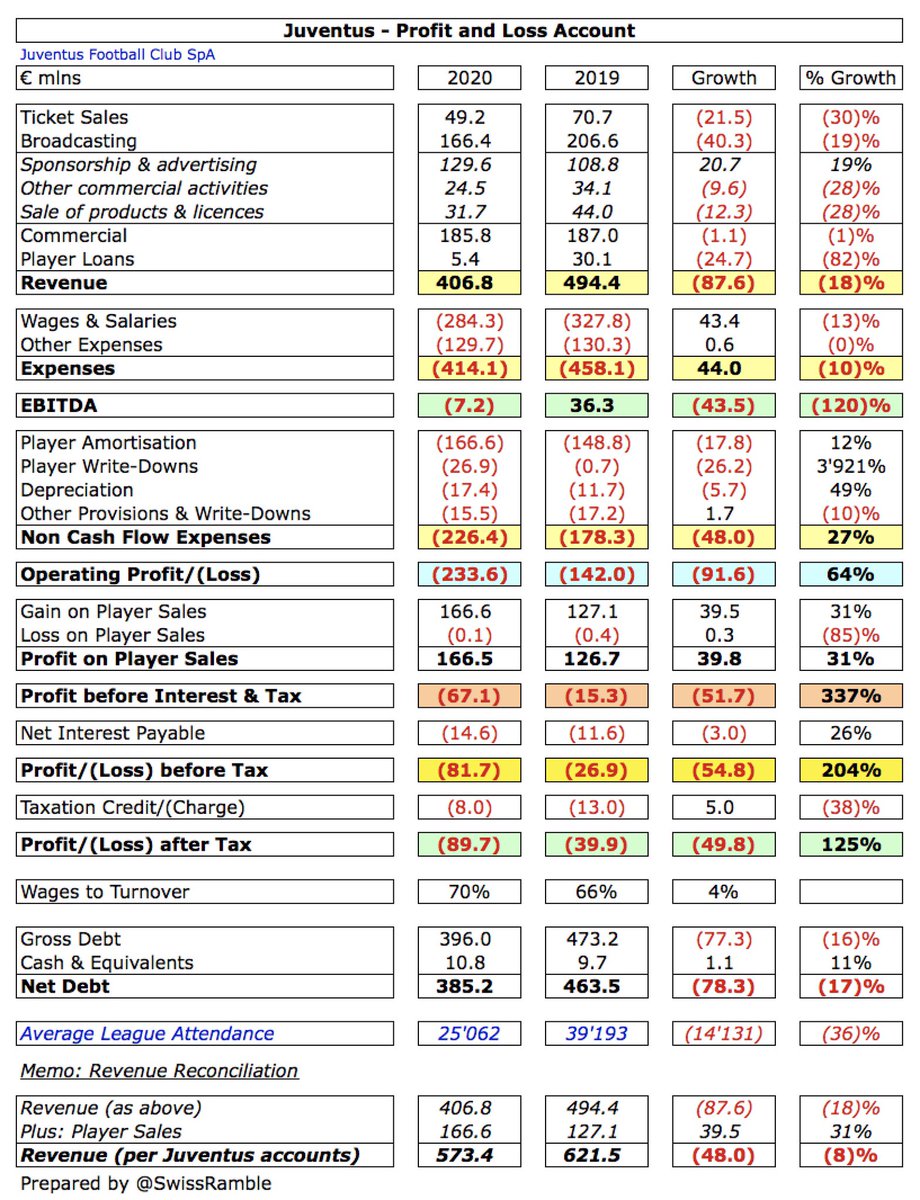

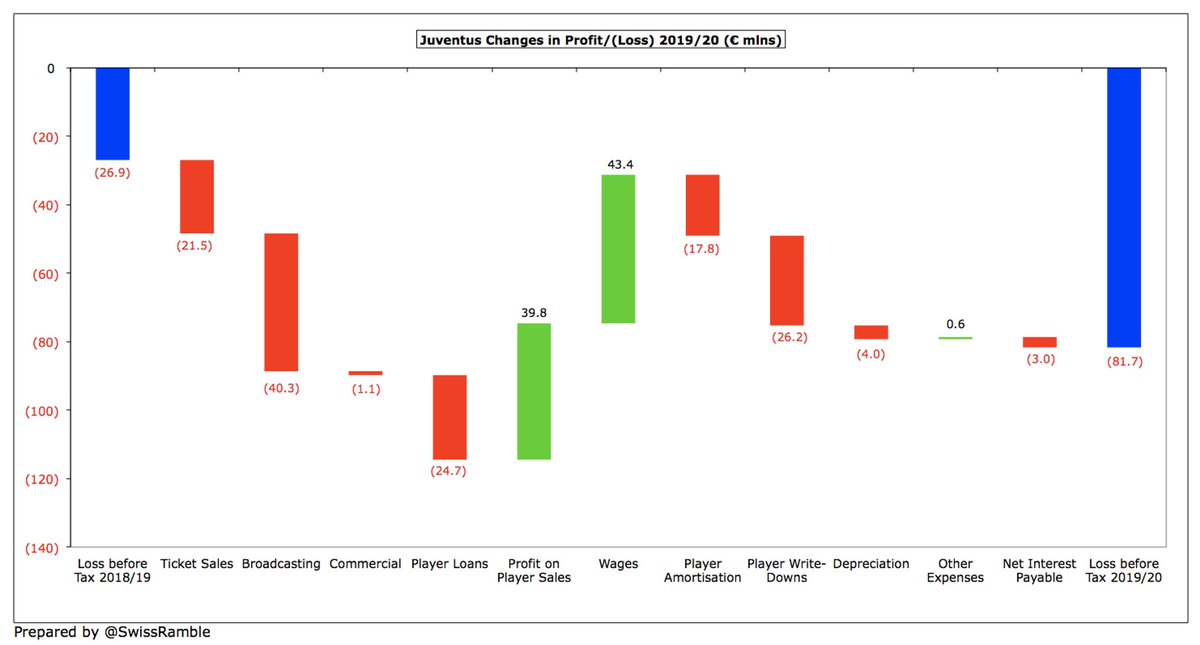

#Ajax profit before tax fell €42m from €69m to €27m (profit after tax down from €52m €20m), largely due to revenue dropping €37m (16%) from a record €199m to €162m and expenses increasing by €17m to €220m, partly offset by profit on player sales rising €12m to €84m.

#Ajax €42m revenue fall was largely due to less progress in the Champions League and pandemic impact. As a result, broadcasting dropped €33m (37%) from €89m to €56m, while match day was down €9m (18%) from €51m to €42m. Commercial increased €5m (8%) from €60m to €65m.

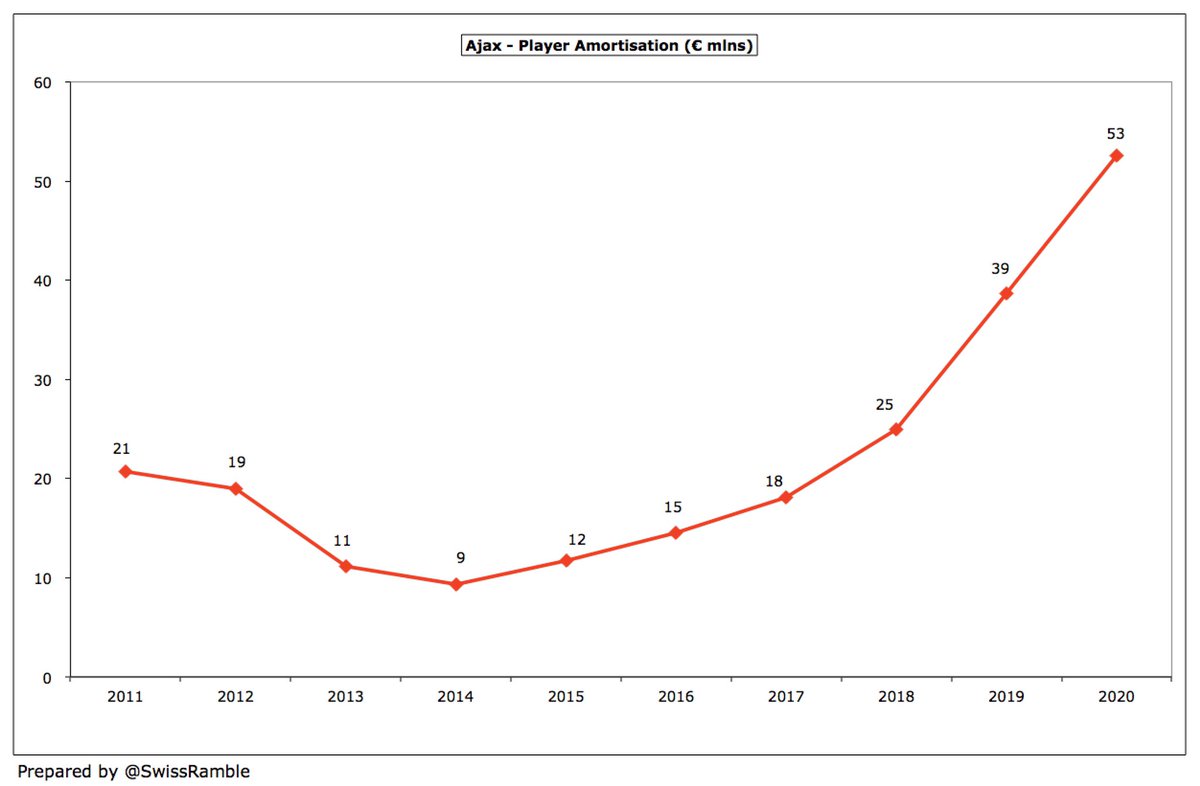

#Ajax wage bill was flat at €92m, while other expenses, including match costs, fell €8m (11%) to €62m. However, player amortisation leapt up €14m (36%) from €39m to €53m. Due to IFRS 16 reclass from rental, depreciation and interest payable rose €8m and €2m respectively.

Despite the fall, #Ajax €27m profit is still the highest in the Eredivisie, well ahead of the next highest, AZ €8m. As a rule, very few Dutch clubs make big money, so Ajax €69m surplus in 2018/19 was something special and unlikely to be repeated.

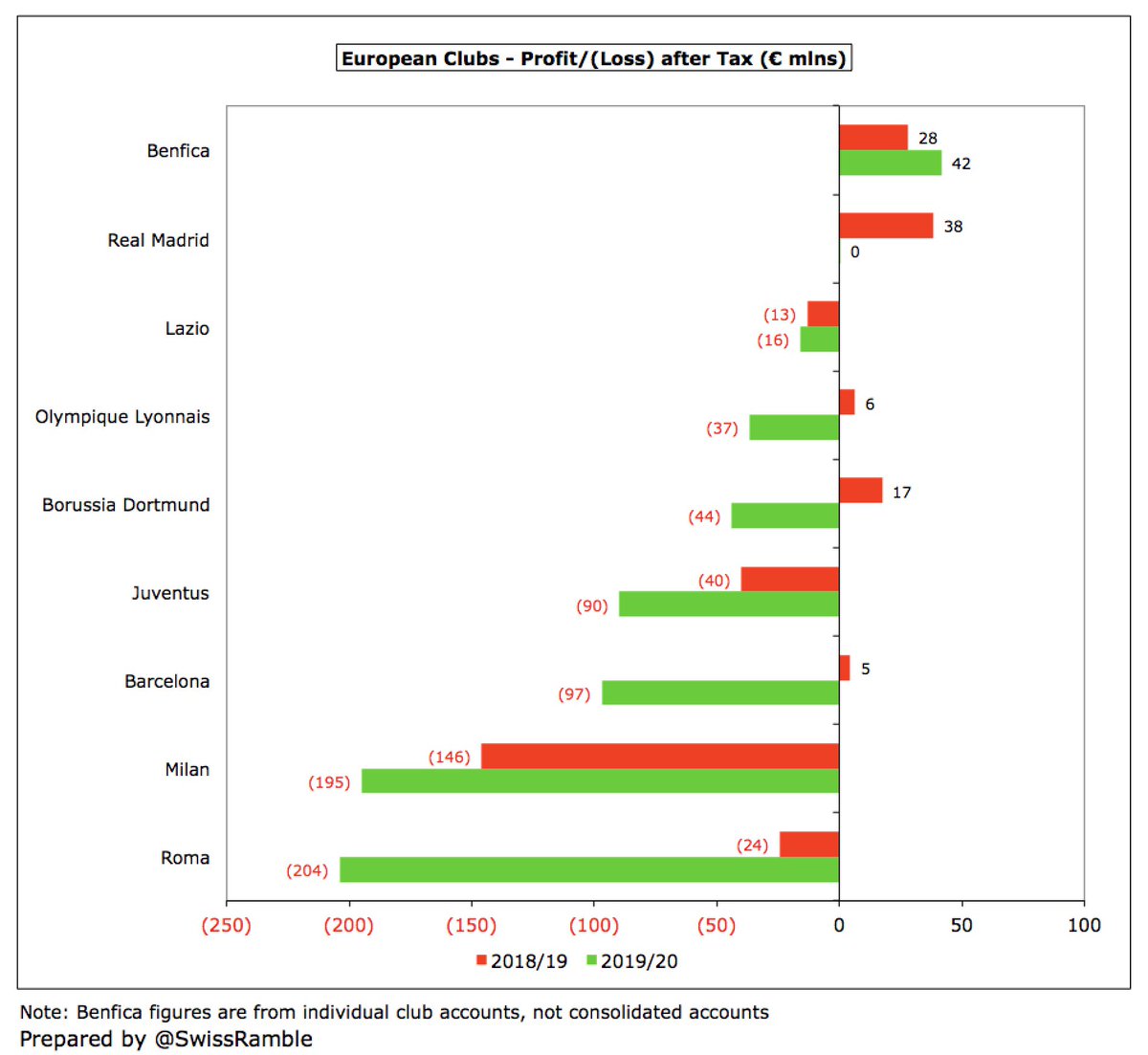

Furthermore, many clubs have announced huge losses for 2019/20, due to COVID, including Roma €204m, Milan €195m, Barcelona €97m, Juventus €90m & Dortmund €44m. #Ajax and Benfica profits were due to high player sales. In 2018/19 Ajax had one of the highest profits in Europe.

#Ajax are known for their strategy of developing and selling players with 2019/20 benefiting from €84m profit from this activity, €12m up on prior season, mainly Matthijs de Ligt to Juventus and Kasper Dolberg to Nice. Next highest profits in Eredivisie: PSV €47m and AZ €13m.

#Ajax have a sustainable business model, reporting profits in 9 of the last 10 years (only loss was €1m in 2015/16). In that period, they have accumulated over a quarter of a billion Euros profit, averaging €26m a season. However, they do expect a loss in 2020/21 due to COVID.

#Ajax are very reliant on player sales to make a profit, earning a thumping great €400m from this activity in the last 10 years, averaging €69m a season since 2017. Next year’s accounts will include Hakim Ziyech to #CFC, Donny van de Beek to #MUFC and Sergio Dest to Barcelona.

#Ajax EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out player sales and non-cash items to give underlying profitability, fell from €38m to €8m, more in line with usual levels (down from €111m to €93m if player sales are included).

Almost all the Eredivisie clubs have negative (or very low positive) EBITDA, so #Ajax €8m is still the highest in the league, even after the decrease in 2019/20. The next highest are RKC Waalwijk €5m, Feyenoord €2m and Twente €2m.

#Ajax usually post operating losses (offset by player sales), but this slumped from €4m to €56m in 2019/20, the worst in Eredivisie, though PSV also dropped to €41m. Only 2 clubs had profits: RKC Waalwijk €4m & Emmen €1m. In 18/19 Ajax €4m loss was one of lowest in Europe.

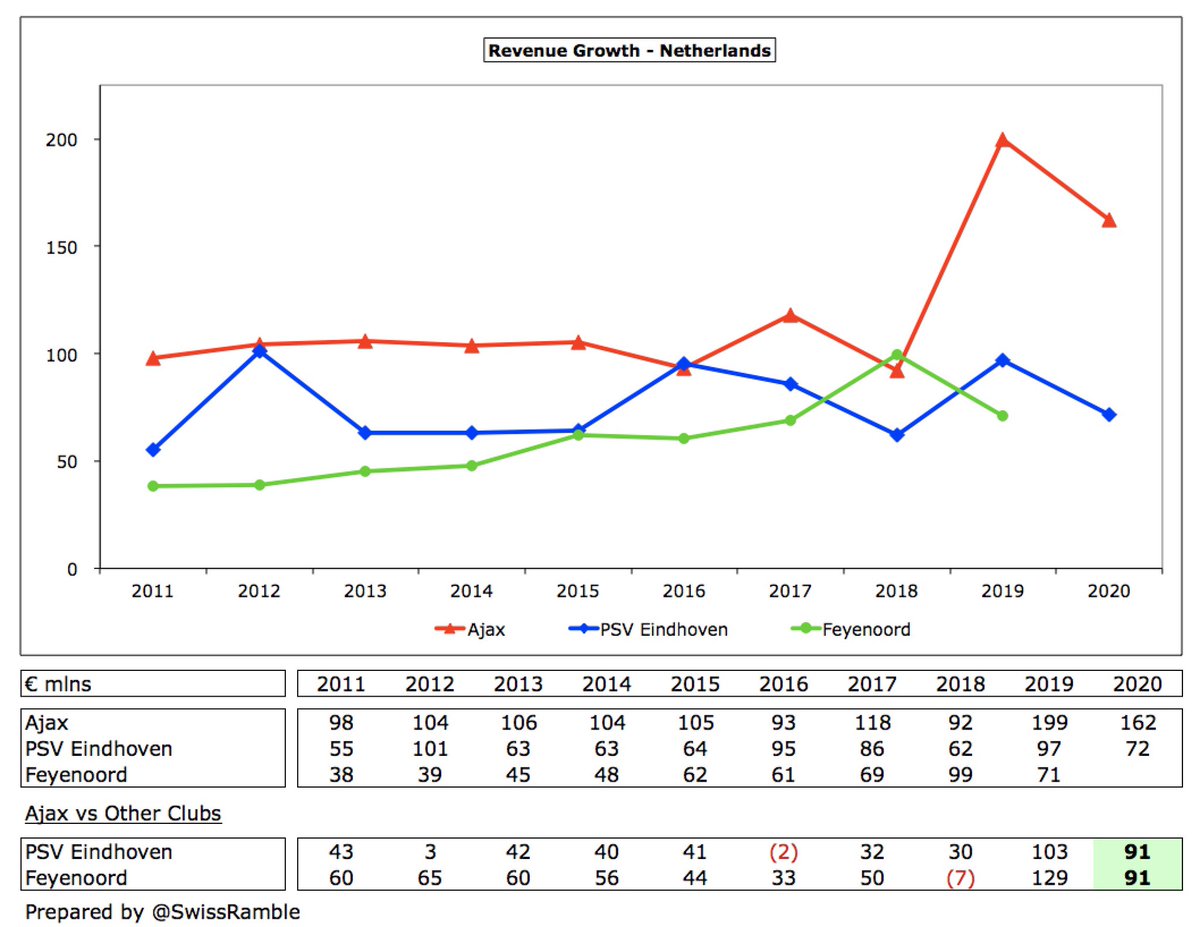

Although #Ajax revenue fell €37m, their 2019/20 revenue of €162m was still their second highest ever, €69m more than €93m two years ago. The growth over 2018 was driven by European TV revenue €44m, but also healthy increases in commercial €16m and match day €11m.

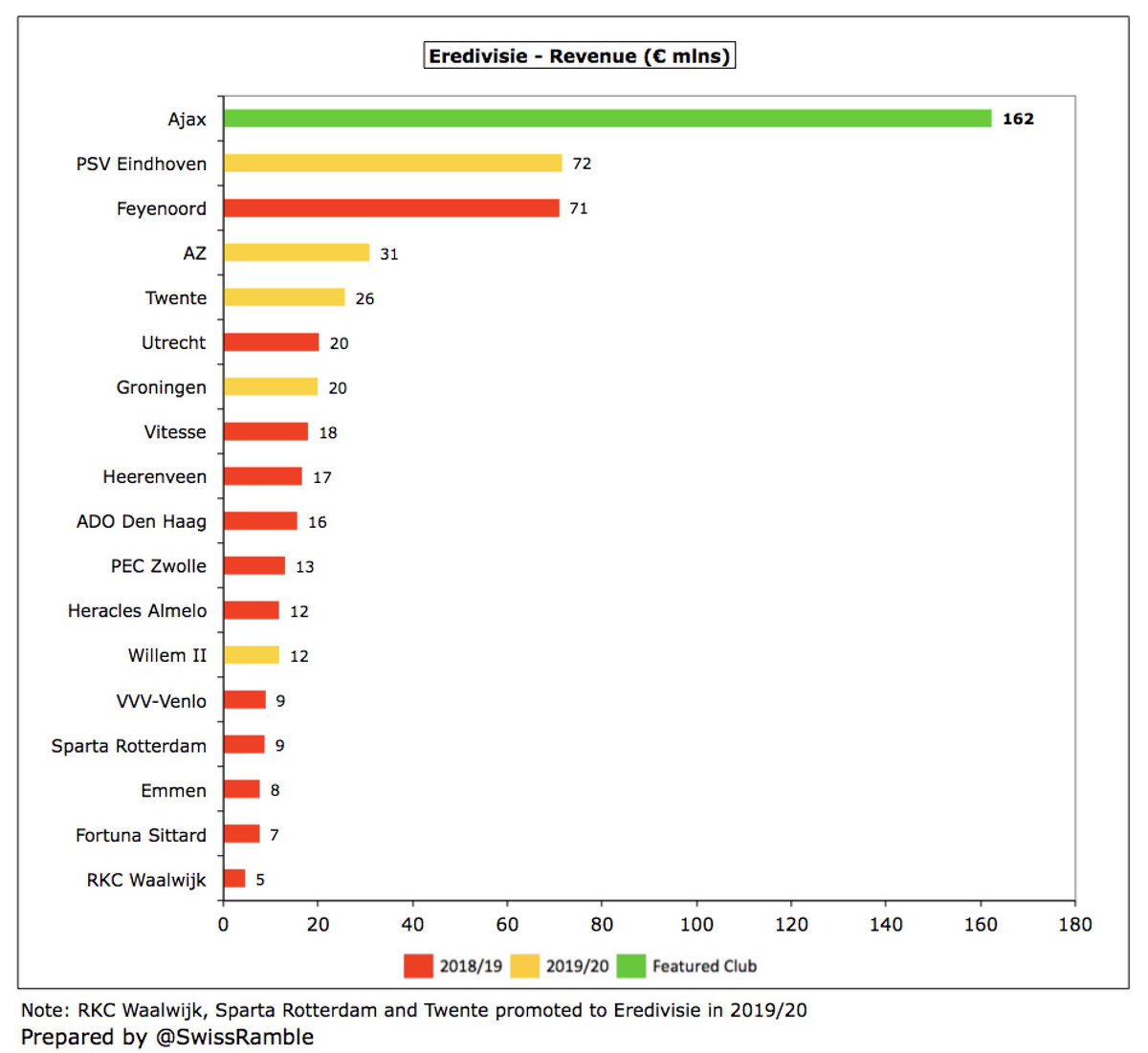

As a consequence, #Ajax €162m revenue is not only the highest in the Eredivisie by far, but also more than the next two clubs combined: PSV €72m and Feyenoord €71m. Looked at another way, it’s also around the same revenue as the lowest 13 clubs combined.

The gap between #Ajax and their two main domestic rivals was only higher last season, but is still €91m for PSV and Feyenoord, who have less than half the revenue of the Amsterdam club. Supports director Marc Overmars’ view, “We need to become the Bayern Munich of our league”

Based on 018/19 revenue of €199m. #Ajax were 23rd in the Deloitte Money League, ahead of Benfica, Wolves and Valencia. This is a fine achievement, though worth noting this is still far below the elite overseas clubs with the top nine all earning more than half a billion Euros.

In fact, even after doubling revenue to €199m in 2018/19, the gap between #Ajax and the top club was almost unchanged with Barcelona growing to an incredible €841m. Overmars again: “It’s like being in Formula 1 and driving a DAF. It’s hard to pass the Mercedes and Ferraris.”

To reinforce the enormous revenue disparity for Dutch clubs, the Eredivisie had €594m revenue in 2018/19, just 10% of the Premier League €5.9 bln. Also miles behind Spain €3.4 bln, Germany €3.3 bln, Italy €2.5 bln & France €1.9 bln. Also below Russia €752m & Turkey €748m.

#Ajax receive less than €10m a season TV money from the Eredivisie, who signed a 12-year deal with Fox that started in the 2013/14 season. The distribution is based on a club’s historical performance (results over the previous 10 years), so Ajax get the most.

For some perspective, the club finishing top of the Premier League received around €170m, while the bottom club got €110m, i.e. 12 times as much as #Ajax €9m. They only get slightly more than an English Championship club not benefitting from parachute payments.

Based on my estimate, #Ajax earned €48m from Europe in 2019/20: €47m from the Champions League group stage plus another €1m after dropping down to the Europa League. Much lower than €79m earned the previous season, when they reached the Champions League semi-final.

#Ajax benefited from a new UEFA coefficient payment (based on performances over 10 years), where they were ranked 14th in the Champions League, thus receiving €21m. This distribution methodology rewards the club’s good record in Europe.

#Ajax have earned a chunky €152m from European competition in the last 5 years, which is even more impressive considering they did not reach the group stage of Champions League or Europa League in 2017/18. Next highest for Dutch clubs: PSV €94m and Feyenoord €30m.

The importance of Champions League qualification for #Ajax cannot be overstated. Including €10m gate receipts, they earned €56m, which was around a third of their total revenue. The €41m fall over prior season’s amazing €97m is the main reason for the club’s revenue decrease.

#Ajax match day income fell €9m (18%) from €51m to €42m, largely due to 9 fewer games, including 4 in Europe (down €7m) and 4 in the Eredivisie (season ending early). Much higher than other Eredivisie clubs with the closest being Feyenoord €17m and PSV €14m.

#Ajax average attendance of 52,300 remains the highest in the Eredivisie, around 11,000 more than Feyenoord 42,200. The only other Dutch clubs above 20,000 were PSV Eindhoven with 33,600 and Twente Enschede 27,200. Ajax 45,448 season tickets were 2,204 more than prior year.

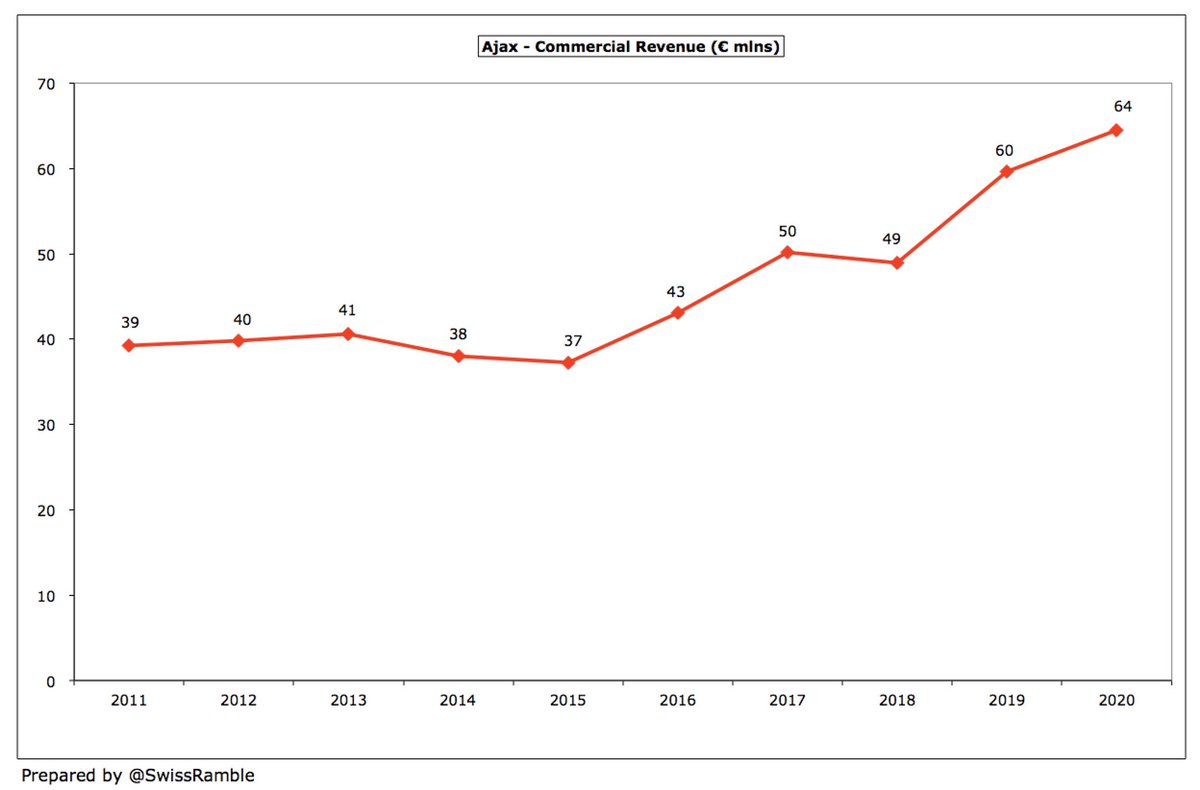

#Ajax commercial income grew €5m (8%) from €60m to €65m, including sponsorship €35m, merchandising €19m (down €2m due to late launch of shirt and closure of fan shops due to virus) and €9m other income (government COVID subsidy and donations from season ticket holders).

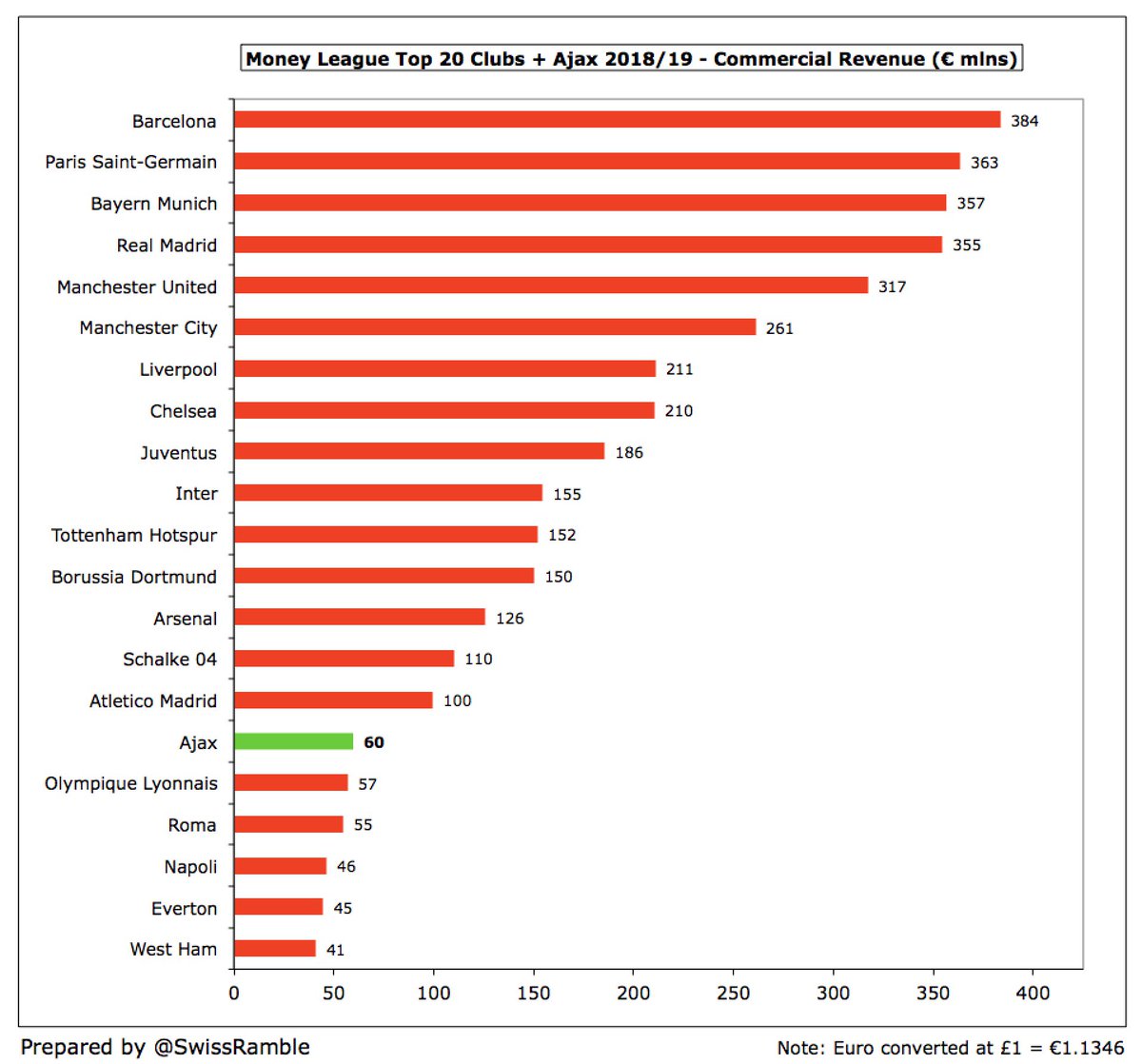

#Ajax €65m commercial revenue is the highest in the Eredivisie, well ahead of Feyenoord €45m and PSV €40m. However, it is less than a fifth of the elite European clubs, such as Barcelona €384m, PSG €363m and Bayern Munich €357m.

#Ajax have extended their two main sponsorship deals: (a) shirt sponsor Ziggo, a telecoms provider, to June 2024, worth around €9m a year; (b) kit supplier Adidas, who have been with the club since 2000, have a new 6-year deal worth around €8m a year until June 2025.

#Ajax wage bill was flat at €92m, as €16m increase in player salaries was offset by €16m decrease in performance related bonuses, due to less progress in the Champions League. Since 2018 revenue (77%) and wages (75%) have grown at the same rate.

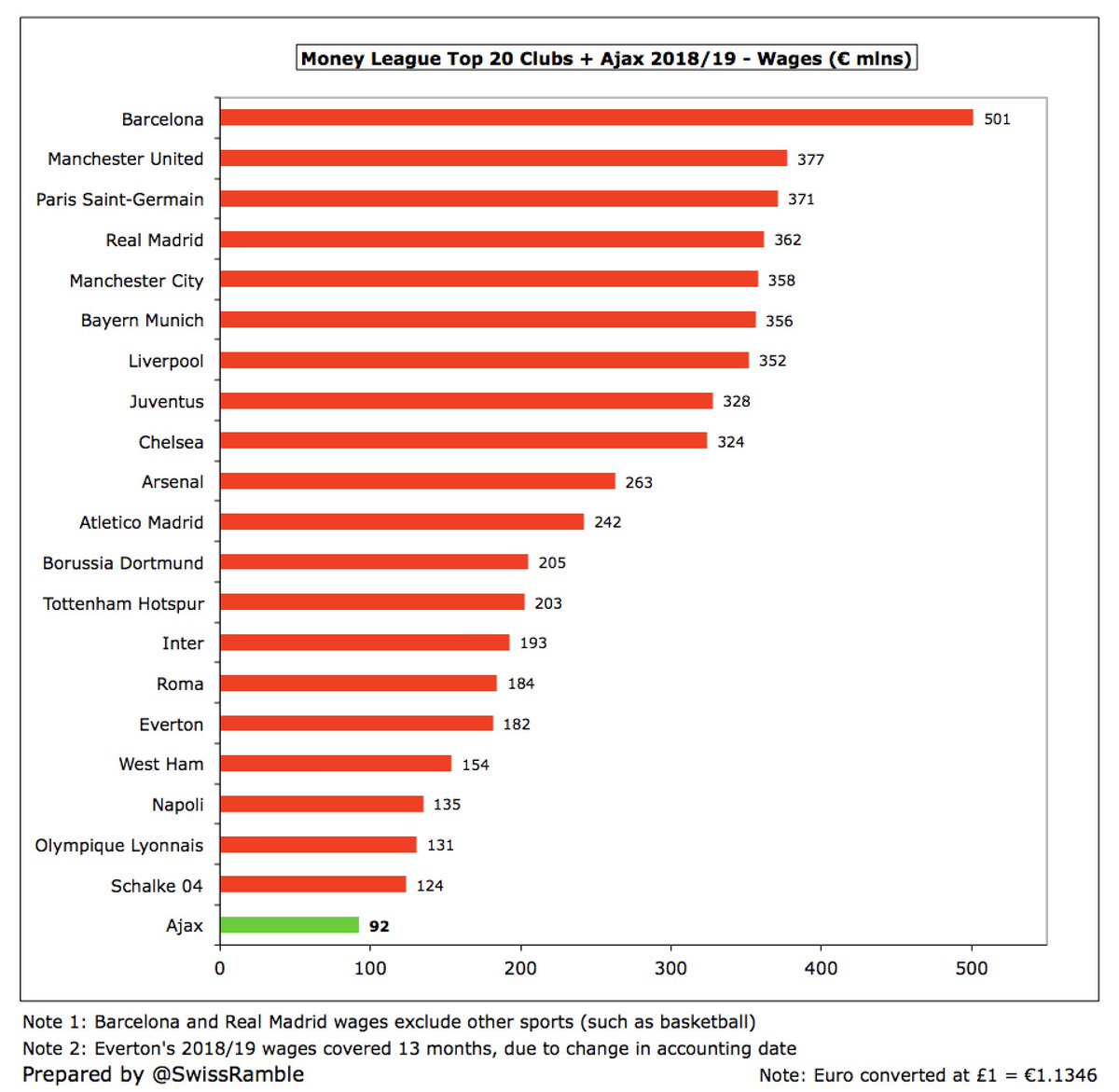

The #Ajax wage bill of €92m is by some distance the highest in the Eredivisie, around twice as much as the closest challenger PSV Eindhoven €47m, followed by Feyenoord €35m. There is then a further big gap to AZ €22m, Vitesse €19m and Twente €15m.

However, for #Ajax it is a case of being “a big fish in a small pond”, as their €92m wage bill is significantly lower than the top clubs in the major leagues, e.g. less than 20% of Barcelona €501m. This makes it fairly inevitable that their young stars will move abroad.

Following the decrease in revenue, #Ajax wages to turnover ratio rose from 46% to 57%, around the same as 2018. This was better than PSV 66%, but worse than Feyenoord 49% (though their ratio may well be worse when 2019/20 accounts are published).

In 2018/19 #Ajax 46% wages to turnover ratio was only bettered among the top 20 Money League clubs by Schalke 04 38% and Tottenham 39%. It was much lower than the likes of Roma 78%, Juventus 66%, Atletico Madrid 63%, Napoli 62%, Lyon 59% and Barcelona 59%.

#Ajax player amortisation (i.e. the annual charge to write-down transfer fees), has risen considerably over the last few seasons, reflecting their growing investment in the playing squad. It has more than quintupled from €9m in 2014 to €53m in 2020, including €14m last year.

#Ajax player amortisation of €53m is easily the highest in the Eredivisie, ahead of PSV €22m and Feyenoord €15m, then a big drop to AZ €6m. However, to place this into perspective, big spending clubs like #CFC, Juventus and Barcelona have more than €140m.

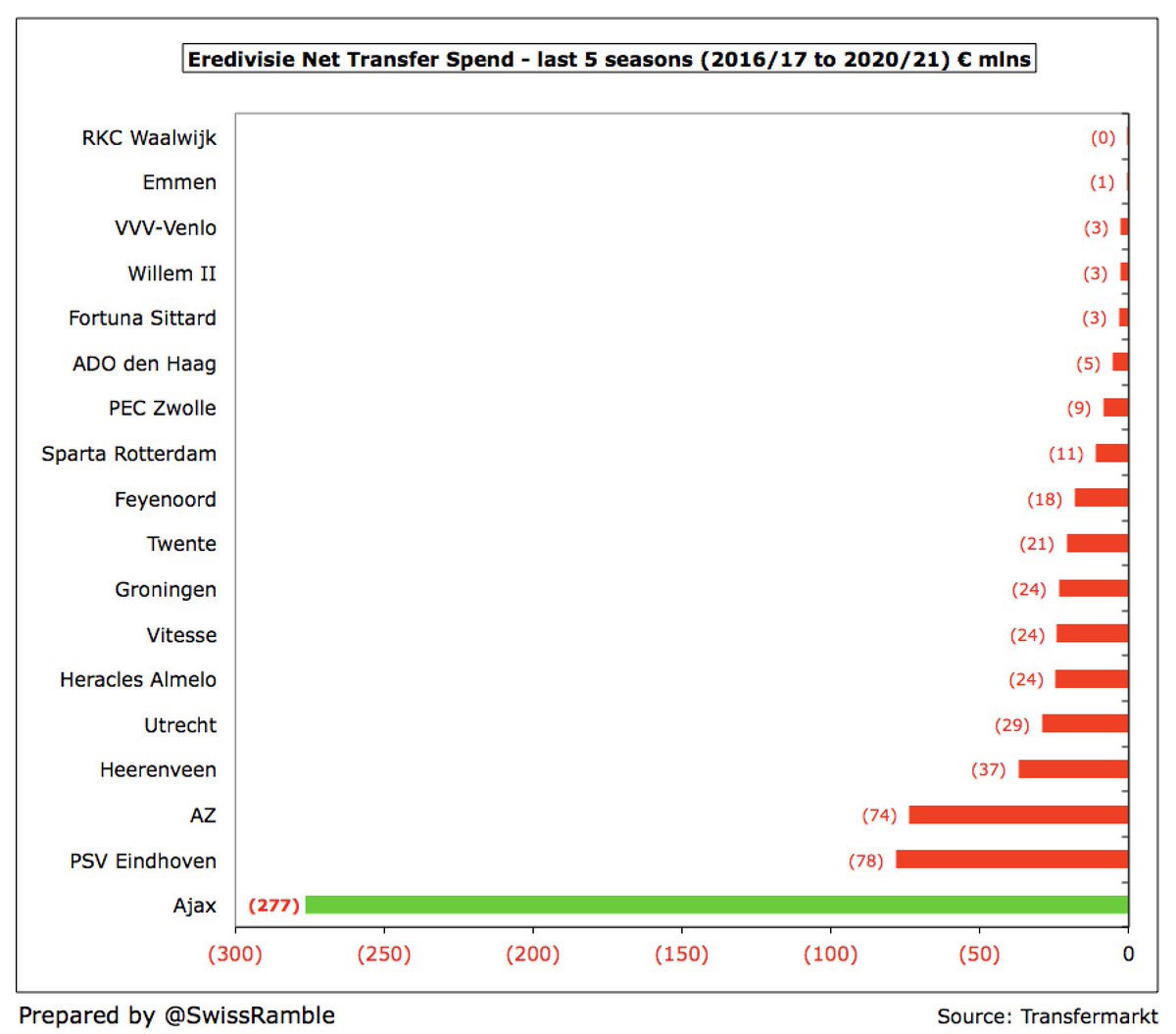

#Ajax have been a selling club for many years, as their financial constraints make it virtually impossible to keep players. In fact, in the last 5 years average annual net sales have increased to €55m, though this disguises purchases increasing to €45m, with sales up to €100m.

Indeed, four of #Ajax five highest ever player sales have come in the last 2 years: de Jong to Barcelona €86m, de Ligt to Juventus €86m, Ziyech to #CFC €40m and van de Beek to #MUFC €39m. This is a hidden benefit of CL success. Their top 25 transfers have generated €658m.

Every single Eredivisie club has had net player sales over the last 5 seasons, as another indicator of the financial position of Dutch football, though #Ajax have the highest figure by some distance with €277m, well ahead of PSV €78m, AZ €74m and Heerenveen €37m.

However, on a gross basis #Ajax have spent more than any other Dutch club on players over the last 5 seasons with their €224m twice as much as PSV €106m, followed by Feyenoord €49m and AZ €26m. In fact, Ajax gross spend was equal to the rest of the league combined.

#Ajax had virtually zero financial debt, though 2019/20 saw a technical increase for the inclusion of €151m financial lease obligations as a result of IFRS 16. Before that, they enjoyed surplus net funds for many years.

Following the increase, #Ajax €151m debt is highest in the Eredivisie. Only other clubs above €10m are PSV €32m, Twente €21m, Groningen €10m & AZ €10m. However, they are a long way below other European clubs, e.g. #THFC €746m, #MUFC €580m, Juventus €473m & Inter €461m.

#Ajax transfer debt fell from €65m to €41m, while amount owed to them by other clubs was also down from €63m to €44m, giving net transfer receivables of €3m. In 2018/19 their transfer debt was significantly lower than European clubs, eg Barcelona €261m and Juventus €221m.

However, it is worth keeping an eye on #Ajax total liabilities, the broadest possible definition of debt, which have grown from €62m in 2016 to €280m in 2020, including a €103m increase last season alone (though mainly due to the inclusion of finance leases per IFRS 16).

In fairness, #Ajax total liabilities are still very low compared to other major European clubs. Only Money League Top 20 club with a lower balance in 2018/19 than Ajax €1777m was Borussia Dortmund €145m, while #THFC, #MUFC and Barcelona have amassed over €1.2 bln liabilities.

#Ajax cash balance dropped €40m from €62m to €22m, mainly due to €45m fall in cash generated from operating activities, plus investment in new players €91m (€20m more than previous season) and payment of income taxes €14m. Also €7m lease repayments and €1.2m dividend.

#Ajax have paid €3.1m in dividends in the last decade, including €1.2m in both 2018 and 2020. They have announced that there will be no payment in 2021, due to the operating loss. Also not allowed to pay dividend, as club has received a COVID government grant.

#Ajax are a very well-run club, but their business model is very reliant on 2 factors: (a) qualification for the Champions League; (b) profitable player sales. They clearly have the best financial resources in the Eredivisie, but are still way behind their elite European rivals.

• • •

Missing some Tweet in this thread? You can try to

force a refresh