How position sizing can affect your trading performance-

Assuming that you are trading a Trend-following system with Big RR and low win-rate.

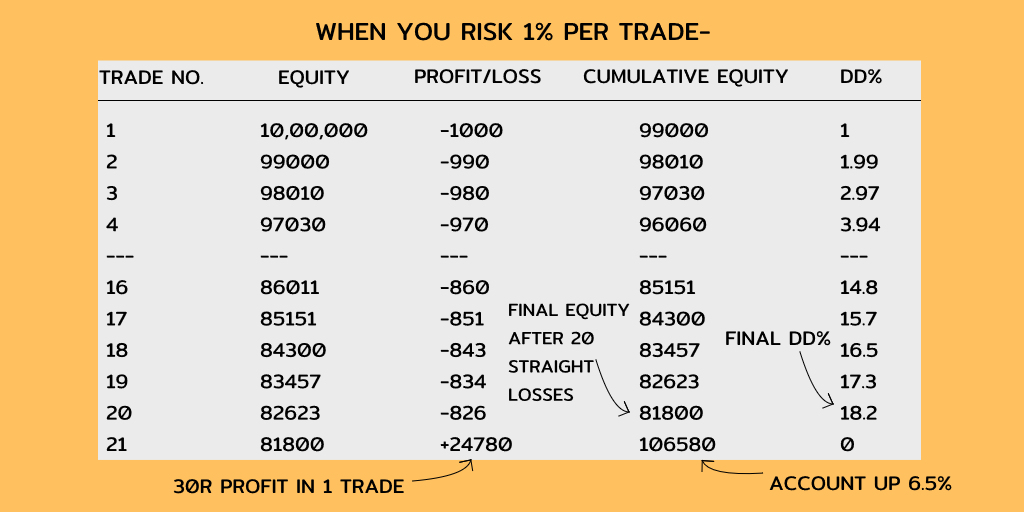

For example, assume that you risk one percent per trade on a 100,000 account

and you have 20 straight losses.

Assuming that you are trading a Trend-following system with Big RR and low win-rate.

For example, assume that you risk one percent per trade on a 100,000 account

and you have 20 straight losses.

That one percent is of your remaining equity and at the end of 20 losses, you would be down to 81,790.60.

Now if you got a 30R winner and you are risking one percent of your balance of 81,790.60, your new equity would be 106,327.9,

Now if you got a 30R winner and you are risking one percent of your balance of 81,790.60, your new equity would be 106,327.9,

You’ve had 20 losses and one winner though you are still up 10Rplus your equity is up by 6.3R percent.

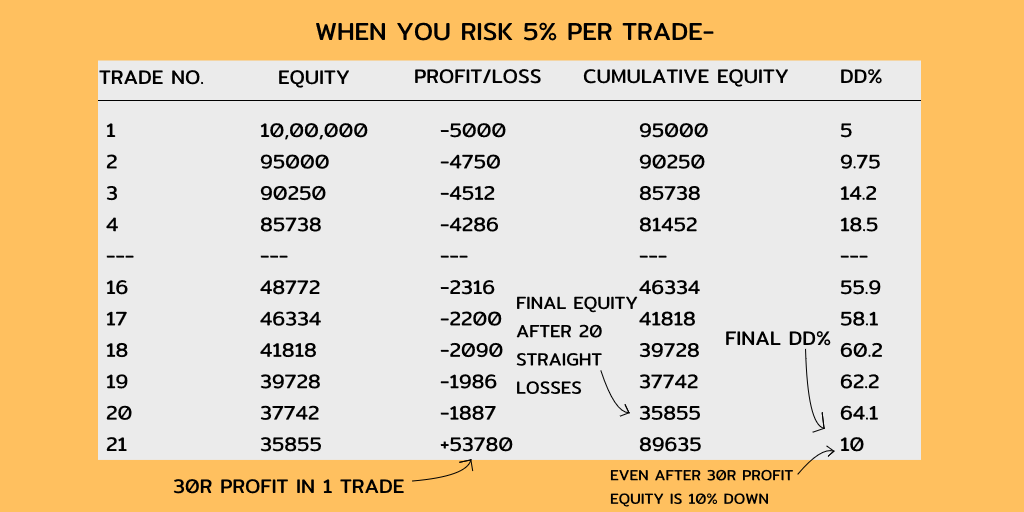

Now, let’s say you risk five percent per trade on your balance. At the end of 20 straight losses, you would be down to 35,772.89 or down 64 percent.

Now, let’s say you risk five percent per trade on your balance. At the end of 20 straight losses, you would be down to 35,772.89 or down 64 percent.

If you risk five percent on this amount and get a 30R winner, you would be up to 89,621.48. You are up 10R, but because of your position sizing, your equity is still down over 10 percent.

#positionsizing

#Trading

#nifty50

#positionsizing

#Trading

#nifty50

This is why position sizing is the most important factor in trading if you get it right and you have an edge, you will do good.

Thanks for reading till here.

@AnandableAnand @jitendrajain @quatltd @sohamtweet

Thanks for reading till here.

@AnandableAnand @jitendrajain @quatltd @sohamtweet

• • •

Missing some Tweet in this thread? You can try to

force a refresh