Today's data: national balance sheets for Q3!! 🥳 www150.statcan.gc.ca/n1/daily-quoti…

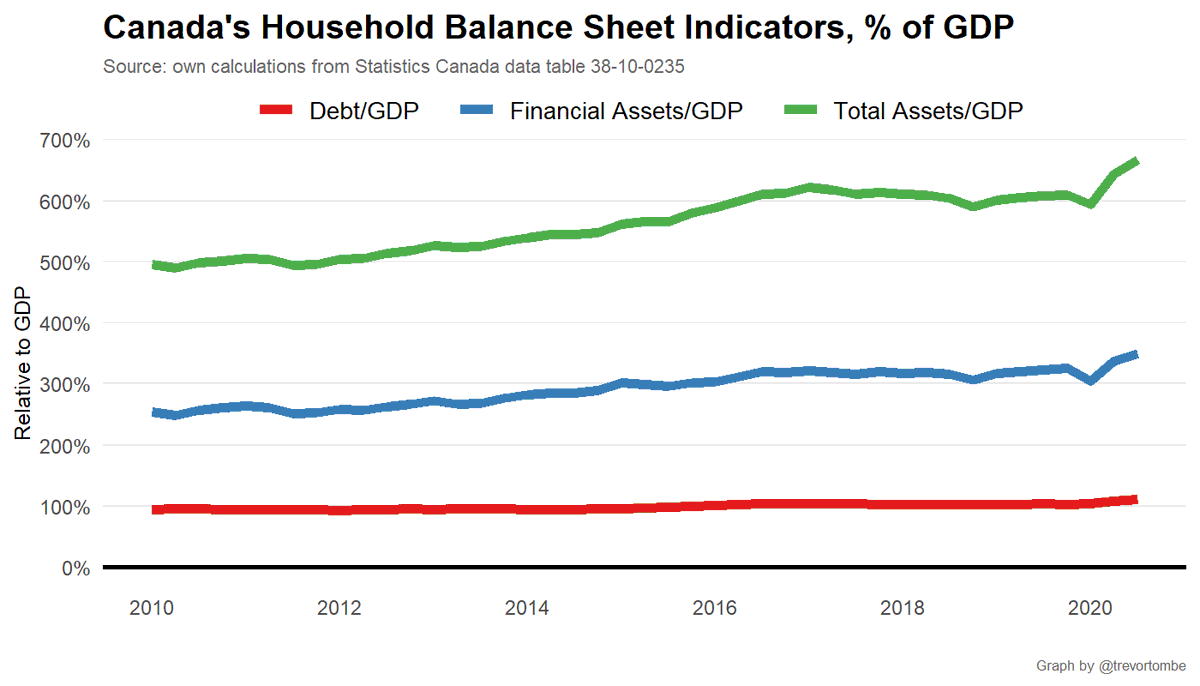

Household debt reaches all time high, but an under-reported statistic is that financial and total assets have also reached new highs. #cdnecon

Household debt reaches all time high, but an under-reported statistic is that financial and total assets have also reached new highs. #cdnecon

This matters since many will see the riding debt as a sign over 'overleverage', but this isn't necessarily true. I'll paint a more optimistic picture here.

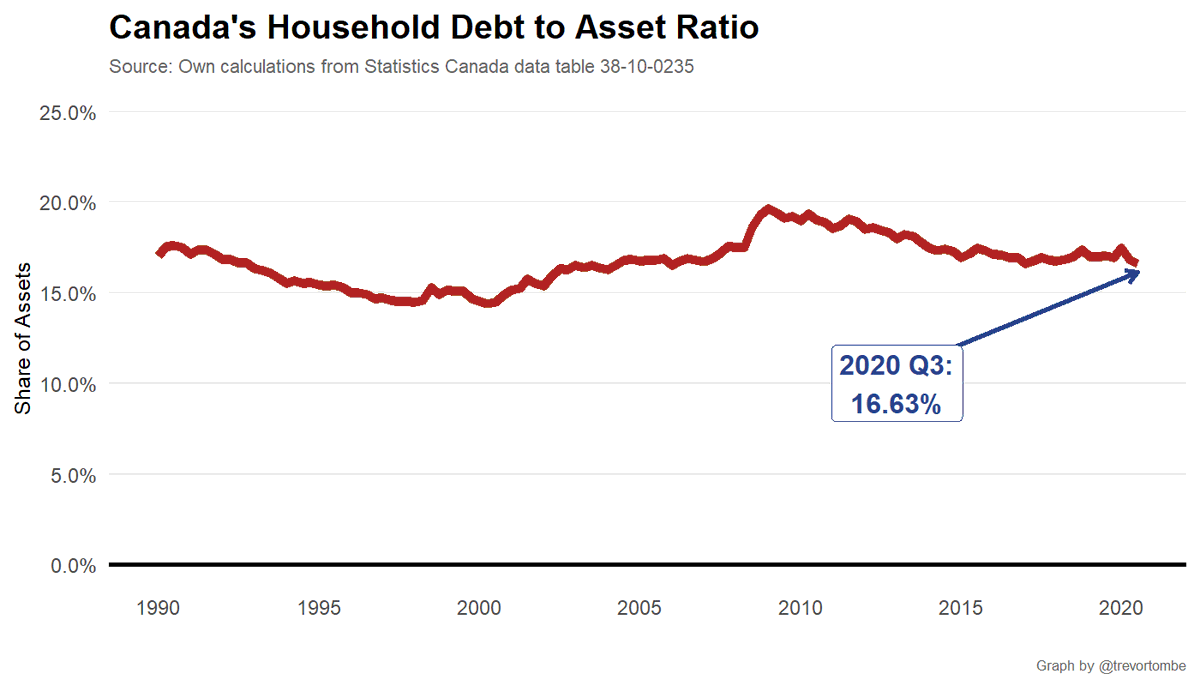

First, debt as a share of assets are very much in line with historical norms.

First, debt as a share of assets are very much in line with historical norms.

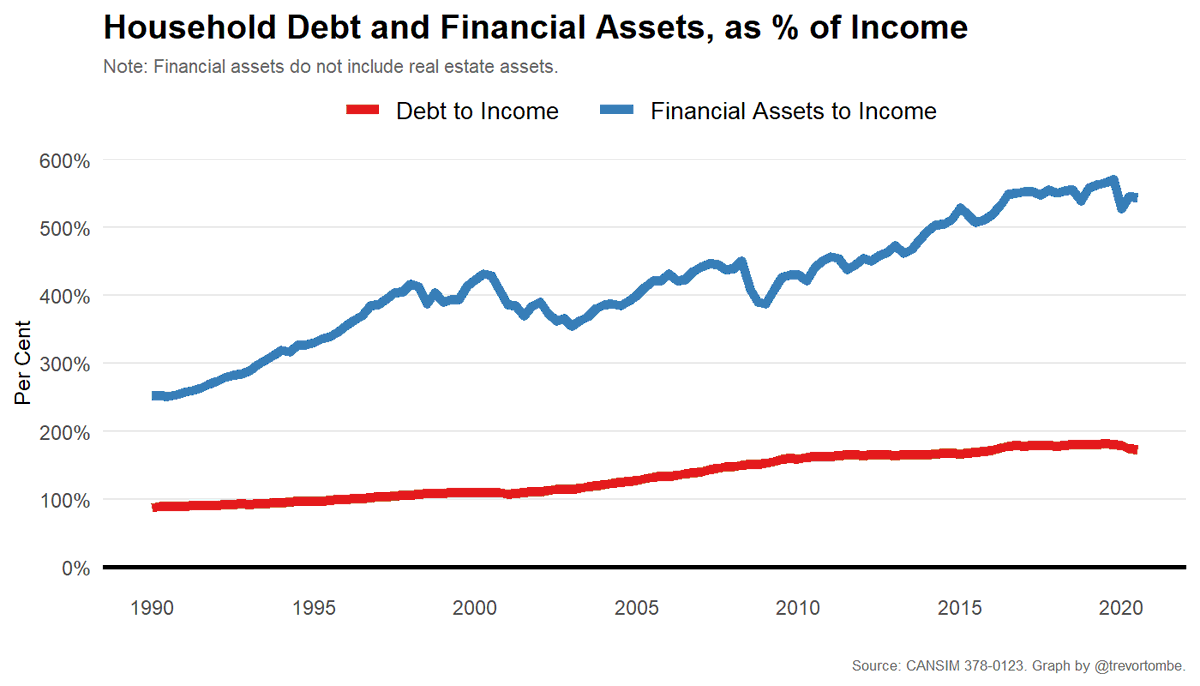

Second, the "household debt is 173% of income" headline is correct. But financial assets (which doesn't include homes, for example) is 544% of income!

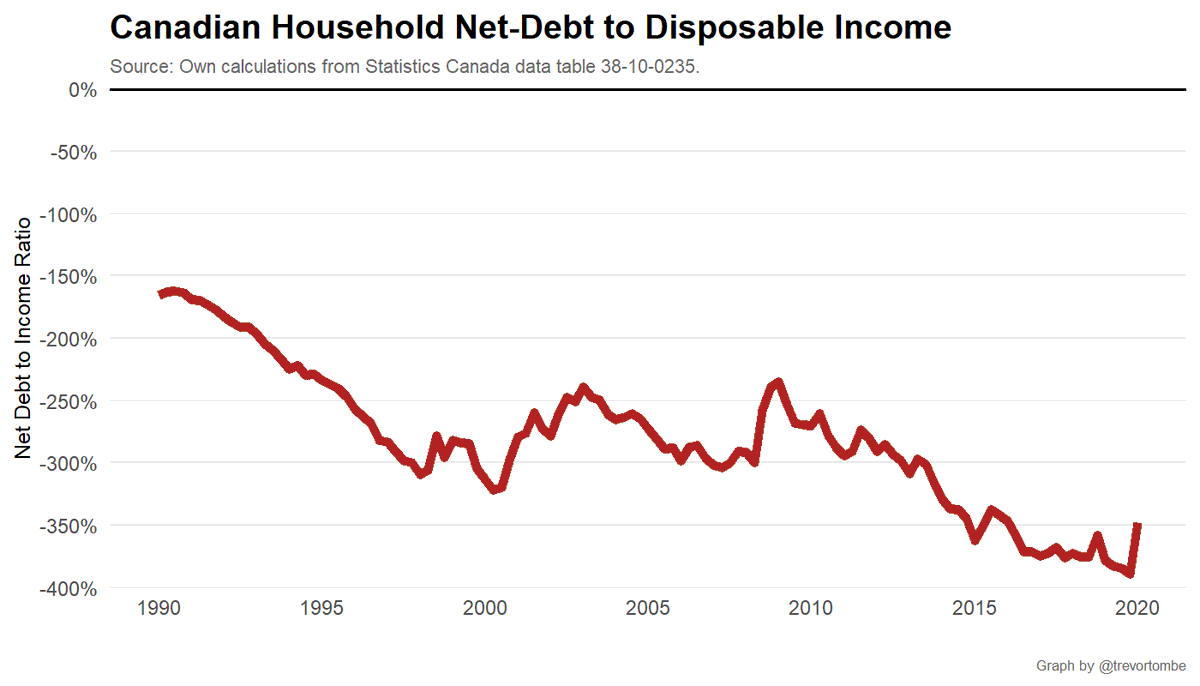

So, instead of "debt" let's look at "net debt". Household net debt as a share of disposable income is actually highly negative. -350%.

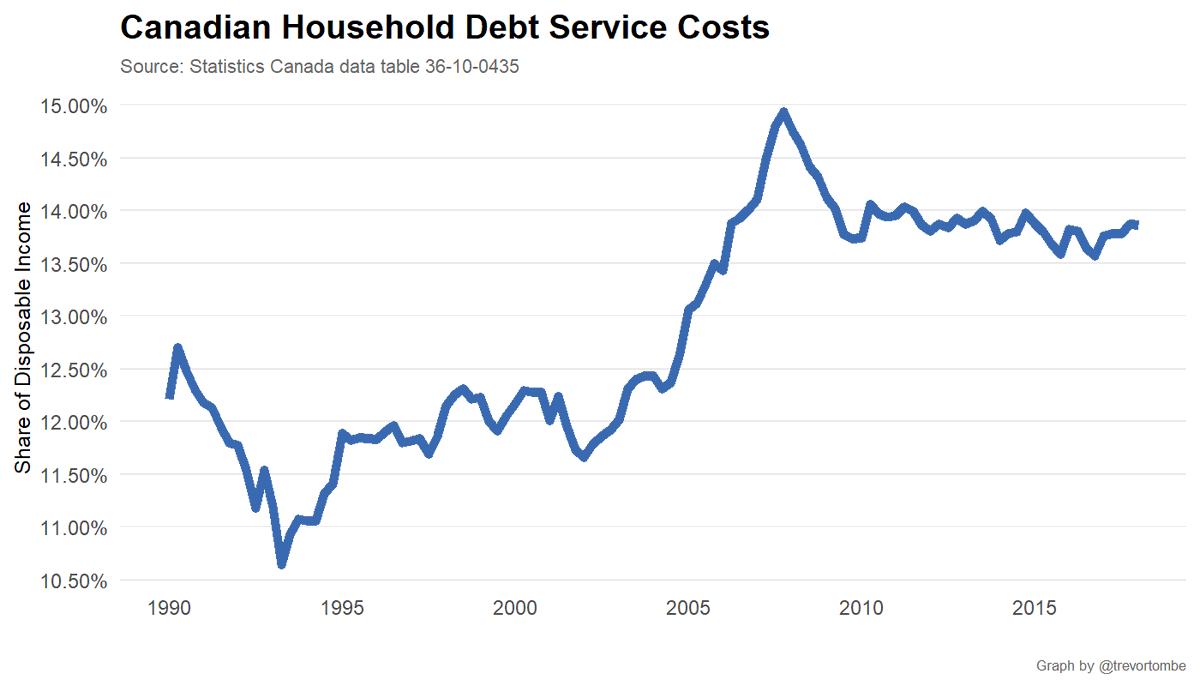

Debt service ratios are an interesting statistics to look at too. Here we see that recent years have remained stable, though notably higher than pre-financial crisis.

.... BUT

.... BUT

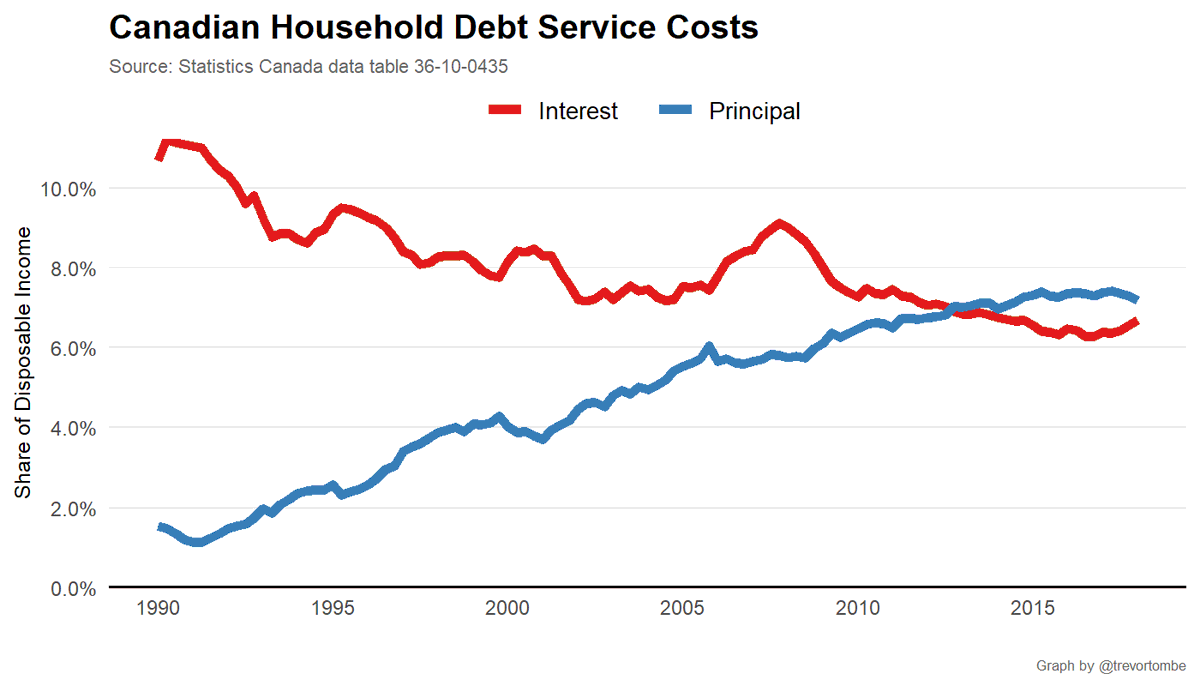

All of the increase in debt service costs are due to rising principle payments. Interest costs have been consistently declining to now barely over 6% of income.

• • •

Missing some Tweet in this thread? You can try to

force a refresh