1/12 Just published "Bitcoin Price Temperature (Bands) - An indicator for the price bandwidth of #Bitcoin's 4-year cycle"

The BPT (Bands) is an improved version of the #Bitcoin Price Z-Scores that I shared before

dilutionproof.medium.com/bitcoin-price-…

I'll summarize in this thread 👇

The BPT (Bands) is an improved version of the #Bitcoin Price Z-Scores that I shared before

dilutionproof.medium.com/bitcoin-price-…

I'll summarize in this thread 👇

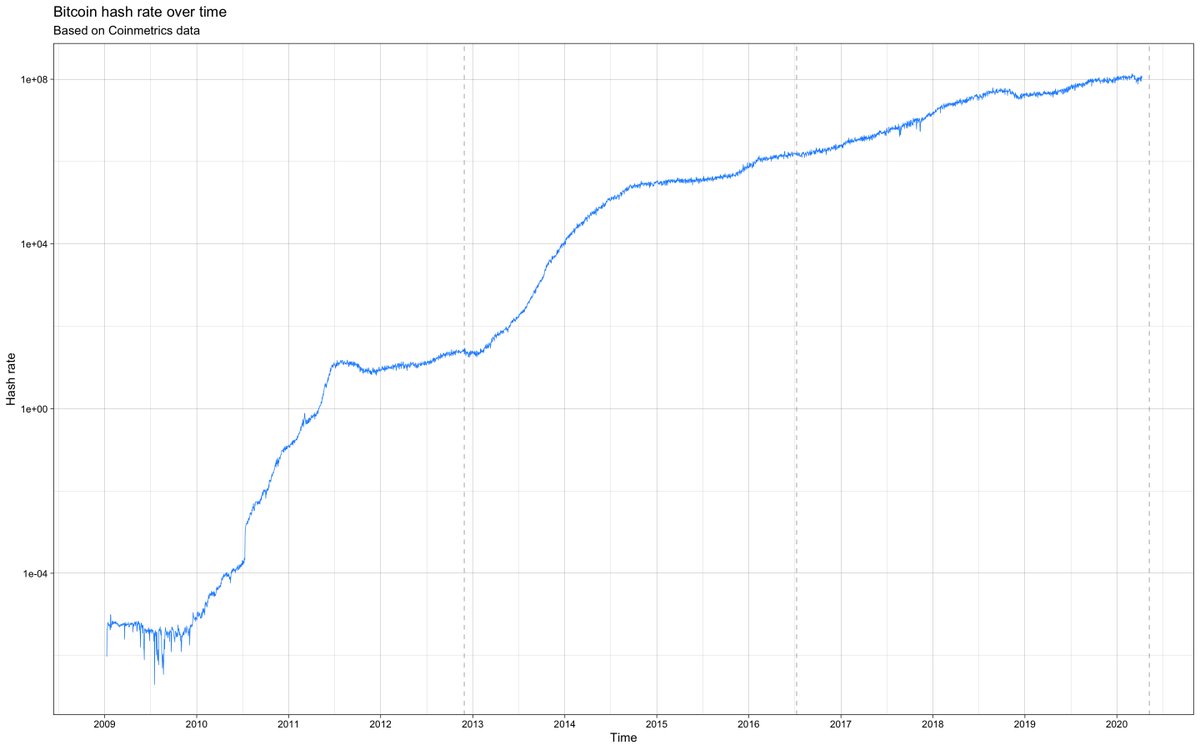

2/12 The article first describes why the #Bitcoin price appears to move in 4-year cycles:

- Halvings occur every ~4 years

- Halvings create a supply shock that may drive up the price as described here:

- N=2.25, but price action so far supports the thesis

- Halvings occur every ~4 years

- Halvings create a supply shock that may drive up the price as described here:

https://twitter.com/Croesus_BTC/status/1319734166557081600

- N=2.25, but price action so far supports the thesis

3/12 The #Bitcoin Price Temperature (BPT) is a metric for the relative distance between the daily price and its 4-year moving average.

More simply put: high BPT values reflect potentially (over)heated prices, whereas low BPT values are a sign of potentially (under)cooled prices.

More simply put: high BPT values reflect potentially (over)heated prices, whereas low BPT values are a sign of potentially (under)cooled prices.

4/12 With BPT, the relative price levels of previous market cycles are much more comparable.

Based on TA, several levels stand out:

- BPT=8 (red): All previous cycles topped soon after

- BPT=6 (orange): Resistance during bull run

- BPT=2 (green): Support/resistance at key points

Based on TA, several levels stand out:

- BPT=8 (red): All previous cycles topped soon after

- BPT=6 (orange): Resistance during bull run

- BPT=2 (green): Support/resistance at key points

5/12 The similarity of the relative price levels during previous cycles becomes even more apparent in this chart. #Bitcoins first period after launch was unique (no price, high inflation), but every halving cycle so far has had a similar boom-bust cycle shortly after the halving.

6/12 It is important to note that the #Bitcoin Price Temperature is solely backwards-looking and has no predictive power.

A good case for the 4-year cycles can be made, but it is also possible to argue against the hypothesis that those halving-induced cycles will keep repeating:

A good case for the 4-year cycles can be made, but it is also possible to argue against the hypothesis that those halving-induced cycles will keep repeating:

7/12 However, the current (2020~2024) and previous (2016-2020) halving cycles again are very similar (r=0.77) so far.

Clearly no guarantees about the future, but it might be interesting to monitor to what extent future prices will again mimic the previous cycle(s).

Clearly no guarantees about the future, but it might be interesting to monitor to what extent future prices will again mimic the previous cycle(s).

8/12 This brings us to the #Bitcoin Price Temperature (BPT) Bands; a visual representation of BPT levels on the #Bitcoin price chart, accompanied by a color-overlay that reflects the price temperature.

Observations:

1) If a BPT is reached again, it tends to be at higher price.

Observations:

1) If a BPT is reached again, it tends to be at higher price.

9/12 (continued)

2) If a price level is reached again, the 'temperature' has usually cooled off. E.g., late 2017 ~$20k had a BPT of ~8, whereas late 2020 ~$20k had a BPT of ~3.

3) Like Bollinger Bands, BPT Bands widen during high volatility and contract during low volatility.

2) If a price level is reached again, the 'temperature' has usually cooled off. E.g., late 2017 ~$20k had a BPT of ~8, whereas late 2020 ~$20k had a BPT of ~3.

3) Like Bollinger Bands, BPT Bands widen during high volatility and contract during low volatility.

10/12 The adaptiveness to volatility marks a key difference between the BPT (Bands) & the Mayer Multiple or other moving average-multiple based indicators. The BPT Bands slope up more steeply towards higher prices during volatility, which may be more appropriate in that context.

11/12 Future efforts could go out to creating a @TradingView indicator for the BPT (potentially using a wider range of Bands, e.g., -2 to 12) or creating a Python implementation that can be more easily be adopted on websites that host #Bitcoin price charts and indicators.

12/12 Special thanks go out to @Anoi30604540 for providing feedback and reviewing the draft of the article! 🙏

I am open for questions, improvement suggestions or anyone looking to further develop or implement this. The used code is available on GitHub:

github.com/dilutionproof/…

I am open for questions, improvement suggestions or anyone looking to further develop or implement this. The used code is available on GitHub:

github.com/dilutionproof/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh