Don't let the crowd's madness clout your judgment.

At any point, 40% up/down is speculative froth from momentum chasers. On the first -10% correction, the speculators all jump off the ship and the stock falls another 30%. 1-2-3 provides cleaner entry point for real investors.

At any point, 40% up/down is speculative froth from momentum chasers. On the first -10% correction, the speculators all jump off the ship and the stock falls another 30%. 1-2-3 provides cleaner entry point for real investors.

@Goldsmithgunner

Fundamentals aside, #3MIndia was available at 15.8k & 23k in a short time span. 46% price difference due to crowd behavior.

21k is still a good price. This will become apparent at 26k. THEN brokerages will invite people giving 29k target celebrating 10% upside.

Fundamentals aside, #3MIndia was available at 15.8k & 23k in a short time span. 46% price difference due to crowd behavior.

21k is still a good price. This will become apparent at 26k. THEN brokerages will invite people giving 29k target celebrating 10% upside.

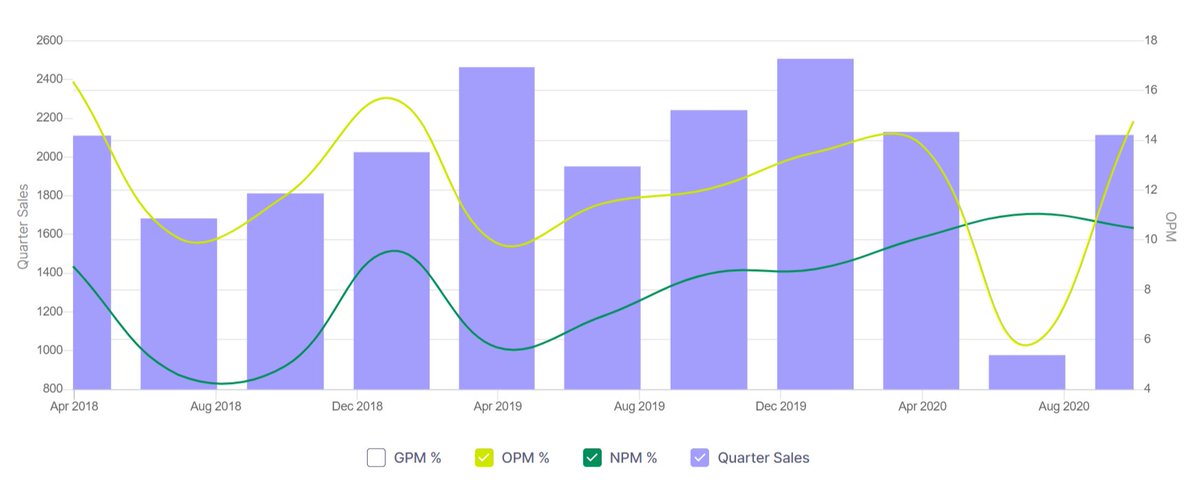

Some big institutional buyer has punched in a massive buy volume of 55,000 stocks on Dec 1,2, at 21k. He also knows that PE is 144, still he's buying with confidence. And retail investors are busy trying to outsmart destiny by buying cheap stocks because Warren chacha said so.

21000/per stock x 55k volume = 115 crore rs. Someone has invested that much money in one stock in one day & walked away like its nothing

Ye kisi short term trader ka kaam nahi. This is either some FII fund or a foreign pension fund. Even promoter himself would not put that much.

Ye kisi short term trader ka kaam nahi. This is either some FII fund or a foreign pension fund. Even promoter himself would not put that much.

*cloud

Sasura typo hui gawa.

Sasura typo hui gawa.

• • •

Missing some Tweet in this thread? You can try to

force a refresh