#VGuard valuation.

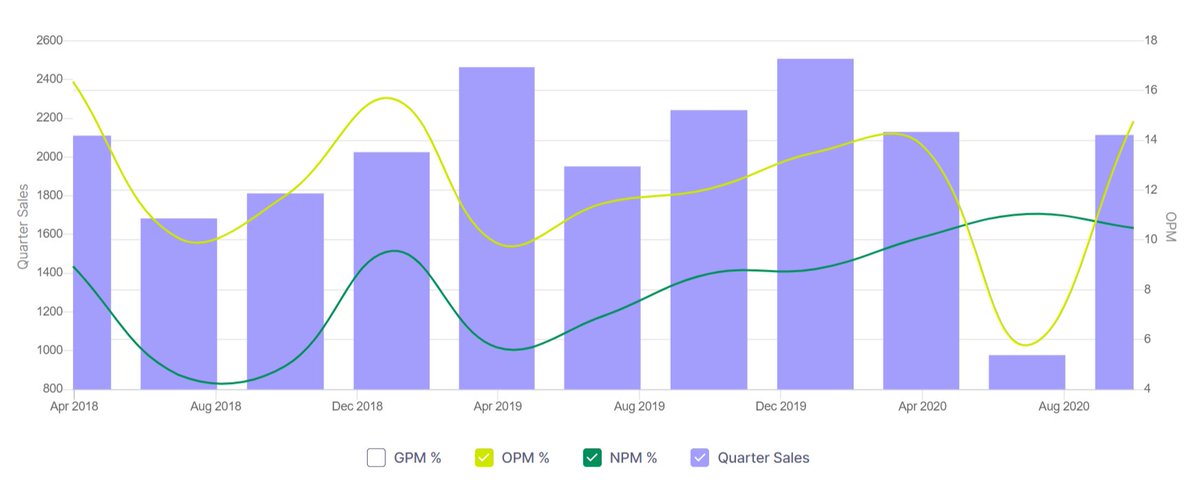

Pre-Covid quarter sales : 620

Corona quarter sales : 405

Current quarter sales : 620

NPM improved from 7.5% to 8.11%

Sales are back to previous glory, NPM has improved. Potential turnaround story.

Pre-Covid quarter sales : 620

Corona quarter sales : 405

Current quarter sales : 620

NPM improved from 7.5% to 8.11%

Sales are back to previous glory, NPM has improved. Potential turnaround story.

DCF valuation :

2030 EPS projection (discounting rate of 17.2%) = 24.3rs/share

2030 CMP = Median PE (30) x 2030's EPS

2030 CMP = 729

4X growth (~14% CAGR) expected in a decade if bought at current price.

2030 EPS projection (discounting rate of 17.2%) = 24.3rs/share

2030 CMP = Median PE (30) x 2030's EPS

2030 CMP = 729

4X growth (~14% CAGR) expected in a decade if bought at current price.

Potential risks :

Profit margin of 7-8% is mediocre at best. Not extraordinary. Other competitors like Havells, and Crompton Greaves may tread into VGuard's monopoly and reduce profit margins further.

Profit margin of 7-8% is mediocre at best. Not extraordinary. Other competitors like Havells, and Crompton Greaves may tread into VGuard's monopoly and reduce profit margins further.

What VGuard has going for it is that it is a medium quality smallcap company available at a good margin of safety. Current CMP represents better value compared to larger competitors like Havells, promising potentially higher returns, despite lesser margins. Pure value play.

Verdict : Prefer not to allocate more than 2% weight to VGuard in the portfolio.

Take advantage of the discounted valuations in VGuard at CMP until Havells gives a meaningful correction.

Take advantage of the discounted valuations in VGuard at CMP until Havells gives a meaningful correction.

• • •

Missing some Tweet in this thread? You can try to

force a refresh