#PolyCab valuation

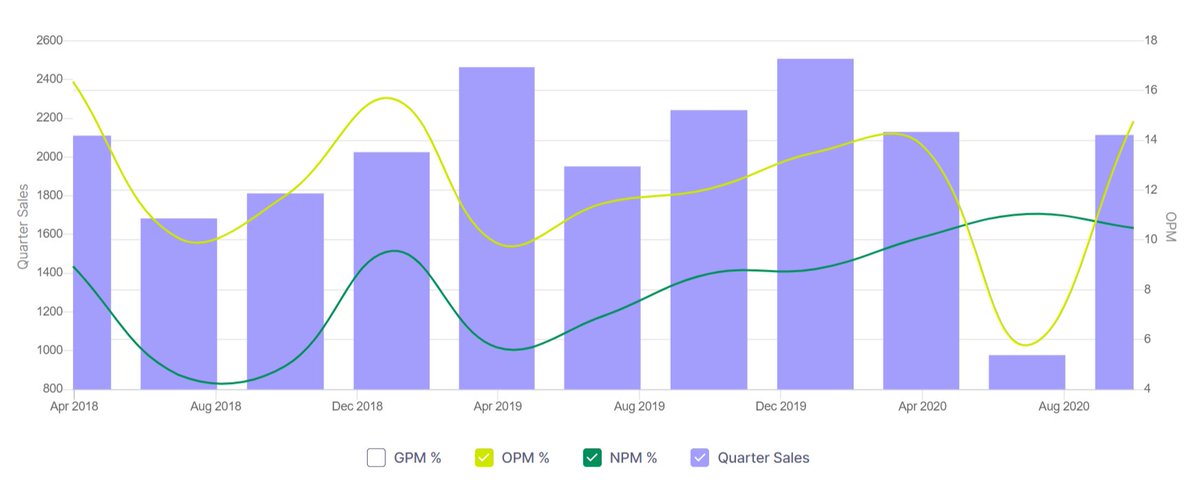

Pre-Corona quarterly sales : 2200

Corona dip : 50%

Current quarterly sales : 2200

It has healed from the lockdown slump. NPM has improved from 8.64% to 10.48%

Pre-Corona quarterly sales : 2200

Corona dip : 50%

Current quarterly sales : 2200

It has healed from the lockdown slump. NPM has improved from 8.64% to 10.48%

EPS has virtually doubled in 18 months, from 25rs/share in 2019 to 50rs/share now.

ROCE 29%. This is a high growth company.

2030 projected EPS (DCF discount rate 20.12%) : 326rs/share

2030 CMP= 6520 (Median PE (20) x 326)

ROCE 29%. This is a high growth company.

2030 projected EPS (DCF discount rate 20.12%) : 326rs/share

2030 CMP= 6520 (Median PE (20) x 326)

Has a wire manufacturing capacity of 3.7 million Kms/yr

Potential beneficiary of 'housing for all' theme and last mile electricity connectivity plan of the government.

Potential beneficiary of 'housing for all' theme and last mile electricity connectivity plan of the government.

Potential risk:

Raw material : Copper.

Commodity business with no premium pricing power.

With just 4600 employees it is a lean business churning out massive revenues (8000cr), impressive BUT raw material costs eat up more than 80% of the revenue.

Verdict AVOID.

Raw material : Copper.

Commodity business with no premium pricing power.

With just 4600 employees it is a lean business churning out massive revenues (8000cr), impressive BUT raw material costs eat up more than 80% of the revenue.

Verdict AVOID.

This hot air balloon will zoom 2x-3x in the coming 4-5 years only as long as the 'housing for all' theme is in play and Copper prices remain in limits

Good for trading swings, but not good enough as a permanent portfolio holding like Havells

@BoostTrade Final verdict is AVOID

Good for trading swings, but not good enough as a permanent portfolio holding like Havells

@BoostTrade Final verdict is AVOID

• • •

Missing some Tweet in this thread? You can try to

force a refresh