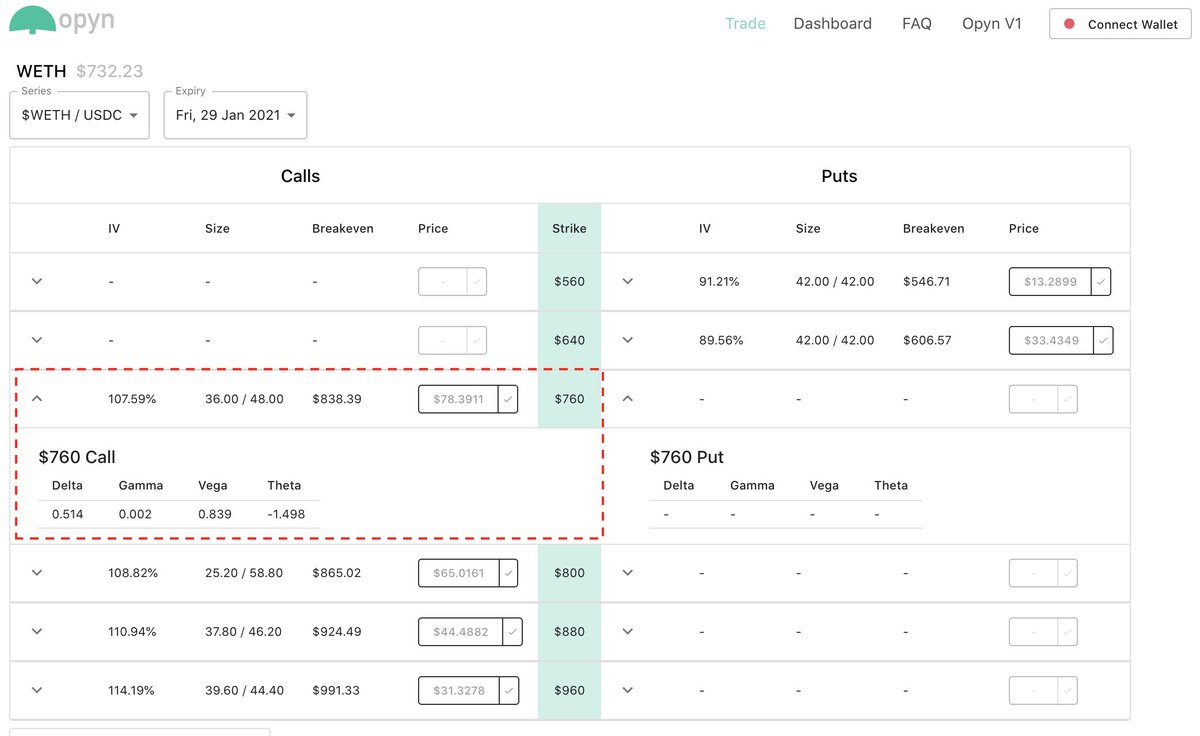

1. Congrats to the @opyn_ team for launching V2 - very exciting! I’m happy that the new V2 dashboard has a clean layout with greeks and implied vols for each respective option. It’s also a pleasant surprise to see the prices are closely in line with @DeribitExchange's options.

2. Many folks in this space use options to make directional bets on the underlying price of an asset ie: if we’re bullish or bearish we can buy a call or put respectively. Things get interesting when we move beyond simply trading the direction of where BTC or ETH is going...

3. Unlike futures, with options we can make bets on the underlying volatility of an asset. This style of trading is commonly referred to as “vol trading” which is a slightly more advanced strategy used by sophisticated retail traders and institutions such as @ledger_prime.

4. Below are a few key terms we need to understand as vol traders:

- Realized Volatility

- Implied Volatility

- Delta

- Realized Volatility

- Implied Volatility

- Delta

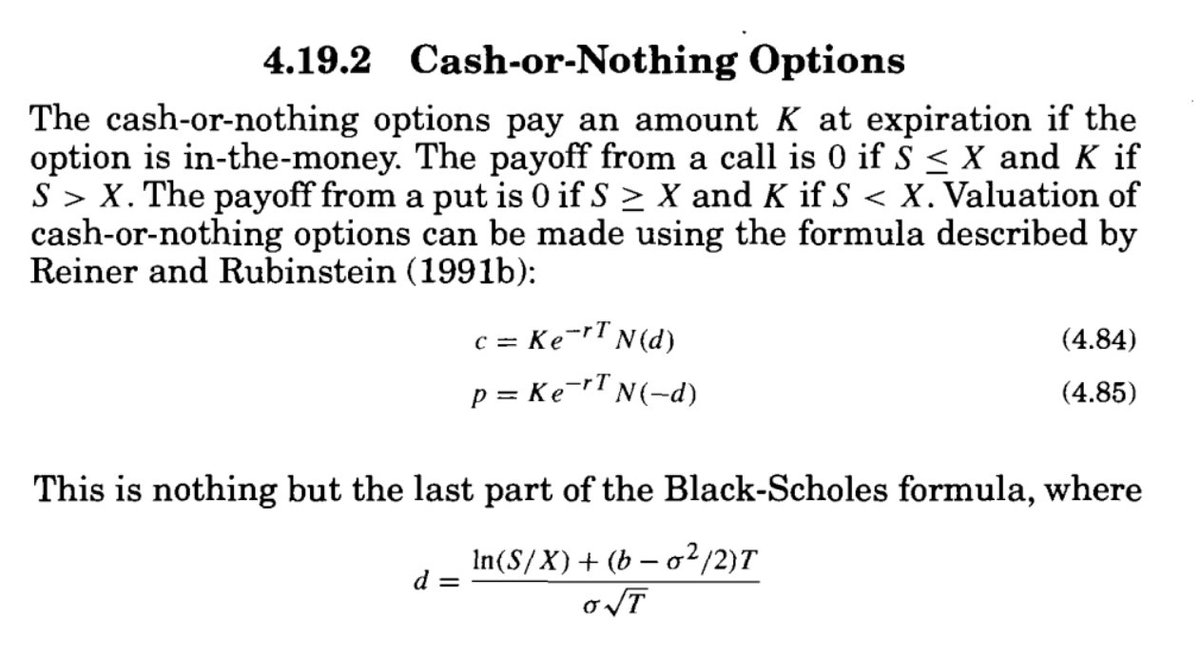

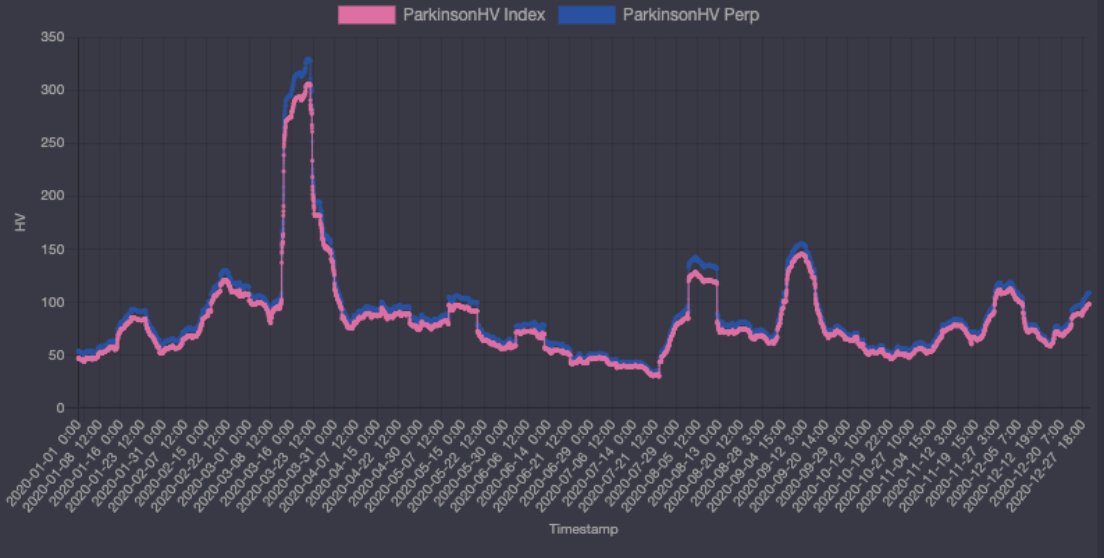

5. Realized volatility (a): the historical volatility of the underlying asset throughout the life of the option. This volatility is measured during a given time period - ie: volatility over a 30 day period. Below is a plot of realized ETH vol from @GenesisVol data.

6. Realized Volatility (b): There’s no set way to measure realized vol rather it needs to be estimated. A decent aprx is to use the annualized stdev of log returns of the underlying asset. For those interested in fancier models, consider checking out Yang-Zhang or Garman-Klass.

7. Implied Volatility (a): This is the market’s *future estimate* of the underlying's realized volatility when the option matures. For example, if we have a 30 day option with an IV of 90%, then the market is implying the underlying asset will realize a vol of 90% across 30 days.

8. Implied Volatility (b): Options are priced in terms of IV which reflects the market's consensus for future vol. Our job as vol traders is to assess whether IV is over or under valued relative to where we think actual realized vol will settle at expiry.

9. Implied Vol (c): If we think there's an upcoming market event which could increase realized vol (ie: SEC crackdown) that isn't currently reflected in the IV, then we could "go long vol". In this case we're betting on *realized vol* to be greater than the current IV at expiry.

10. Delta (a): Delta is how much the option value will change for a *small change* in the underlying asset. Calls have +delta and puts have -delta (ie: calls increase in value as spot rises whereas puts decrease in value as spot rises).

11. Delta (b): With @opyn_ options, if a put has a delta of -0.40, this means for a $1 increase in the underlying, the value of the put should decrease by around $0.40. Conversely, a $1 decrease in the underlying will result in a +$0.40 change in the option value.

12. Delta (c): If we want to trade an option w/o worrying about the direction of the underlying price, we need to eliminate our delta exposure so we’re only trading the vol. Let's use a real-world example with @opyn_'s options.

13. We'll use the Jan. 29/2021, ETH $760 CALL as it's closest to at-the-money with a delta of +0.514. This means for a $1 increase in ETH we can expect a $0.514 increase in the option price (this is similar to being long 0.514 units of ETH).

14. The call option also has an IV of 107.59%. This means the market is expecting future ETH realized volatility to be 107.59% in ~ 30 days. Currently the realized ETH vol is around 108% based on @GenesisVol's data.

15. If we believe that realized vol will be far higher than its current level of around 108% in 30 days time, then we could place a "long vol" trade - ie: a bet on higher realized volatility.

16. To place this long vol trade using the call, we need to eliminate our delta exposure so we’re only trading the vol. If we’re exposed to +0.514 units of ETH on the call then we need to short 0.514 units of ETH to neutralize our delta exposure.

17. In order to hedge our deltas, we can hop over to @dydxprotocol where we can use margin to short 0.514 units of ETH. In other words, we would end up shorting 0.514 ETH to remove our call option delta exposure (we get better tx fees when we trade in larger size on dydx).

18. As a recap:

LONG: Call Option: +0.514 ETH Delta

SHORT: @dydxprotocol ETH: -0.514 ETH Delta

------------------------------------------------

Net Portfolio Delta Exposure = 0

LONG: Call Option: +0.514 ETH Delta

SHORT: @dydxprotocol ETH: -0.514 ETH Delta

------------------------------------------------

Net Portfolio Delta Exposure = 0

19. Note: The delta of the option is not constant and changes over time. This requires us to constantly rebalance our net delta exposure (dynamically hedge) so it stays low - recall we're trading vol not the underlying. A large absolute delta will give us exposures we don't want.

20. *Very important*: don't over-hedge your delta exposures! This will result in massive over-trading and any potential profits will be eaten up by gas fees + tx costs. Be sensible with your hedging frequency - not every move needs to be hedged.

21. At the end of the trade, if realized vol > the implied vol of when you bought the option, then you'll likely make money if you were able to keep your hedging costs low. This topic goes into much more detail in @SinclairEuan's great book on vol trading.

22. For experienced option vol traders - we can approximate the PNL from this trade with the following formula: option vega x (realized vol - implied vol).

23. It's quite amazing that we now have the tools and building blocks within the DeFi eco-system to play around with decentralized crypto vol trading - all thanks to the innovative projects in this space. Keep up the great work!

Any thoughts or suggestions with this explanation? @BitcoinMises @saah1lk @andrewjleone @kyled116 @fb_gravitysucks @SinclairEuan

• • •

Missing some Tweet in this thread? You can try to

force a refresh