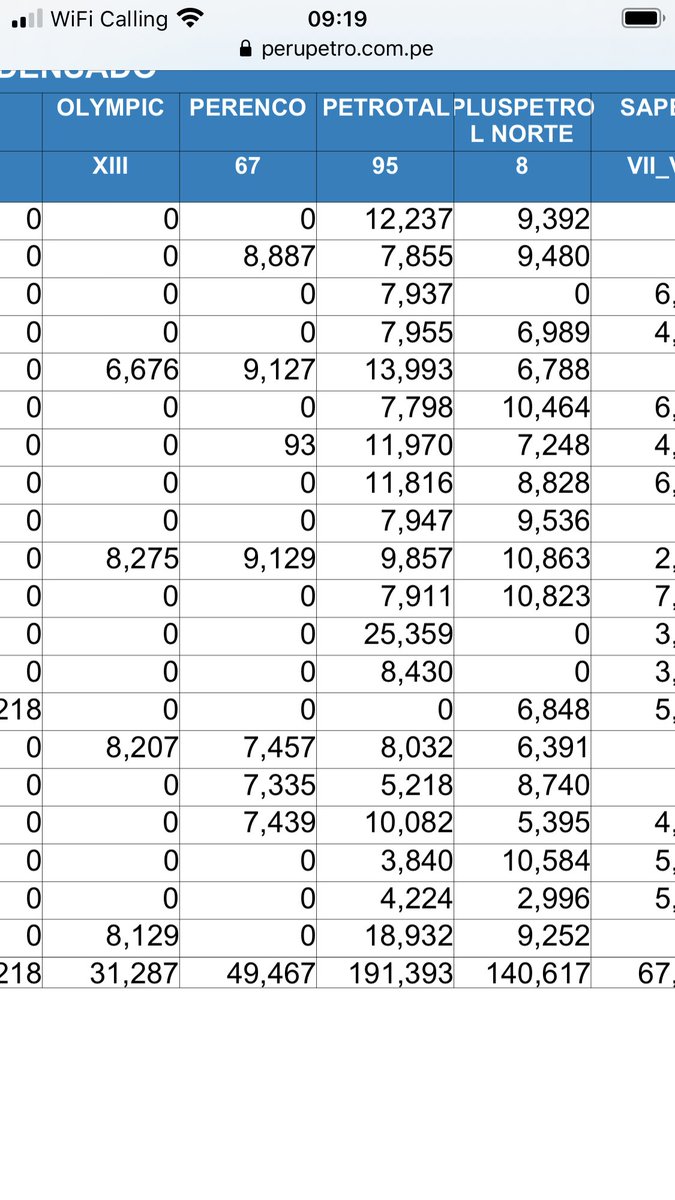

On #PTAL #TAL: Today, company announced pilot sales to Atlantic through Amazonian river of Peru and Brazil. While a small first step, let me explain the strategic context 1/

https://twitter.com/petro_tal/status/1344180689776889857

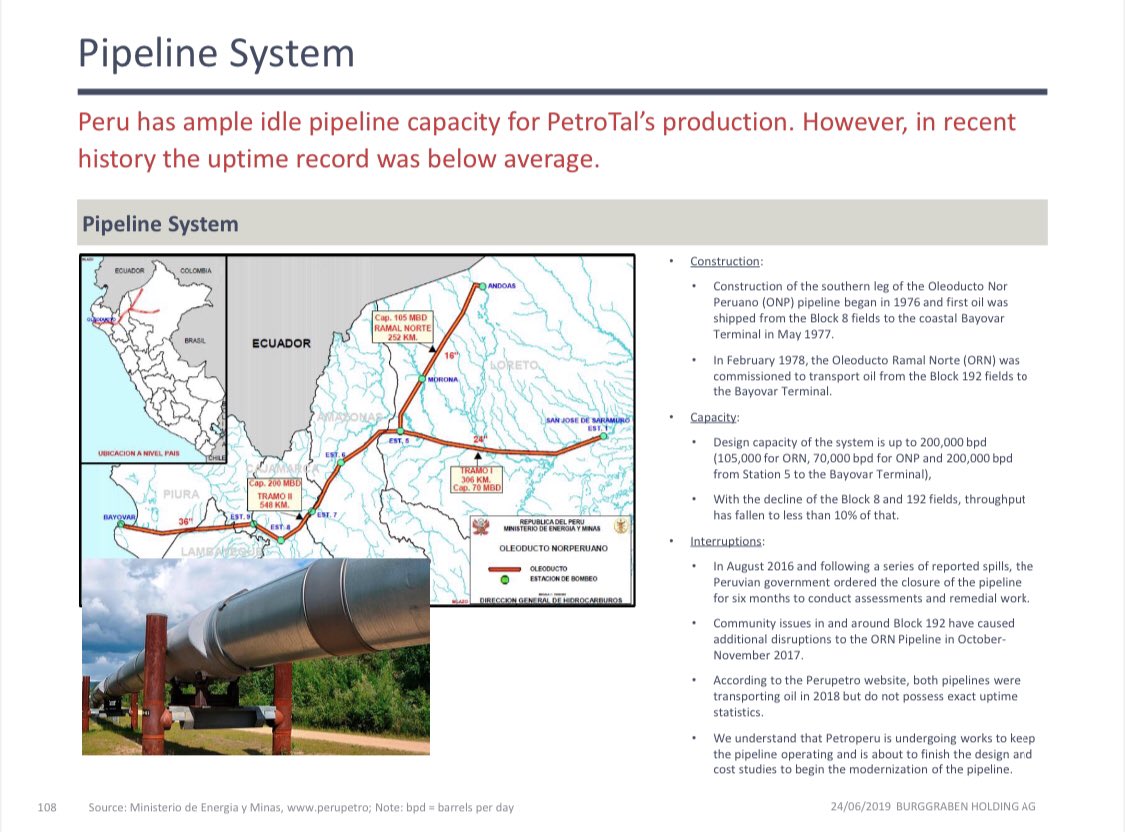

Base case, PetroTal exports Bretana oil through the Peruvian pipeline system, owned and operated by PetroPeru. System is modern and has a ample capacity...2/

Including barging to ship oil to so called pump station 1, we assume all-in transportation cost of around $13/bbl for all our intrinsic modelling work. This is slightly higher than mgmt guidance. 3/

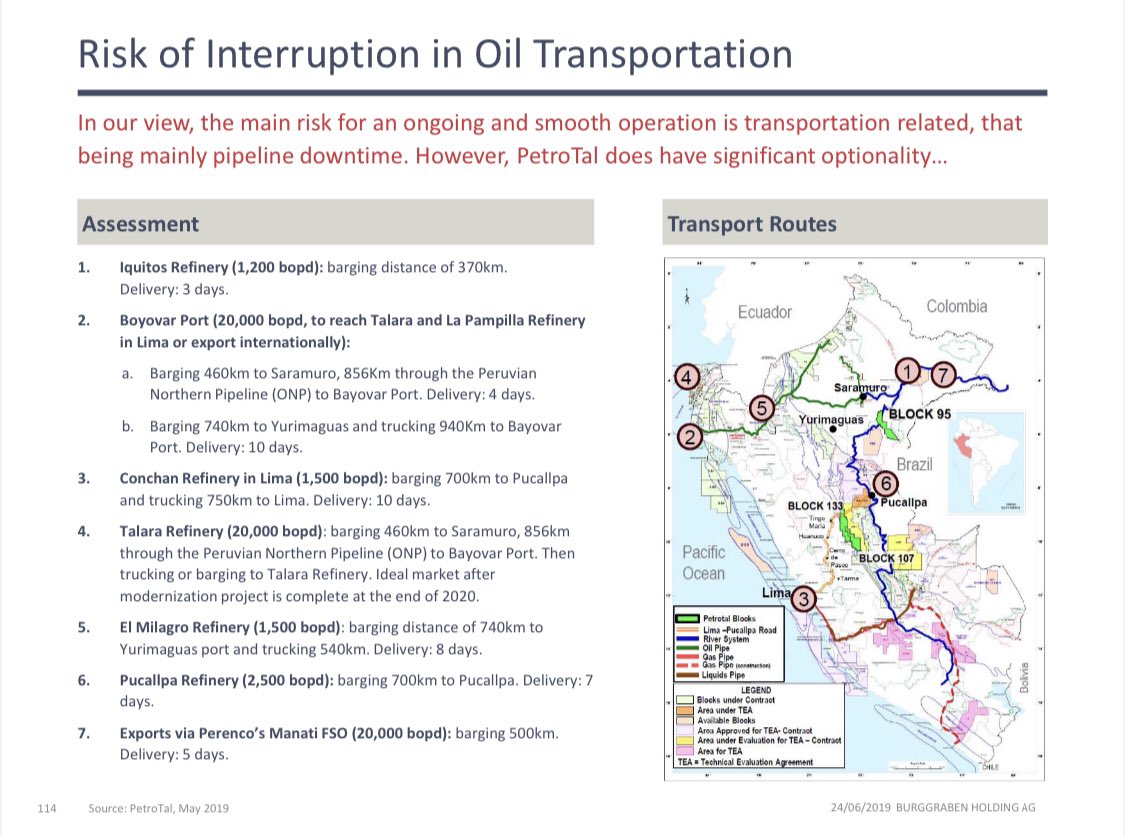

This makes Bretana so called land-locked oil with superior low lifting cost ($4-8/bbl subj vol) but reliant on pipe being operational. Some risk can be addressed from alternative national routes but they are > expensive & do not work in extremes such as Covid social unrest 4/

This is why a relatively benign protest mainly at Station 5 let to 85 days of downtime. Not good for all parties; resolved now! Meanwhile, good things happen when tunnel was darkest! TAL team figured out Bretana was NOT land-locked; river system allows export to Brazil; 5/

106k bbl with all-in cost of approx $25/bbl (transport cost; quality discounts; export fees; ie net $25 proceeds on $50ish Brent) is higher than pipe cost, cash is received asap (no contingent price risk as with pipe sales) while low vol pilot leaves ample room for scale;

True value to be understood is Optionality! PetroPeru now knows #TAL is happy user of its pipe at right cost; reliability; payment terms as Atlantic export route does not have limitation on scale; Brazil reduces, if not removes, downtime risk (which was Covid extreme). Huge!

• • •

Missing some Tweet in this thread? You can try to

force a refresh