1/15

Sometimes I run into companies that make no sense with backward-looking fundamentals. Instead of thinking what a company is, one must think what it can become.

In this simple THREAD I'll briefly explain how #narrative valuation works. 🧵 👇

Sometimes I run into companies that make no sense with backward-looking fundamentals. Instead of thinking what a company is, one must think what it can become.

In this simple THREAD I'll briefly explain how #narrative valuation works. 🧵 👇

2/15

When a company has more potential than track-record, investor can use narrative valuation.

Being more reliant on future deliverables (e.g. market share, margins) than long track-record of fundamentals, it is also favored by early-stage investors, e.g. venture capitalists.

When a company has more potential than track-record, investor can use narrative valuation.

Being more reliant on future deliverables (e.g. market share, margins) than long track-record of fundamentals, it is also favored by early-stage investors, e.g. venture capitalists.

3/15

Take Chipotle Mexican Grill $CMG that sells high-quality, tasty Mexican food, but is priced like a blockhain and AI driven, machine-vision company:

P/S 7

P/E 166

P/FCF 100

EV/EBITDA 58

Fundamental investor in me feels little sick, but let's look through the narrative lens

Take Chipotle Mexican Grill $CMG that sells high-quality, tasty Mexican food, but is priced like a blockhain and AI driven, machine-vision company:

P/S 7

P/E 166

P/FCF 100

EV/EBITDA 58

Fundamental investor in me feels little sick, but let's look through the narrative lens

4/15

Narrative valuation forces us to imagine where the company could realistically be in the future, and discount that value to current day.

For that, we need a set of credible assumptions that we can easily follow as time goes by to validate our hypothesis.

Narrative valuation forces us to imagine where the company could realistically be in the future, and discount that value to current day.

For that, we need a set of credible assumptions that we can easily follow as time goes by to validate our hypothesis.

5/15

To come up with a somewhat credible narrative, let’s use a global player, McDonald’s, as a proxy. There were 40,000 “Golden Arches” in the world in 2019, but hamburgers tend to travel better than Mexican food.

Why?

To come up with a somewhat credible narrative, let’s use a global player, McDonald’s, as a proxy. There were 40,000 “Golden Arches” in the world in 2019, but hamburgers tend to travel better than Mexican food.

Why?

6/15

Firstly, everyone doesn’t like spicy food. Secondly, some people really hate cilantro.

Hence, we shouldn’t assume similar global coverage

but maybe 1/4 of it, meaning that Chipotle could grow its restaurants from current base of 2,622 to 10,000, or one-fourth of 40,000.

Firstly, everyone doesn’t like spicy food. Secondly, some people really hate cilantro.

Hence, we shouldn’t assume similar global coverage

but maybe 1/4 of it, meaning that Chipotle could grow its restaurants from current base of 2,622 to 10,000, or one-fourth of 40,000.

7/15

Let’s say that in the low-interest world we live in today, Chipotle could grow to reach 10,000 restaurants within 10 years, nearly fourfold from today.

With larger-than-before scale, Chipotle should be able to exceed the high end of its historical profitability spectrum.

Let’s say that in the low-interest world we live in today, Chipotle could grow to reach 10,000 restaurants within 10 years, nearly fourfold from today.

With larger-than-before scale, Chipotle should be able to exceed the high end of its historical profitability spectrum.

8/15

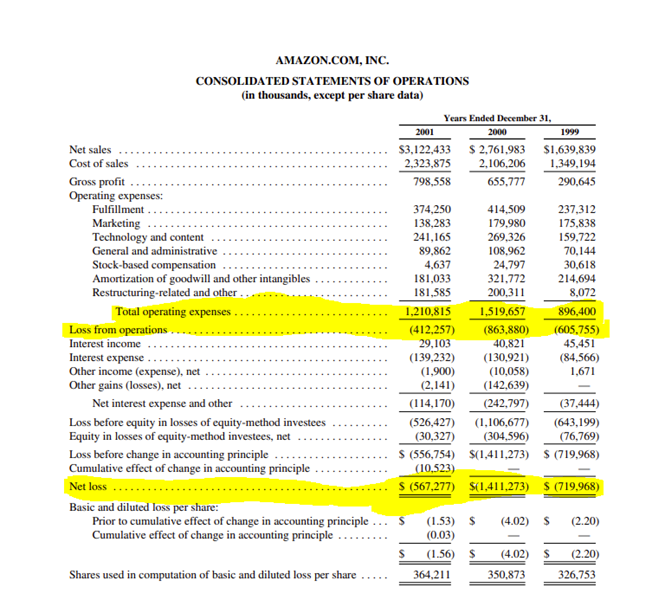

During the past decades, Chipotle's operating margin has been around 10% of its revenue. With larger scale, let's assume Chipotle to reach 30% operating margins, a level still well below McDonald’s operating margin of 40%.

Such a rosy future doesn't come without risks.

During the past decades, Chipotle's operating margin has been around 10% of its revenue. With larger scale, let's assume Chipotle to reach 30% operating margins, a level still well below McDonald’s operating margin of 40%.

Such a rosy future doesn't come without risks.

9/15

In other words, the uncertainty of this scenario in its ambitiousness is high.

To keep things simple, we assume 70% odds for permanent loss of capital (i.e. bankruptcy) and 30% odds for our narrative to hold.

In reality, of course, there is a lot of outcomes in between.

In other words, the uncertainty of this scenario in its ambitiousness is high.

To keep things simple, we assume 70% odds for permanent loss of capital (i.e. bankruptcy) and 30% odds for our narrative to hold.

In reality, of course, there is a lot of outcomes in between.

10/15

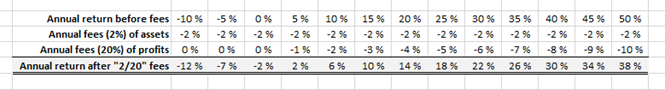

Let's also assume that we sell our shares after 10 years, at the end of our narrative laid out above.

As $CMG would be a huge success story, we can safely assume EV/EBIT of 20 at year 10, giving some room for error with respect to interest rate changes, for example.

Let's also assume that we sell our shares after 10 years, at the end of our narrative laid out above.

As $CMG would be a huge success story, we can safely assume EV/EBIT of 20 at year 10, giving some room for error with respect to interest rate changes, for example.

11/15

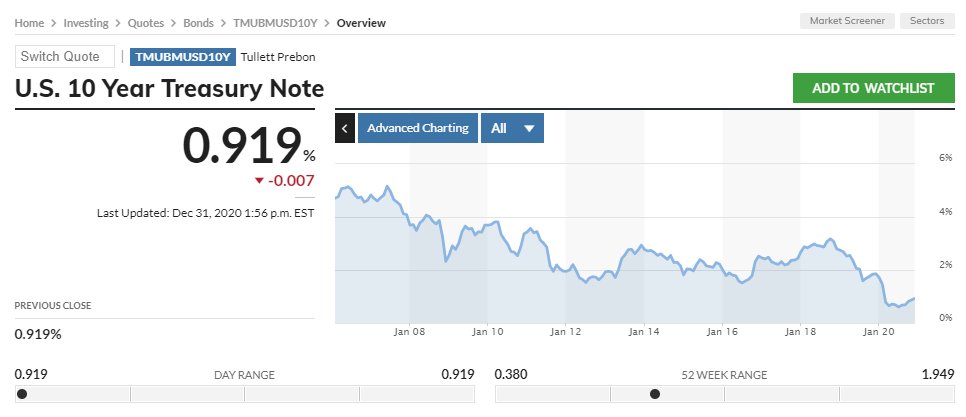

Lastly, we need to discount Chipotle's value at year 10 to today's money.

Currently, 10-year yields are at 0.9% so we use that as our opportunity cost (discount rate).

Lastly, we need to discount Chipotle's value at year 10 to today's money.

Currently, 10-year yields are at 0.9% so we use that as our opportunity cost (discount rate).

12/15

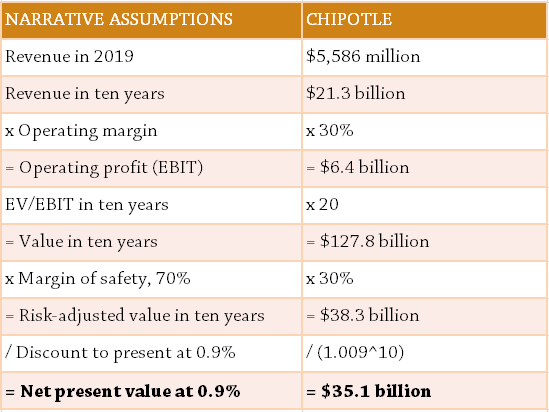

By using our earlier assumptions, we can now formulate the following table and conclude a valuation of $35 billion for Chipotle $CMG.

Today, Chipotle's enterprise value is $41 billion. Therefore the current market value expects even better outcome.

By using our earlier assumptions, we can now formulate the following table and conclude a valuation of $35 billion for Chipotle $CMG.

Today, Chipotle's enterprise value is $41 billion. Therefore the current market value expects even better outcome.

13/15

It goes without saying that the narrative valuation approach is VERY susceptible to changes in the used assumptions.

For example, if 10-year yields would rise to 3% (level two years ago in 2018), our valuation would drop from $35 to $28 billion, i.e. a drop of 20%.

It goes without saying that the narrative valuation approach is VERY susceptible to changes in the used assumptions.

For example, if 10-year yields would rise to 3% (level two years ago in 2018), our valuation would drop from $35 to $28 billion, i.e. a drop of 20%.

14/15

To learn more about the approach, I can highly recommend a book by @AswathDamodaran, Narrative and Numbers: The Value of Stories in Business.

Additionally, @bgurley's response to his Uber narrative valuation is golden, found here:

abovethecrowd.com/2014/07/11/how…

To learn more about the approach, I can highly recommend a book by @AswathDamodaran, Narrative and Numbers: The Value of Stories in Business.

Additionally, @bgurley's response to his Uber narrative valuation is golden, found here:

abovethecrowd.com/2014/07/11/how…

15/15

That’s it for today, folks.

Liked this post? ♥️ Please like or retweet.

Want more of the same? 💙 Please follow.

Much appreciate you taking your precious time for this 🙏 Happy New Year!

The end.

That’s it for today, folks.

Liked this post? ♥️ Please like or retweet.

Want more of the same? 💙 Please follow.

Much appreciate you taking your precious time for this 🙏 Happy New Year!

The end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh