2020 was an unprecedented year for the world and for crypto.

Before we fully plunge into 2021, let me share a brief recap of the major industry events of the past year and the lessons learned.

Thread below 👉

Before we fully plunge into 2021, let me share a brief recap of the major industry events of the past year and the lessons learned.

Thread below 👉

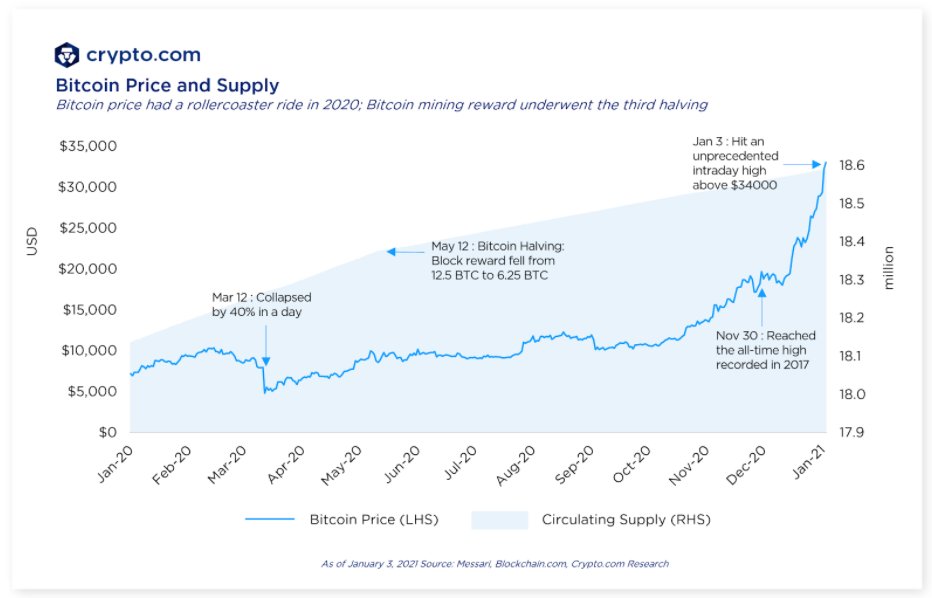

1/ Bitcoin's Big Year: 2020 was a rollercoaster year for #Bitcoin. We experienced halving, extreme lows on Black Thursday, followed by a robust recovery📈that led us to a parabolic rally and high volatility still going on today.

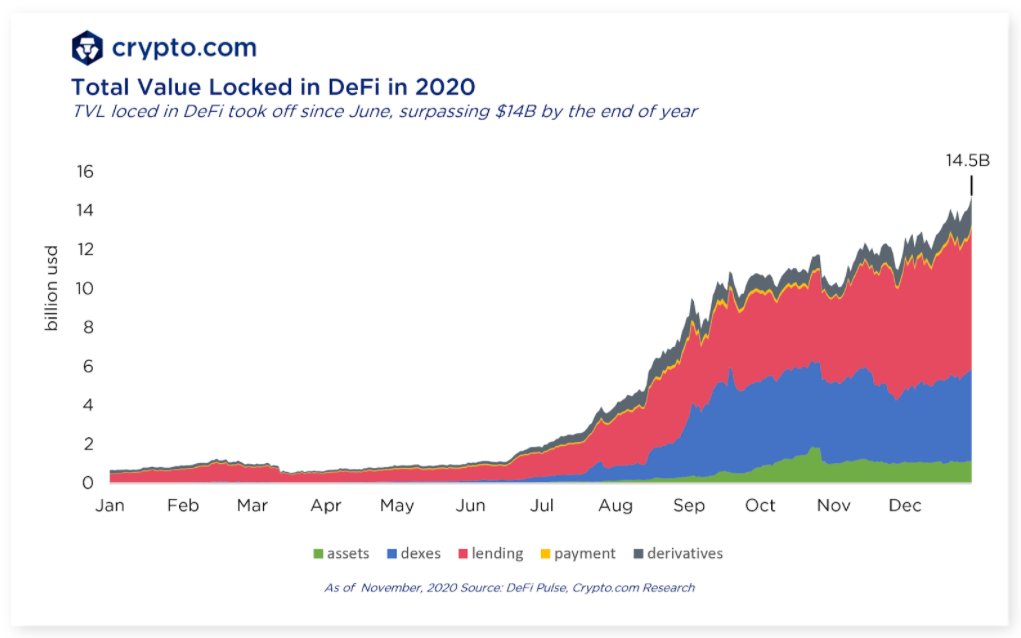

2/ DeFi Summer: This year was an insane frenzy of action for #DeFi as new protocols and yield farming initiatives were announced seemingly every week. By end 2020, TVL (total value locked) in DeFi grew more than 23-fold from under $700M to $15B.

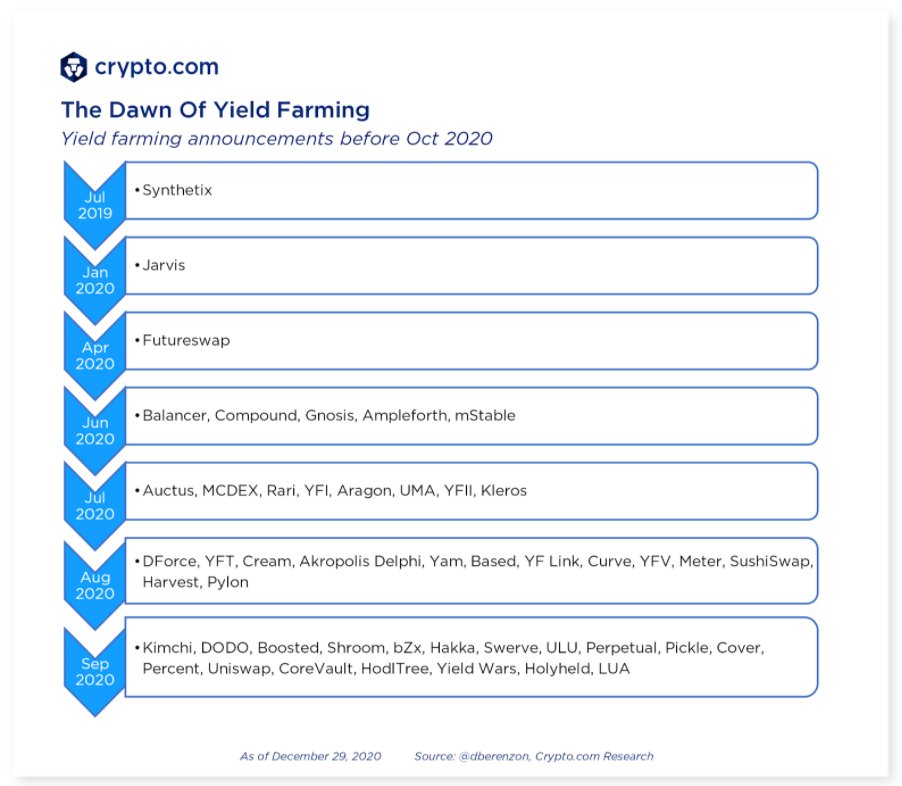

3/ The Dawn of Yield Farming: Among DeFi’s most revolutionary ideas was the idea of #yield farming🧑🌾. The idea that the ownership of platforms belongs to its users and early supporters was one that spoke to all of us.

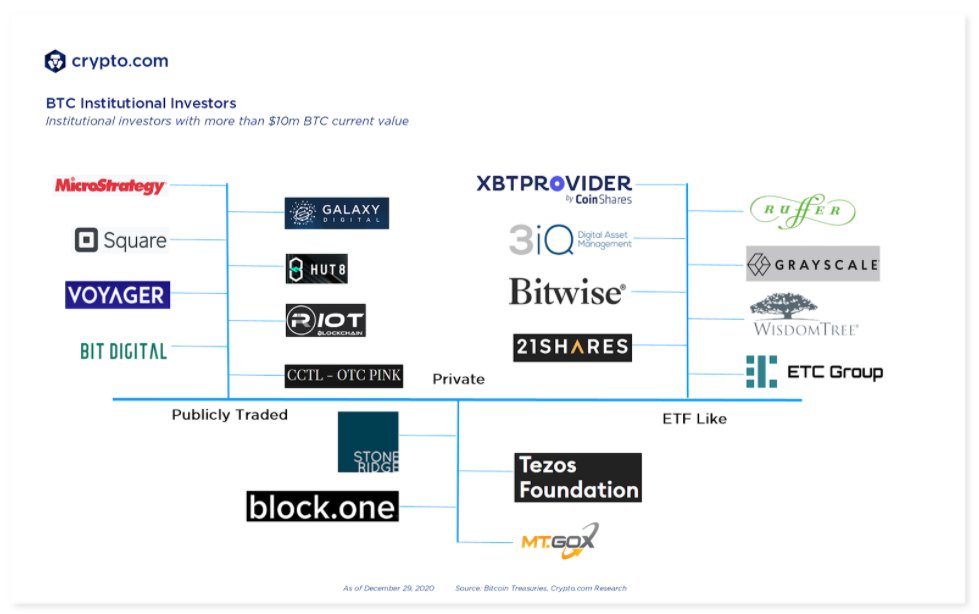

4/ Institutional Adoption of Bitcoin: Besides Microstrategy and Square buying outright, institutions 🏦 one by one announced their support of crypto, notably financial heavyweights like Goldman Sachs, Fidelity, and Citibank, to name a few.

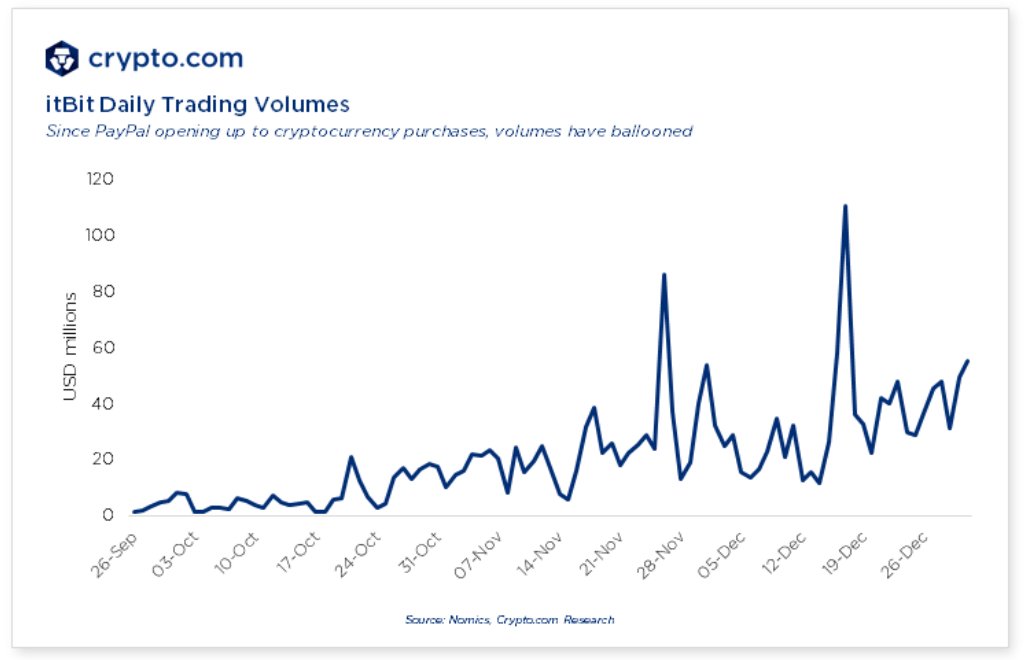

5/ Paypal and the Beginnings of Crypto Mass Adoption: With #Paypal allowing its 300M users to purchase crypto directly, we have seen a tremendous inflow of PayPal funds into crypto, especially #bitcoin. Chart shows the uptick below of volumes on PayPal's partner exchange service.

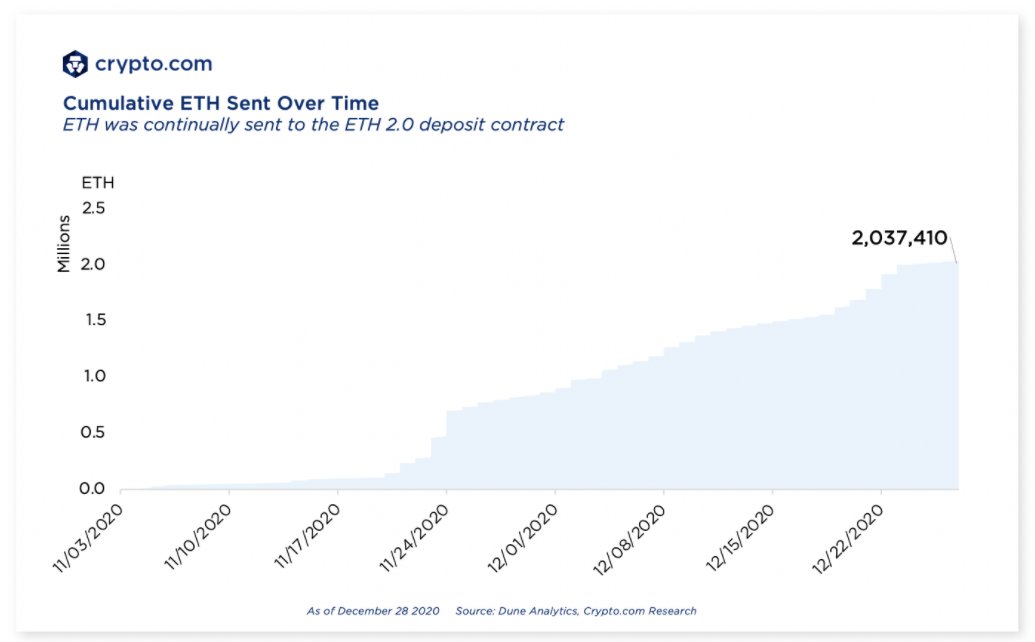

6/ Ethereum 2.0: The upgrade to Ethereum 2.0 has been long-awaited by the #ETH community. If anything, summer’s DeFi madness has shown that Ethereum is in dire need of an upgrade in scalability. More than 2 million ETH is locked in the ETH 2.0 staking contract.

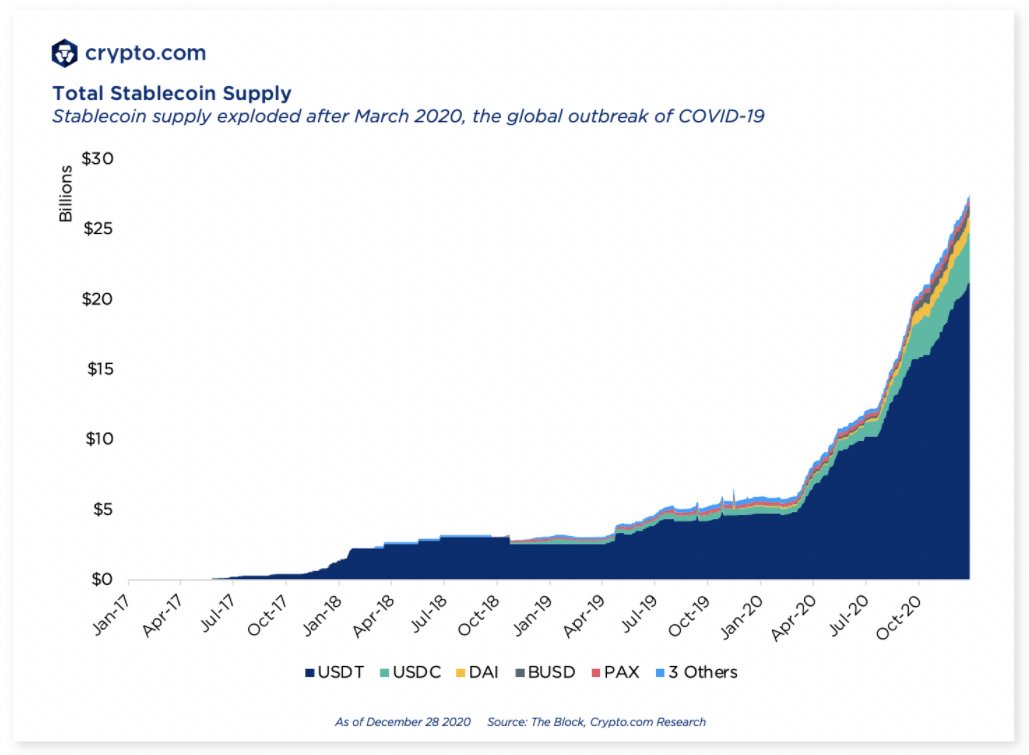

7/ Explosion in Stablecoin Supply: The crypto industry has become increasingly reliant on centralized #stablecoins, most notably Tether. The world’s most popular stablecoin has ballooned to over $20 billion in circulating supply, taking 75% market share in USD-based tokens.

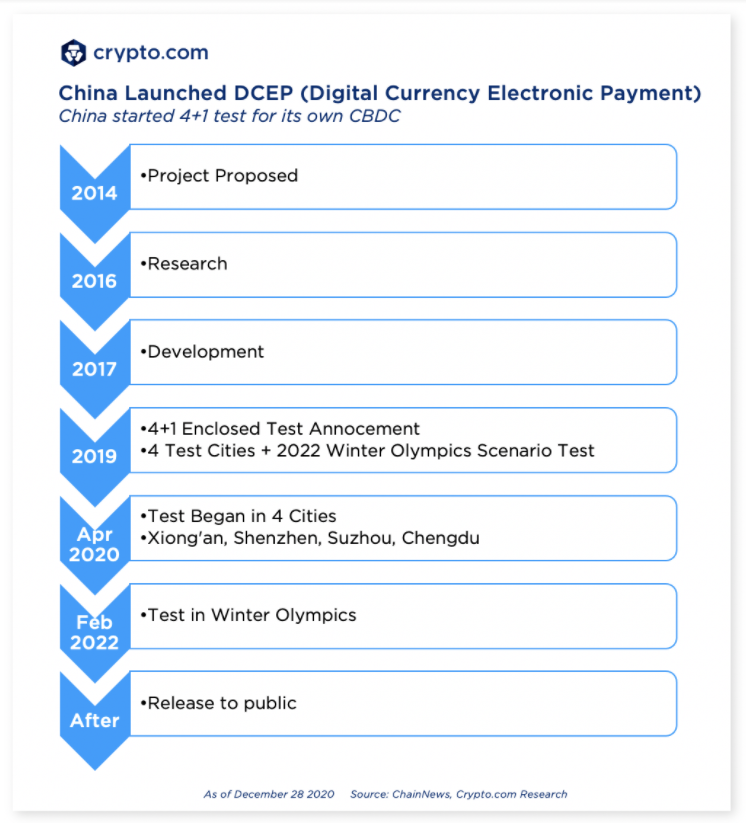

8/ China Launches Digital Yuan: Central banks around the world may be taking their first steps towards #CBDC, but not the PBoC. China rolled out its CBDC at a rapid pace in 2020, trialing pilot programs all over the country.

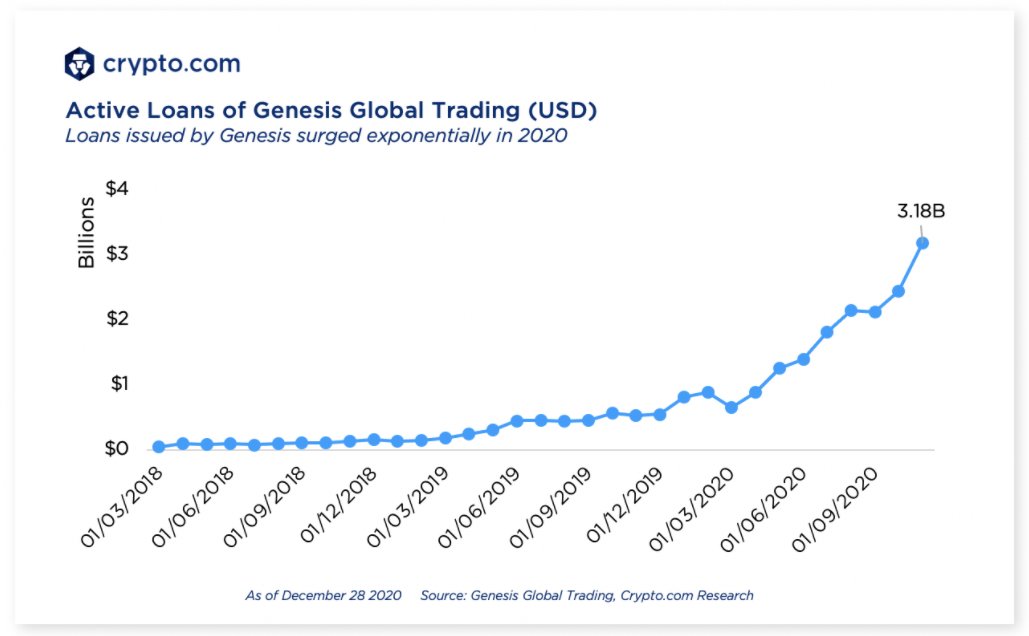

9/ Record Crypto Credit Growth: Crypto credit products of all kinds has seen a tremendous year of growth, from derivatives to on- and off-chain lending. Credit-fueled selloffs will be a risk to watch.

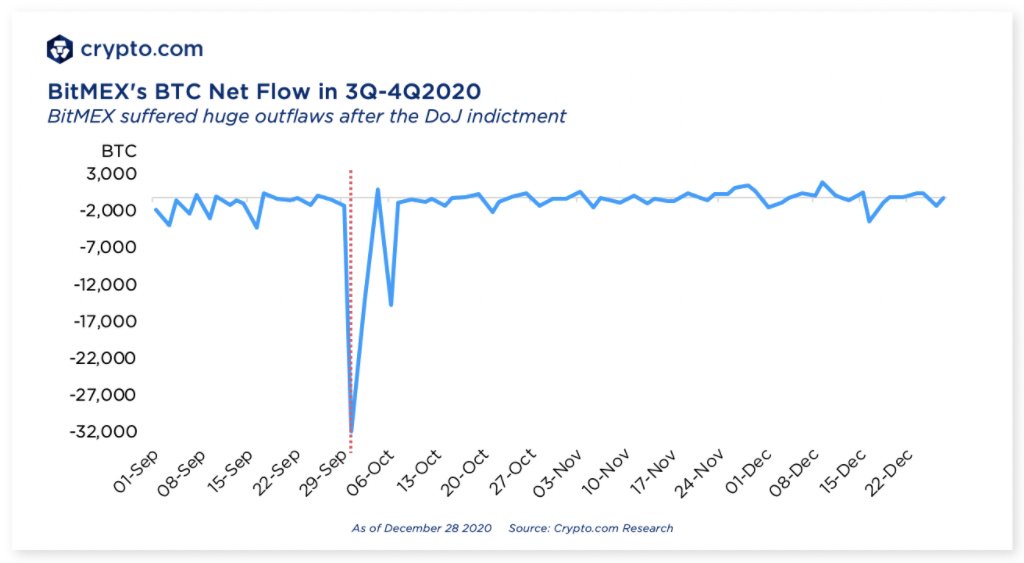

10/ Regulatory Scares for BitMEX and OKEx: these two events might have been fatal to risk appetite in any other year, but 2020 proved that crypto investors are nothing if not resilient. Bitcoin stuttered briefly after both incidents, but quickly recovered.

The full report will be available soon at the Crypto.com Research hub.

Tomorrow, I will share the major trends we can expect unfolding in 2021! 🚀

Tomorrow, I will share the major trends we can expect unfolding in 2021! 🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh