Now a £35M cap, a fortnight on

It's one of those small UK if-it-were-listed-in-the-US companies. Bidstack #BIDS and it puts advertising into major online games

It's rocketing - and there are some grounds to think that in quite short order it may be about to turn into a firework

It's one of those small UK if-it-were-listed-in-the-US companies. Bidstack #BIDS and it puts advertising into major online games

It's rocketing - and there are some grounds to think that in quite short order it may be about to turn into a firework

https://twitter.com/hareng_rouge/status/1339479766827712515

"May" and also:

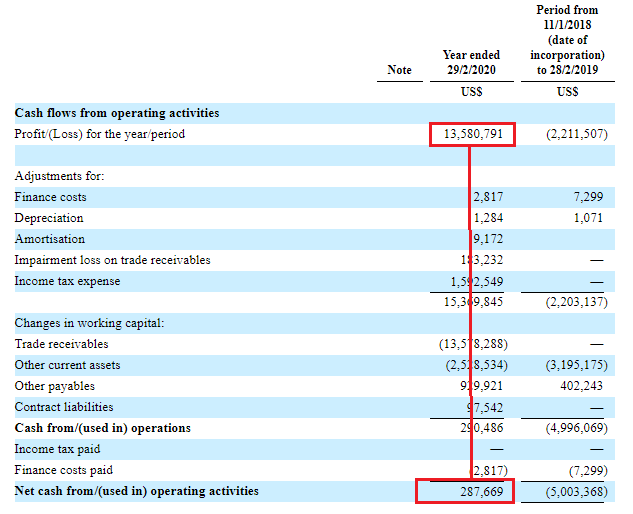

- history of over promising and disappointing

- very much a AIM small cap

- burns cash

- will place and dilute

- has share price on homepage

- Glassdoor is not great

- emoji issues when discussed

- history of over promising and disappointing

- very much a AIM small cap

- burns cash

- will place and dilute

- has share price on homepage

- Glassdoor is not great

- emoji issues when discussed

*But* it may now be delivering for real. If so it may also be extremely cheap. How cheap?

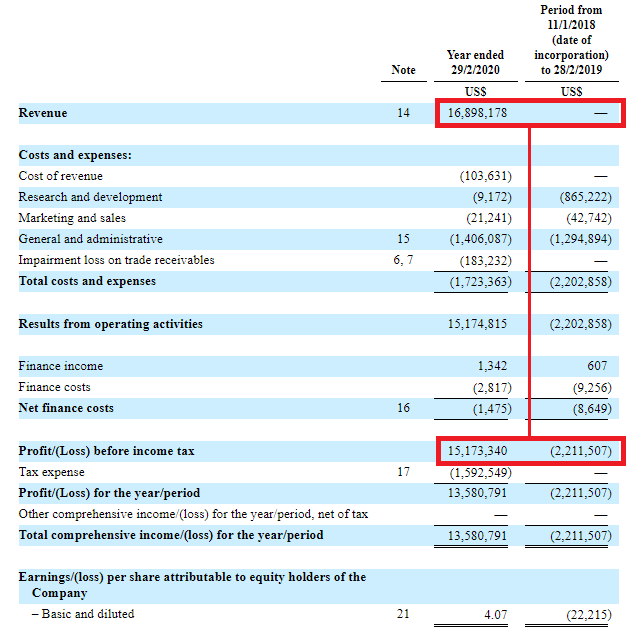

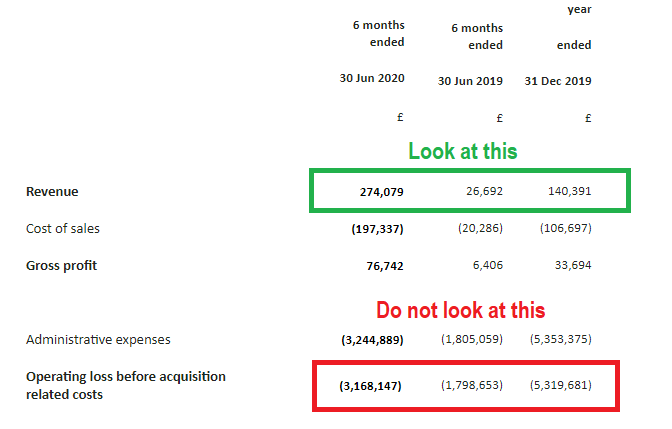

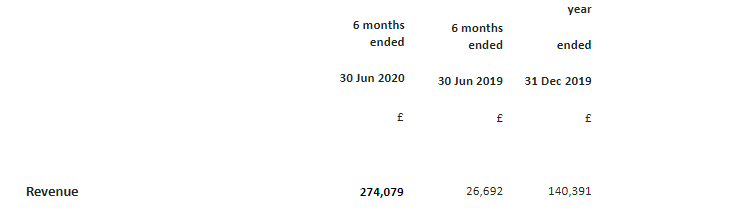

20H1 was 2x sequentially and 10x YoY

It may be about to report H1-H2 sequential growth of 5x.

If so, FY20: 10x YoY.

Fwd 21 rev multiple? Perhaps half that number, perhaps even less.

20H1 was 2x sequentially and 10x YoY

It may be about to report H1-H2 sequential growth of 5x.

If so, FY20: 10x YoY.

Fwd 21 rev multiple? Perhaps half that number, perhaps even less.

I need to explain in some detail what they do because it's necessary to understand it to gauge not only the opportunity but also the risk - and also to be able to translate aspects of what the company put out in their releases. The juicy stuff comes after.

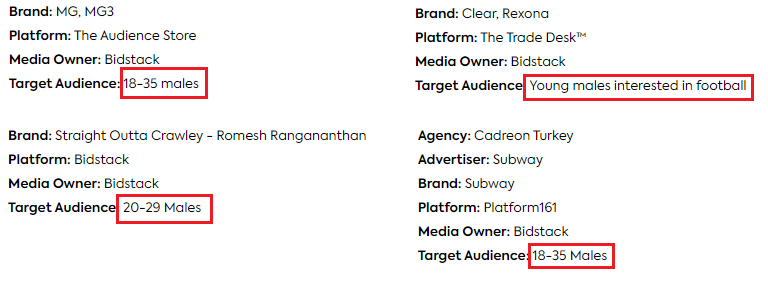

As simply as I can: Bidstack provide a SDK (software developer kit) to games companies: so far Sega and Codemasters

The SDK allows companies to create areas in their games where adverts can be placed by Bidstack.

The ads appear within the fabric of the game, natively

The SDK allows companies to create areas in their games where adverts can be placed by Bidstack.

The ads appear within the fabric of the game, natively

This means that for example, they're on the pitchside hoardings inside a football game. This increases realism and more importantly it avoids some issues around overt advertising to children and cannot be blocked / skipped as interstitial ads can - think ad breaks in Youtube.

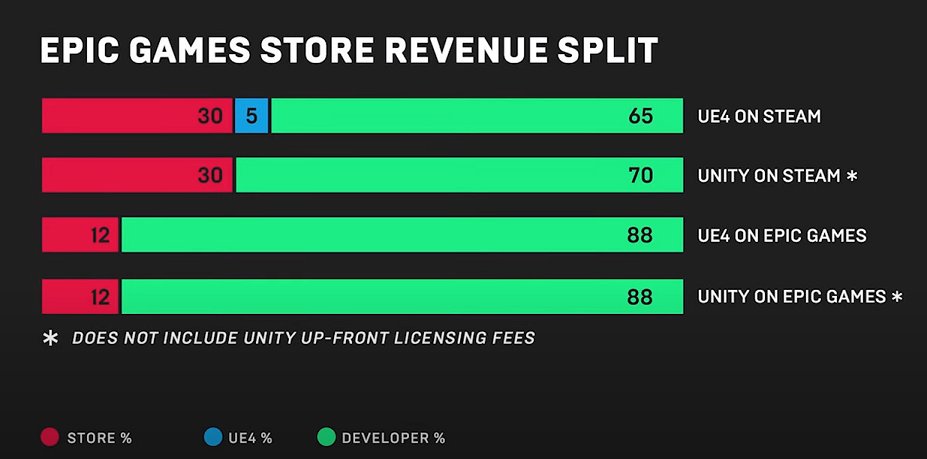

The SDK works with Unity and Unreal. These are the tools some companies use to make their games; they are the cutting edge. Unity has recently listed on NASDAQ - type in $U and from sea to shining sea you'll find widespread foaming at the mouth.

Bidstack then either provides this space in the games on their own ad platform which links to ad exchanges (Tradedesk $TTD and the like) - this is still early stage for 2 reasons: it's technically hard in part because the "spaces" in games are dynamic and non-standard

Secondly, I see issues around a supermarket say, being seen to place advertising behind where a player may be decapitating someone in order to drink their spinal fluid.

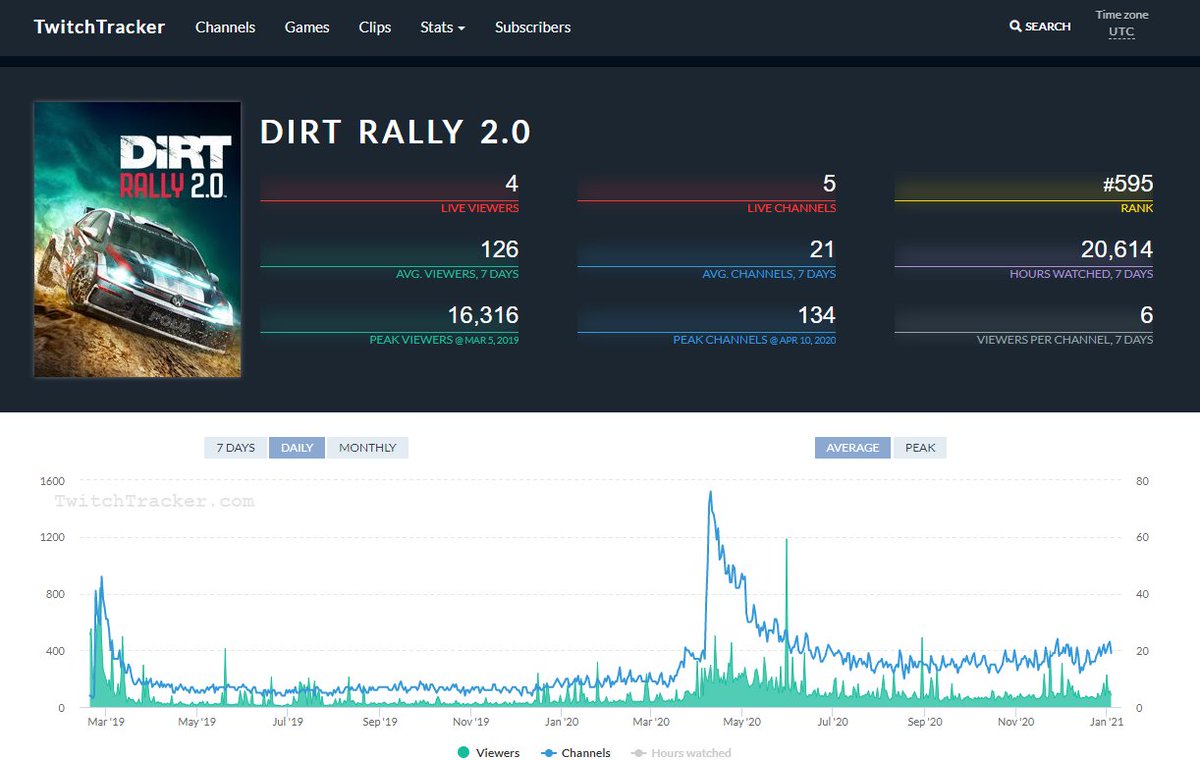

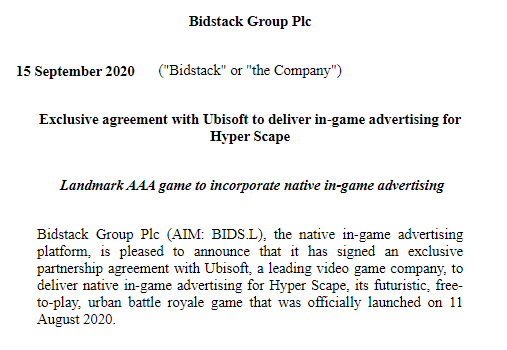

To date the games are a couple in car racing, one in football and a battle royale. Will come back to this.

To date the games are a couple in car racing, one in football and a battle royale. Will come back to this.

However, what else they do is deal directly with brands: handhold them through the process, clean up the ads so they look right in-game and then place where the corporate image will not suffer.

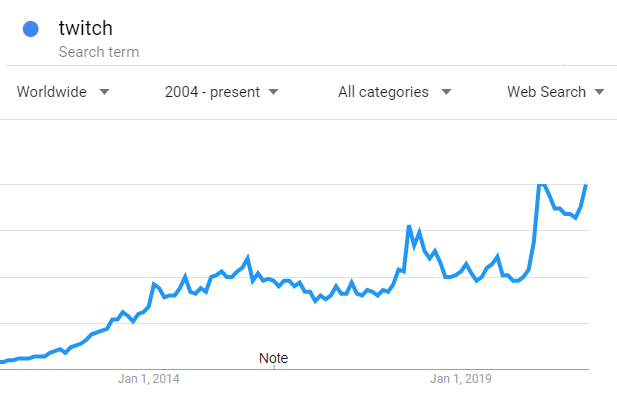

They get them to a very hard to reach demographic.. who then re-consume ads endlessly

They get them to a very hard to reach demographic.. who then re-consume ads endlessly

This is new to brands and advertisers and so far these have been limited test campaigns.

And this is what they have achieved from those tests: H1 10x YoY and 2x sequentially

And this is what they have achieved from those tests: H1 10x YoY and 2x sequentially

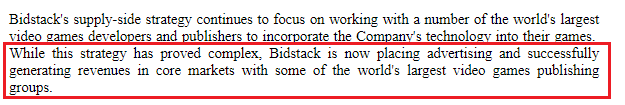

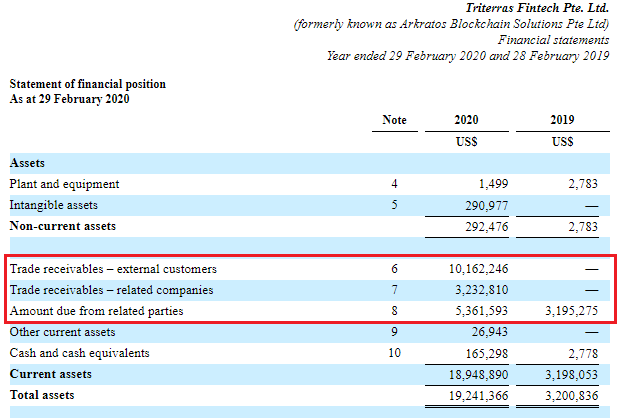

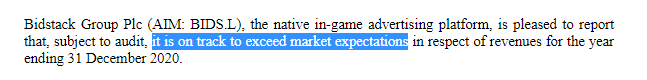

When I first noticed this it was this update which prompted my initial tweet but the real headline isn't the one that originally caught my eye - that first underlining

It's the second. Having seen the numbers from tests alone, hopefully you can now understand why.

It's the second. Having seen the numbers from tests alone, hopefully you can now understand why.

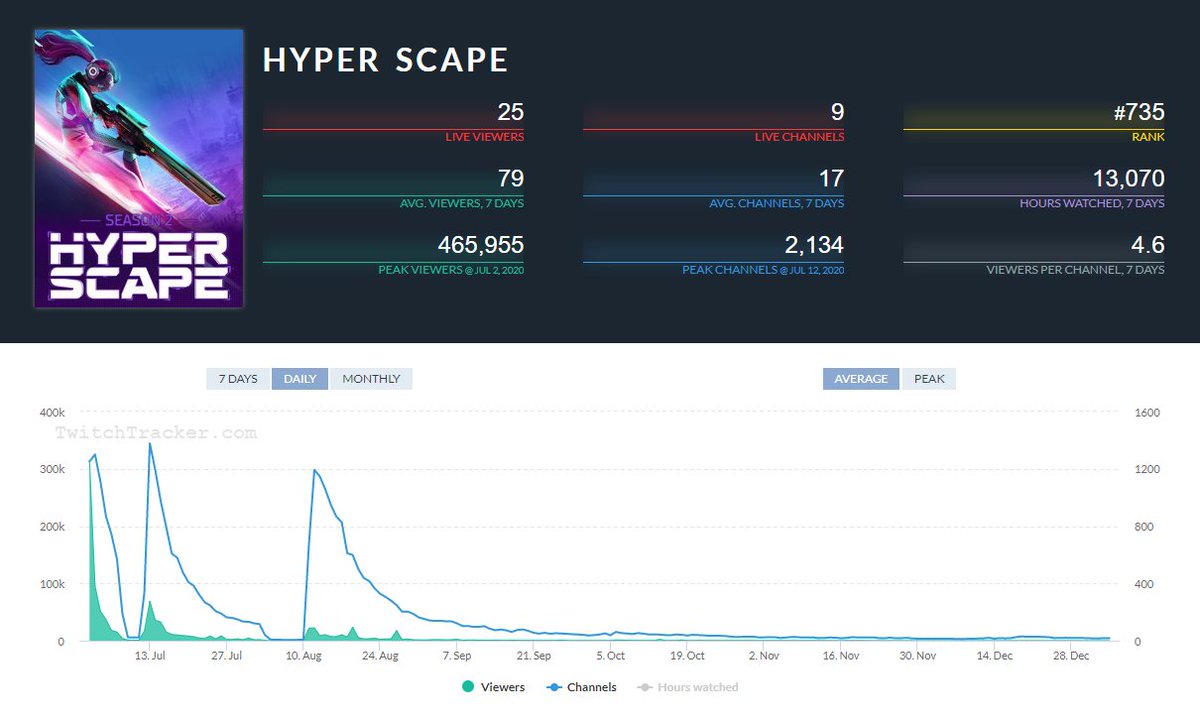

There are 2 main games. Dirt 2.0 from Codemasters - broadly well received (via are viewer numbers from Twitch) and Sega Football Manager. A third w/codemasters Dirt 5 is new and has issues about launching without support for steering wheels (🇸🇪)

At the August half year report the company said this, which I read as "we're trying to get more beyond Sega and Codemasters"

It's actually Ubisoft for their Hyper Scape BR game, easily missed and buried amongst the price monitoring blizzard that's par for the course here. It was a free-to-play (FTP), comatose now and there may be a second season soon. The FTP part is important.

Also September: cricket game app for phones. It's a new area being non-console / PC and again this is free to play (don't worry, I'm not going to review them)

exchangewire.com/blog/2020/09/2…

exchangewire.com/blog/2020/09/2…

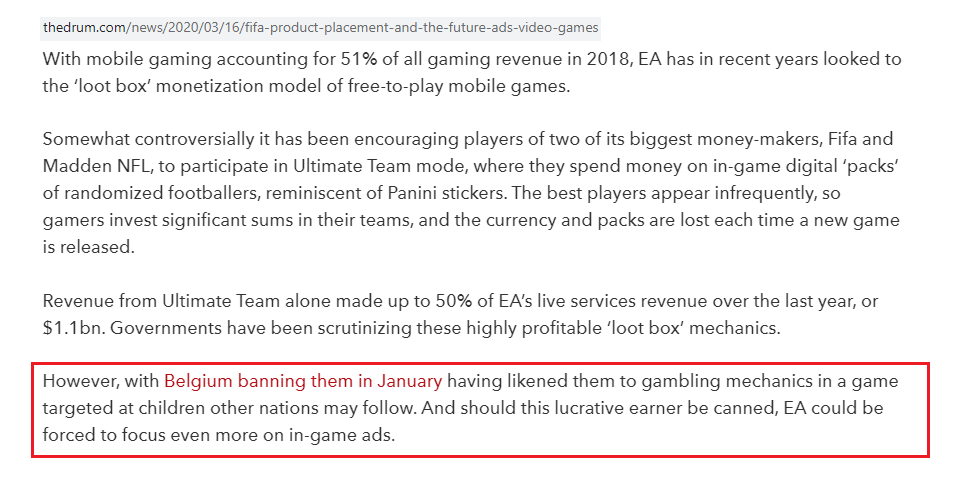

FTP is interesting because it feeds into the economics of understanding why gamecos like this - of course it's just more money but allowing advertising also enables not only successful apps to be monetised but new genres of FTP games - think Fortnite

There are issues around how FTPs make money: loot boxes. Ads can allow a new revenue source. This is FIFA, not even a FTP, taking heat from Belgium - this kind of move is becoming increasingly discussed and widespread.

Remember the bit about SDKs? Codemasters now acquired by EA, the maker of FIFA - so BIDS are present there too. Of course, this doesn't mean that EA start using Bidstack all of a sudden but as a foot in the door, you could do worse.

Lastly, I promise, here is another example of why developers need this: platforms capture a decent amount of their economics - you'll be aware of the spat around the Apple store and games for instance.

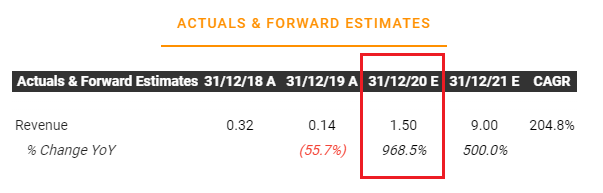

Numbers: suppose BIDs does H1-H2 2020 equivalent to H1 - H2 2019?

That was £26K and £113K, a little over 4x sequentially

20/H1 of £274K at that rate would be £1.2M - so just under £1.5M for FY and 10x YoY

That was £26K and £113K, a little over 4x sequentially

20/H1 of £274K at that rate would be £1.2M - so just under £1.5M for FY and 10x YoY

But they said this in Dec. What's a market expectation? It a number the company tells their broker that they should be able to achieve. Like they've already made dinner and now expect to be able to get most of the food from the plate to their mouth: it's a low bar to beat

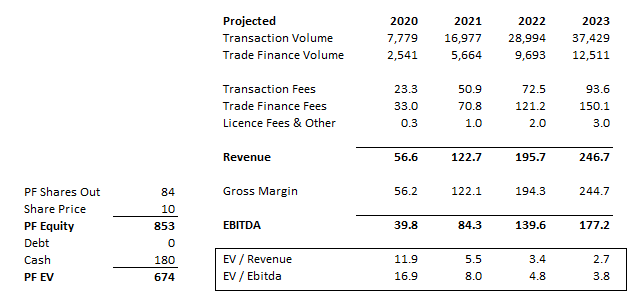

Next year: £9M

First, I don't know when that number was issued and second, given the history here, I don't think it should be given too much credence but.. with this kind of momentum? Perhaps not impossible that it's not a million miles off. At a £35M cap that's 4x Fwd revenues

First, I don't know when that number was issued and second, given the history here, I don't think it should be given too much credence but.. with this kind of momentum? Perhaps not impossible that it's not a million miles off. At a £35M cap that's 4x Fwd revenues

• • •

Missing some Tweet in this thread? You can try to

force a refresh