The is a tech bubble in the stock market, and it will burst soon. The question is, which of the #NGS companies below will come out stronger from the stock market tech bubble bursting? $ILMN $PACB @nanopore @MGI_BGI

https://twitter.com/AlbertVilella/status/1348725995960991744

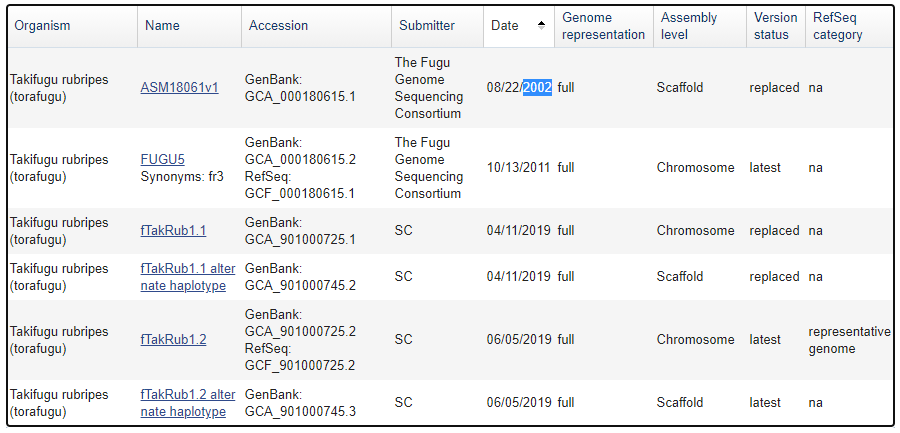

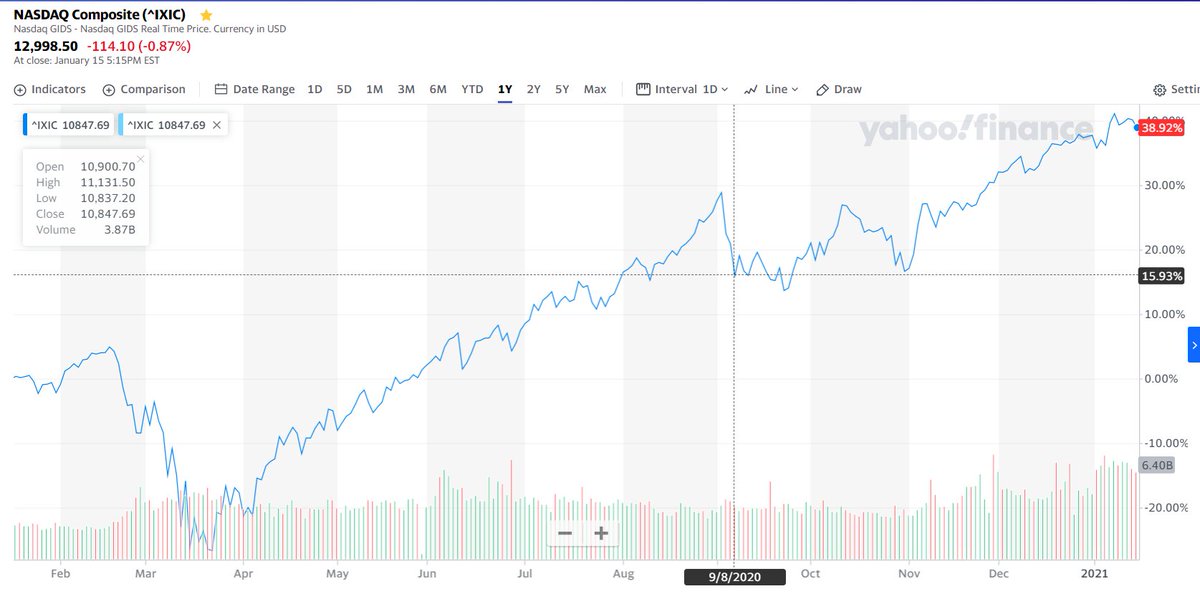

Looking at the NASDAQ for the last 5 years, there was a big drop in March 2020, triggered by the first wave of worldwide #COVID19. The tech bubble was already inflated back then. But the market recovered with a matter of weeks, and kept climbing up.

By 9/8/2020 there was another attempt of a correction, mostly #COVID19 related, but again, with a highly inflated tech bubble, the market recovered and quickly jumped another 1,000 points (around 11,800):

The NASDAQ spent 2 months (and a bit) deciding what to do, fluctuating around the 10-11K mark. This was probably the closest we've seen the tech bubble to burst, but it didn't:

Now to the analysis of each of the #NGS companies:

$ILMN has been going up in the last 5 years, but at a slower pace than the NASDAQ. In fact, in the last 2 years, which are the worst of the tech bubble, $ILMN has been hovering at around $350-400.

$ILMN has been going up in the last 5 years, but at a slower pace than the NASDAQ. In fact, in the last 2 years, which are the worst of the tech bubble, $ILMN has been hovering at around $350-400.

If the NASDAQ crashes down from 13,000 to 7,000, $ILMN may go down a bit but retain the $250 mark, maybe even the $300 mark.

Next is $PACB: this is a difficult to predict after the tech bubble bursts, because it spent 2-3 years undervalued (at around the time the Sequel2 came out), but spent the last few months overvalued. The price before the last big NASDAQ correction was around $14-15.

I can't tell if $15 is a good valuation for $PACB after the tech bubble bursts because we haven't had enough time to test any of the valuations between $15 and what it currently is, which is around $35-40 (depending on when you ready this tweet!).

$PACB could hold the $15-20 mark after the tech bubble bursts but a lot will depend on what the company does financially between now and crash: if the have a couple of share issues of $200-300M total, I think they can hold the $20 mark. This may seem counterintuitive,

but for companies with a strong offering and good R&D, raising capital when it's practically free makes you stronger when the bubble bursts. We saw something similar with Google and Yahoo back in the last tech crash (yes, it's been more than 20 years!).

Next in the analysis is @MGI_BGI: here we can't compare them against the NASDAQ because unless I am mistaken, they only trade directly in China (Shenzhen stock market IIRC). So the question is: will they be a stronger or weaker company relative to the other contenders?

My feeling is that they will be relatively unaffected: their biggest rival in #NGS so far is $ILMN, and neither will suffer too much from the tech crash.

Next in the analysis is @nanopore: they've been raising money steadily in the last 2-3 years, seemingly with ease. As an example, when they had to reallocate a big chunk out of Woodford, they did it easily and it wasn't even in the news.

.@nanopore has been charting plans for an IPO for as long as the last 2-3 years, but haven't committed. Why? They don't need to: they've been raising capital without any problems in the last 2-3 years and at decent valuations ($1-2.5B).

We know they feel strongly about the company being bought out by American money one way or another: it's no secret the key people feel strongly about UK companies being sold too quickly to the US. Their investors are well spread, with quite a bit from China/Asia.

So what are their options: 1/ IPO before the tech crash, and profit from the crazy inflation we are seeing in the last 2 years. It's not easy to IPO in the US, as it's tightly regulated, and now actually easier to do in, e.g. Japan or Israel.

But if they do go for a pre-crash IPO, they have a chance to get close to the $10B (or 3-5x the projected current valuation based on past 2-3 raises). Is it crazy to value @nanopore at $10B? Not before the tech crash.

Option 2/ wait for a while, as they have a big inflection point coming from their denser ASICs with voltage squiggles. This may mean the tech bubble bursts before they IPO, which inevitably will mean a correction to the valuation.

But waiting for the voltage-based new ASICs means they are then a threat to *all* the companies in the #NGS market, and all fields, including #LiquidBiopsy. Given that the TAM would be $50-100B, then a post-crash IPO valuation could still range at around $10B.

So that's my opinion on what the #NGS field may look like after a post tech bubble crash. You may be wondering why I am tweeting about this? Well, for one I've been interested in the stock market for the last 22 years. I've traded mostly in tech stocks since then.

I learned a lot about the 2008 financial crisis, more than the first tech bubble (too early for me). I remember buying a lot of $GOOGL for $495 weeks after Lehman's imploded. My flatmate at the time thought I was crazy.

Moreover, I am interested in #NGS (that's why people follow me on @twitter isn't it?) and keen on seeing what other people's opinion is about this: unless I vocally express my opinion, I won't have people's attention on the matter.

Finally, we all like to be correct in our predictions, don't we? I know a tech crash will be another failure of a system that has already had many failures in my lifetime, but I want to make my prediction so that I publish here what I think will happen.

If the tech crash happens tomorrow (it won't, I am not Nostradamus), the sector itself, including biotech, will be smaller than before, which is bad for people in the sector (I include myself here). But the market will be redefined, reshaped, and hopefully wiser than before.

If the tech crash doesn't happen in the next two years, then I will be wrong, and I will have missed an opportunity to put some of my savings to good use: I pulled out of the NASDAQ in April/May 2020. I hope I have a way in soon, and I can continue to invest in tech stock.

Responding to questions (thanks for your replies):

Q: when do I predict the crash will happen?

A: I pulled out in April/May 2020, so I am already wrong by about 8 months! Although to be honest, the 2 months before selling was basically CFDs on $TSLA, so March 2020?

Q: when do I predict the crash will happen?

A: I pulled out in April/May 2020, so I am already wrong by about 8 months! Although to be honest, the 2 months before selling was basically CFDs on $TSLA, so March 2020?

Q: Where would the money depart to? Crypto?

A: It will leave some of the tech tickers for a while, but then go back to it. $GOOGL only became the dominant company that we know today by replacing Yahoo and others post-crash. And I have no opinion on crypto.

A: It will leave some of the tech tickers for a while, but then go back to it. $GOOGL only became the dominant company that we know today by replacing Yahoo and others post-crash. And I have no opinion on crypto.

Q: There is still a long way to the 2000 tech bubble

A: If true, then there is still a long way for the bubble to burst. But the current NASDAQ includes large established companies like AMZN, AAPL, MSFT, which are going to be unaffected by it. They are buffers in your FT plot.

A: If true, then there is still a long way for the bubble to burst. But the current NASDAQ includes large established companies like AMZN, AAPL, MSFT, which are going to be unaffected by it. They are buffers in your FT plot.

@d2unroll unroll

If you find the $ILMN analysis missing, there was a disconnect in my twitter thread. It should have connected here:

https://twitter.com/AlbertVilella/status/1350905017235079169

• • •

Missing some Tweet in this thread? You can try to

force a refresh