1/ "Inflation is dead!"

"We can print as much money as we want!"

"Don’t worry about it, there will never be any inflation!"

Time to take a closer look. 👇

"We can print as much money as we want!"

"Don’t worry about it, there will never be any inflation!"

Time to take a closer look. 👇

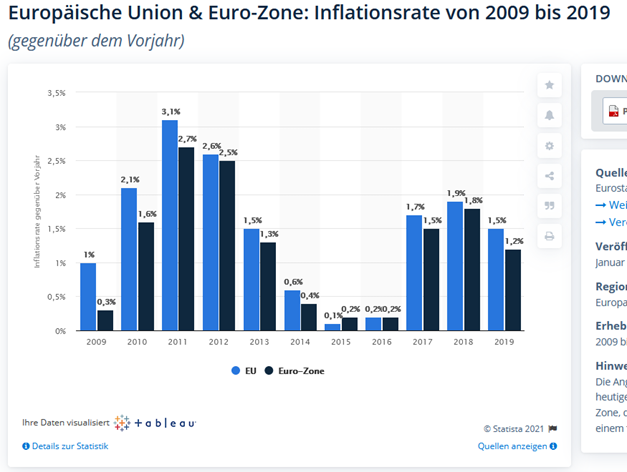

2/ First, a few definitions:

Inflation measures how much more expensive a basket of goods and services has become over a certain period, usually a year.

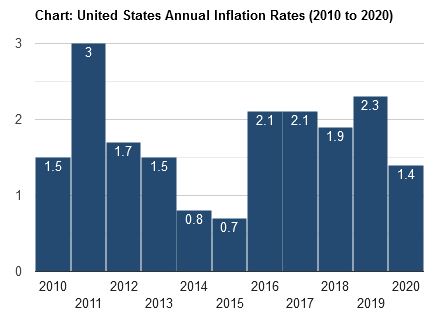

Looking at the US and Europe the numbers don’t look too bad.

But wait there is more ;)

Inflation measures how much more expensive a basket of goods and services has become over a certain period, usually a year.

Looking at the US and Europe the numbers don’t look too bad.

But wait there is more ;)

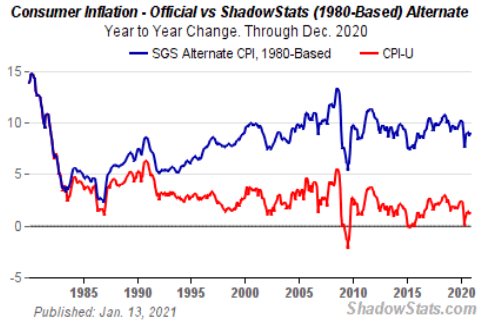

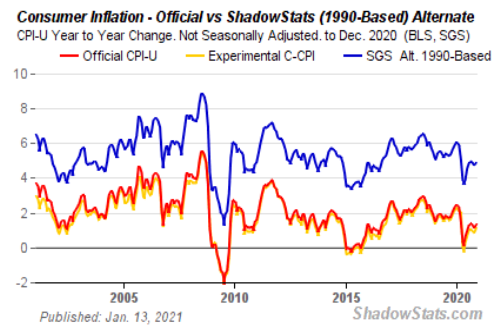

3/ As Winston Churchill once said:

The only statistics you can trust are those you falsified yourself.”

Over the past decades the government changed the way how to measure inflation several times to give you the expression there is nothing to worry about.

The only statistics you can trust are those you falsified yourself.”

Over the past decades the government changed the way how to measure inflation several times to give you the expression there is nothing to worry about.

4/ If we calculate inflation the same way as in the 80ies or 90ies, it is at least double the amount!

5/ But there is more....

The Chapwood Index reflects the true cost-of-living increase in America. It reports the unadjusted actual cost and price fluctuation of the top 500 items on which Americans spend their after-tax dollars in the 50 largest cities in the nation.

The Chapwood Index reflects the true cost-of-living increase in America. It reports the unadjusted actual cost and price fluctuation of the top 500 items on which Americans spend their after-tax dollars in the 50 largest cities in the nation.

6/ What does that mean?

The money in your bank account is actually losing 10% a year.

Same goes for your salary unless you get a 10% raise a year. If not, you should ask for it!

How can that be true? Why is there no revolution, you might ask.

The money in your bank account is actually losing 10% a year.

Same goes for your salary unless you get a 10% raise a year. If not, you should ask for it!

How can that be true? Why is there no revolution, you might ask.

7/ Unfortunately most people are not aware of it as inflation is a perfidious and hidden tax.

As Henry Ford once said:

"It is well enough that people do not understand our monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

As Henry Ford once said:

"It is well enough that people do not understand our monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

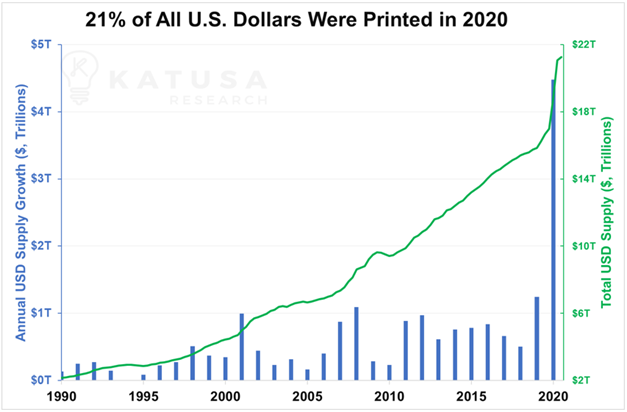

8/ Let’s take a look why there is inflation in the first place:

Did you know? 21% of all us dollars were printed in 2020?

This is an outrageous and freaking high number!

Even if you do not know anything about finance that number should alert you!

Did you know? 21% of all us dollars were printed in 2020?

This is an outrageous and freaking high number!

Even if you do not know anything about finance that number should alert you!

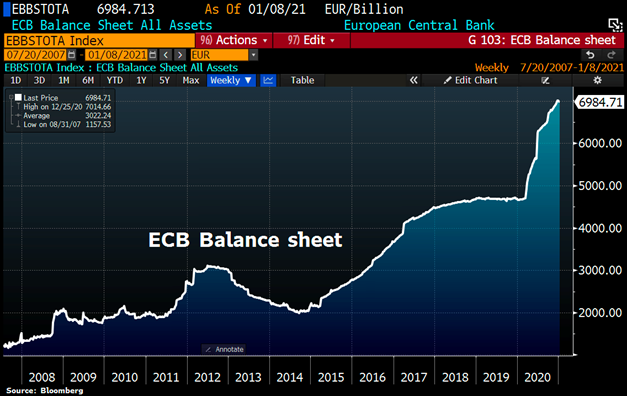

9/ But is not only the US. For the first time in history every country on this little planet is busy, debasing its currency.

Things are about to get wild.

Please pay some attention to these trends and act accordingly.

Things are about to get wild.

Please pay some attention to these trends and act accordingly.

10/ How are money printing and inflation linked to each other?

Inflation occurs when there is too much money chasing too few goods and services. In slightly more technical terms, inflation occurs when money supply growth outpaces economic growth.

Inflation occurs when there is too much money chasing too few goods and services. In slightly more technical terms, inflation occurs when money supply growth outpaces economic growth.

11/ So what we have is a 100% increase in money supply and no increase in the supply of goods. Now there is more money chasing the same amount of goods, so sellers of the goods raise their prices.

Simple supply and demand.

This is inflation in action.

@SahilBloom

Simple supply and demand.

This is inflation in action.

@SahilBloom

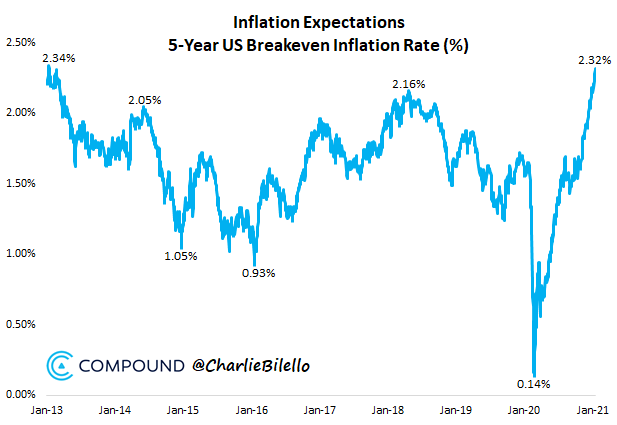

12/ But there is more…

Inflation is not a linear process but an exponential one!

Once it starts, it is really hard to control.

And unfortunately things are already moving fast.

Let me show you some data points: 👇

Inflation is not a linear process but an exponential one!

Once it starts, it is really hard to control.

And unfortunately things are already moving fast.

Let me show you some data points: 👇

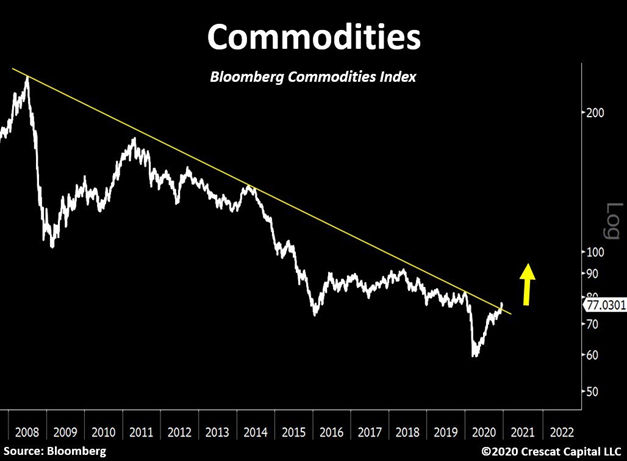

14/ Remember, inflation occurs when too much money is chasing the same amount of goods.

As it seems, money is starting to chase commodities.

Commodities are close to a 5 year high.

As it seems, money is starting to chase commodities.

Commodities are close to a 5 year high.

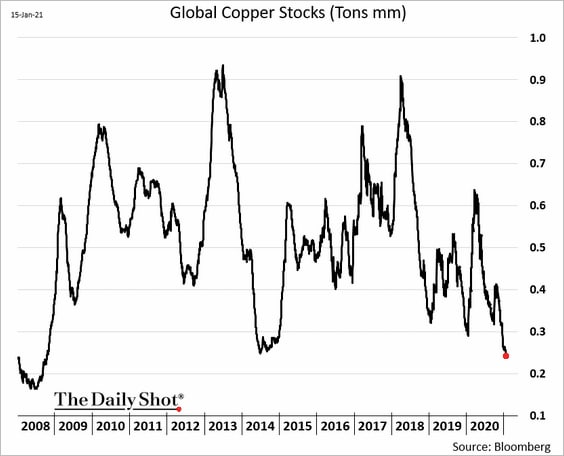

15/ Lets take a closer look at some of them:

Dr. Copper is because of it is wide use one of the best commodities to measure inflation.

Already trading at a 7 year high! I expect copper prices to shoot out of that chart below over the next couple of years.

Dr. Copper is because of it is wide use one of the best commodities to measure inflation.

Already trading at a 7 year high! I expect copper prices to shoot out of that chart below over the next couple of years.

17/ The same can be seen through the whole base metals space.

Zinc, Platin are moving higher.

Silver is still very cheap in comparison!

Zinc, Platin are moving higher.

Silver is still very cheap in comparison!

18/ But there is more…

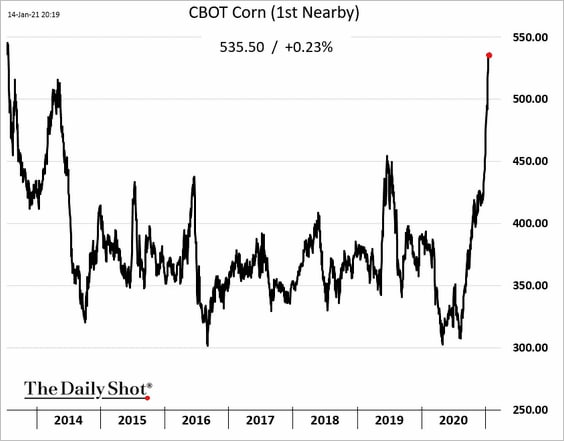

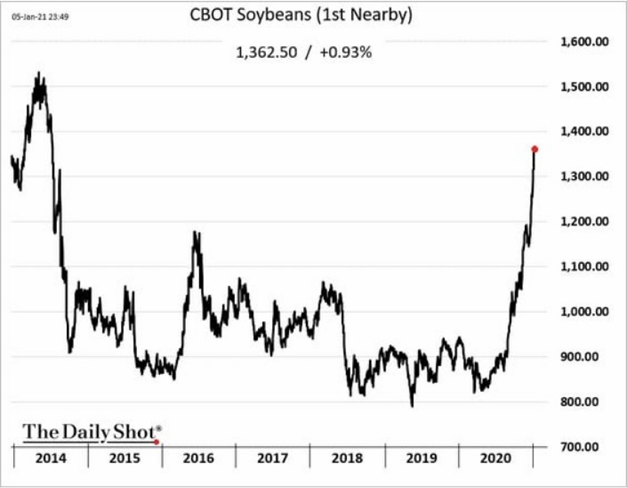

What’s even more alarming: agriculture commodities are on a tear lately.

Look at these charts:

Corn: 7 year high

Soybeans: 7 year high

Sugar: going ballistic

What’s even more alarming: agriculture commodities are on a tear lately.

Look at these charts:

Corn: 7 year high

Soybeans: 7 year high

Sugar: going ballistic

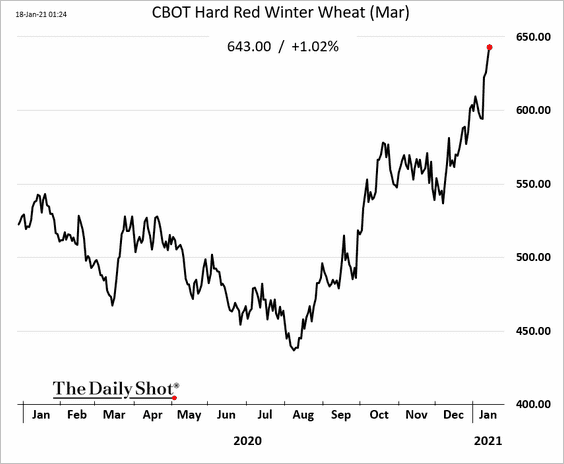

19/ But there is more….

Russia the biggest wheat exporter of the world just introduced new export taxes on wheat.

reuters.com/article/idAFL1…

So wheat is going up....

Russia the biggest wheat exporter of the world just introduced new export taxes on wheat.

reuters.com/article/idAFL1…

So wheat is going up....

20/ Once foods get more expensive, it gets harder and harder for governments to hide inflation. Higher food prices affect everyone in society.

Few seem to know that raising food prices, might be one of the big drivers behind the arab spring.

medium.com/something-abou…

Few seem to know that raising food prices, might be one of the big drivers behind the arab spring.

medium.com/something-abou…

21/ So next time a politician tries to convince you, there is no inflation, show him some agriculture future price charts!

Inflations is right there!

Inflations is right there!

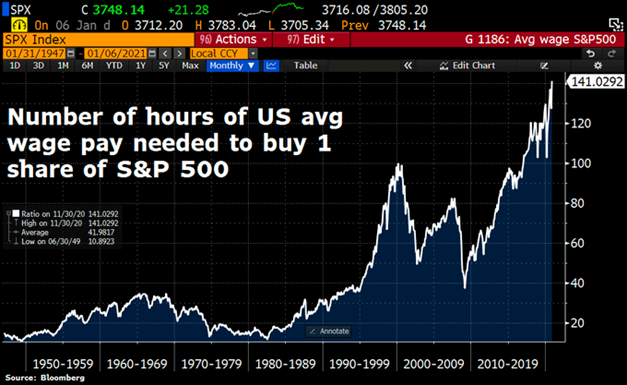

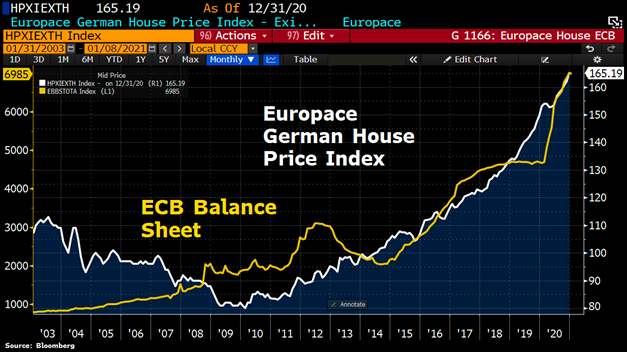

22/ Obviously there other very bad side effects to inflation.

I am convinced, inflation is the main driver behind today’s wealth inequality.

If you live paycheck to paycheck you keep getting screwed by inflation.

I am convinced, inflation is the main driver behind today’s wealth inequality.

If you live paycheck to paycheck you keep getting screwed by inflation.

23/ More on this:

Cheap money is the main driver of stocks and real estate.

If you are a social justice warrior, you should focus all your energy on a sound monetary system.

Central Banking is the biggest fraud in the 21 first century.

And it is right in front of our eyes!

Cheap money is the main driver of stocks and real estate.

If you are a social justice warrior, you should focus all your energy on a sound monetary system.

Central Banking is the biggest fraud in the 21 first century.

And it is right in front of our eyes!

24/ This is why I #Bitcoin. BTC provides an alternative. It allows the Common Man to exit this system, start working with his fellow man instead of fighting with him, and leave behind the overarching kleptocratic system that wants him poor and divided.

25/ #Bitcoin is treaded by the market as a digital commodity. (spoiler: it is much more than this)

Therefore it does not come as a surprise that Bitcoin is exploiding as of late.

Therefore it does not come as a surprise that Bitcoin is exploiding as of late.

26/Bottom line:

Inflation is already here. If you are lucky enough to have some savings, act accordingly.

During this decade the biggest wealth transfer of all time will go down.

Fortunes will be made and lost.

Get yourself prepared for wild outcomes and spread the word.

GL!

Inflation is already here. If you are lucky enough to have some savings, act accordingly.

During this decade the biggest wealth transfer of all time will go down.

Fortunes will be made and lost.

Get yourself prepared for wild outcomes and spread the word.

GL!

@TheLastDegree @SCInsiderAlerts @LukeGromen @TaviCosta @phil_geiger @GrantMBeasley @Galactic_Trader @Caseforsilver @jillruthcarlson @JeffBooth @PrestonPysh @MartyBent @matt_odell @Steve63051825 @DonDurrett @Ben__Rickert @Super_Crypto @IGWTreport @goldseek @stephanlivera @friiyo

@HaslamPhilip @MarkusTurm @MarkValek @fabthefoxx @stefanievjan @Markus_Krall @maxotte_says @marcfriedrich7 @heikelehner @JilNik @_d11n_ @Tiefseher @DoCruz1 @Bquittem @HODLdax @LeoNelissen @Kathidie2te @LawrenceLepard @CitizenBitcoin @wmiddelkoop @100trillionUSD @SHomburg

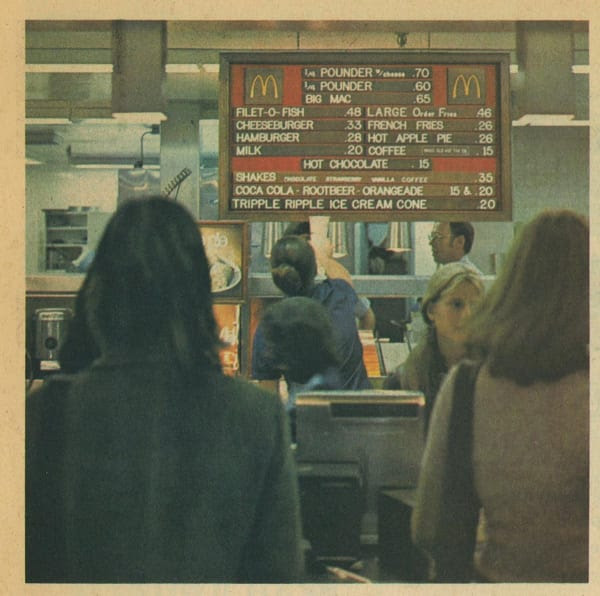

27/ Little Addon

Prices at McDonalds in 1970:

French Fries - $ 0.26

Big Mac - $ 0.65

Coke - $ 0.15

Obviously prices only went up as the quality of products got better! 🤪🤡

Prices at McDonalds in 1970:

French Fries - $ 0.26

Big Mac - $ 0.65

Coke - $ 0.15

Obviously prices only went up as the quality of products got better! 🤪🤡

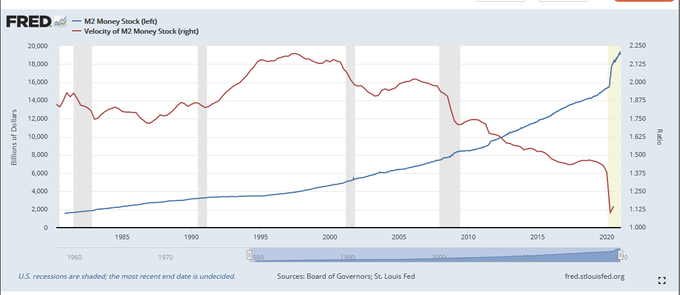

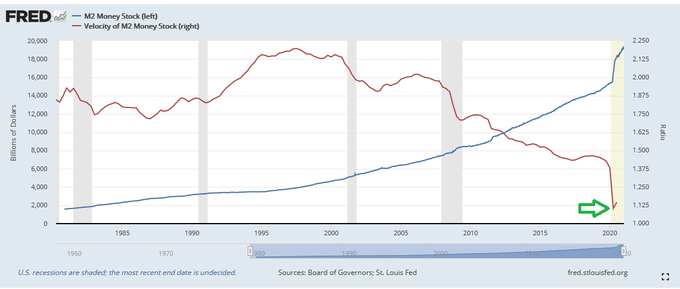

28/ As I pointed out, real inflation is probably way higher than the official data might suggest.

Nevertheless considering the amount of money printed over the past decade, it still seems low.

Lets follow the money!

As M2 went up, velocity of M2 droped like a stone.

Nevertheless considering the amount of money printed over the past decade, it still seems low.

Lets follow the money!

As M2 went up, velocity of M2 droped like a stone.

29/ This might tell you, the newly printed money didnt go in the real economy but went straight into assets like real estate and stocks (asset price inflation).

But things might turn around as of lately.

Definitely something to pay attention to.

But things might turn around as of lately.

Definitely something to pay attention to.

30/ Especially considering this:

'Spend as much as you can,' IMF head urges governments worldwide.

Sent in the 🚁🚁🚁💸💸💸

reuters.com/article/us-rus…

'Spend as much as you can,' IMF head urges governments worldwide.

Sent in the 🚁🚁🚁💸💸💸

reuters.com/article/us-rus…

31/ They are telling us openly what will happens next:

"ECB Ready to Use All Tools Needed to Lift Inflation"

#inflation #bitcoin #silver

bloomberg.com/news/articles/…

"ECB Ready to Use All Tools Needed to Lift Inflation"

#inflation #bitcoin #silver

bloomberg.com/news/articles/…

32/ Nobody can claim, he did not know what happened next:

Fed Chair Powell: ‘We’d Welcome Higher Inflation’

coindesk.com/fed-chair-powe…

Fed Chair Powell: ‘We’d Welcome Higher Inflation’

coindesk.com/fed-chair-powe…

• • •

Missing some Tweet in this thread? You can try to

force a refresh