@HDFCLIFE #Q3marketupdates #Q3investorpresentations

Mkt share up 214 bps to 16.4%

NBM at 25.6%

8% Individual WRP growth compared to private industry de-growth of 6%

25.6% New Business Margin on the back of growth, balanced product mix

Mkt share up 214 bps to 16.4%

NBM at 25.6%

8% Individual WRP growth compared to private industry de-growth of 6%

25.6% New Business Margin on the back of growth, balanced product mix

17% growth in Protection (Indl) and 42% growth in Annuity in APE terms

22% growth in renewal premium with stable persistency

PAT of Rs 1,042 Cr, with growth of 6%

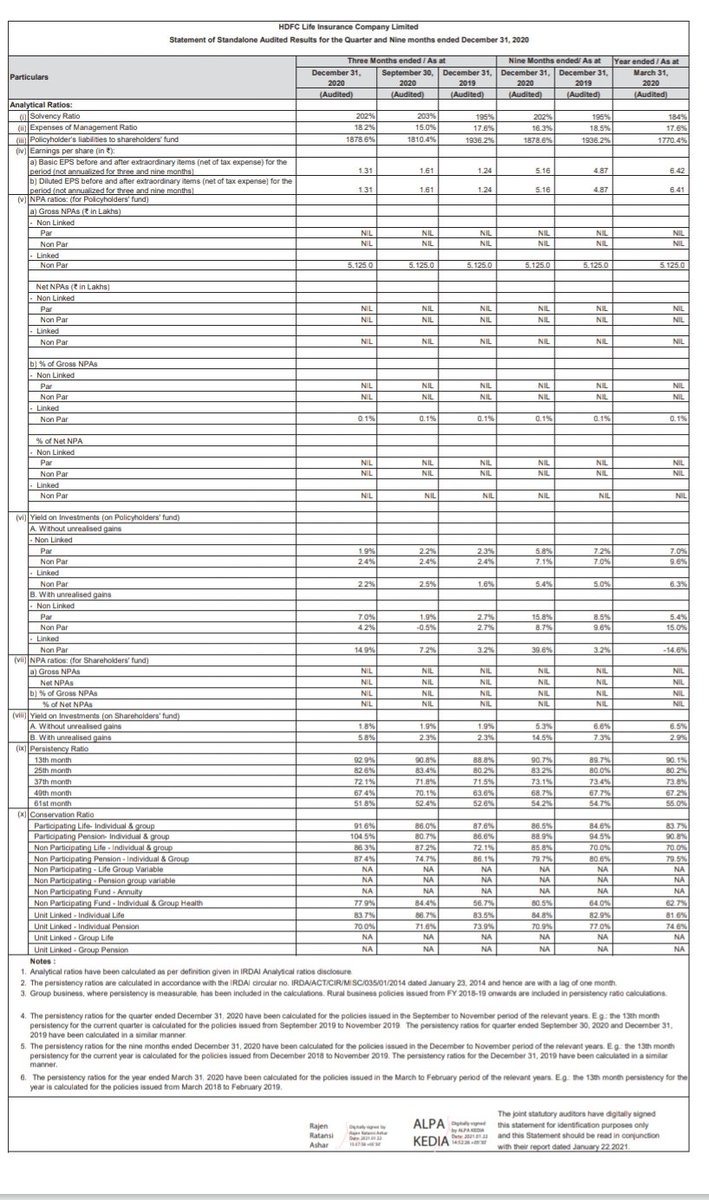

Solvency healthy at 202%

22% growth in renewal premium with stable persistency

PAT of Rs 1,042 Cr, with growth of 6%

Solvency healthy at 202%

Pvt mkt share rank up to 2,gain 214 bps 14.3 to 16.4%

Balanced product mix %

Savings 35

Non participating savings 30

Ulips 23

Protection 7

Annuity 5

Distribution 300+ partners

AUM 31Dec 20

1.7 lkh cr

Debt:equity mix 64:36

98% debt in Gsecs & AAA

Renewal premium growth 22%

Balanced product mix %

Savings 35

Non participating savings 30

Ulips 23

Protection 7

Annuity 5

Distribution 300+ partners

AUM 31Dec 20

1.7 lkh cr

Debt:equity mix 64:36

98% debt in Gsecs & AAA

Renewal premium growth 22%

NBM 25.6%

PAT 10.4 bn,up 6%

Solvency ratio 202%

42 % growth in annuity business

NBM %

2019 24.6

2020 25.9

9 months fy21 25.6

Strong partner ships

Hdfc bank ,Yes ,RBL , pnb housing ,Idfc 1st

etc

Sustained growth in Individual protection %

2018 2.5

9mnth fy21 3

PAT 10.4 bn,up 6%

Solvency ratio 202%

42 % growth in annuity business

NBM %

2019 24.6

2020 25.9

9 months fy21 25.6

Strong partner ships

Hdfc bank ,Yes ,RBL , pnb housing ,Idfc 1st

etc

Sustained growth in Individual protection %

2018 2.5

9mnth fy21 3

NPS - #1 with AUM 139 bn amongst pvt players ,strong growth AUM 9mnths 81%

26000 lives covered in 9mnths Fy21

5 building blocks

Insta suite

InstaInsure

Online payments & services

AI ,Big data ,Cloud

Life 99

26000 lives covered in 9mnths Fy21

5 building blocks

Insta suite

InstaInsure

Online payments & services

AI ,Big data ,Cloud

Life 99

Life insurance penetration %

Taiwan 16.5

Hong kong 18.3

Japan 6.7

China 2.3

India 2.8

Life insurance density US$

Hong kong 8979

Taiwan 4129

Japan 2691

China 230

India 58

Indias insurable population to touch 750 mn 2020

Elderly population to double 2035

Taiwan 16.5

Hong kong 18.3

Japan 6.7

China 2.3

India 2.8

Life insurance density US$

Hong kong 8979

Taiwan 4129

Japan 2691

China 230

India 58

Indias insurable population to touch 750 mn 2020

Elderly population to double 2035

Protection gap 2019

India 83%

China 70

Singapore 55

Hong kong 41

Protection gap growth rate to grow 4% per annual

Retail credit growth CAGR 18% last 10 yrs,retail indebtedness to spur need for credit life products

Only 1 out of 40 people who can afford buying insurance

India 83%

China 70

Singapore 55

Hong kong 41

Protection gap growth rate to grow 4% per annual

Retail credit growth CAGR 18% last 10 yrs,retail indebtedness to spur need for credit life products

Only 1 out of 40 people who can afford buying insurance

Indias pension mkt is under penetrated at 4.8% GDP

Increased life expectancy to lead to avg retirement period of 20 years

60+ population to triple by 2050

Total pension AUM to grow to 47 trillion by 2025

Mandatory schemes to increase coverage for org & unorganized sectors

Increased life expectancy to lead to avg retirement period of 20 years

60+ population to triple by 2050

Total pension AUM to grow to 47 trillion by 2025

Mandatory schemes to increase coverage for org & unorganized sectors

@HDFCLIFE #insurance #StockMarket #Nifty #stocks

Unroll

@threadreaderapp

Compile

@threader_app

Unroll

@threadreaderapp

Compile

@threader_app

• • •

Missing some Tweet in this thread? You can try to

force a refresh