#glandpharma

#Q3marketupdates #Q3investorpresentations

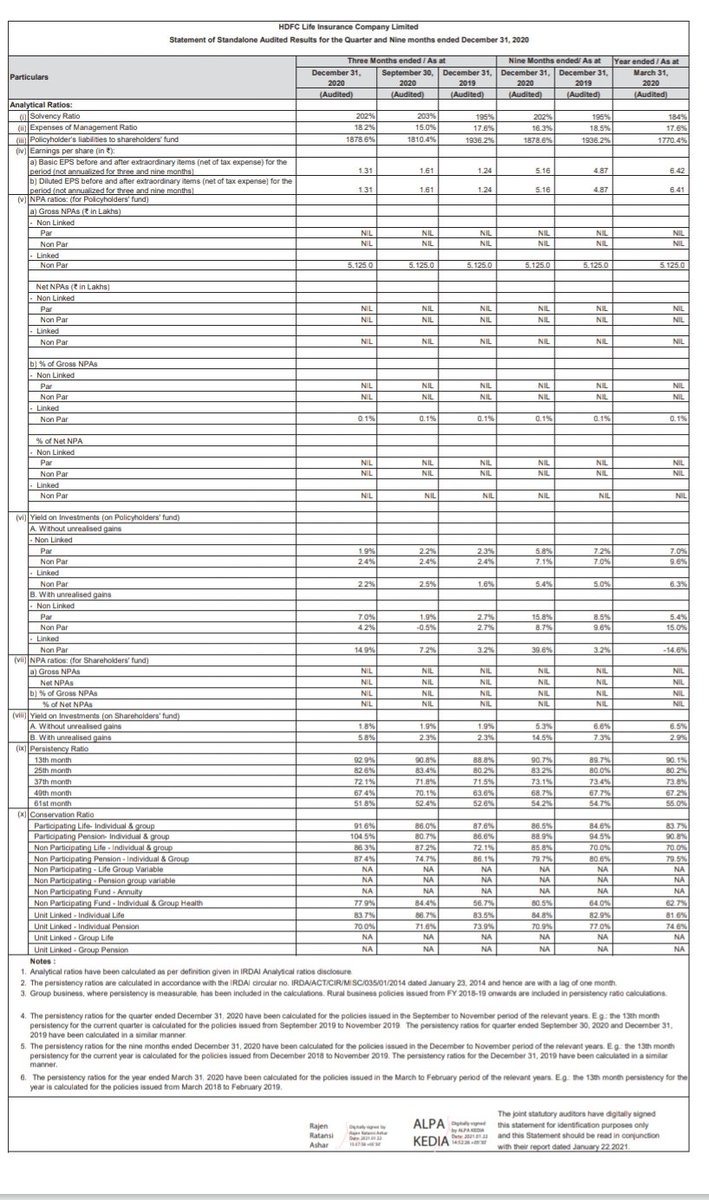

Good show inr in mn

Rev 8945 /6712

PAT 2041 /1540

EPS 12.83 /9.95

9 months fy21 /20

Rev 26626 /20909

PAT 7365 /5780

EPS 47.12 / 37.31

Mkt wise

US 6021 /4853

India 1495 /1193

ROW 1078/413

#Q3marketupdates #Q3investorpresentations

Good show inr in mn

Rev 8945 /6712

PAT 2041 /1540

EPS 12.83 /9.95

9 months fy21 /20

Rev 26626 /20909

PAT 7365 /5780

EPS 47.12 / 37.31

Mkt wise

US 6021 /4853

India 1495 /1193

ROW 1078/413

R&D expenses INR Mn

Q3 fy21 434

Q3fy20 312

9M Fy21 916

9m Fy20 749

Net worth INR Mn

Mar 20 36462

Dec 20 56221

Net cash INR Mn

Mar 20 13202

Dec 20 28128

Capital expenditure

9M Fy20 1342

9M Fy21 1826

CFO

9M Fy20 4244

9M fy21 4056

Q3 fy21 434

Q3fy20 312

9M Fy21 916

9m Fy20 749

Net worth INR Mn

Mar 20 36462

Dec 20 56221

Net cash INR Mn

Mar 20 13202

Dec 20 28128

Capital expenditure

9M Fy20 1342

9M Fy21 1826

CFO

9M Fy20 4244

9M fy21 4056

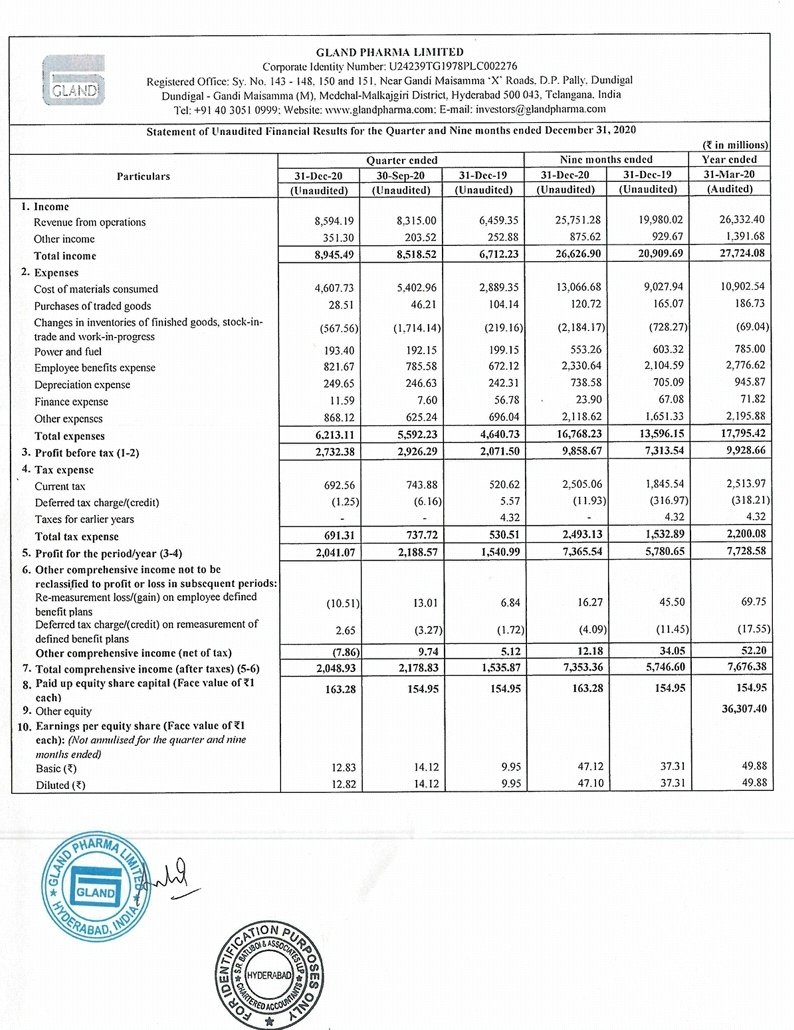

New launches

9months fy21 - 31 product SKUs (4 mols)

US mkt - Dec 20 ,with partners filed 282 ANDAs, 226 approved, 56 pending

Core mkts (US,EU,Canada,Australia)

9M fy21 17415 mn

Growth 20%

Q3 fy21 6021 mn

Growth 24%

Domestic MKT

9M fy2110 product SKUs

Started Remdesivir mftg

9months fy21 - 31 product SKUs (4 mols)

US mkt - Dec 20 ,with partners filed 282 ANDAs, 226 approved, 56 pending

Core mkts (US,EU,Canada,Australia)

9M fy21 17415 mn

Growth 20%

Q3 fy21 6021 mn

Growth 24%

Domestic MKT

9M fy2110 product SKUs

Started Remdesivir mftg

Domestic mkt

9M fy21 4317 mn

Growth 20% yoy

Q3 fy21 1495 mn

Growth 25% yoy

Commissioned new pre filled syringe line at Pashamylaram facility

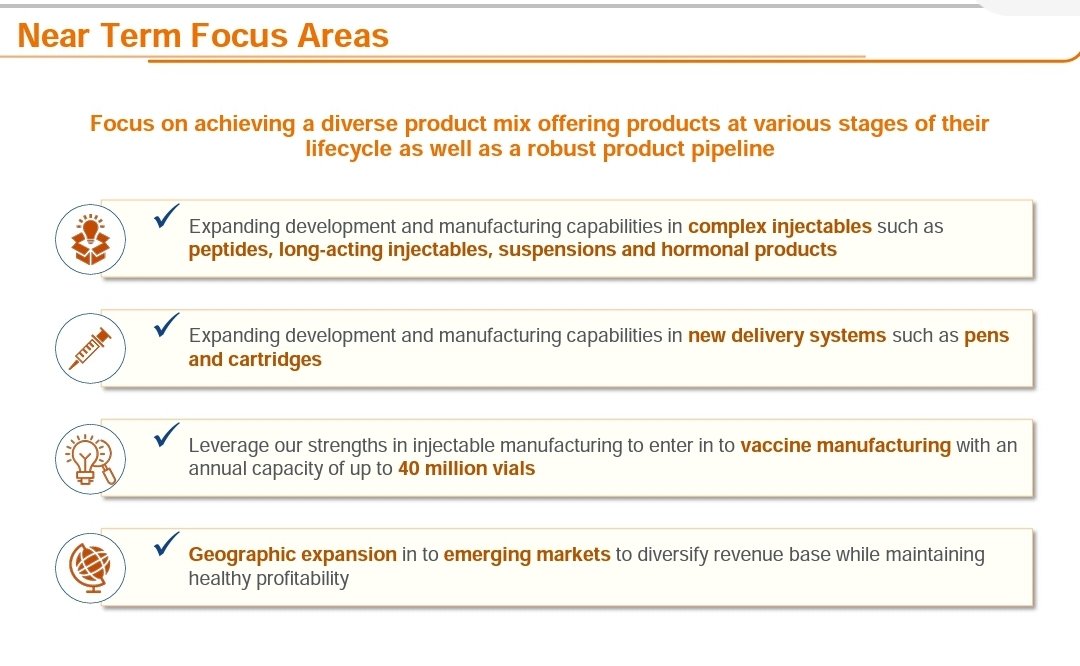

To enter vaccine mfg with annual capacity 40 mn vials

To enter new delivery systems- Pens & cartridges

Export to 60 countries

9M fy21 4317 mn

Growth 20% yoy

Q3 fy21 1495 mn

Growth 25% yoy

Commissioned new pre filled syringe line at Pashamylaram facility

To enter vaccine mfg with annual capacity 40 mn vials

To enter new delivery systems- Pens & cartridges

Export to 60 countries

Centralized R&D lab with 265 personnel

7 facilities

4 finished dosage facilities - 767mn units

3 API facilities - 11000 kg/year

3API facilities provide in house mftg capabilities for critical APIs

No USFDA warning letter since inception, cGMP compliant at all facilities

7 facilities

4 finished dosage facilities - 767mn units

3 API facilities - 11000 kg/year

3API facilities provide in house mftg capabilities for critical APIs

No USFDA warning letter since inception, cGMP compliant at all facilities

35+ audits per year on avg

Diversified B2B led model across regulated mkts complemented by B2C model in India

Extensive portfolio - sterile injs, oncology ,opthal, complex injcs, NCE-1s, F2F ,505(2) Filings

1478 product registrations globally

Diversified B2B led model across regulated mkts complemented by B2C model in India

Extensive portfolio - sterile injs, oncology ,opthal, complex injcs, NCE-1s, F2F ,505(2) Filings

1478 product registrations globally

Global generic injs mkt estimated $131 bn

$61.3 bn inj brand sales to lose patent protection 2020-24

Growth driver for injs - rising chronic diseases, convenience of new drug delivery systems, drug shortages in US

Barriers in inj mkt -

High capital reqs,stringent STDs,regltn

$61.3 bn inj brand sales to lose patent protection 2020-24

Growth driver for injs - rising chronic diseases, convenience of new drug delivery systems, drug shortages in US

Barriers in inj mkt -

High capital reqs,stringent STDs,regltn

40% overall drug shortages betn 2014-18 in US were in injs

23 production lines with flexibility to accommodate diff product reqs

Dundigal - sterile injs,API

Pashamylaram - sterile injs ,penems

Vishakapatnam - oncology ,2 APIs

R&D expenditure as % of rev

Fy18 3.8

Fy20 3.5

23 production lines with flexibility to accommodate diff product reqs

Dundigal - sterile injs,API

Pashamylaram - sterile injs ,penems

Vishakapatnam - oncology ,2 APIs

R&D expenditure as % of rev

Fy18 3.8

Fy20 3.5

Expertise in complex drug mols - LMWH ,Steroids ,Cytotoxics

Expanding capacity - Peptides ,Long acting injs, Suspensions, Hormones ,Pens ,Cartridges

New product contribution to revenue

2018 22%

2019 13

2020 9%

Promoted by Shanghai Fosun pharma ,global player listed on HKSE

Expanding capacity - Peptides ,Long acting injs, Suspensions, Hormones ,Pens ,Cartridges

New product contribution to revenue

2018 22%

2019 13

2020 9%

Promoted by Shanghai Fosun pharma ,global player listed on HKSE

Fosun is global pharma major,established player in China & Africa ,both key mkts for injs

Benefit from Fosun to expand in China

Unroll

@threadreaderapp

Compile

@threader_app

#pharma #cdmo #API #nifty #stocks

@tycoonmindset05 @nid_rockz @thescorpionphil @AdityaKhemka5

Benefit from Fosun to expand in China

Unroll

@threadreaderapp

Compile

@threader_app

#pharma #cdmo #API #nifty #stocks

@tycoonmindset05 @nid_rockz @thescorpionphil @AdityaKhemka5

• • •

Missing some Tweet in this thread? You can try to

force a refresh