SM | How Entrepreneurs became Millionaire (Mln)

23 Jan,

23 tweets, 4 min read

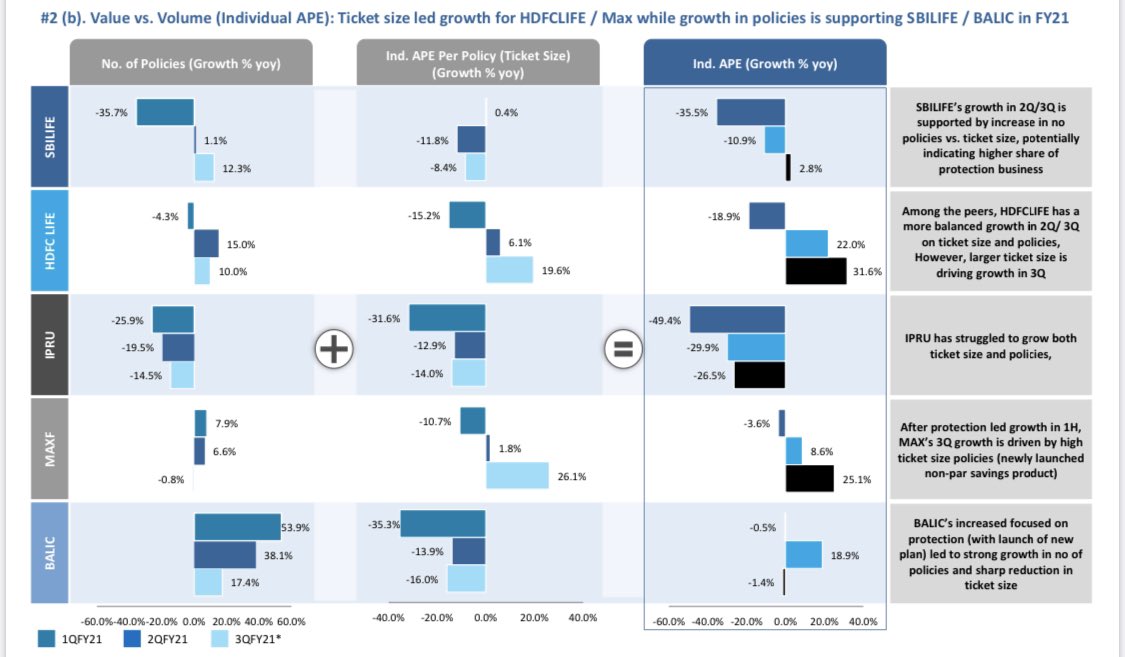

Business Update: Witnessing improving customer confidence reflected in new business trends in individual as well as group credit protect business. Continue to see improved pickup in savings business due increased volume as well as ticket size.

(2/n)

(2/n)

Product mix remains balanced. Constant endeavour to grow annuity protect business. Remains watchful on renewal and persistency trend.

(3/n)

(3/n)

COVID update: Settled 1,271 individual and 571 group COVID-related claims. Frequency of claims has been higher in Q3, while the actual overall experience is in line with expectations, but will keep re- examining COVID provisions.

(4/n)

(4/n)

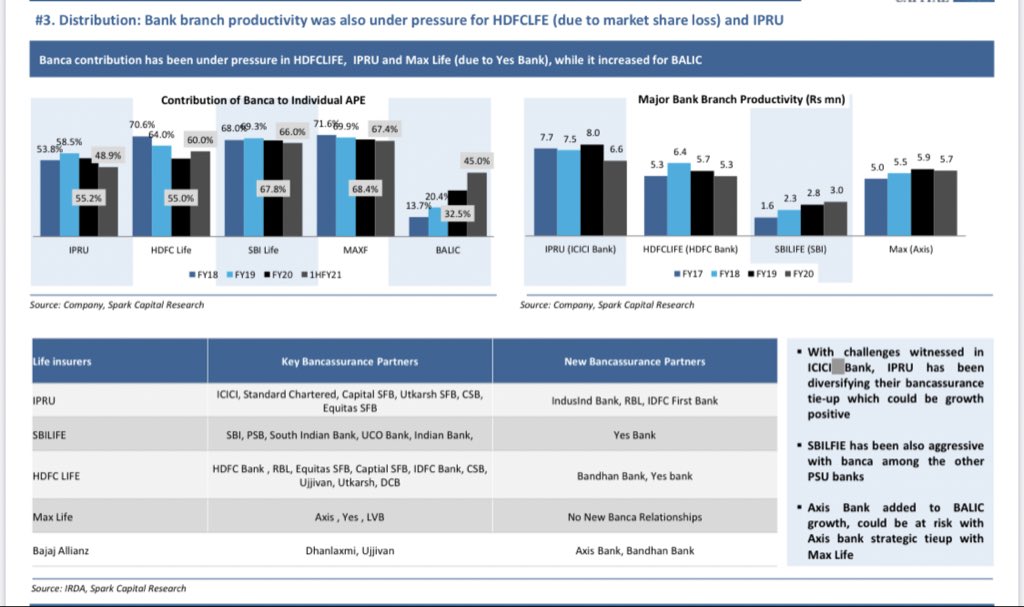

Strong growth in Bancassurance channel, which has grown by 20% in 9MFY21. Within this channel, HDFC Life saw strong traction from its parter HDFC Bank. HDFC Life is also actively collaborating with new partners like Yes Bank and SBI Capital Markets on new business.

(5/n)

(5/n)

Focus on balanced product mix. Management has launched a new term plan “HDFC lifeClick2Protect life” recently which has innovative features. Refining pricing as well asconservative underwriting. Balance mix provides natural hedge against interest rates and mortality risks.

(6/n)

(6/n)

Credit protect has now reached 95% of previous year volume.

(7/n)

(7/n)

Outlook: Given that vaccination is initiated, HDFC Life will strive for new business growth. Management focuses on balanced mix, diversified distribution mix, and conservative risk pricing.

(8/n)

(8/n)

Non PAR persistency: 13th month persistency is above 90% and has very low surrender.

(9/n)

(9/n)

Tax reason for Life Insurance is reducing and tax benefit which was at one point of time the top reasons for buying the insurance is now at lower priority as customer awareness improves.

(10/n)

(10/n)

IRDAI figures indicated that December 2020 had seen sum assured contraction. Savings have returned to growth in Q3 due to which Sum Assured is looking smaller. People are allocating higher ticket size to saving products. Management believes protection will grow gradually

(11/n)

(11/n)

Price of reinsurance: Reinsurer asking for hike is uncertain as of now. Term growth is muted, as the company wants to partner with reinsurer and want to do cautious underwriting due to which re-insurer pricing is expected to be stable as of now.

(12/n

(12/n

ULIP persistency: Persistency shows strength and has a positive operating variance on persistency.

(13/n)

(13/n)

PAR Outlook: HDFC Life expects PAR products to grow and improve going forward.

(14/n)

(14/n)

Non-PAR: Management believes in balanced product mix and is fully matched on risks; and hence, management has brought down the tenure to nine months.

(15/n)

(15/n)

Standardised Policies: Co expects the underwriting to be stringent since the product launched will be across the industry lines.

(16/n)

(16/n)

Balanced mix: The company expects balance between PAR and non-PAR to stabilize in long term and prefers to give customer requirement priority versus company’s own push strategy.

(17/n)

(17/n)

Protection business from HDFC Bank: The pricing of business has been competitive, so that margins and overall claims are managed. HDFC Life market share with HDFC Bank has risen on a y-o-y basis.

(18/n)

(18/n)

Protection business ... contd ... The new product HDFC Click2protect Life is also being viewed as an attractive product. Overall protection share in HDFC Bank is going up and within that HDFC Life’s share is improving too. (19/n)

Growth Outlook: Growing protection business by ~100 bps per year is reasonable. Savings will also continue to grow and annuity is likely to be a bigger piece in savings. HDFC Life wants to grow its retirement corpus 3x by 2025.

(20/n)

(20/n)

Cautious stance due to COVID: Co is having a cautious stance on protection & expects some headwinds due to the pandemic. Levers for VNB margin exist. Would like to examine the individual’s unique record so that company gets a nuanced approach to properly price the product.

(21/n)

(21/n)

Business outlook: Looking to innovative solutions and hopeful that protection opportunity will grow.

(22/n)

(22/n)

IRDAI move of standardisation: HDFCLife does not believe that the development will lead to cannibalisation of its existing products as the average sum assured is ₹75L for industry, while this product Sum Assured is ~₹12L, hence it will be targeting a separate market.

(23/23)

(23/23)

• • •

Missing some Tweet in this thread? You can try to

force a refresh