1. I’ve been looking at how tradfi markets are pricing options for public co’s with large exposures to crypto relative to the BTC options market on @DeribitExchange. For this analysis, I focused on @MicroStrategy (MSTR) and Marathon Group (MARA).

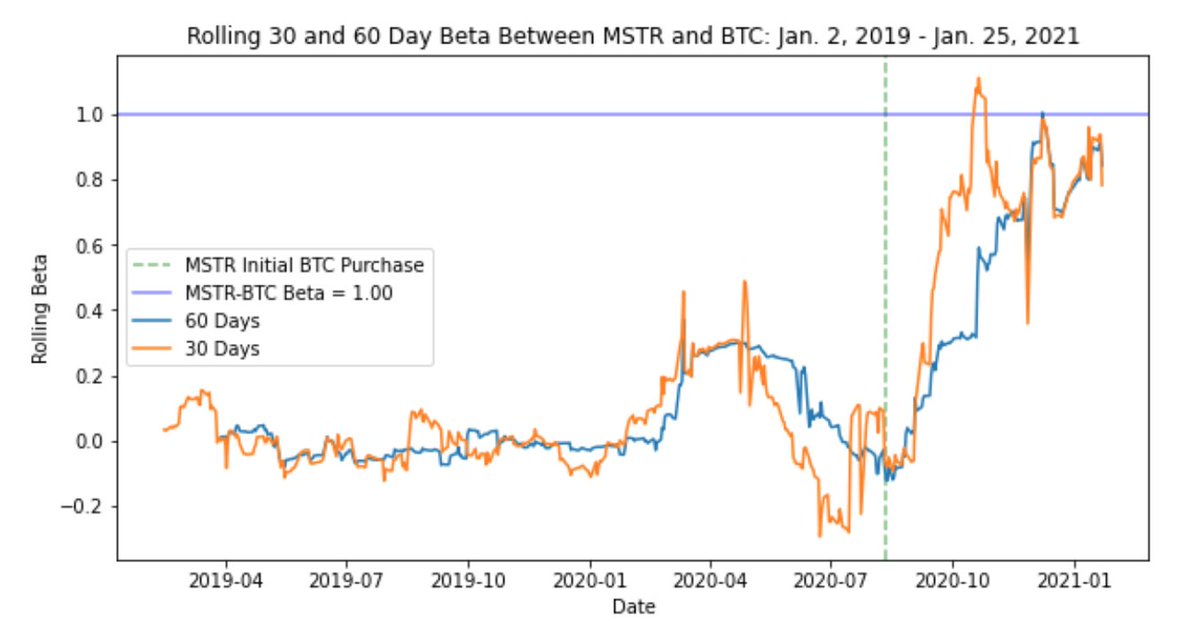

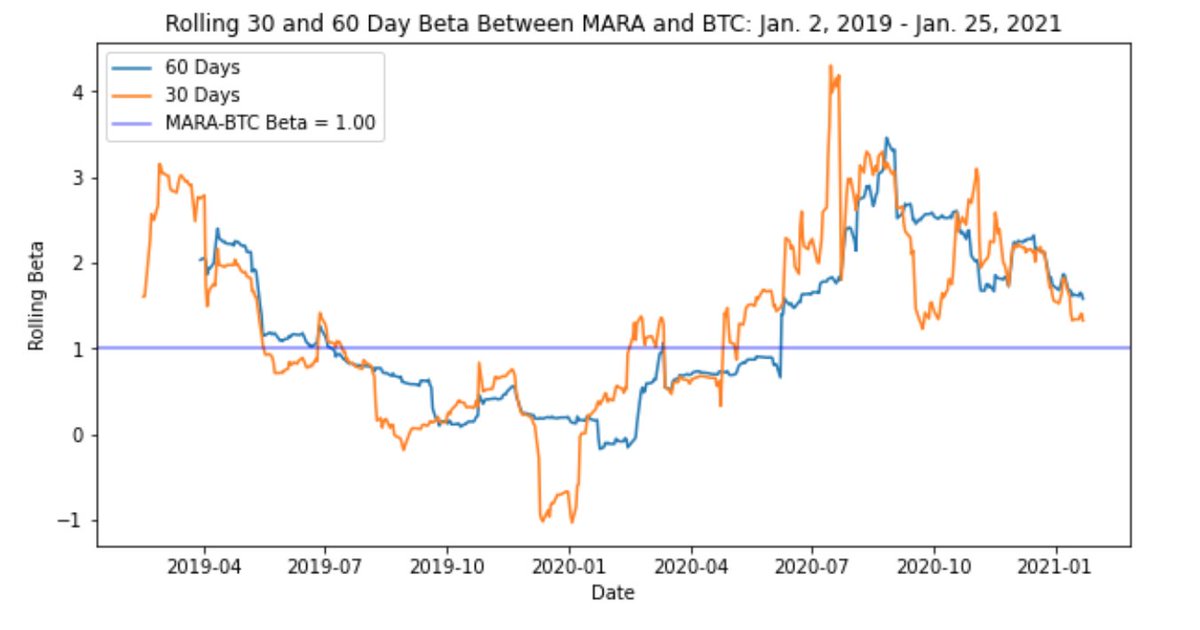

2. First, it’s worthwhile exploring how MSTR and MARA trade w.r.t BTC. Ever since MSTR’s buying spree, we’ve seen its beta relative to BTC shift within the +0.6 to +1.0 range. Similarly, we can see MARA is more volatile with a beta of +1.0 to +3.0 in the past few months.

3. In this analysis I'm going to use the rolling 60 day beta values:

- MSTR Beta: 0.76

- MARA Beta: 1.94

In other words, for a 1% increase in BTC we should expect MSTR and MARA to increase by 0.76% and 1.94% respectively.

- MSTR Beta: 0.76

- MARA Beta: 1.94

In other words, for a 1% increase in BTC we should expect MSTR and MARA to increase by 0.76% and 1.94% respectively.

4. This makes intuitive sense b/c a good chunk of MARA’s business is in mining and this is more volatile than outright buying BTC (similar to GLD vs GDX in tradfi - h/t @ShiliangTang ). As such, if one was super bullish on crypto, a higher beta asset would likely outperform BTC.

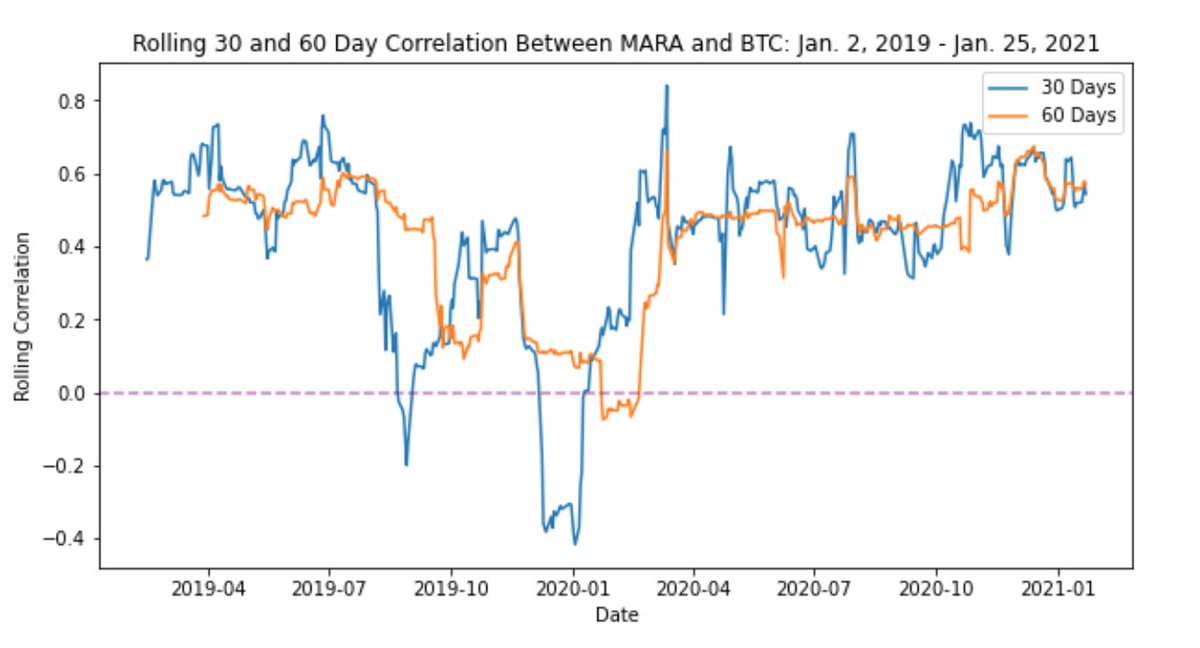

5. Similarly, for the rolling 30 and 60 day correlations w.r.t BTC, MSTR’s correlation shot up after the buying announcement whereas MARA’s remained consistently high across time given it is a crypto-focused business.

6. Furthermore, here’s a 30 day rolling realized volatility plot for all three assets. Owning BTC doesn’t look too scary after we compare it to the recent volatility of MARA and MSTR!

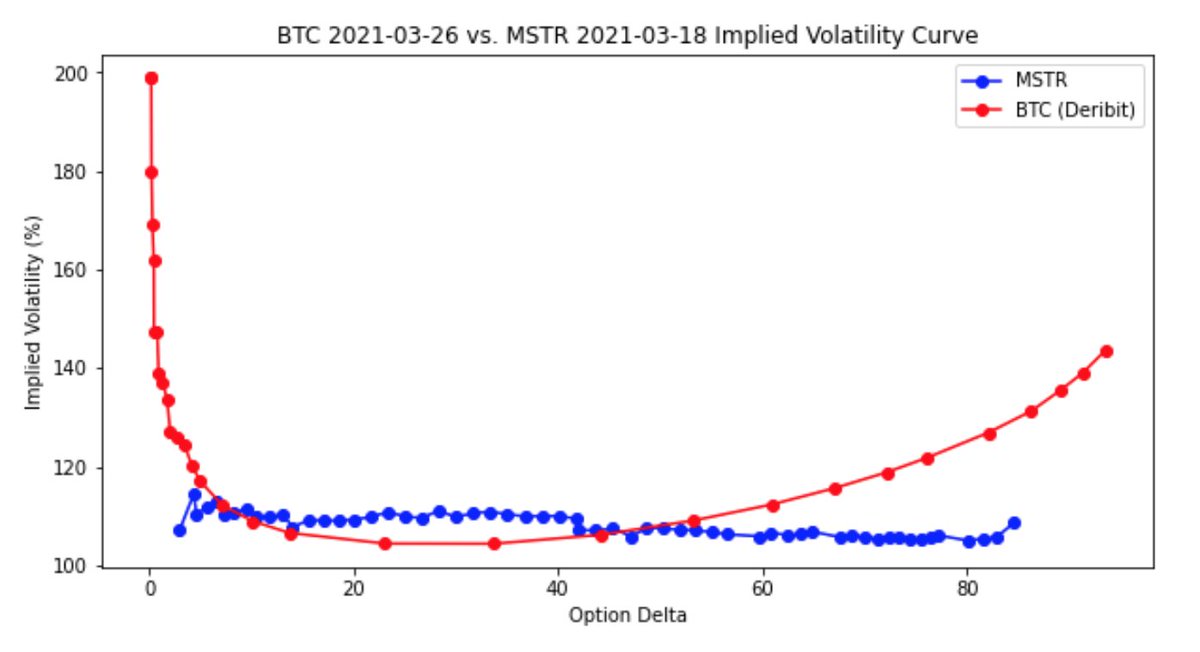

7. Now we'll look at how implied vol is priced for these different assets. Let’s look at BTC’s MARCH-26 and MSTR’s MARCH-18 expiries (maturities don’t line up perfectly). MSTR upside call option IV seems to be lower relative to BTC which is expected of a lower beta asset.

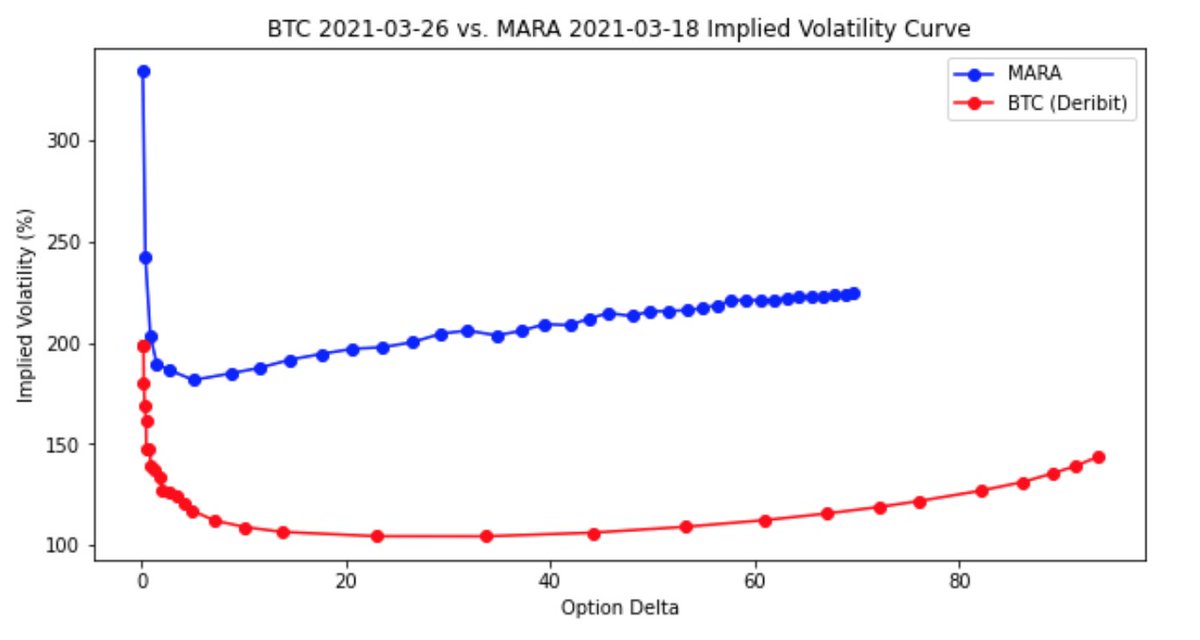

8. We can see a massive difference between BTC’s MARCH-26 and MARA's MARCH-18 IV - nearly 100 vol point spread for ATM options! This sort of makes sense given the significantly higher realized volatility of MARA relative to BTC.

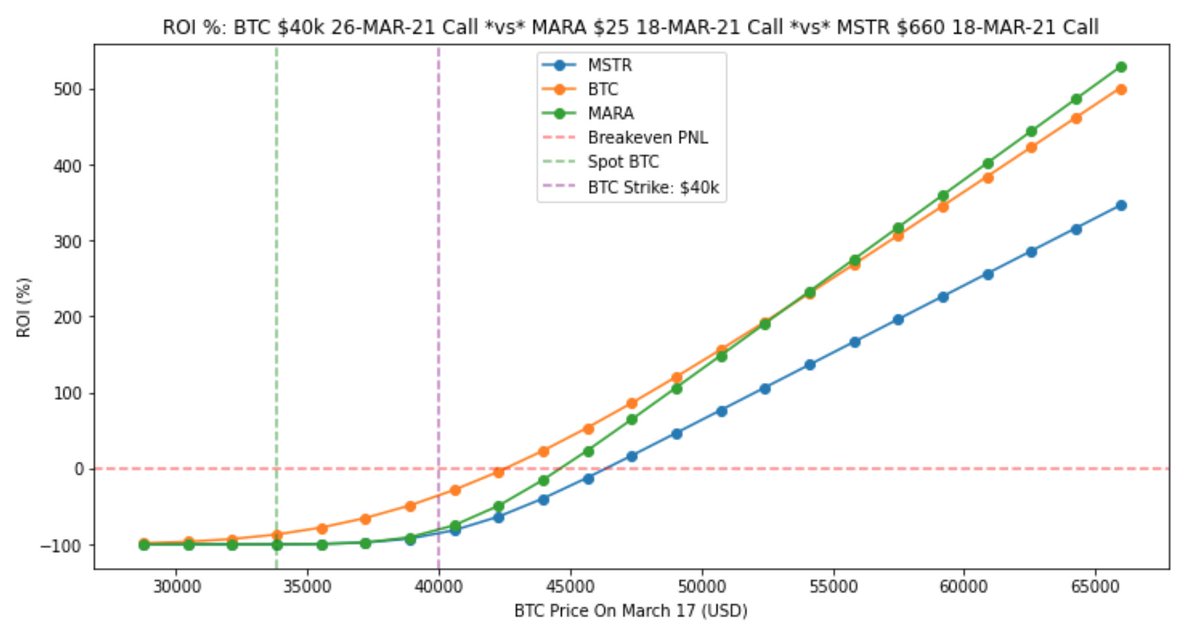

9. Our next step is to analyze which option we should buy for the highest ROI if we expect BTC to rally over the next ~2 month period. All of these options have different initial costs so we’ll look at things from an ROI perspective.

10. If we pick a BTC strike that’s 20% higher from the current spot price, then it makes sense to pick a MARA strike that’s 38.8% higher than the current MARA spot price (20% x 1.94 beta) and a MSTR strike that’s 15.2% greater than its spot (20% x 0.76 beta).

11. Using this approach above we can get a sense of which strikes to choose for MSTR and MARA so our comparison is on an equal level. Here we'll be using $40k / $660 / $25 for BTC, MSTR, and MARA strikes respectively.

12. From here we can run scenarios of different prices for BTC and our final ROI across each strategy. If we reprice these options **on the day before** the MARCH-18 maturity, we can get a numerical aprx for our theoretical ROI relative to the initial call price.

13. Note - here we’re only looking at the BTC price, but behind the scenes we’re also finding the new prices of MARA and MSTR. If BTC +10% from its current price, we'll use our beta values (1.974/0.76) and find the new estimated spot prices for MSTR/MARA to reprice the options.

14. *Key assumptions*:

- Betas are constant (the ROI depends on the beta value we use and is sensitive to this parameter)

- The IV is the same when we reprice the option at the end of its maturity (not perfect but we’re only modelling the delta impact here).

- Betas are constant (the ROI depends on the beta value we use and is sensitive to this parameter)

- The IV is the same when we reprice the option at the end of its maturity (not perfect but we’re only modelling the delta impact here).

15. From this view, BTC options on @DeribitExchange seem to offer the highest ROI if BTC spot is between the $40k - $50k range on March 17. Beyond $50k, MARA slightly outperforms in terms of ROI although the difference is small.

16. Although call IV for MSTR < call IV for BTC, we're not able to get sufficient ROI w/ MSTR calls. Personally, I would've expected MSTR options to do much better but it sorta makes sense - a lower beta asset w.r.t BTC shouldn't have the same ROI as MARA (high beta asset).

17. Some other ideas could be to look at mispricings between the MSTR/MARA/BTC IV and trade that accordingly. I’m thinking there could be a nice relative value trade here. @darshanvaidya , @OrthoTrading , @fb_gravitysucks @rambo1stbld @ShreyasChari

- any ideas / feedback?

- any ideas / feedback?

• • •

Missing some Tweet in this thread? You can try to

force a refresh