1. This legendary $36k call trade led me down a rabbit hole into the world of higher order option greeks to analyze this trade using past historical data. This was a good learning opportunity and I wanted to share some stuff I've been exploring.

https://twitter.com/GenesisVol/status/1348984303548571650

2. The $36k JAN-29-2021 calls began trading on @DeribitExchange on Oct. 31, 2020 and had an initial delta of around 3%. At this time, BTC’s index price was trading around $13.5k. On this date, it seemed like a long shot that prices could do a ~3x within 90 days.

3. My guess is the buyer of these calls was trading a re-pricing of risk as opposed to speculating that the price of BTC would actually be >= $36k on Jan 29/2021 (one thing we can say with confidence is they were smart and used @tradeparadigm to avoid massive slippage).

4. This thread does an excellent job explaining how traders can make money by trading relative probabilities.

https://twitter.com/robbylevy/status/1319377558761279488

5. If the trader believed the market was pricing too low of a probability for an option reaching ITM, they could purchase options with the intention of selling them before maturity once the market’s expectations become more bullish (as we’ve seen over the past few weeks).

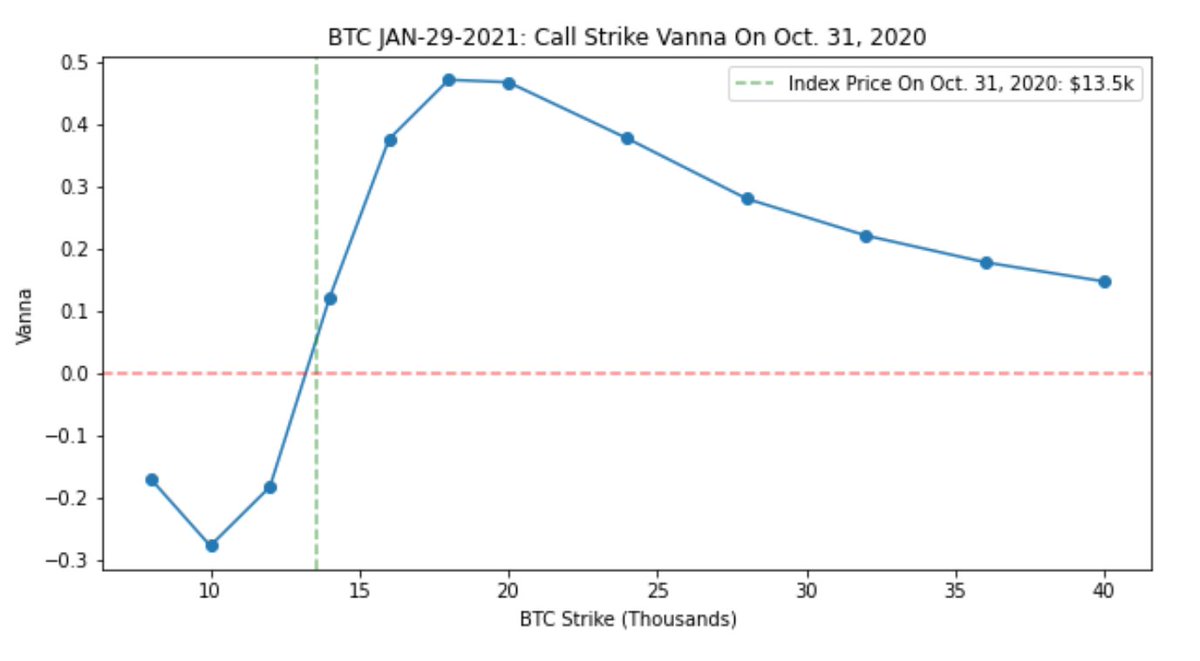

6. If we want to be long the re-pricing of risk we could buy options which will react aggressively to changes in market sentiment. This is where we can use higher order greeks to help us decide which strikes to use for this scenario. I’ll keep my focus on on vanna and volga.

7. Vanna: tells us how much delta will change if we see a small change in volatility. It’s also the same as how much vega will change for a small change in price. Typically, deep OTM options have large +vanna which makes them good to own if we think vols will massively increase.

8. In other words, these OTM options are like sleeping giants which initially have low vega and delta values. If we see a material narrative change which causes a spike in volatility and price, these OTM options will derive lots of vega/delta given their large +vanna exposures.

9. This is where we need to think about the spot-vol correlation. Over the past few weeks as BTC has made its ATHs we’ve seen that IV has also risen. If we believe this positive spot-vol correlation will continue going forward then increasing our +vanna exposure will help us.

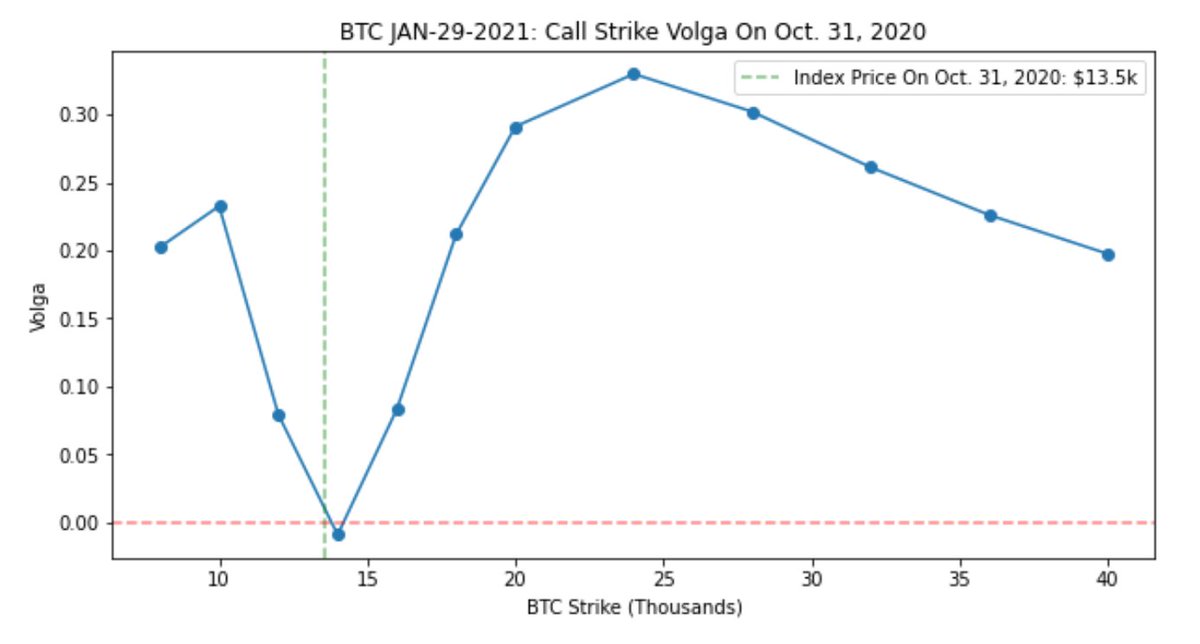

10. Volga: similar to how we think about gamma as the derivative for delta, volga (volatility gamma) is the derivative of vega. We can use volga to understand how an option’s vega changes as IV changes. Similar to vanna, deep OTM options generally have the highest volga.

11. Let’s do some plots of these higher order greeks.

This is the vanna plot for all BTC call strikes as of Oct. 31/2020 for the JAN-29-2021 maturity (~90 days to maturity). Spot is around $13.5k and we can see that vanna peaks around the $20k range.

This is the vanna plot for all BTC call strikes as of Oct. 31/2020 for the JAN-29-2021 maturity (~90 days to maturity). Spot is around $13.5k and we can see that vanna peaks around the $20k range.

12. The volga plot below shows us that we have very little vega convexity exposure near the ATM strike. If we want a larger volga exposure we need to look at strikes farther away from ATM near the $25k region.

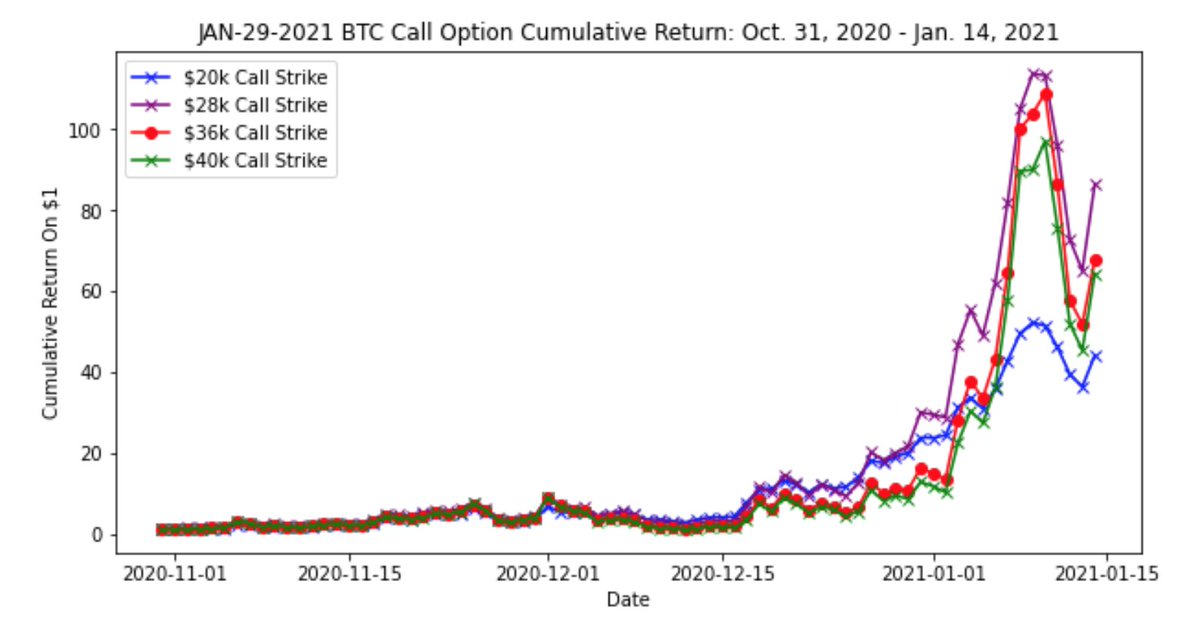

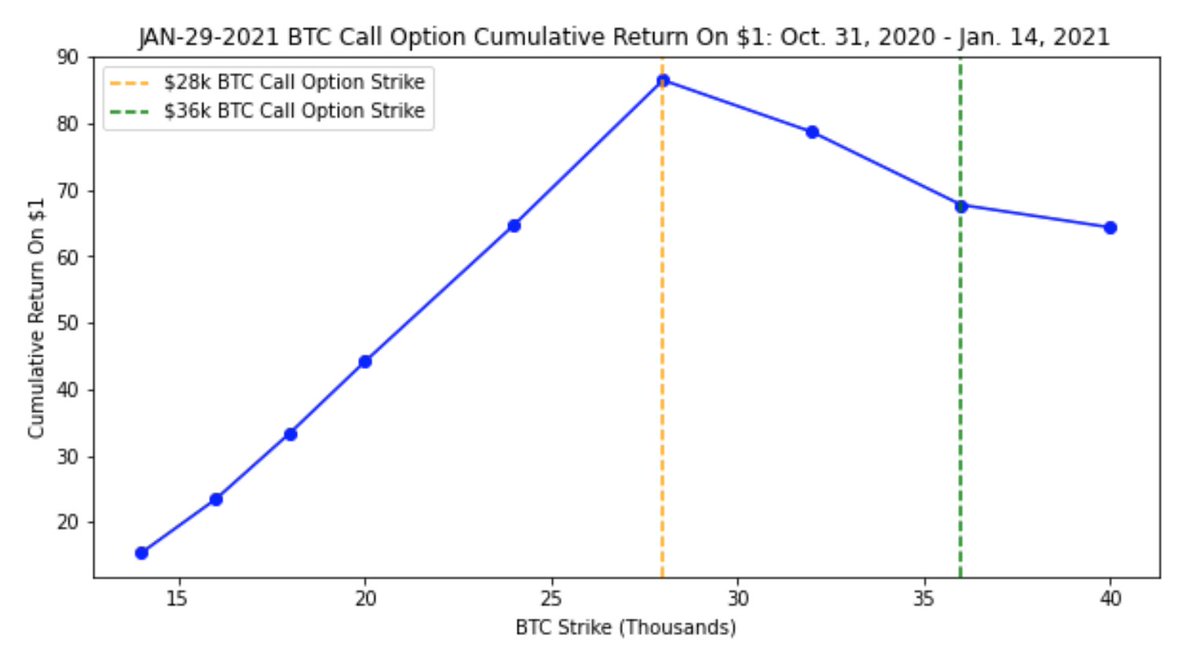

13. I was curious to see the different PNL outcomes if the trader chose strikes with higher volga/vanna. The $36k call buyer made around 68x cumulative return whereas the $28k call (highest volga) would have resulted in 87x on their initial investment.

14. Furthermore, we can see the current ending cumulative PNL over time for a variety of different strikes. Again we can see the $28k call has done the best in terms of overall returns. I'm still thinking through why $28k has done the best overall. Thoughts?

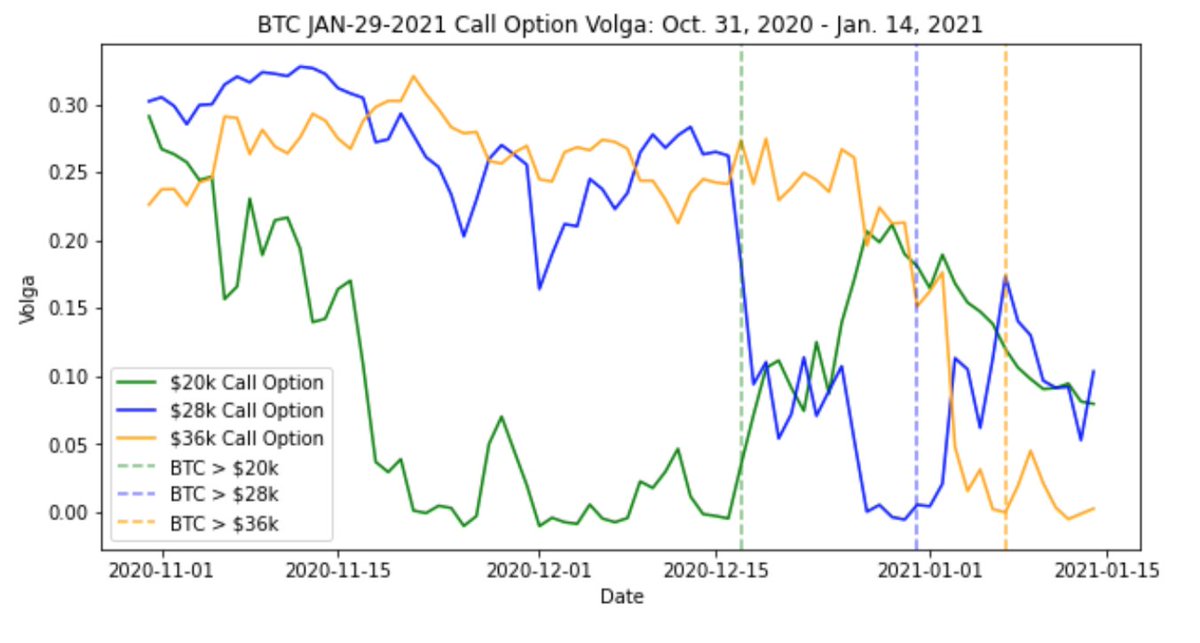

15. I then focused on three OTM calls (as of Oct. 31/2020) to look at some of their patterns. I chose 20k/28k/36k.

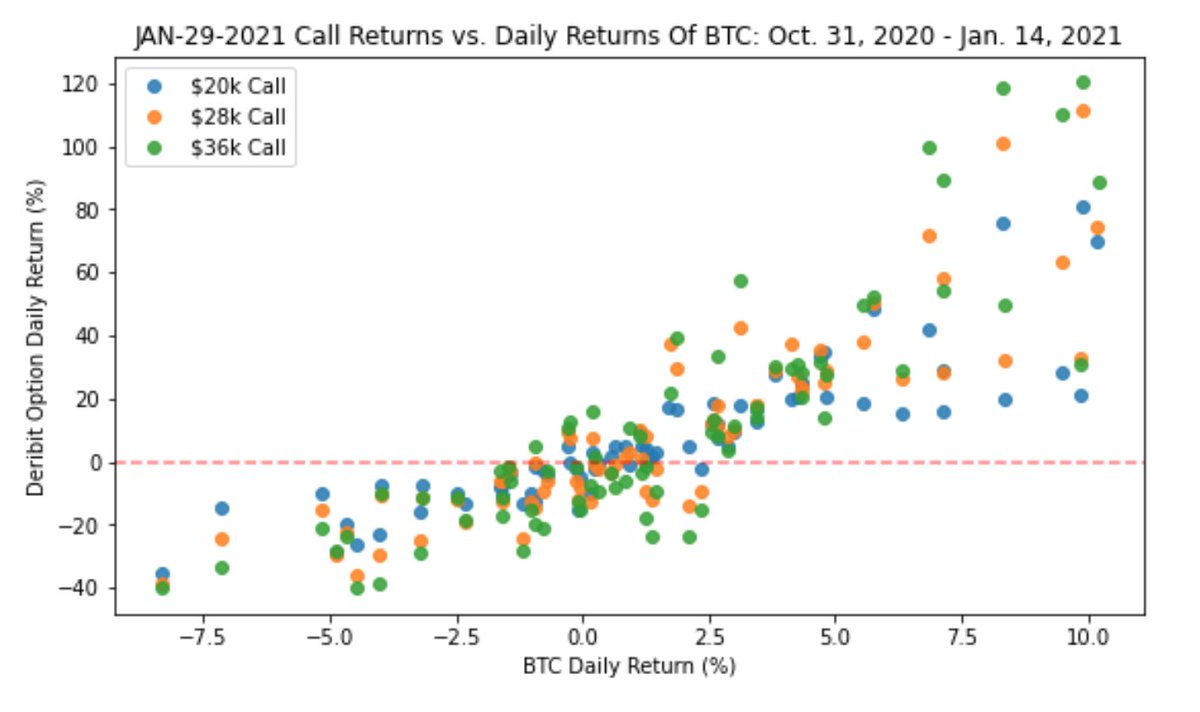

To start, we can see the daily call option returns are fairly similar, however, the 28k/36k are jumpier.

To start, we can see the daily call option returns are fairly similar, however, the 28k/36k are jumpier.

16. As an aside, this plot above showcases how options are inherently leveraged products. A +5% move in BTC can result in +40% move in the option. The same is also true for the downside as a -5% move can result in a -40% move in the option price.

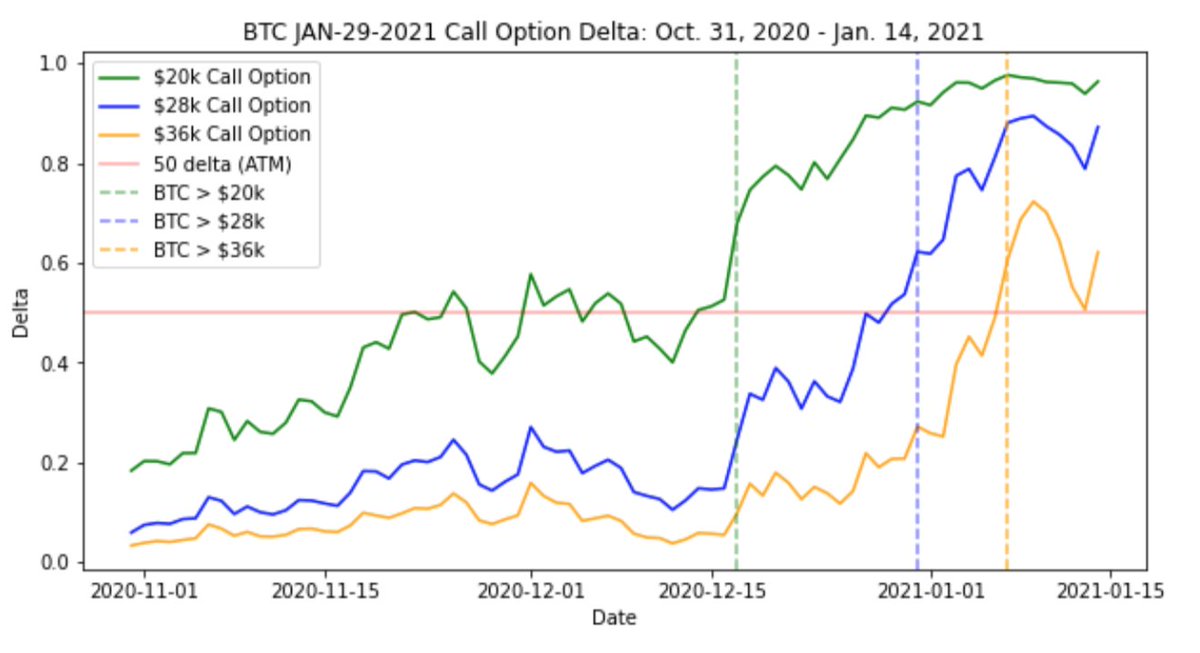

17. I was also curious to see how the option deltas evolved over time. We can see that as the BTC price hits through each option’s strike, the option delta shoots past ATM (around 50 delta) as it gets deeper and deeper ITM.

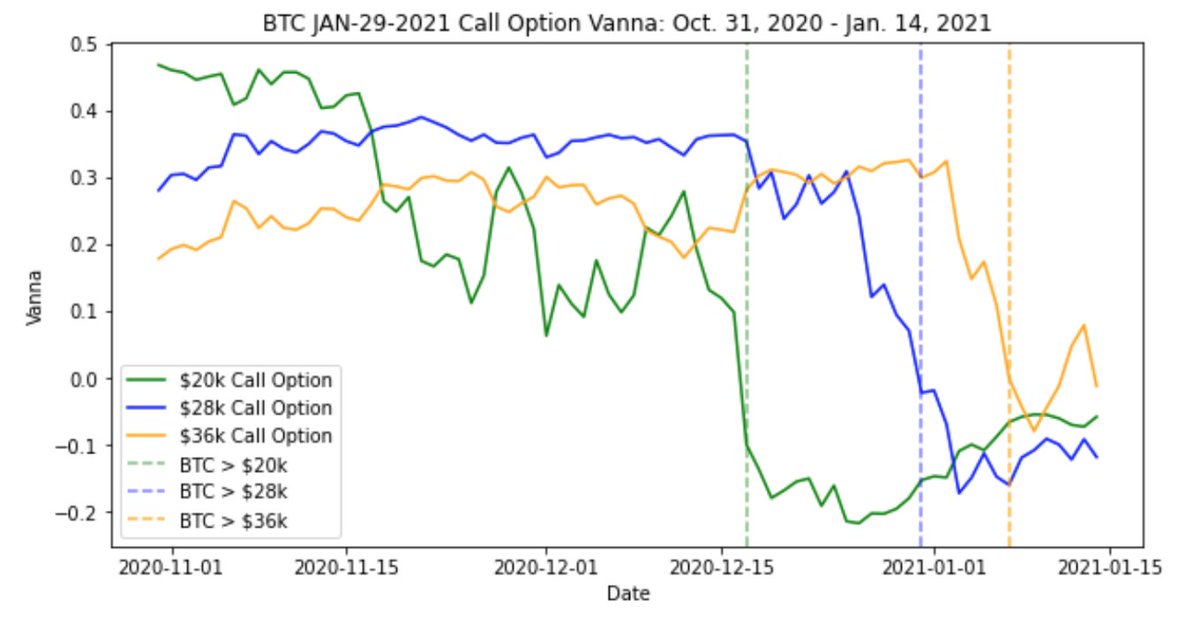

18. As a result of getting deeper ITM, these options will start to lose their vanna and volga exposures. As we discussed earlier above, deep OTM options have large vanna exposures. As these options hit their strike and move past ATM, we can see their vanna values crash.

19. A slightly different story for volga - it was surprising to see that despite the calls being hit ITM, the volgas actually went up! Not what I’d expect and I’m curious to learn why this may be. Nonetheless, their current values are much lower than their starting point.

20. As a recap, initially our deep OTM options had large vanna/volga exposures. This gives us long exposure to sharp changes in vol notably through the vega convexity. However, as these options become further ITM their exposure to these higher order greeks is drastically reduced.

21. Given BTC spot has rallied past these deep OTM strikes, we would now need to roll our trade to higher strikes if we still want maximum exposure to vanna/volga. This seems to be what the savvy $36k call buyer did - recycling profits into deep OTM vanna/volga rich options.

22. I have a few questions which I’m thinking through:

a) What is the expected behaviour for volga when a near-dated option reaches ATM or becomes deep ITM? In this case, what could be a reason for the $20k/$28k volga exposure to rise as the options become ITM?

a) What is the expected behaviour for volga when a near-dated option reaches ATM or becomes deep ITM? In this case, what could be a reason for the $20k/$28k volga exposure to rise as the options become ITM?

23. b) To what extent is looking at these higher order greeks useful for trading the repricing of risk? Is there a more effective method here?

c) For this trade, which first-order/second-order greek would have the most significant impact on the overall PNL (ie: vanna vs. volga)?

c) For this trade, which first-order/second-order greek would have the most significant impact on the overall PNL (ie: vanna vs. volga)?

24. Any guidance/comments/suggestions from the experts would be greatly appreciated!

@darshanvaidya @SinclairEuan @GammaHamma22

@mgnr_io @PelionCap @saah1lk @JSterz @OrthoTrading @BitcoinMises @Shamitha_R

@darshanvaidya @SinclairEuan @GammaHamma22

@mgnr_io @PelionCap @saah1lk @JSterz @OrthoTrading @BitcoinMises @Shamitha_R

• • •

Missing some Tweet in this thread? You can try to

force a refresh