1. I typically focus exclusively on crypto options but GME's wild moves last week led me to take a look into its options chain. This analysis only looks at GME options data up to Jan 29, 2021 and does not cover today’s move.

***None of this information is investing advice!!***

***None of this information is investing advice!!***

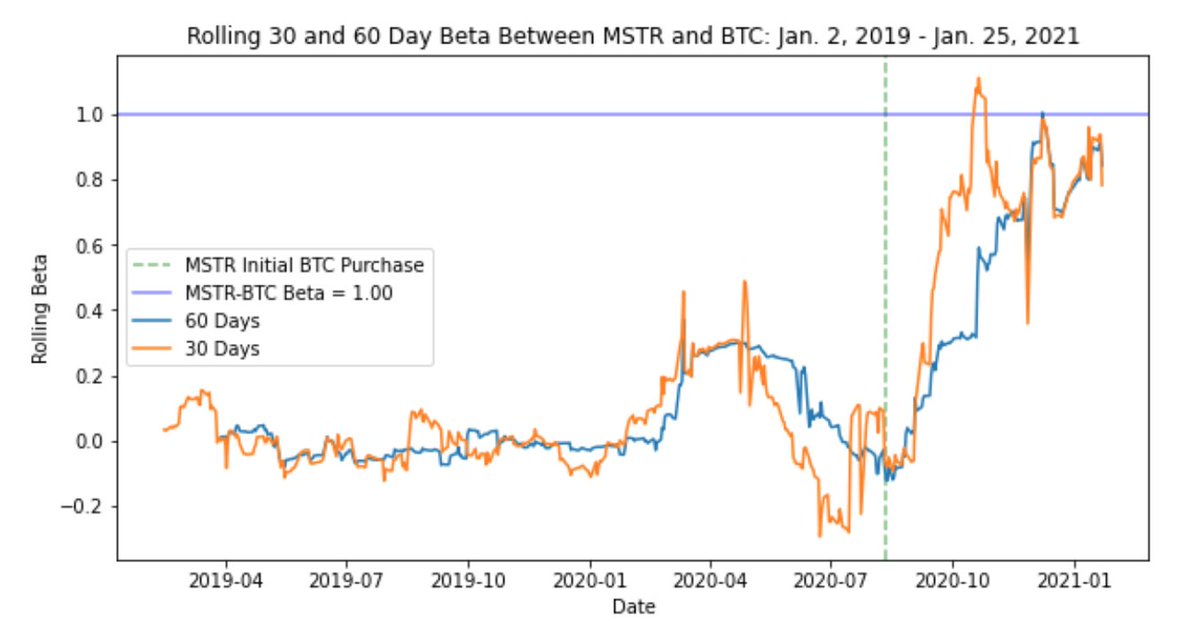

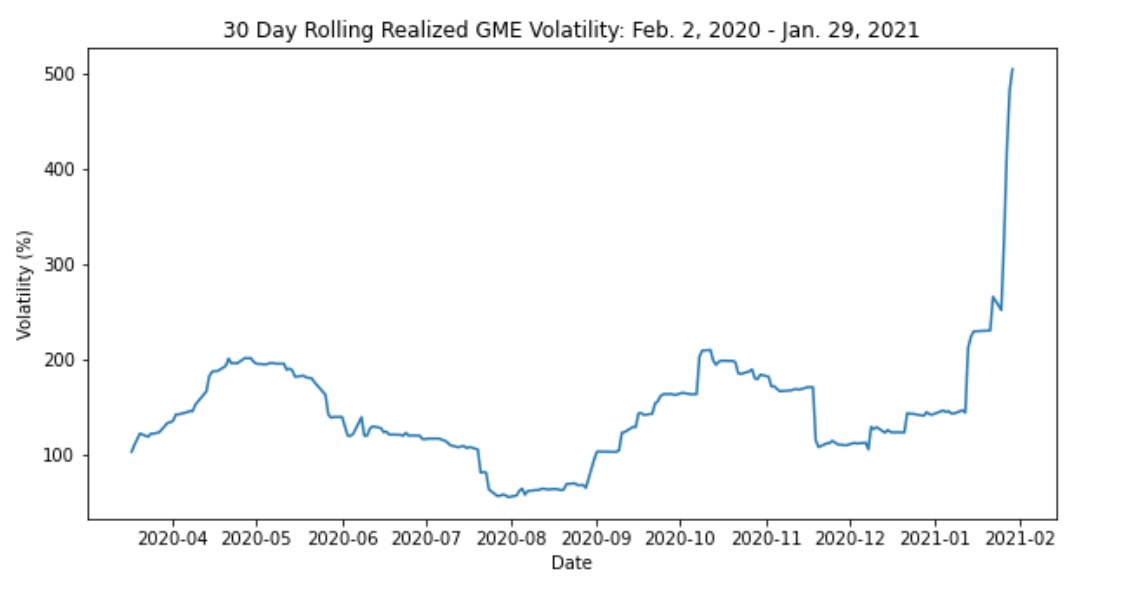

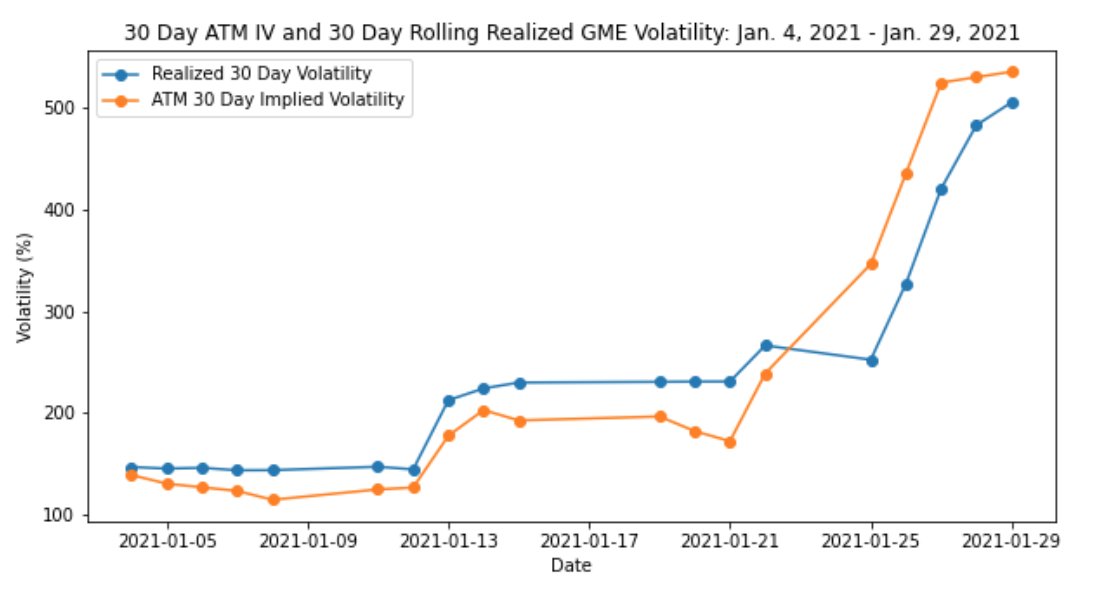

2. Let’s start by taking a look at the realized vol for GME. Clearly we can see it has shot upwards near multi-year highs. Furthermore, we can see the vol of vol in the past followed a mean-reverting process right up until January 2021.

3. Tricky to say whether it’ll mean-revert in the near future- if we see a crash in GME's price we could see vol & vvol stay near these high levels. Regardless, I would be very surprised if we don't see vols mean-revert over the next few weeks (vols usually don't stay that high).

4. Interestingly, even up until mid Jan, 30 day GME RV was trading nearly 20 vol points higher than 1 month ATM IV. In most cases we’d expect the opposite - IV tends to be higher than RV because the market usually prices higher vol in the future.

5. In other words, for most of January, option markets were pricing in lower future realized vol. However, after Jan. 25th, this relationship reversed and IV spiked massively higher (right after GME jumped from $65 -> $96 overnight).

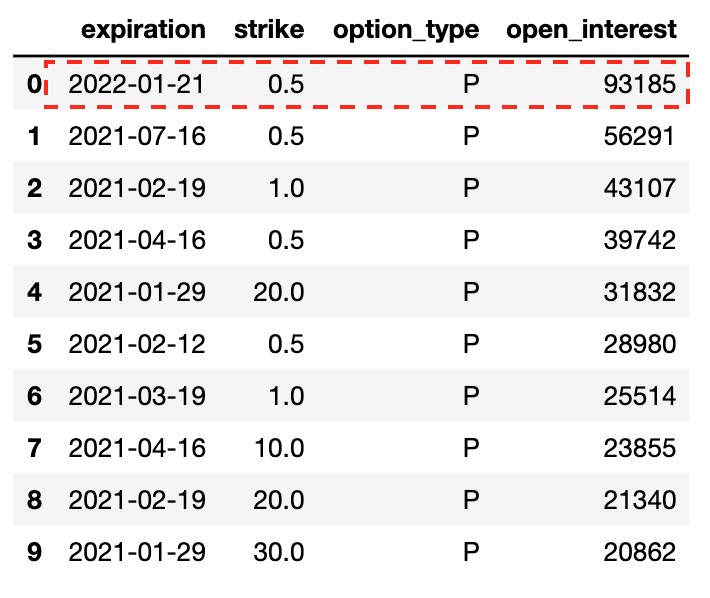

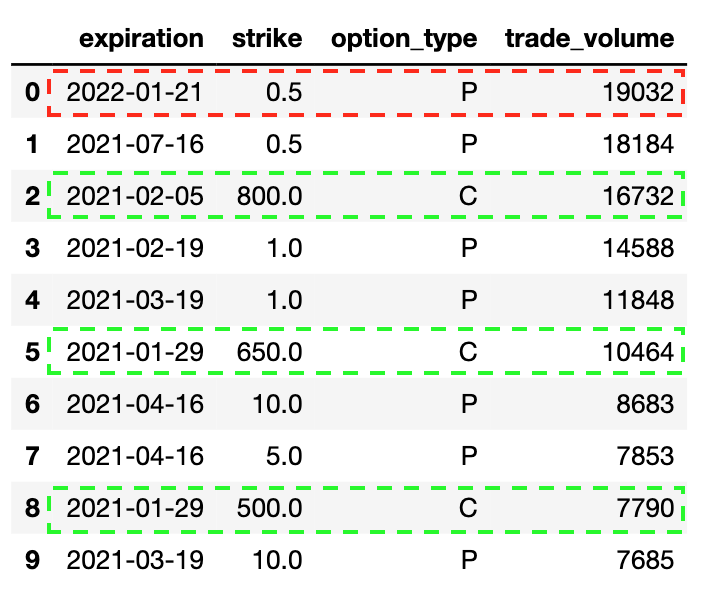

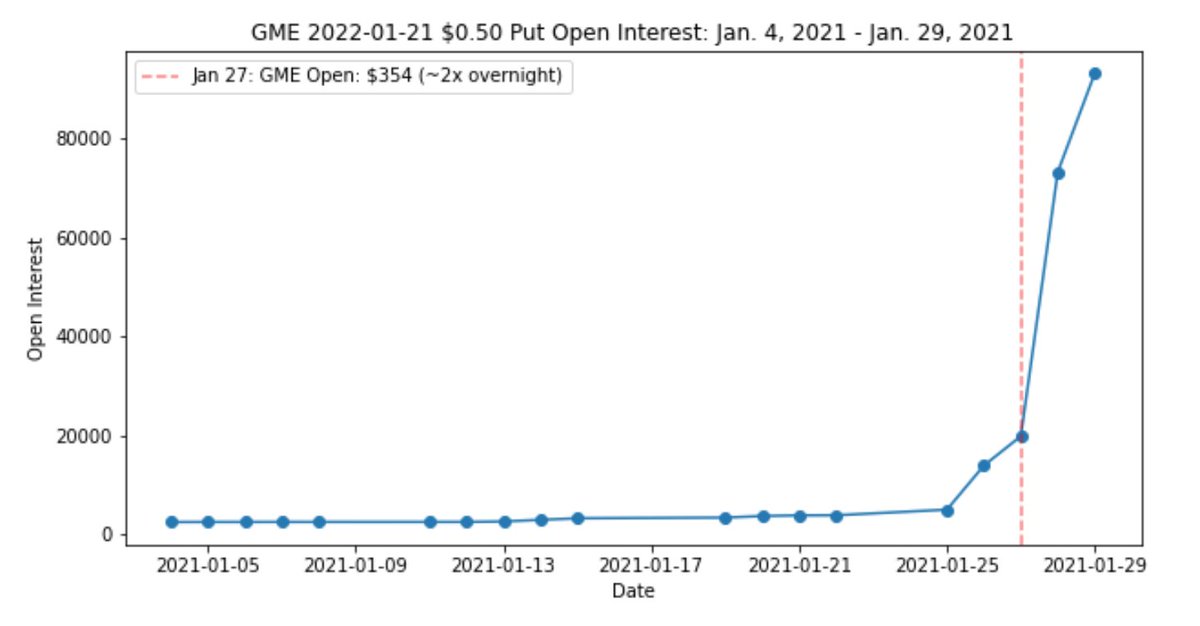

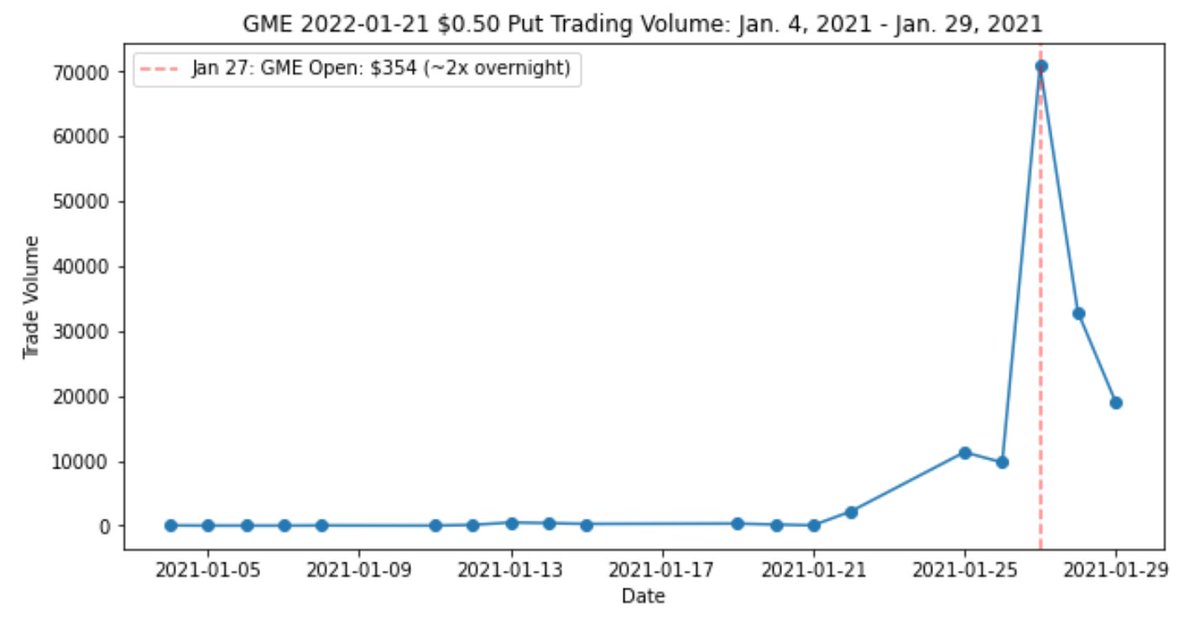

6. Let’s now take a look at open interest and trade volumes. Despite the massive run up in GME’s price, at the beginning of Jan. 29, we can see the highest OI was in a low strike put - specifically the $0.5 Jan 2022 put.

7. Similar story for trade volumes - the teeny option had the highest volume for this day. We can see some large volumes in deep OTM calls but the overall flow was dominated by puts. I’d guess most of the put volume is from ppl buying puts from MMs rather than ppl selling puts.

8. I'm thinking someone is betting on a major repricing of risk here (ie: huge gap downwards). Below are the plots showing the overall OI and volume flows for this particular option over the past month.

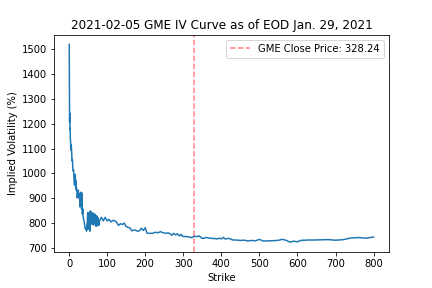

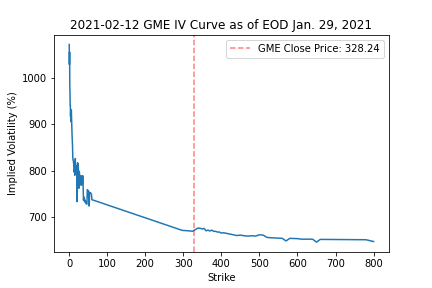

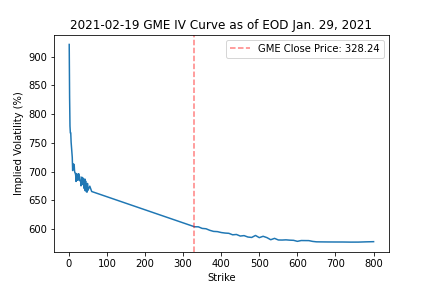

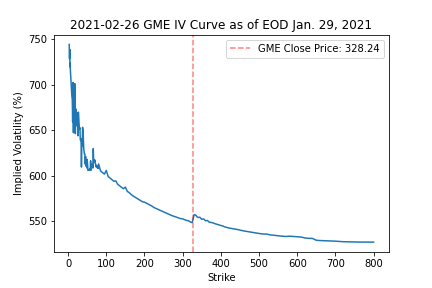

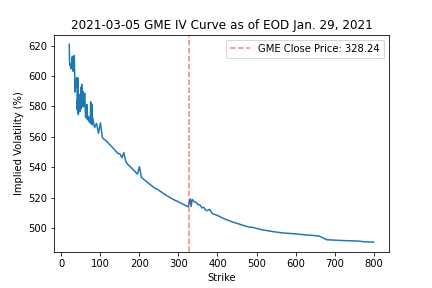

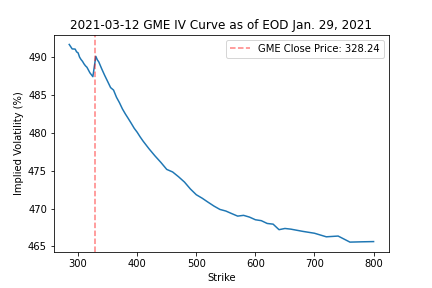

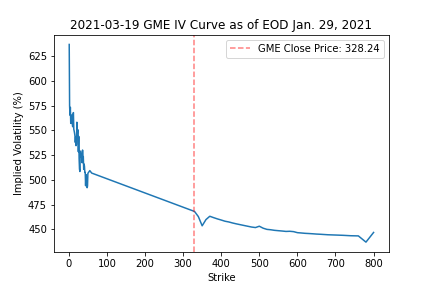

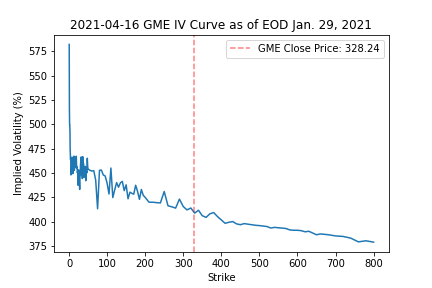

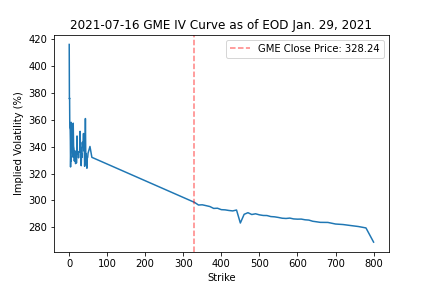

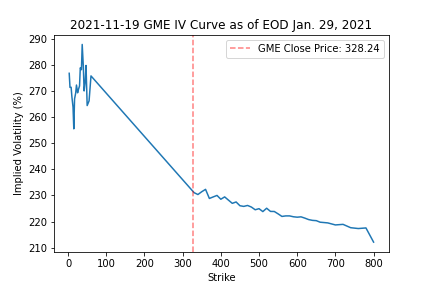

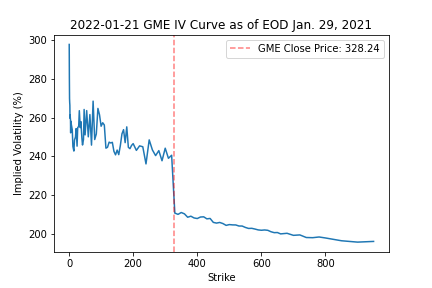

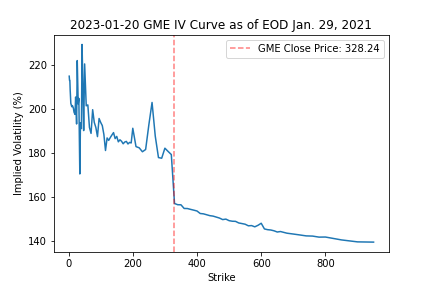

9. We can also look at some IV skew plots to see how MMs are pricing vol...

13. All across the board, the vol skew is massively higher for puts than calls. It seems MMs are desperately bidding put IV to compensate themselves for the risk they’re taking by making markets for these downside options.

14. Recall, selling puts loses $ when asset prices go down - hence MMs are justifiably terrified of downward jumps. As a result, buying puts outright may not actually give the protection you need against a collapse in price if you’re paying too much in vol.

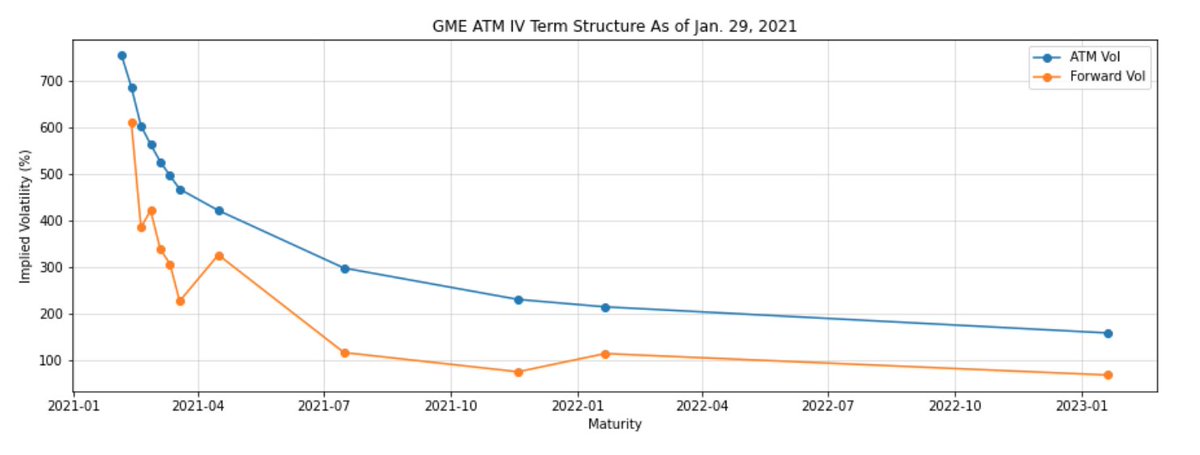

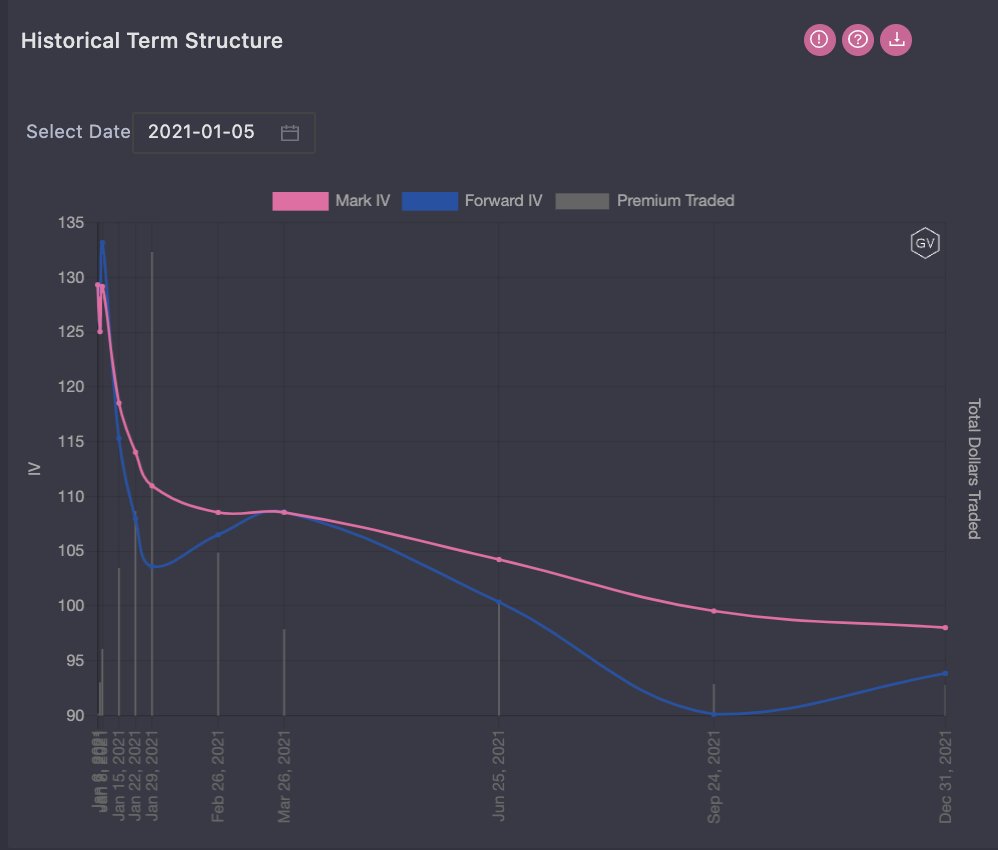

15. Here’s the ATM IV term structure. It reminds me of BTC a few weeks ago when its vol term structure was inverted as shown by @GenesisVol's plot. Forward vols for GME are suggesting lower vol across the curve which may be good opportunities for short vol positions.

16. From a trading perspective I’m still thinking of how to approach this. Although the vol skew for selling puts is attractive there’s still a lot of downward jump risk. If we sell puts, I’d imagine the delta-hedging would need to be very aggressive.

17. For downside directional trades, I’m thinking a put spread or even selling a 1x2 ratio put spread could work for a major leg down. For upside, a potentially cheaper way than just buying calls could be a risk-reversal -- selling an OTM put and buying an OTM call.

18. The nice thing with the RR is we sell expensive put IV and buy cheaper upside vol so we may even be able to get paid to take on this position. However, the standard RR leaves us exposed to downside jump risk which may result in poor risk/reward in this situation.

19. Although headlines suggest bullish moves ahead for GME, option markets don’t seem to agree. Not saying it can’t happen but successful option MMs like Citadel have an edge trading against the market. Something to consider before holding the line w/ deep OTM calls…

20. Would be happy to get some insights, suggestions, or feedback from the experts:

@Ksidiii

@OrthoTrading

@darshanvaidya

@SinclairEuan

@cmsholdings

@ShreyasChari

@mgnr_io

@Ksidiii

@OrthoTrading

@darshanvaidya

@SinclairEuan

@cmsholdings

@ShreyasChari

@mgnr_io

• • •

Missing some Tweet in this thread? You can try to

force a refresh