Quick thoughts + charts on $SNAP Q4 earnings

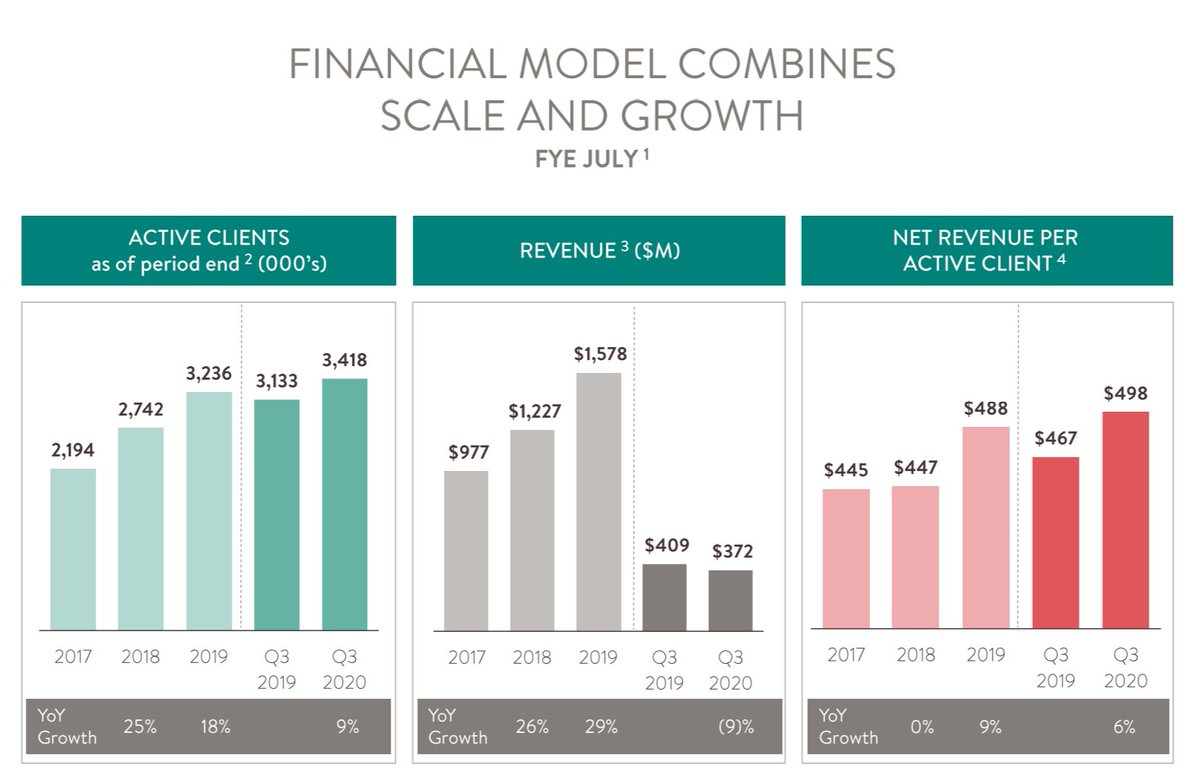

For the first time ever, Snap's largest user base is now Rest of World, or users outside North America and Europe

Snap's NorthAm / EU user growth held steady in the 8-12% range the past year, RoW continues accelerating. Wouldn't be surprised if total userbase exceeds 1 billion within five years.

This user growth is all within the backdrop of the pandemic and lockdowns, of which CEO Evan Spiegel disclosed to CNBC has "been a drag on our user growth"

cnbc.com/video/2021/02/…

cnbc.com/video/2021/02/…

RoW revenue per user has been flast the past two years, but this is likely to ramping user growth in India and SEA (which don't appear to monetize yet).

Biggest story is North American (essentially US) ARPU:

~$20 in 2020 compared $213 for FB. It could 5x to $120 over time.

Biggest story is North American (essentially US) ARPU:

~$20 in 2020 compared $213 for FB. It could 5x to $120 over time.

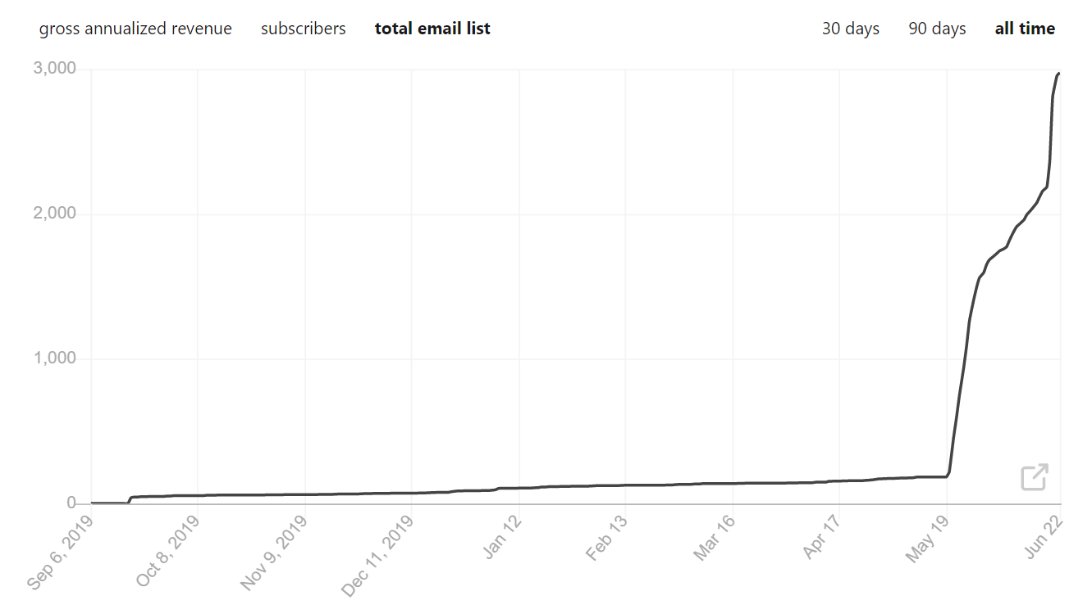

Despite significantly ramping up revenue-generating Discover content, Snap's core hosting costs per user has been flat over the past four years. Showing the core product has significant operating leverage.

Another way to look at it, Snap now generates more revenue than actual cash costs it incurs per employee.

Another strong chart: over the past three years, Snap's contribution margin on its hosting costs has stayed around 100%. Every incremental dollar in revenue Snap generates can be redeployed into other parts of the business.

Snap actually stopped disclosing growth in ad impressions (revenue = # of impressions x ad prices) in Q3, but the price of ads is actually up YoY for the first time ever. For FB, this flip represented the beginning of a significant ramp in the business (and stock price).

Rough calc of Snaps sent per day, per user also steady since IPO. Core messaging product appears to remain healthy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh