🔥I JUST bought $300,000.00 in ASTRA ( $HOL ) STOCK!🔥

1/ It's a #SpaceX type company & I'm very excited!

Read the 61 thread post below with my notes on WHY I did it. 👇👇👇

>>AND RETWEET THIS, PLEASE.<<

1/ It's a #SpaceX type company & I'm very excited!

Read the 61 thread post below with my notes on WHY I did it. 👇👇👇

>>AND RETWEET THIS, PLEASE.<<

2/ #ASTRA ($ASTR) currently trading under the #SPAC symbol $HOL (Holicity)

It is a space company the manufactures smaller rockets and #spacecraft to allow businesses to launch into space very quickly and cheaply, from anywhere in the world.

It is a space company the manufactures smaller rockets and #spacecraft to allow businesses to launch into space very quickly and cheaply, from anywhere in the world.

3/ I first bought 10K shares of $HOL last week at $15...

... an additional 7500 shares this morning in pre-trading @$20/share...

...for a total of $300,000 (actually $304,233 / I rounded the share prices.)

... an additional 7500 shares this morning in pre-trading @$20/share...

...for a total of $300,000 (actually $304,233 / I rounded the share prices.)

4/ #ASTRA is a pre-revenue company. If you don't like this, $HOL is not for you.

I'm going to talk about a 5-year vision for this company, and why I invested because of it.

I'm going to talk about a 5-year vision for this company, and why I invested because of it.

5/ When I say pre-revenue, keep in mind that #Astra DOES have $150 million in contracted revenue representing over a hundred spacecraft waiting to be launched into space.

6/ The first commercial #ASTRA flight is scheduled for mid-2021, but it appears they won't have the capacity to fulfill even their current backorders until 2023...

...not including all the NEW orders they pick up over the next 3 years.

...not including all the NEW orders they pick up over the next 3 years.

7/ I like that #ASTRA will be backlogged and have tons of orders (and revenue) for the foreseeable future. $ASTR will be growing as fast as they possibly can.

8/ OK, so here's the bottom line -- people want to invest in #SpaceX.

But you typically can't unless you're an accredited investor, and then you have to be in the right place at the right time to find somebody willing to sell those #stocks.

And #SpaceX isn't going ...

But you typically can't unless you're an accredited investor, and then you have to be in the right place at the right time to find somebody willing to sell those #stocks.

And #SpaceX isn't going ...

9/ public anytime soon according to #ElonMusk (I don't think). I believe they'll spin off #IPO's on things like #Starlink.

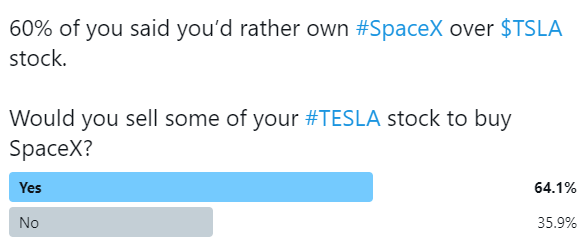

That said, I ran a poll recently that showed that 60% of the investors that took the poll would rather own #SPACEX than #TESLA.

That said, I ran a poll recently that showed that 60% of the investors that took the poll would rather own #SPACEX than #TESLA.

10/ I ran a second poll that showed 64% of you would sell off some or all of your $TSLA stock to invest in #SPACEX if that was an option.

11/ $ASTR (currently $HOL) seems to be as close to that opportunity as you can get.

#Astra became the 3rd privately funded US company to demonstrate orbital launch capability. That's huge.

#Astra got to space faster than anyone in history for a private company. That's EPIC!

#Astra became the 3rd privately funded US company to demonstrate orbital launch capability. That's huge.

#Astra got to space faster than anyone in history for a private company. That's EPIC!

12/ Timeline - Number of years to reach orbital launch:

#Astra: 3 years

#SpaceX: 7 Years

#RocketLab: 12 years

#Virgin: 13 years

#Astra did it in less than half the time it took SpaceX to do it.

#Astra: 3 years

#SpaceX: 7 Years

#RocketLab: 12 years

#Virgin: 13 years

#Astra did it in less than half the time it took SpaceX to do it.

13/ While #SpaceX is designed to deliver a crap-ton of stuff into space in low volume missions, ASTRA is setting up to do smaller daily launches around the world to cater to a much larger audience that doesn't need all the capacity of SpaceX.

14/ And that turns into orders. There's a massive market here not being served well.

And for #ASTRA, that translates into a flood of orders:

And for #ASTRA, that translates into a flood of orders:

15/ Sales Pipeline:

*10+ customers w/ 100+ launches backlogged

*$150M in contracted revenue

*All customers currently in orbital operation (serious customers)

*Strong commercial traction with over $1.2B in pipeline opportunities

*10+ customers w/ 100+ launches backlogged

*$150M in contracted revenue

*All customers currently in orbital operation (serious customers)

*Strong commercial traction with over $1.2B in pipeline opportunities

16/ #ASTRA was Recently awarded the NASA Venture Class Launch Services (VCLS) contract for the launch of NASA CubeSats.

17/ Markets available for #ASTRA now: Satellites for broadband, weather, earth observation, maritime, IOT/M2M connectivity, governments, etc.

Over 38K satellites to be launched by 2029 (I think this is low... more on that later)

Government investing $40B in space projects.

Over 38K satellites to be launched by 2029 (I think this is low... more on that later)

Government investing $40B in space projects.

18/ For some time, ASTRA / $HOL is likely to be the only potential provider of daily, low-cost and global access to Space.

Here's why:

A) If you need to get a satellite into Space now, you need to book months, even years in advance.

B) It's expensive to launch a small ...

Here's why:

A) If you need to get a satellite into Space now, you need to book months, even years in advance.

B) It's expensive to launch a small ...

19/ ... satellite - SpaceX is designed for large volume or large items.

C) You're limited to a small number of launch dates per year.

D) You're limited to where in the world you must launch from.

C) You're limited to a small number of launch dates per year.

D) You're limited to where in the world you must launch from.

20/ #Astra $HOL is small & portable. The launch system fits into 4 standard shipping containers to be shipped worldwide & can be launched with a small team of 5 ASTRA employees in 5 days.

That's disruptive!

You need a concrete pad, some fencing, and you're good to go.

That's disruptive!

You need a concrete pad, some fencing, and you're good to go.

21/ Companies can launch on extremely short notice.

Morgan Stanley forecasts the space economy will grow to over a trillion dollars over the next decade or two.

This trillion-dollar economy is comprised of ...

Morgan Stanley forecasts the space economy will grow to over a trillion dollars over the next decade or two.

This trillion-dollar economy is comprised of ...

22/ hundreds of billions of dollars of new services, hundreds of billions of dollars of new satellites being manufactured, & tens of billions of dollars of new government investment in space, including the creation of the new Space Force.

23/ #ASTRA is also building out a new facility in 2024 to introduce their modular space platform, allowing companies to produce mass satellites.

This has me super excited and makes me ultra bullish on a 5-year outlook.

This has me super excited and makes me ultra bullish on a 5-year outlook.

24/ Here are the advantages to this modular space platform to make satellites for clients:

A) $ASTR Astra can drive down cost significantly by mass producing this hardware, achieving scale & efficiency never seen in this industry.

B) Customers can focus on the ...

A) $ASTR Astra can drive down cost significantly by mass producing this hardware, achieving scale & efficiency never seen in this industry.

B) Customers can focus on the ...

25/ ...important parts of their satellite (software, cameras, mirrors, sensors, etc.) and not have to worry about building the base components like the shell, power management, solar panels, radios, etc.)

(posts 26 through 60 continued in another thread...)

(posts 26 through 60 continued in another thread...)

Nice pop today on $$HOL. Was up 13% today, now a gift at 9%.

When the ticker changes to $ASTR, its game on. There's not even a listing for it when I hashag it here: #astra

When the ticker changes to $ASTR, its game on. There's not even a listing for it when I hashag it here: #astra

Returns, not reruns. 🤣 Wish I could edit.

Continued $HOL ($300k buy) thread for posts 26 through 50 here:

https://twitter.com/BullishAngel/status/1358866539404005381

• • •

Missing some Tweet in this thread? You can try to

force a refresh