1. Thread on CONDITIONAL BUY:

Purpose is to catch trending moves once it is confirmed.

Plot the most important support and resistance on the chart such that violating those levels will lead to a trending move in all likelihood.

#OptionsTrading #markets

Purpose is to catch trending moves once it is confirmed.

Plot the most important support and resistance on the chart such that violating those levels will lead to a trending move in all likelihood.

#OptionsTrading #markets

2. Eg. Banknifty is at 36000. Support at 35500 and Resistance at 36500.

Place buy orders in the system such that 35500PE is bought if 35500 is violated.

36500CE is bought if 36500 is breached.

#OptionsTrading #markets

Place buy orders in the system such that 35500PE is bought if 35500 is violated.

36500CE is bought if 36500 is breached.

#OptionsTrading #markets

3. What should be the limit price order for the two contracts (35500PE, 36500CE)?

Ideally, the price of an ATM contract should be same keeping everything else constant ( Days to expiry, volatility, interest rates etc.)

#OptionsTrading #markets

Ideally, the price of an ATM contract should be same keeping everything else constant ( Days to expiry, volatility, interest rates etc.)

#OptionsTrading #markets

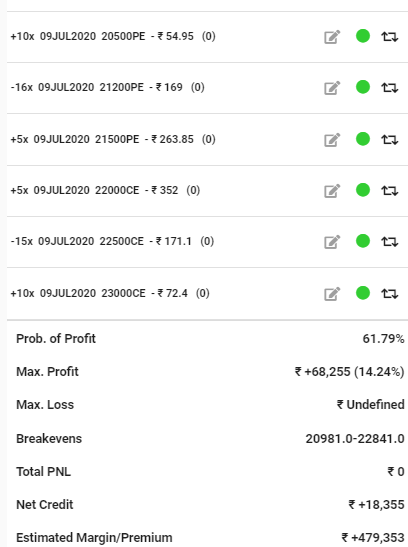

4. So the conditional limit price for 35500PE and 36500CE will be the same as current price of 36000PE & 36000CE respectively.

35500PE buy at 425.

36500CE buy at 378.

One may choose a common number for both.. say 400 here.

35500PE buy at 425.

36500CE buy at 378.

One may choose a common number for both.. say 400 here.

5. Place the trigger at a comfortable width so that your order is executed even if the market moves sharply. For less than 10 lots, I keep a width of 3 points for Banknifty weekly contracts.

6. Also, one need not execute all orders at one go. Major support and resistance levels are also the zones where max shake out candles are formed. Hence, incrementally adding to your position is advisable as the trending move gets confirmed.

7. For this reason, a ladder of orders should be placed. If first order will get executed at 35500, then next one should get executed if 35400 is breached. Given that the delta of an ATM contract is 0.5, a 100 point move would move the option price by approximately 50 points.

8. Next order should be at a price 40-50 points higher than the first order.

For the 3rd order, the difference could be halved to 20-25 points higher than the 2nd order as delta increases.

For the 3rd order, the difference could be halved to 20-25 points higher than the 2nd order as delta increases.

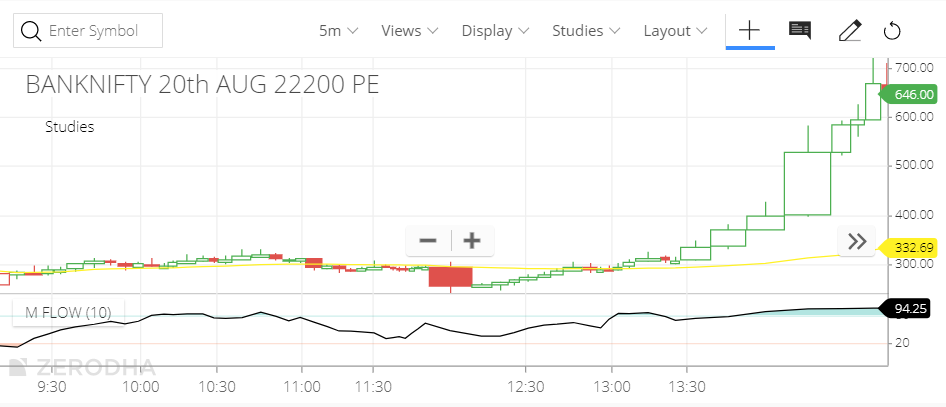

9. All these orders should be in place on both sides before market opens. Or if you want to avoid morning volatility, one can do it after the first 5-10 minutes of trading.

And then you just relax and let the market do its thing.

And then you just relax and let the market do its thing.

10. Setting a profit target or trailing your positions is of utmost importance to decide your exit. Trends wont last forever. I personally prefer to book 30-40% positions once I have seen a decent profit.

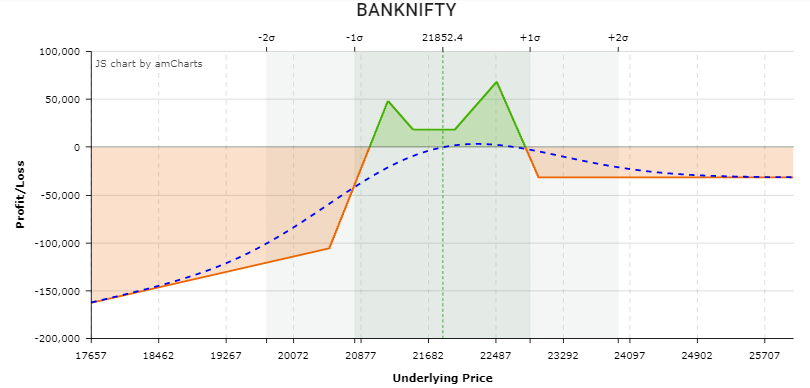

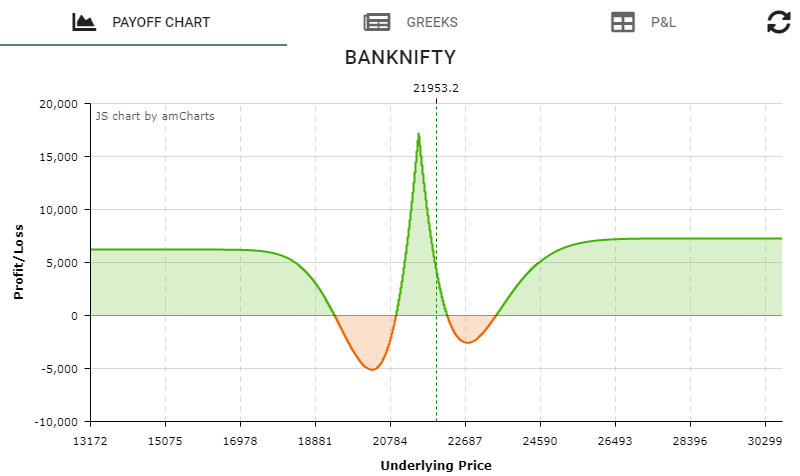

11. If volatility is high, and exiting is difficult, convert ur positions into debit spreads for lower cost to chase the trend. If trend looks like weakening, the same debit spread could be converted into ratio spreads.

If it looks like the trend is reversing, its better to exit.

If it looks like the trend is reversing, its better to exit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh