Elon's Roadster is currently less than 32M miles from Earth and closing: whereisroadster.com

Elon says 0-60 time is actually 1.96 seconds, so the 1.99 seconds on the website is sandbagged just a little bit.

tesla.com/models

tesla.com/models

Elon said if you floor the Plaid S when the light turns green, it could hit 60 mph *before exiting the intersection*.

"In the future, as the car becomes more autonomous, it's going to be about entertainment first and foremost, and productivity."

-ERM

-ERM

"I think we do need to make sure that people from California who move to Austin do not inadvertently create the same issues they wanted to escape."

-ERM

-ERM

"Austin's gonna be the biggest boomtown America's seen in 50 years."

-ERM

-ERM

On Cybertruck:

"We'll have probably limited production at the end of this year and then volume production next year."

"We'll have probably limited production at the end of this year and then volume production next year."

"Roadster will have enough range that you'll never have to worry about range. Let me put it that way."

Elon, joking: "5G causes Corona! *It's a fact*!" (laughing)

"People are worried that cell phones and towers and 5G cause cancer. This is not true. If I had a helmet made of cell phones around my head- and my nuts- I would not worry."

On FacebookAI:

"Even worse, they're going to feed all of everyone's data into their AI, FacebookAI, they have a public account, you can follow them... and see what happens. Could lead to a dystopian outcome."

"Even worse, they're going to feed all of everyone's data into their AI, FacebookAI, they have a public account, you can follow them... and see what happens. Could lead to a dystopian outcome."

"At the end of the day, somebody has to go to Facebook or Google or Tesla- Tesla has a lot of AI- and say "this is OK" or "this is not OK", and report back to the public, "this is what we found". Otherwise it's the inmates running the asylum."

"Our airbag technology is crazy good. In the case of Tesla, we go way beyond the legal requirements. Teslas are the safest cars ever. We get 5 stars in every category and subcategory and if there were 6 stars, we'd get that too."

"Can you imagine if $GM had just kept iterating? If they'd just gone EV1, EV2, EV3? They would've owned the world."

"To transition from a petroleum-based economy, we need a shit ton of batteries. A giga shit ton."

On his talks with the Biden Administration about a carbon tax:

"They thought it was too politically difficult, but I was like, 'it was at least half the reason you got elected: put a price on carbon. it's an obvious move'."

"They thought it was too politically difficult, but I was like, 'it was at least half the reason you got elected: put a price on carbon. it's an obvious move'."

"Like I say, provided we are not complacent about reducing CO2 emissions, I think we'll be fine, unless there's some nonlinear event. You cannot change the chemical composition of the atmosphere and oceans and expect that nothing bad's gonna happen."

On affordable, efficient carbon sequestration technology:

"I'm funding a $100M carbon capture prize to answer that question. We don't actually know the answer, but there's nothing good that we're aware of currently."

"I'm funding a $100M carbon capture prize to answer that question. We don't actually know the answer, but there's nothing good that we're aware of currently."

"China has the most progressive environmental policies of any large economy on Earth. China is super pro environment- more than America."

On Model X Falcon Wing Doors:

"It was an exercise in hubris. To avoid having an ultrasonic puck, we developed the only ultrasonic sensor we know of that can hear through metal."

"It was an exercise in hubris. To avoid having an ultrasonic puck, we developed the only ultrasonic sensor we know of that can hear through metal."

On Plaid X:

"It'll be like high 300's (range, in miles). It has a higher coefficient of drag and a larger cross-sectional area, so it's probably 10% less range than the (Plaid) Model S."

"It'll be like high 300's (range, in miles). It has a higher coefficient of drag and a larger cross-sectional area, so it's probably 10% less range than the (Plaid) Model S."

"In terms of CO2 per mile, (internal combustion engine) SUVs are the worst, so the best thing you can do is get those off the road."

"Eventually (EV semi trucks) will be autonomous, but I think in the short-term we'll see convoys." (where driverless trucks follow a lead truck with a human driver).

"I'm committed to run Tesla for several more years. There's a lot to get done."

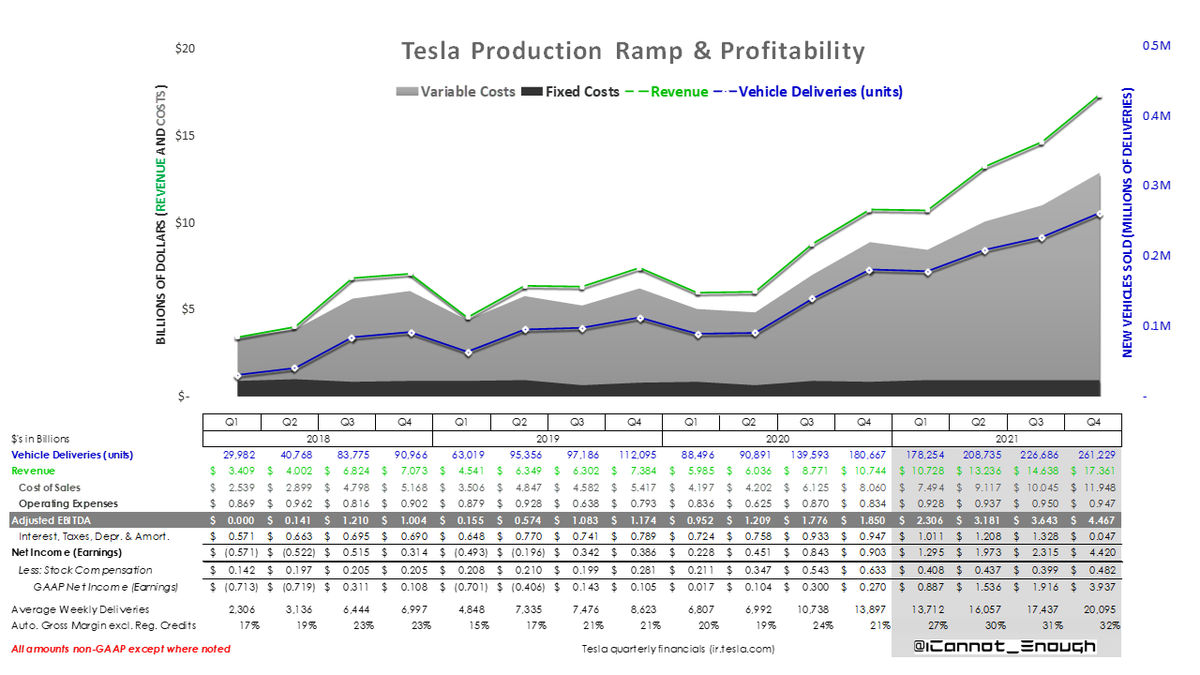

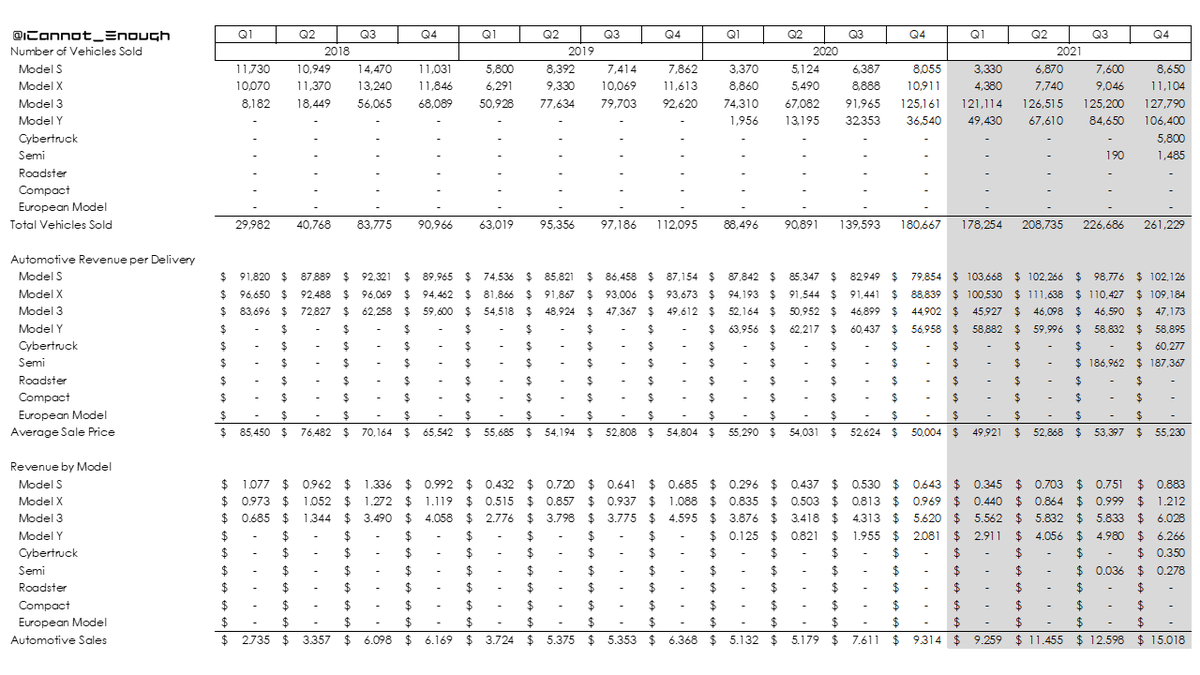

$TSLA

$TSLA

• • •

Missing some Tweet in this thread? You can try to

force a refresh