Inflation is coming, inflation is coming!

Last month I wrote about the distinction between long-term secular inflation and shorter-term cyclical inflation

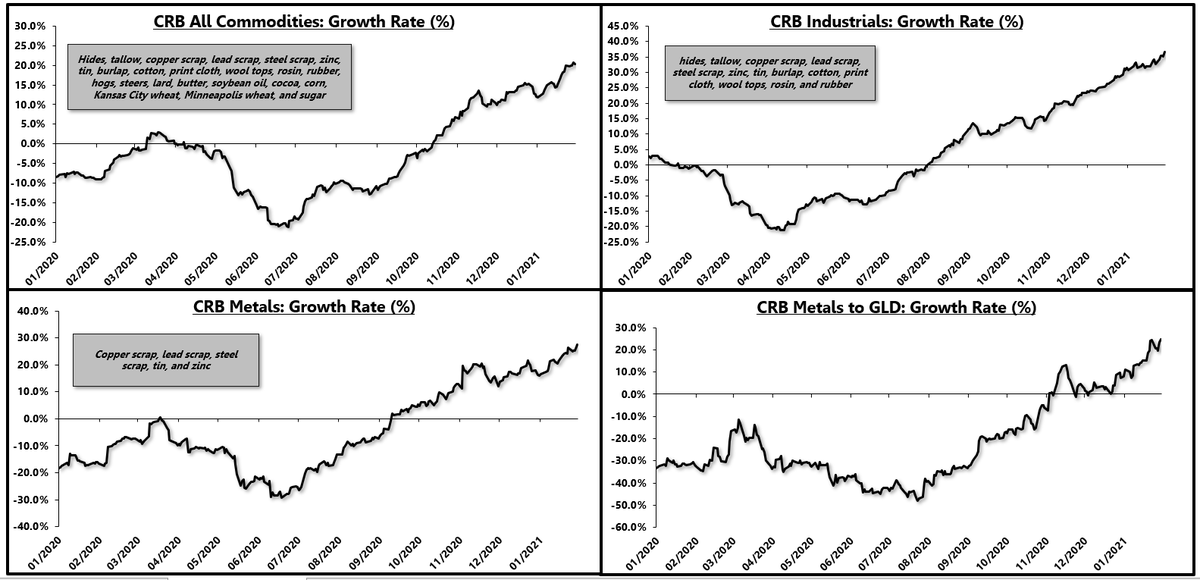

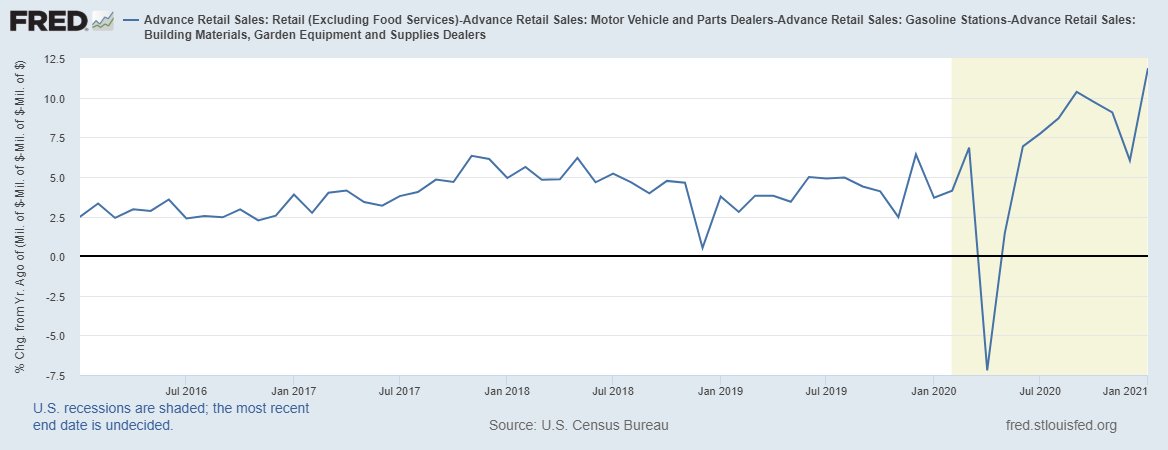

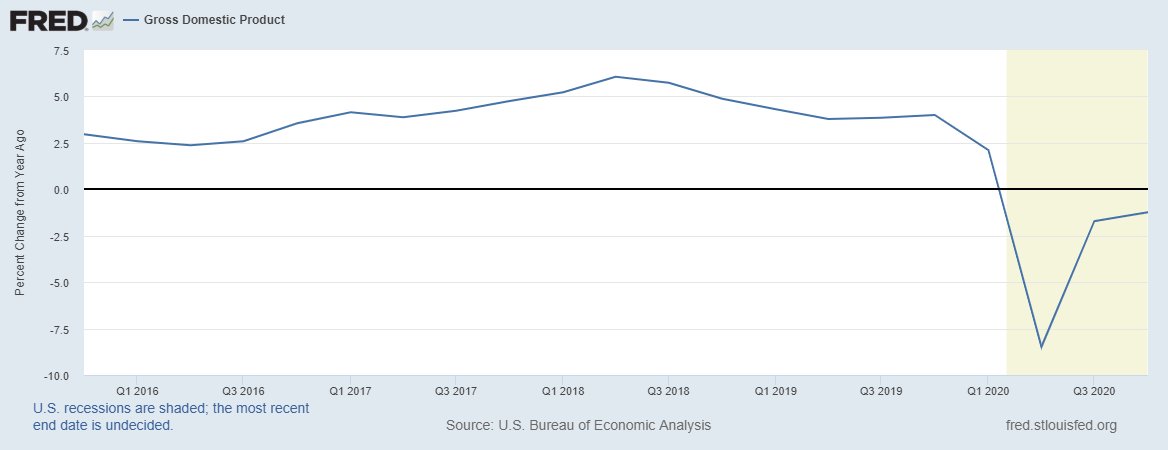

It has been clear for several months that we are in the middle of a cyclical rise in inflation

1/

Last month I wrote about the distinction between long-term secular inflation and shorter-term cyclical inflation

It has been clear for several months that we are in the middle of a cyclical rise in inflation

1/

https://twitter.com/EPBResearch/status/1346101456735125505?s=20

The full thread can be reviewed here:

2/

https://twitter.com/EPBResearch/status/1346101439756570625?s=20

2/

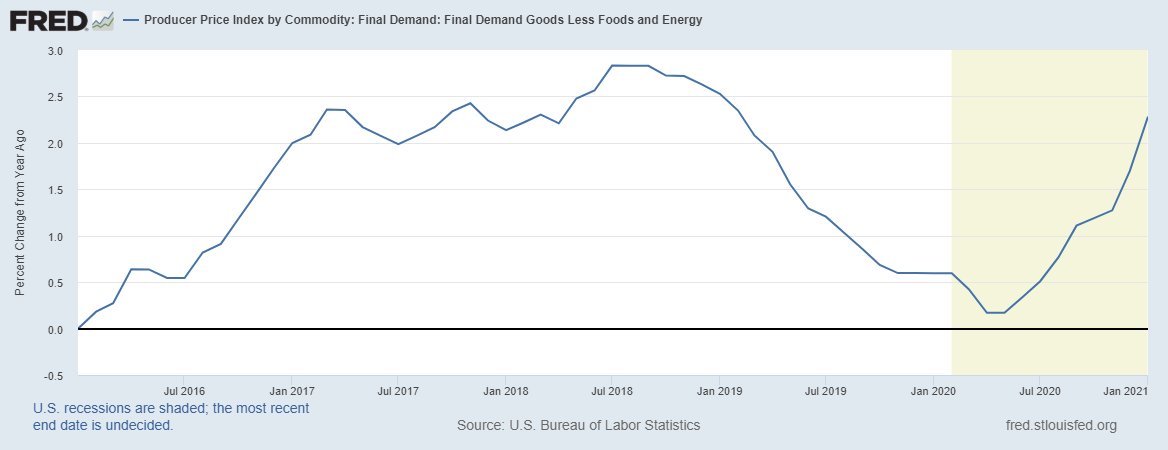

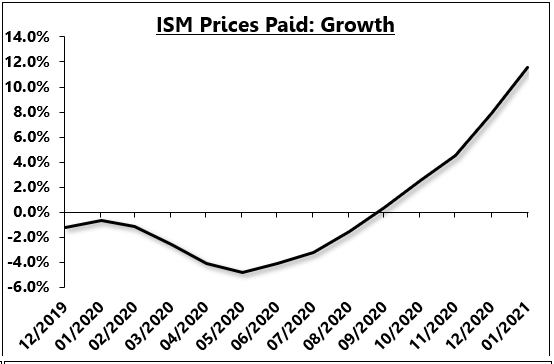

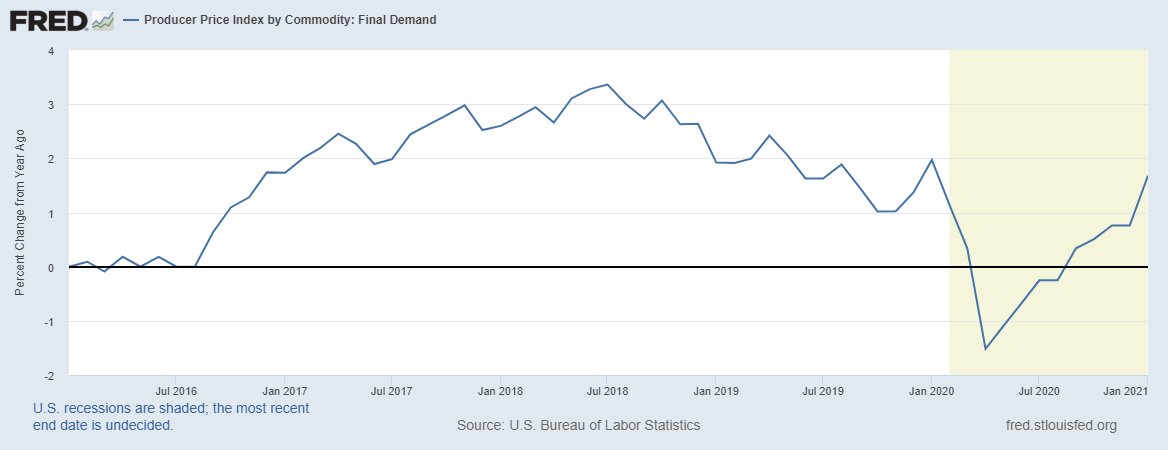

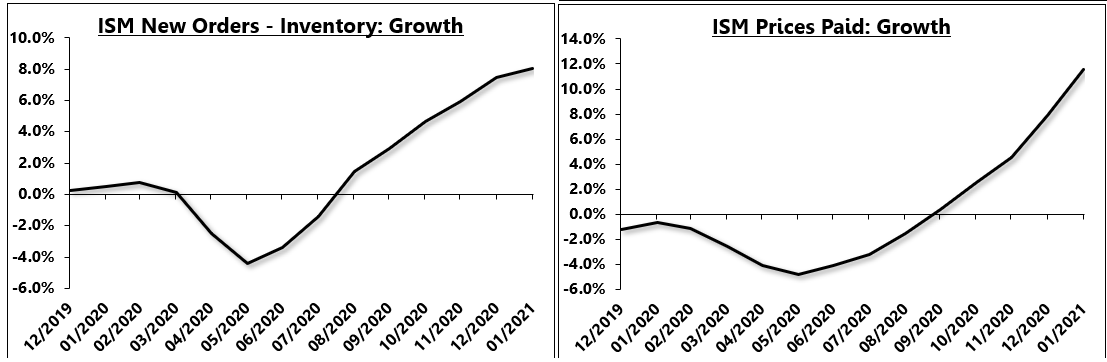

Today's PPI report should have been expected to surprise to the upside as the leading indicators of inflation have been screaming to the upside for months!

Here is the ISM prices paid index, cumulated into a growth rate

3/

Here is the ISM prices paid index, cumulated into a growth rate

3/

So today's PPI report was in line with the leads, suggesting that we have a cyclical upturn in inflation that is * primarily concentrated in the manufacturing sector *

This is a key point.

5/

This is a key point.

5/

To be very clear, this cyclical upturn in inflation will continue for the next several months and should not be expected to fall apart imminently

This does not mean the secular disinflationary trend is over. We have had 4-5 of these upturns since 2010. They happen. They fade

7/

This does not mean the secular disinflationary trend is over. We have had 4-5 of these upturns since 2010. They happen. They fade

7/

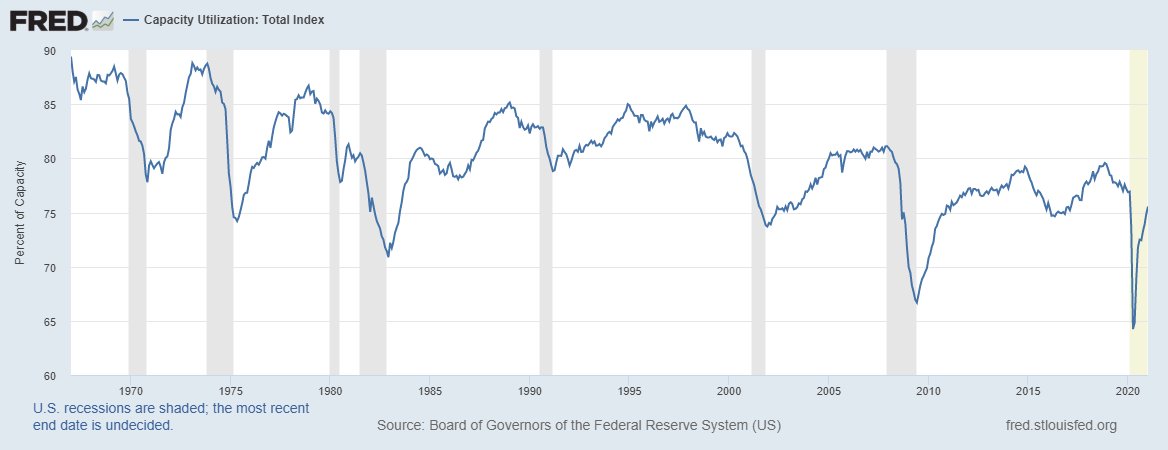

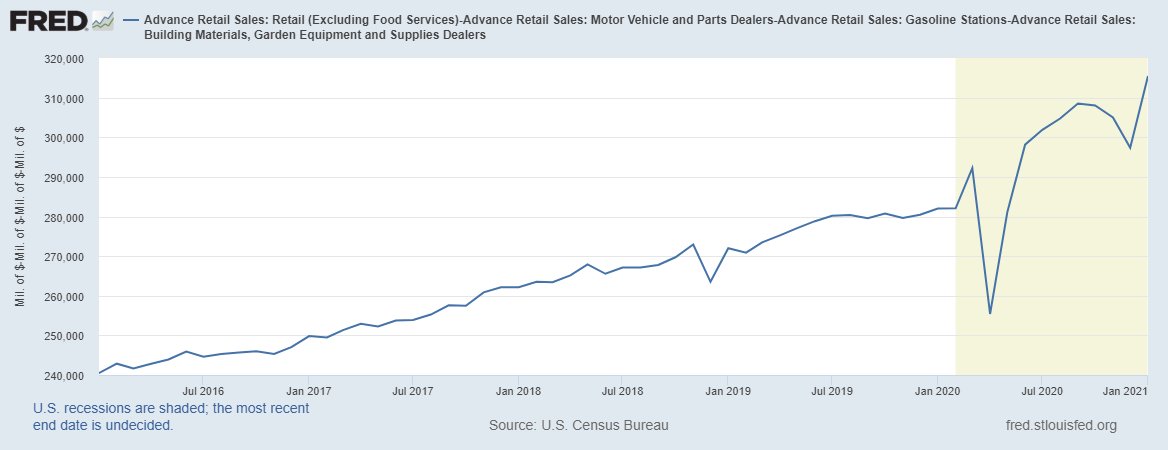

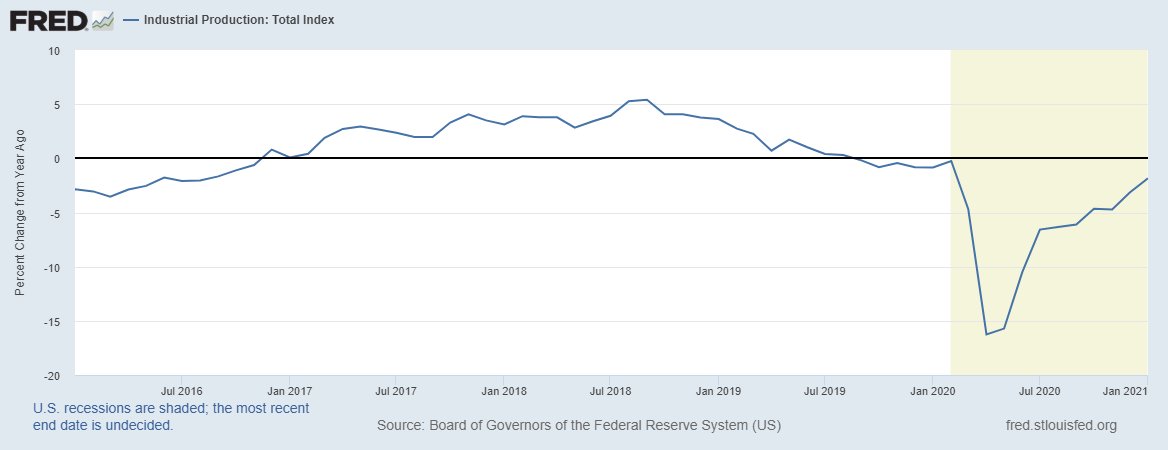

Sticking with the trend of a general manufacturing-based upturn, what else surprised to the upside (shouldn't have been a surprise)...industrial production.

IP growth increased to -1.83% y/y

8/

IP growth increased to -1.83% y/y

8/

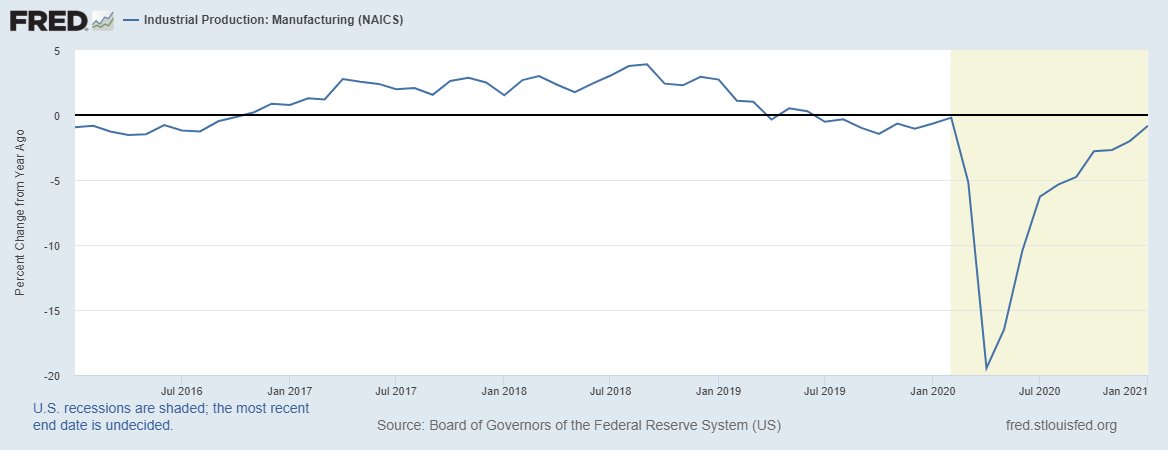

Industrial production for manufacturing specifically is almost back to positive growth on a year over year basis.

9/

9/

Should we expect the manufacturing-based growth and inflation upturn to continue?

Yes.

But remember to differentiate cyclical for secular.

10/

Yes.

But remember to differentiate cyclical for secular.

10/

TLDR:

Play the cyclical trend. Don't lose sight of the long-term fundamentals.

12/12

Play the cyclical trend. Don't lose sight of the long-term fundamentals.

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh