You can now become a millionaire selling your memes & digital art

How much would you pay for this digital character?

$2? $200?

Someone recently paid $2m. Yes, two million US dollars!!

This is one of 10,000 unique CryptoPunks digital characters which sold for $126m in total.

How much would you pay for this digital character?

$2? $200?

Someone recently paid $2m. Yes, two million US dollars!!

This is one of 10,000 unique CryptoPunks digital characters which sold for $126m in total.

How much would you spend to own this GIF?

$6? $60?

This Nyan Cat GIF recently sold for nearly $600k

$6? $60?

This Nyan Cat GIF recently sold for nearly $600k

When you buy a piece of CryptoArt, proof of ownership is stored on the Ethereum blockchain. You own the NFT.

NFTs (Non-fungible tokens) are digital certificates for intellectual property.

It's the digital version of buying an autographed piece of merchandise.

NFTs (Non-fungible tokens) are digital certificates for intellectual property.

It's the digital version of buying an autographed piece of merchandise.

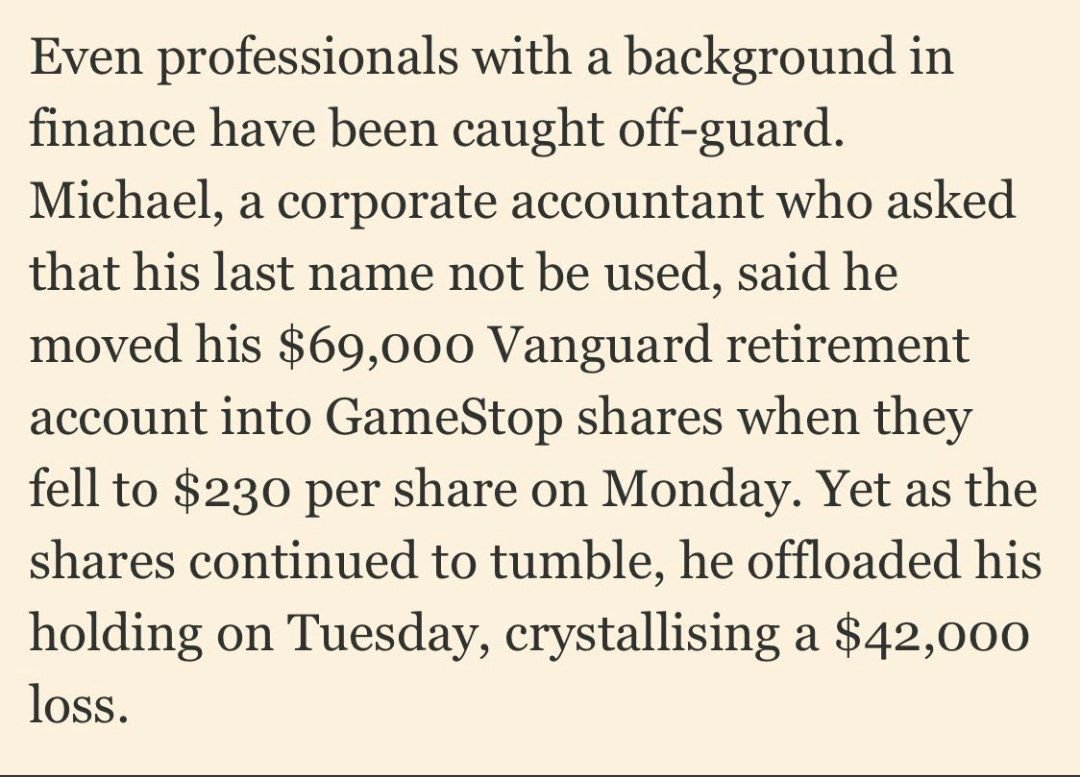

The explosion of digital art has raised interesting questions over valuations, investing and human behaviour.

You own the certificate of the meme. Unlike music royalties - you can't stop people using your meme/ GIF.

Essentially you hope someone will pay more it in the future.

You own the certificate of the meme. Unlike music royalties - you can't stop people using your meme/ GIF.

Essentially you hope someone will pay more it in the future.

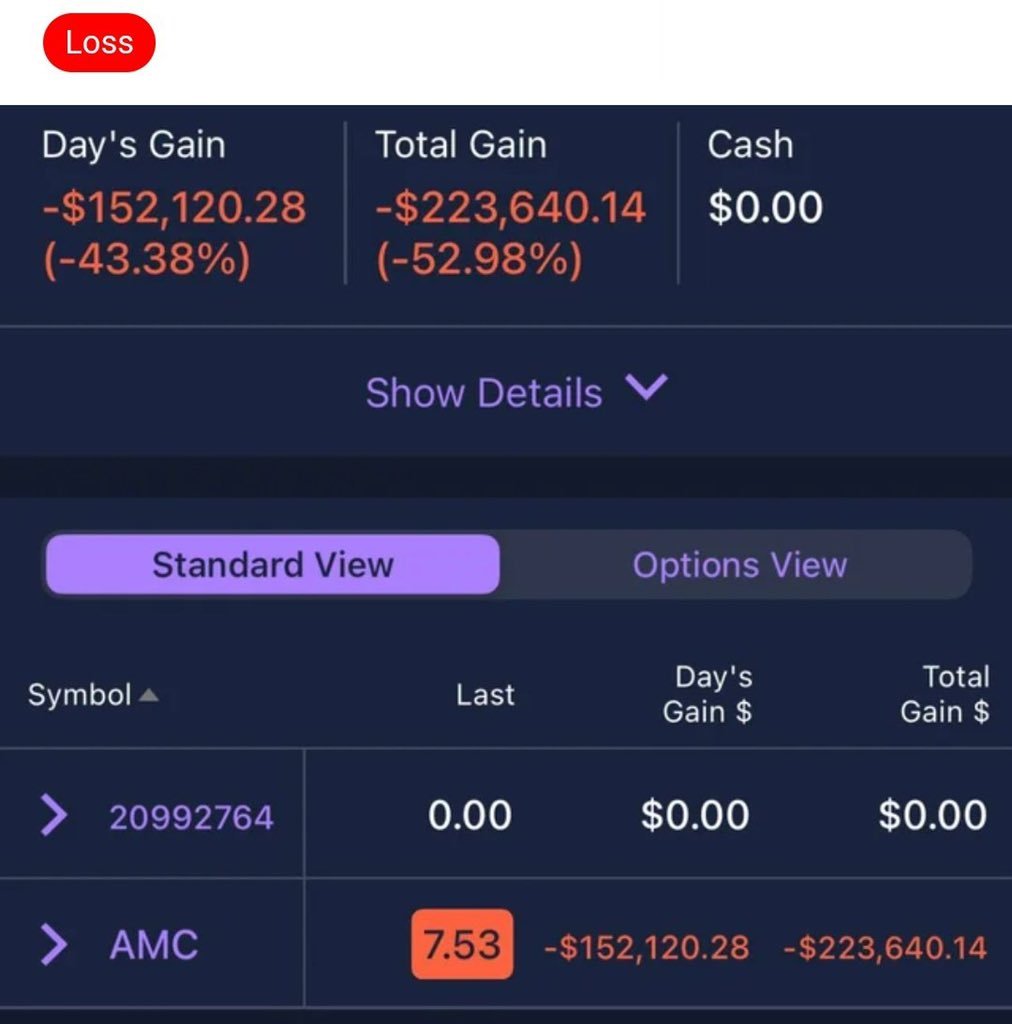

CryptoArt is both fast growing and pretty risky business

If you hold stock & a company you invest in goes bust, you may salvage a few cents. If the meme you hold becomes irrelevant or can't sell.. you have less options.

Ultimately, price is what you pay, value is what you get.

If you hold stock & a company you invest in goes bust, you may salvage a few cents. If the meme you hold becomes irrelevant or can't sell.. you have less options.

Ultimately, price is what you pay, value is what you get.

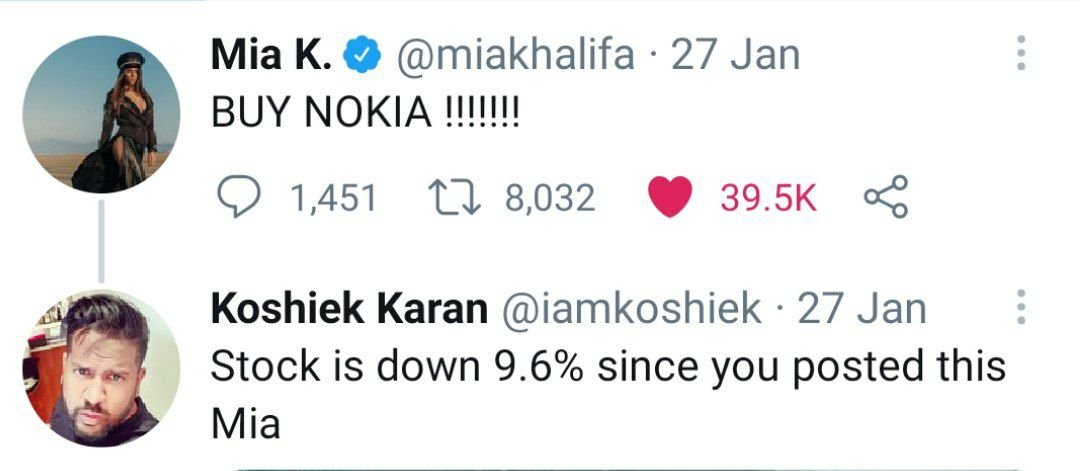

Here's how you can use NFTs & the power of blockchain to sell your tweets

https://twitter.com/iamkoshiek/status/1368143918123151363?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh