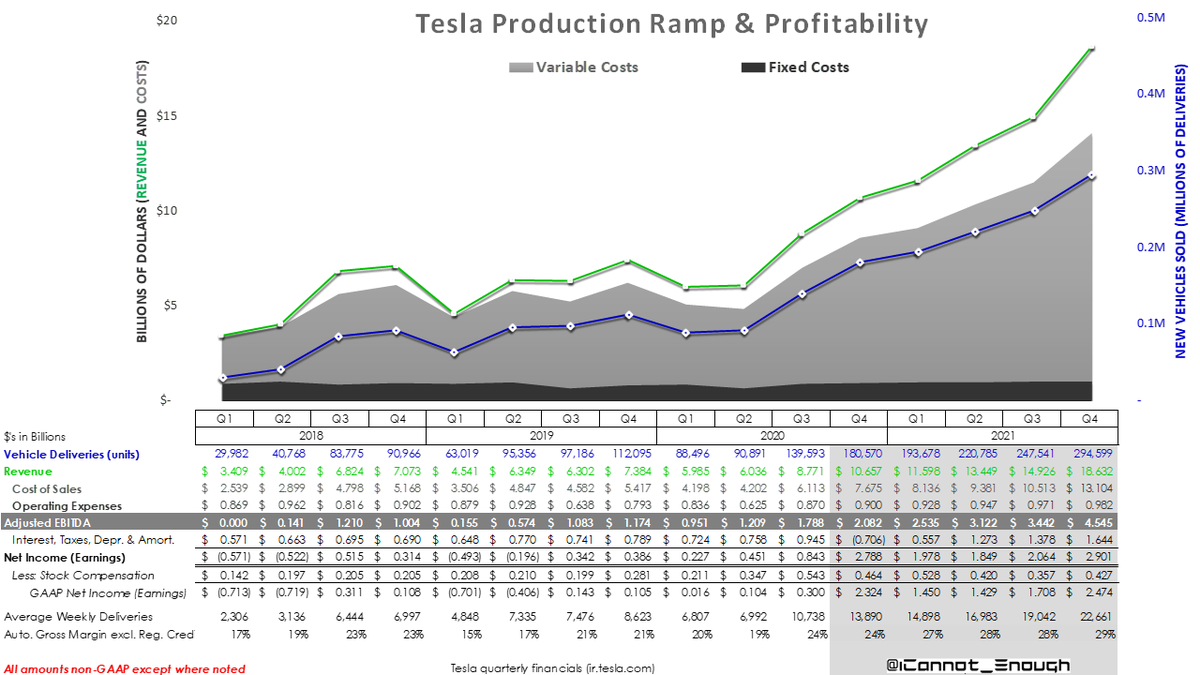

So I looked up all the $TSLA price targets on TipRanks.com along with each analyst's star rating (how good their past predictions have been on a 5-pt scale).

Then I just put them on a bubble chart, weighting each price target by the analyst's rating.

Notice anything?

Then I just put them on a bubble chart, weighting each price target by the analyst's rating.

Notice anything?

Lots of possible takeaways, as with many data visualizations, but the one I'd like to draw your attention to is:

Without exception- *every analyst* who thinks $TSLA ought to be trading above $800/share is an above-average analyst.

Without exception- *every analyst* who thinks $TSLA ought to be trading above $800/share is an above-average analyst.

And- again, without exception- every one of the below-average analysts thinks $TSLA is worth less than $800/share.

Here are the average stock price targets, for the 28 analysts who have one, grouped by ranking:

Bottom Quartile 7 analysts (1-star or worse):

$350

Top Quartile 7 analysts (4.7 stars or better):

$758

The other 14 analysts ranked toward the middle (1-4.7 stars):

$677

Bottom Quartile 7 analysts (1-star or worse):

$350

Top Quartile 7 analysts (4.7 stars or better):

$758

The other 14 analysts ranked toward the middle (1-4.7 stars):

$677

• • •

Missing some Tweet in this thread? You can try to

force a refresh