1/ $INV @InverseFinance (inverse.finance)

- A "Deposit X / Earn Y" yield earning product

- An innovative lending protocol based on a mixed synthetic/credit stable coin

- A star lead dev

- And one of the most active community governances in Crypto...

- A "Deposit X / Earn Y" yield earning product

- An innovative lending protocol based on a mixed synthetic/credit stable coin

- A star lead dev

- And one of the most active community governances in Crypto...

2/ Inverse Finance is one of the most promising projects in #DeFi right now and for good reason.

It is on track to establish itself as a major DeFi primitive after barely 3 months of existence and its founder @NourHaridy counts @AndreCronjeTech among his earliest supporters.

It is on track to establish itself as a major DeFi primitive after barely 3 months of existence and its founder @NourHaridy counts @AndreCronjeTech among his earliest supporters.

3/ Most of CT probably knows $INV as the largest airdrop in crypto history. 80 $INV tokens were sent to early supporters, and were initially non-transferable and to be used for governance only. But as the tokens later became transferable, that airdrop is now worth over $100k pp

4/ But now onto the products. @InverseFinance's first product was a "Deposit X / Earn Y" earnings protocol, which deposits users funds into yield aggregators such as yearn V2 vaults, and automatically converts the earned yield into another crypto of choice.

5/ So if you want to DCA into $ETH without taking market risk on your USD savings, you can deposit $DAI into Inverse Finance and your 20%+ apy returns will be automatically converted to $ETH. Other target tokens available are $WBTC & $YFI, and more will be added over time.

6/ We could call this @InverseFinance’s brilliantly simple product, but they also have a mind-bendingly innovative one to go with it. And that would be the Anchor Protocol, a new lending protocol based on a mixed synthetic / credit stable coin, $DOLA.

7/Currently there are 2 kinds of lending protocols. Protocols like @MakerDAO where you deposit collateral and receive a synthetic stable coin in exchange. Or protocols such as @compoundfinance, where you deposit collateral and get a certain USD equiv amount of “borrowing credit"

8/ But on Maker you cannot use your DAI as collateral to take loans on other assets, and on Compound your borrowing credit is not a transferable stable coin that you can spend as you please. So with $DOLA, Anchor is offering both: a borrowing credit, and a synthetic stable coin.

9/This means you can deposit $ETH to borrow $DOLA and either spend this $DOLA elsewhere or use it as collateral to take out loans in other assets, all while earning yield on your $ETH collateral. Currently the only available assets are $ETH and $DOLA, but the list will grow soon

10/ As a last piece of the puzzle, $INV tokens can serve as a backstop for $DOLA within Anchor (similar to $MKR), which opens the door to under collateralised lending and the issuance of $DOLA for protocol to protocol lending, similar to the Iron Bank’s solution.

11/ One crazy side effect of this, which the team dubs “Whale Extractable Value”, is that Inverse DAO could lend itself DOLA with no collateral and use it to swap into other stables (through @CurveFinance) or assets (through Anchor), and earn yield on them on other protocols.

12/ At the end, the process would be reversed and the $DOLA burned, while the yield earned goes to Inverse’s treasury, or to improve the Inverse vaults’ yields.

During all this, $INV tokens would be acting as backstop for the newly issued $DOLA.

During all this, $INV tokens would be acting as backstop for the newly issued $DOLA.

13/ While the above is far from covering all the possibilities created by Anchor / $DOLA / $INV, we can see how in barely 3 months @InverseFinance has already released two major products that should greatly contribute to improving flexibility and capital efficiency across #DeFi

14/ This is also a project that takes governance very seriously, to the point of seizing airdropped tokens from holders that were inactive on governance (before tokens became transferable), and they have reached a record level of 74% participation in a recent governance vote.

15/Now on the $INV token itself. At its core, $INV is a governance token. This is evidenced by the early decision to make it non-transferable (it became transferable later following a governance decision), and by the fact there isn’t yet any $INV liq farming or staking available

16/ This is a token you are supposed to hold and use for governance voting. But governance here has real power. It decides on the use of over half of the $INV supply, that is yet to go into circulation, and of all protocol revenues (10% performance fee on vault returns).

17/ For instance, there are talks within the community on the possibility of implementing staking of $INV tokens to receive a share of the platform’s revenues. If governance approves something like this, the impact on the $INV tokens valuation would be material to say the least.

18/ In addition, with the launch of Anchor Protocol and $DOLA, some new utilities for $INV have started to emerge, such as acting as a backstop for under-collateralised $DOLA issuance, and being accepted as collateral on Anchor for borrowing $DOLA.

19/ In terms of farming opportunities, currently $INV rewards are given to stakers of ETH/DOLA LP tokens (approx. 120% APY), as a way to incentivise $DOLA liquidity and help it maintain its 1$ peg, and soon $INV rewards will also be given to borrowers and lenders on Anchor.

20/ The max supply of $INV is 100,000 tokens, with 38.4% currently in circulation. 53.7% of the supply is in the DAO treasury, 7.3% are the dev’s allocation (vesting over 2y) and the remaining 0.6% are already assigned to ETH-DOLA LP rewards.

21 / New tokens may be minted in addition to the current 100k supply, with minting limited to 4% max per year / 1% per quarter. However this will be subject to governance voting, and with 53.7% of the supply still not released, any such supply increase should still be far off.

22/ In terms of roadmap, as mentioned before it will soon be possible to use $INV as collateral to borrow on Anchor, and lenders and borrowers on Anchor will soon earn $INV rewards. Additional assets will also be added both on Anchor and on their Deposit X / Earn Y product.

23/ Over the past week alone, $INV has been added as approved collateral on @CreamdotFinance and @RulerProtocol, and $INV price feed has been added to the Unicode Keep3r oracle (managed by @AndreCronjeTech).

Inverse has also been added to @CoverProtocol since Dec 2020.

Inverse has also been added to @CoverProtocol since Dec 2020.

24/ This shows how quickly $INV is being integrated and supported by major platforms in the #DeFi space. At a $45M market cap, I am sure this is just the beginning for $INV, as Inverse Finance quickly becomes one of the essential pieces in the #DeFi money lego toolkit.

25/ A few links:

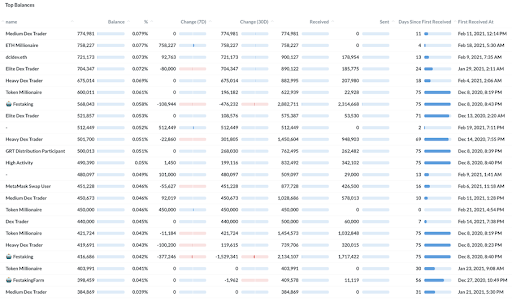

- Dune analytics stats: duneanalytics.com/naoufel/invers…

- Anchor presentation: medium.com/inversefinance…

- Discord (which is where most of the action happens): discord.com/invite/YpYJC7R…

- @NourHaridy interview on @Cointelegraph: cointelegraph.com/news/a-lifetim…

- Dune analytics stats: duneanalytics.com/naoufel/invers…

- Anchor presentation: medium.com/inversefinance…

- Discord (which is where most of the action happens): discord.com/invite/YpYJC7R…

- @NourHaridy interview on @Cointelegraph: cointelegraph.com/news/a-lifetim…

FYI: I didn’t get the airdrop and have probably bought someone's bag at the local top, but that’s okay!

• • •

Missing some Tweet in this thread? You can try to

force a refresh