1/ $WAULT, wault.finance, @Wault_Finance

Here is one of the most legit projects on Binance Smart Chain #BSC, working to bring much needed products to the ecosystem...

h/t @AlgodTrading

Here is one of the most legit projects on Binance Smart Chain #BSC, working to bring much needed products to the ecosystem...

h/t @AlgodTrading

2/ $WAULT is going to offer a full suite of DeFi products on BSC: yield aggregator, AMM DEX, lending platform, staking/liquidity mining, Wault LaunchPad, Wault Locker, an elastic supply stable coin, and “Dextools” for BSC....

3/ Essentially developing the tools that are needed for the BSC DeFi ecosystem to mature and become safer for investors; and these are not far-away goals.

These tools are in active development and $WAULT is dropping new announcements almost daily!

These tools are in active development and $WAULT is dropping new announcements almost daily!

4/ The latest announcements were on the release of Wault LaunchPad (helping projects hold their pre/private sales through Wault), and Wault Locker (a Unicrypt-like tool to ensure raised funds and tokens are locked as intended). In short, Wault will help rug-proof BSC.

5/ Liquidity mining pools and $WAULT staking are already live, and next in line will be their flagship product: yield optimization Vaults, which will invest the users funds across different DeFi platforms shifting funds automatically to seek the best returns.

6/ In Q2 Wault will release an elastic supply stable token, $WOLD, that will be used as collateral for their yield optimisation and lending platforms.

In Q3, they will release their own AMM Dex to compete with @PancakeSwap, and in Q4 their own lending platform.

In Q3, they will release their own AMM Dex to compete with @PancakeSwap, and in Q4 their own lending platform.

7/ Another point that makes $Wault stand out from other BSC projects is its focus on security. Not only have their smart contracts been audited by @certikorg, but they are working on solutions to make other project launches safer.

8/ $WAULT is the platform’s governance token (governance will be fully transferred to the community by the end of Q1), which also allows holders to earn staking rewards incl. part of the liq mining supply, platform revenues and token inactivity fees (more on that later).

9/ The max supply of $WAULT is 1M, with 50% reserved for liquidity mining and staking rewards, 24% sold in private + public sales, 17% for initial exchange liquidity and market makers, 4% for marketing and treasury, 3% for the team (locked for 3m), and 2% for bug bounties.

10/ Staking & liquidity mining incentives will be distributed over the first 80 days, starting Feb 23rd, with 50% in the first 10 days, 25% over the following 10, and so on w/ distribution halving every 10 days.

11/ As mentioned above, $WAULT also has an “inactivity fee” where for every transaction on the token, 0.8% of the tx amount is deducted from the combined group of inactive wallets (wallets that aren’t staking or providing liquidity) and redistributed as LP & staking rewards.

12/ This inactivity fee was initially an unintended consequence of porting the project code from Ethereum to BSC, but the team decided to maintain it as a useful feature to incentivise token holders to participate in the network.

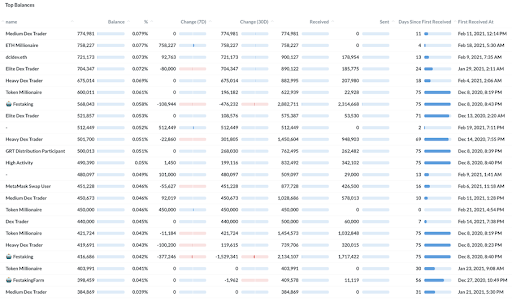

13/ The project launch on Feb 23rd was a success, with over $16.7M in TVL right after launch, and token price rising from the listing price of $1.30 to a high of $44 in the first 24h.

Current price is $31 with a $10M MCap, and FDV of $31M.

Current price is $31 with a $10M MCap, and FDV of $31M.

14/ An idea of $WAULT's potential upside can be formed when considering it's closest competitor is $AUTO with a $61M MCap and $366M FDV.

15/ Wault’s main dev (@CreppyDe on TG) is anon but doxed for the @certik_io team. He is very present on the project’s TG, whilst making new medium articles and announcements nonstop. He is also the main dev of Bas3r, which will potentially be integrated into the Wault ecosystem.

16/ Finally, following the successful project launch the team have announced that 8 new devs have joined the project, meaning even faster development and more product announcements coming soon...

17/ Some useful links for those wishing to dig deeper:

- Wault app: app.wault.finance

- Project Litepaper: wault.finance/litepaper/

- Wault Locker announcement: waultfinance.medium.com/wault-locker-a…

- Wault app: app.wault.finance

- Project Litepaper: wault.finance/litepaper/

- Wault Locker announcement: waultfinance.medium.com/wault-locker-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh