1/7

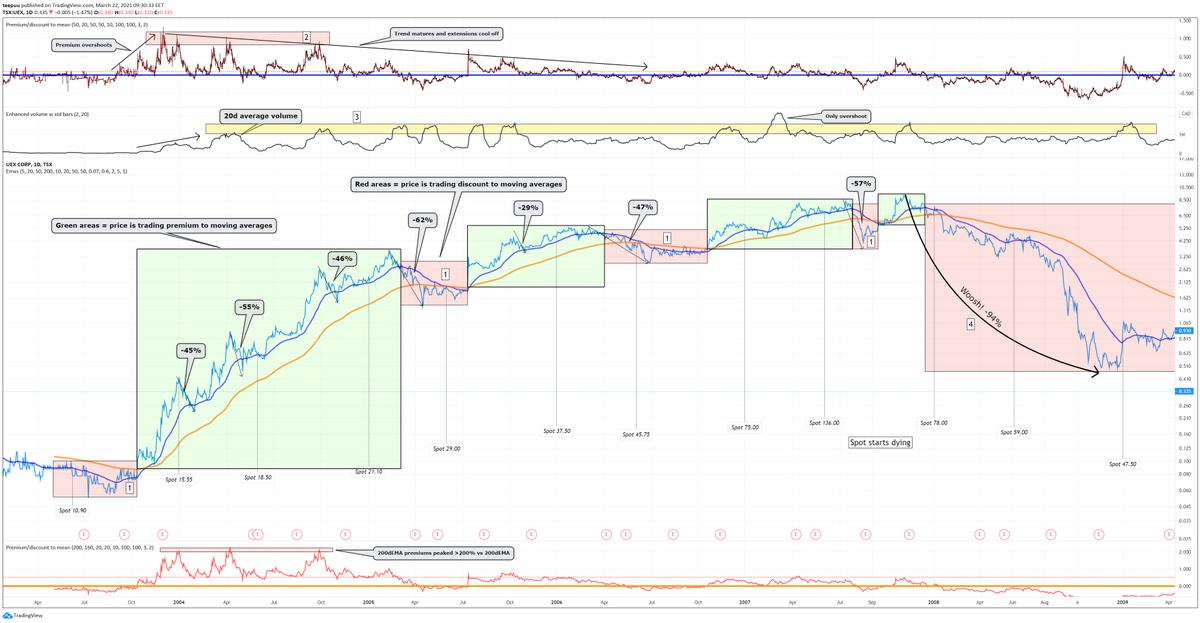

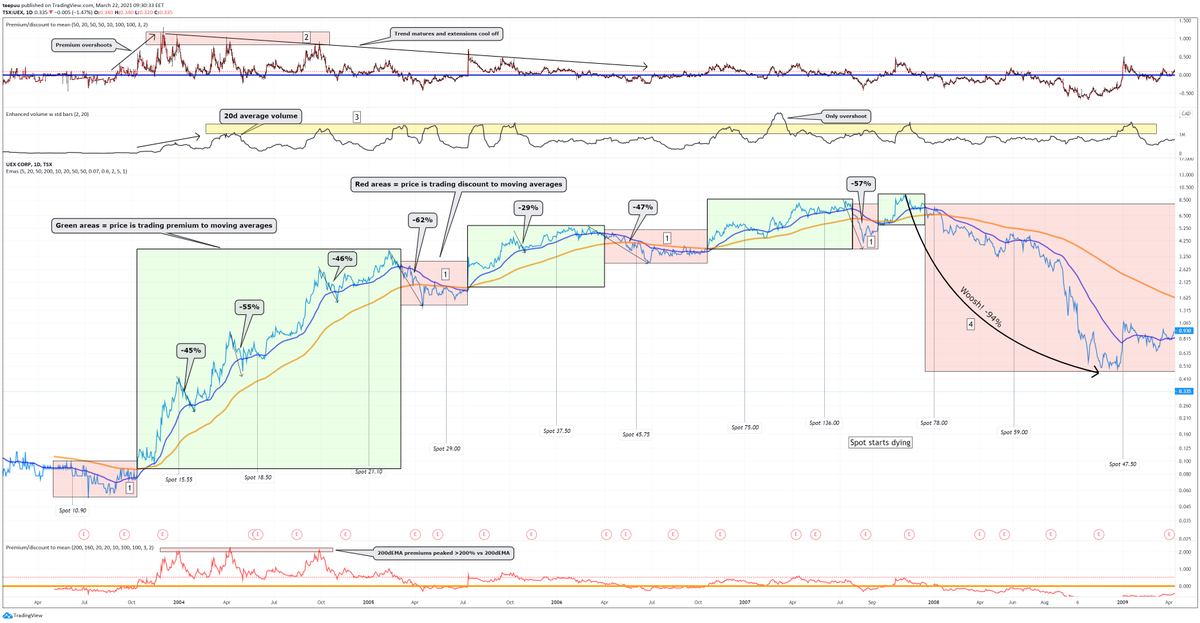

Let's take a look on $UEX price action history from the last great #uranium bull market.

Note how any discounts(1) to 50 & 200dEMA would have been affordable to buy until the spot started dying.

Let's take a look on $UEX price action history from the last great #uranium bull market.

Note how any discounts(1) to 50 & 200dEMA would have been affordable to buy until the spot started dying.

2/7

When a #uranium stock moves, it tends to stay above its means, pushing extension to mean(2) very high, in case of $UEX all the way to 80-120% premium vs 50dEMA.

When a #uranium stock moves, it tends to stay above its means, pushing extension to mean(2) very high, in case of $UEX all the way to 80-120% premium vs 50dEMA.

3/7

At the start of the trend the 20 day volume of the stock (3) increased substantially but as the trend matures, the 20d volume stays in the range of 1-1.5M shares, with only one overshoot on the way.

At the start of the trend the 20 day volume of the stock (3) increased substantially but as the trend matures, the 20d volume stays in the range of 1-1.5M shares, with only one overshoot on the way.

4/7

I marked 7 corrections on the way avg -48%. When these happen, think for it yourself, are you going to be able to hold on for POSSIBLE higher prices?

My a lot questioned way of trading my LT positions is based on these corrections.

I marked 7 corrections on the way avg -48%. When these happen, think for it yourself, are you going to be able to hold on for POSSIBLE higher prices?

My a lot questioned way of trading my LT positions is based on these corrections.

5/7

Opportunity cost on trying to time this magnitude of a correction is eventually quite small compared to the possible benefit (no advice though). And you never know, when a correction... ->

Opportunity cost on trying to time this magnitude of a correction is eventually quite small compared to the possible benefit (no advice though). And you never know, when a correction... ->

6/7

...will be ultimately the one that won't rally anymore, as when these stocks go, they really go... (4).

...will be ultimately the one that won't rally anymore, as when these stocks go, they really go... (4).

7/7

I'm not saying we're seeing same kind of price in $UEX this time, but maybe we'll in some other company which is now in same situation UEX was back then.

I'm not saying we're seeing same kind of price in $UEX this time, but maybe we'll in some other company which is now in same situation UEX was back then.

• • •

Missing some Tweet in this thread? You can try to

force a refresh