AFC Bournemouth’s 2019/20 financial results covered a season when they finished 18th, resulting in relegation to the Championship after five years in the Premier League. Finances were significantly impacted by the COVID-19 pandemic. Some thoughts in the following thread #AFCB

#AFCB loss almost doubled from £32m to a club record £60m, largely due to revenue dropping £36m (27%) from £131m to £95m, partly offset by profit on player sales rising £20m to £23m. Expenses increased £8m, while other operating income (mainly player loans) fell £1m to £7m.

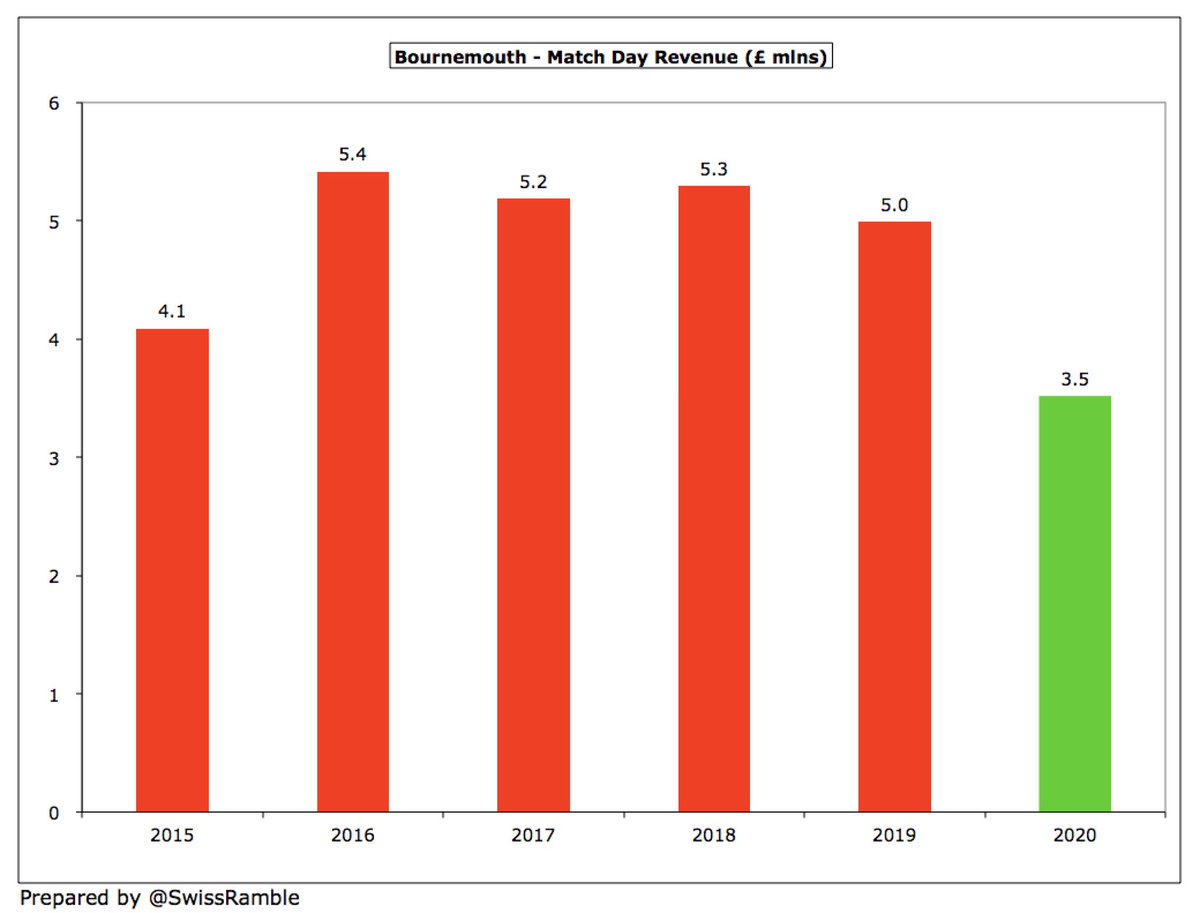

#AFCB revenue decrease was mainly attributable to COVID, which contributed to broadcasting falling £35m (30%) from £116m to £81m, though match day was also down £1.5m (29%) from £5.0m to £3.5m. These reductions were partly compensated by commercial rising £1m (9%) to £11m.

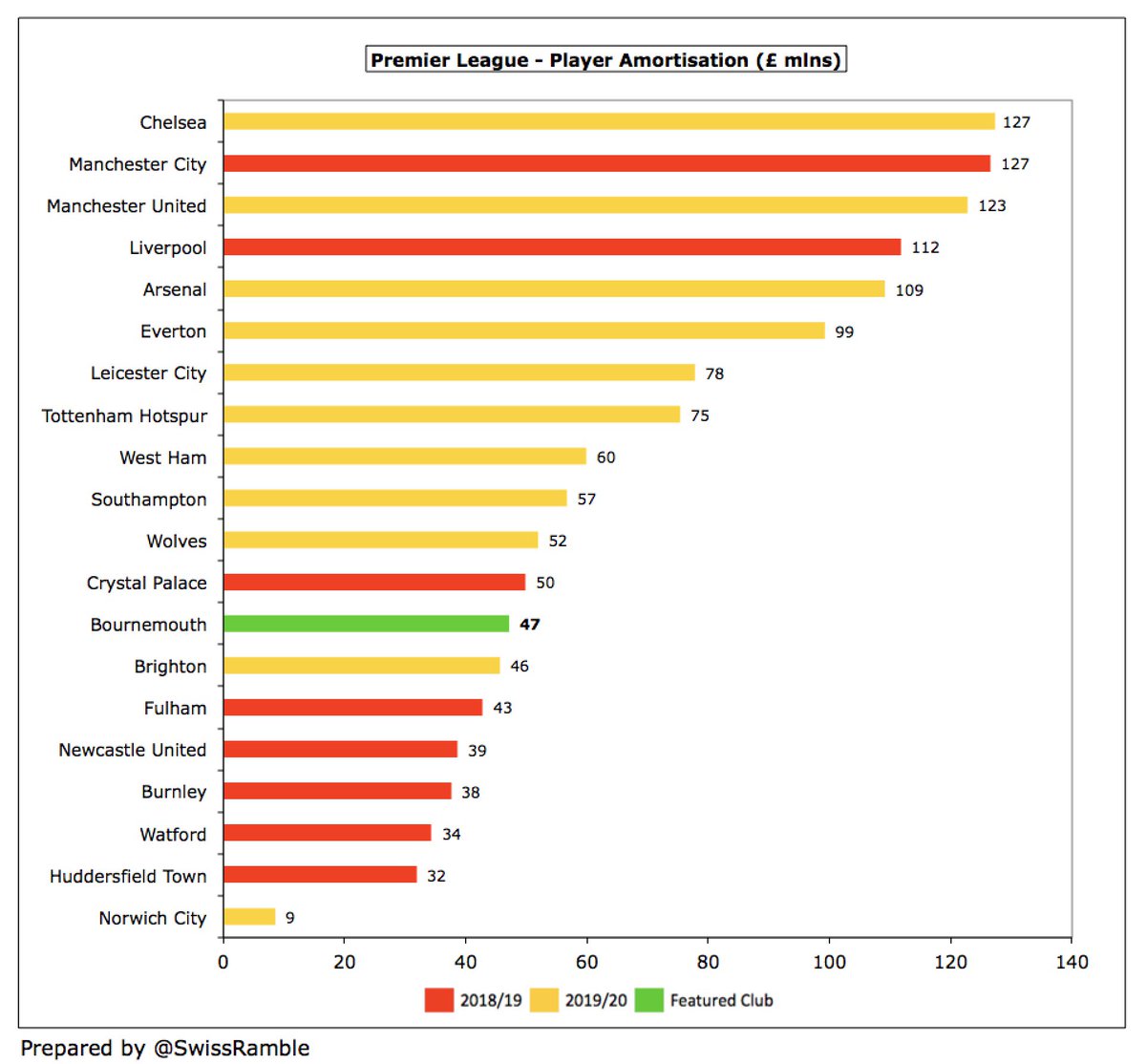

#AFCB investment in the squad saw player amortisation increase £11m (30%) from £36m to £47m, though the wage bill was down £3m (3%) from £111m to £108m. Other expenses were flat at £21m, but net interest payable rose £3m (52%) from £5m to £8m.

All clubs have been adversely impacted by COVID in 2019/20, so #AFCB £60m loss is far from unusual with no fewer than 8 clubs posting losses above £50m, the others being #EFC £140m, #SaintsFC £76m, #THFC £68m, #LCFC £67m, #BHAFC £67m, #WHUFC £65m and #AFC £54m.

Without COVID, #AFCB revenue can be estimated as £25m higher at £121m (8% less than 2019), as £18m broadcasting deferred to 2020/21 and £7m foregone (TV rebate £6m, match day £1m), meaning the club would have posted a £35m loss, around the same as prior year.

#AFCB profit on player sales increased from £3m to £23m, mainly Tyrone Mings to #AVFC and Lys Mousset to #SUFC. Still only mid-table in the top flight, but would have been much higher if the summer 2020 transfer window had not been delayed due to COVID.

#AFCB have now reported losses three years in a row, amounting to £103m, having made money in their first two seasons in the Premier League. Before that they posted 4 consecutive years of losses, including a hefty £39m deficit in the 2014/15 promotion season.

The sizeable loss in 2014/15 was partly due to £10m exceptional items, including a £7.6m provision for a Financial Fair Play settlement with the EFL (subsequently reduced to £4.75m in 2018). There have been no such charges in the last two years.

#AFCB have traditionally made little money from player sales, so £23m in 2019/20 is by far their record high. Even this will be comfortably surpassed this season with £51m profit, due to the sales of Nathan Aké to #MCFC, Callum Wilson to #NUFC and Aaron Ramsdale to #SUFC.

#AFCB EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £7m to £(26)m. This is actually the second worst in the Premier League, though may look better when all clubs publish 2019/20 accounts.

#AFCB operating loss (i.e. excluding player sales and interest) more than doubled from £30m to £75m, a huge decline from £17m profit 3 years ago. However, this is by no means the highest in the top flight with 3 clubs’ losses over £100m: #EFC £175m, #LCFC £122m and #CFC £112m.

This is the third year in a row that #AFCB revenue has fallen, from £136m in 2017 to £95m in 2020, largely due to broadcasting (still 85% of total revenue). This season will again be lower, despite £42m parachute payments and £18m TV money deferred from 2019/20.

#AFCB £95m revenue is the lowest reported to date in the 2019/20 Premier League, a fair way behind #NCFC £119m, though most clubs would classify £7m other operating income (mainly player loans) as revenue, bringing the total up to £102m. For context, less than 20% of top three.

All Premier League clubs’ revenue is down in 2019/20, due to the pandemic impact, though #AFCB 27% reduction is the highest in the Premier League ( though larger clubs are higher in absolute terms). #EFC small 1% decrease is due to once-off £30m for stadium naming rights option.

#AFCB broadcasting income fell £35m (30%) from £116m to £81m, due to £18m revenue from 7 games slipping to 2020/21 accounts and £6m rebate to broadcasters, plus £11m lower merit payment for finishing 18th. Others will see similar falls when they publish 2019/20 accounts.

So #AFCB broadcasting revenue in 2020/21 will benefit from the £18m deferred from 2019/20, as the season was extended beyond the club’s 30th June accounting close. Note: overseas rights now partially split per league position (were previously distributed equally).

Following relegation from the Premier League, #AFCB TV income will fall significantly in 2020/21, albeit cushioned by £42m parachute payment, giving them much higher revenue than most other Championship clubs. Parachutes then fall to £35m (year 2) and £16m (year 3).

#AFCB match day fell £1.5m (29%) from £5.0m to £3.5m, as they played 5 home games behind closed doors due to COVID. Lowest income in the Premier League, due to the small Vitality stadium. For some context, #THFC £95m is 27 times as much after the move to the new stadium.

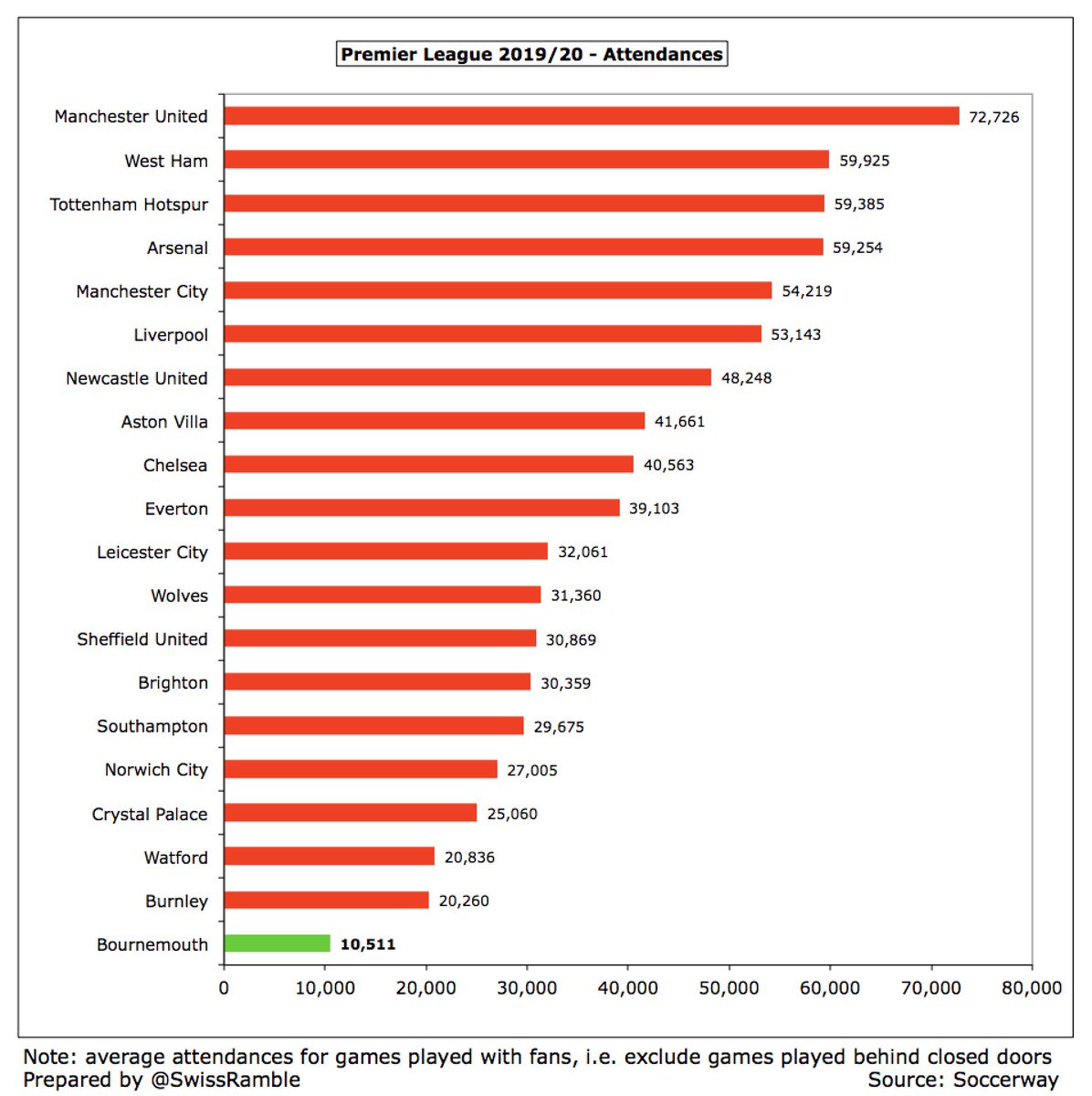

#AFCB average attendance fell slightly from 10,532 to 10,511 (for those games played with fans), so has decreased every season in the premier League from a peak of 11,189 in 2015/16. By some distance the lowest in Premier League, around half the next smallest, Burnley 20,260.

#AFCB commercial income rose £1m (9%) from £10m to £11m, comprising sponsorship & advertising £8.7m, hospitality & events £1.2m, shop merchandise £1.0m and other income £0.2m. Club’s highest ever, but still one of the lowest in the Premier League.

#AFCB ended £5m M88 shirt sponsorship following investigation by the Gambling Commission, replaced by MSP Capital in 2020/21, almost certainly for a lower amount. Also have kit supplier Umbro (5-year deal from 2017), sleeve sponsor Mansion and Vitality Stadium naming rights.

#AFCB wage bill fell £3m (3%) from £111m to £108m, as some senior members of non-playing staff took voluntary pay reductions. Nevertheless wages have risen £36m (51%) in the last three years, even though revenue has fallen £41m (30%) in the same period.

As a result, #AFCB £108m wage bill was 12th highest in the Premier League, a lot higher than most would expect, due to offering “competitive remuneration packages” suitable for a club in the top flight. Will fall in Championship thanks to relegation clauses and player departures.

Due to the revenue fall, #AFCB wages to turnover ratio increased (worsened) from 85% to 113%, the highest in Premier League to date in 2019/20 and the worst in the top flight since QPR’s 129% in 2013. Would have been “only” 89% without COVID revenue loss.

Remuneration for #AFCB highest paid director fell 30% from £1,864k to £1,306k. That’s currently 8th highest in the Premier League, which seems quite steep after relegation, though is much less than the likes of #MUFC Ed Woodward and #THFC Daniel Levy (both more than £3m).

#AFCB player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £11m (30%) from £36m to £47m, up from just £4m in 2015, though still firmly in the bottom half of the Premier League, £80m below big-spending #CFC £127m.

#AFCB spent £39m on player purchases, down from prior year’s club record £94m. Included Philip Billing from #HTAFC, Arnaut Danjuma from Club Brugge, Lloyd Kelly from Bristol City and Jack Stacey from Luton Town. On the low side for the Premier League.

As might be expected, #AFCB gross transfer spend substantially increased in the Premier League, amounting to £268m in the last five years with a net spend of £209m. However, following relegation, they spent hardly anything in the summer 2020 transfer window.

#AFCB gross debt shot up by by £42m from £100m to £142m. The majority (£126m) is owed to the club’s owner Maxim Demin via the Russian’s company AFCB Enterprises Ltd, though club also took out £16m of bank loans in 2019/20.

#AFCB £142m gross debt was 8th largest in the Premier League. This might be considered a little concerning, though it is not really a problem – so long as Demin continues to provide support. This is more important than ever following relegation to the Championship.

The good news for #AFCB is that the owner’s loans are interest-free, which gives them a competitive advantage against many clubs. That said, it is surprising to see no interest paid in the cash flow statement, given the new external loans the club arranged during the year.

#AFCB did manage to cut transfer debt from £81m to £77m, though this is still around twice as much as £38m in 2018. Partly offset by £18m transfer fees owed by other clubs, so net payable is £59m. On the low side for the Premier League, around half #AFC £154m.

#AFCB £75m operating loss improved to £46m negative operating cash flow after adding back £48m amortisation/depreciation, offset by £19m working capital movements. Boosted by £14m net player sales, but mainly funded by £37m new loans (£23m from owner, £14m external).

Since he bought #AFCB, Maxim Demin has put in £153m (£132m loans and £21m share capital). Most of this has been spent on £106m net player purchases, £27m to cover operating losses and £19m infrastructure. £35m construction of new training ground at Canford Magna put on hold.

#AFCB cash balance increased from £10m to £13m. This was still one of the lowest in the Premier League, but was boosted by receiving a net £17m transfer fee upfront after the accounts closed in September, probably for Callum Wilson’s move to #NUFC.

#AFCB did not manage to retain Premier League status, despite spending more than their revenue in the last three years, highlighting the challenges faced by smaller clubs. Their focus will be on a rapid return, but this will be far from easy in the very competitive Championship.

• • •

Missing some Tweet in this thread? You can try to

force a refresh