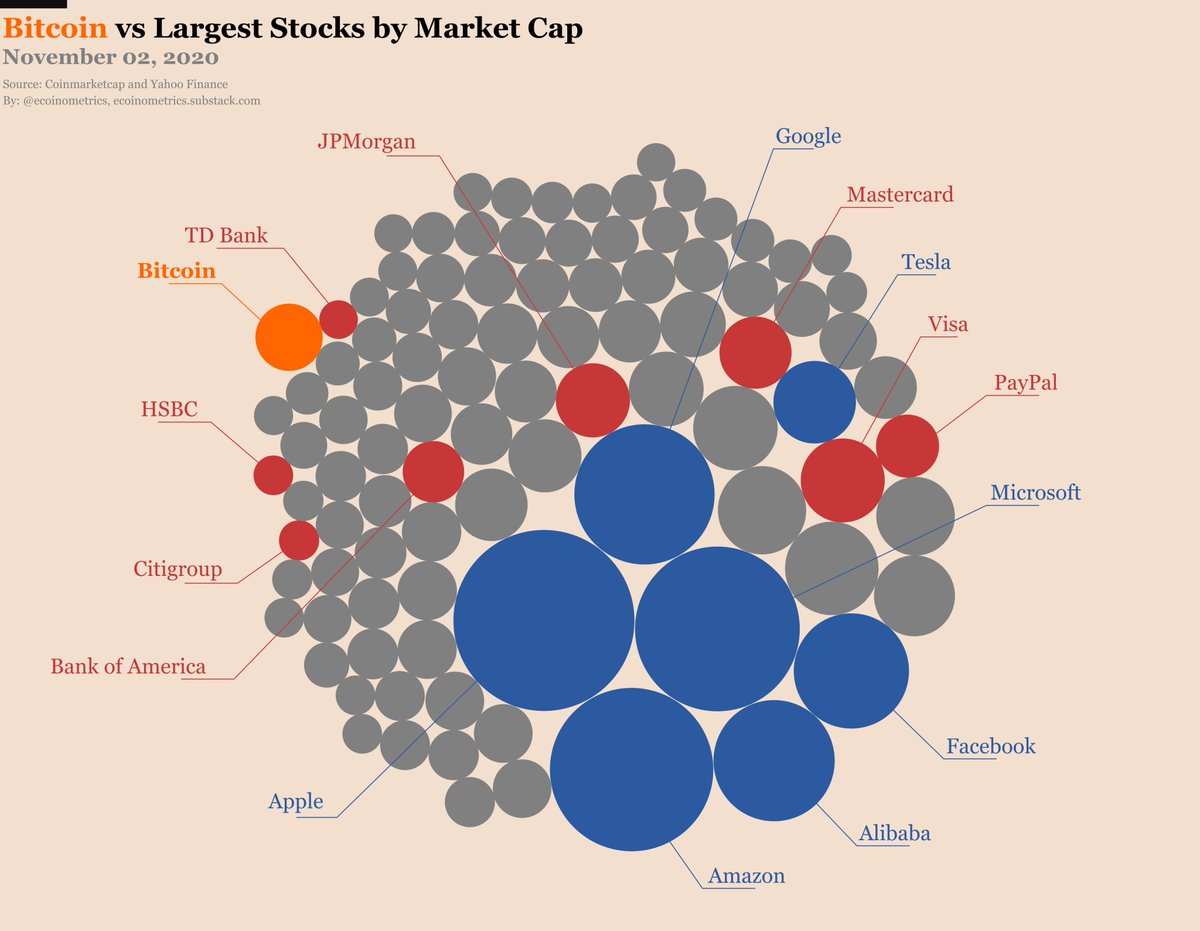

When #Bitcoin hits $110k, its market cap will be larger than Apple. That’s about 2x from the current price.

So how long could it take for #BTC to get there?

Maybe faster than you’d expect...

Time for a thread 🧵👇

So how long could it take for #BTC to get there?

Maybe faster than you’d expect...

Time for a thread 🧵👇

1/ Starting at the time of the halving, how long does it take for #Bitcoin's value to double? Then double again? And again?

The answer is anywhere between 12 days and 300 days each time.

Check it out 👇

The answer is anywhere between 12 days and 300 days each time.

Check it out 👇

2/ So far in this cycle the 1st doubling took 190 days and the 2nd took 50 days.

The next doubling will happen at $74k. We have been waiting for it for 3 months.

The next doubling will happen at $74k. We have been waiting for it for 3 months.

3/ That’s already a hint that price doubling can happen pretty fast.

But the real question is:

If you buy #BTC on any given day, how long can you expect to wait until your investment doubles?

Here is the answer 👇

But the real question is:

If you buy #BTC on any given day, how long can you expect to wait until your investment doubles?

Here is the answer 👇

4/ In the past on average you’ve had to wait a year to see your investment double.

But during bull markets it is much more likely you’ll have to wait only two months for #Bitcoin’s value to double...

But during bull markets it is much more likely you’ll have to wait only two months for #Bitcoin’s value to double...

5/ ... and if you bought around the peak of the bull market or early in the bear market then you might have to wait a full cycle to double your money… so just hodl.

6/ Currently we are still in the first phase of the post halving bull market.

That means we can expect #Bitcoin’s next doubling to happen in a few weeks to a few months.

At this rate we could see Bitcoin flip Apple this year...

That means we can expect #Bitcoin’s next doubling to happen in a few weeks to a few months.

At this rate we could see Bitcoin flip Apple this year...

7/ If you want to learn more about Bitcoin’s market dynamics then go checkout the latest issue of the Ecoinometrics newsletter. 👇

ecoinometrics.substack.com/p/ecoinometric…

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh