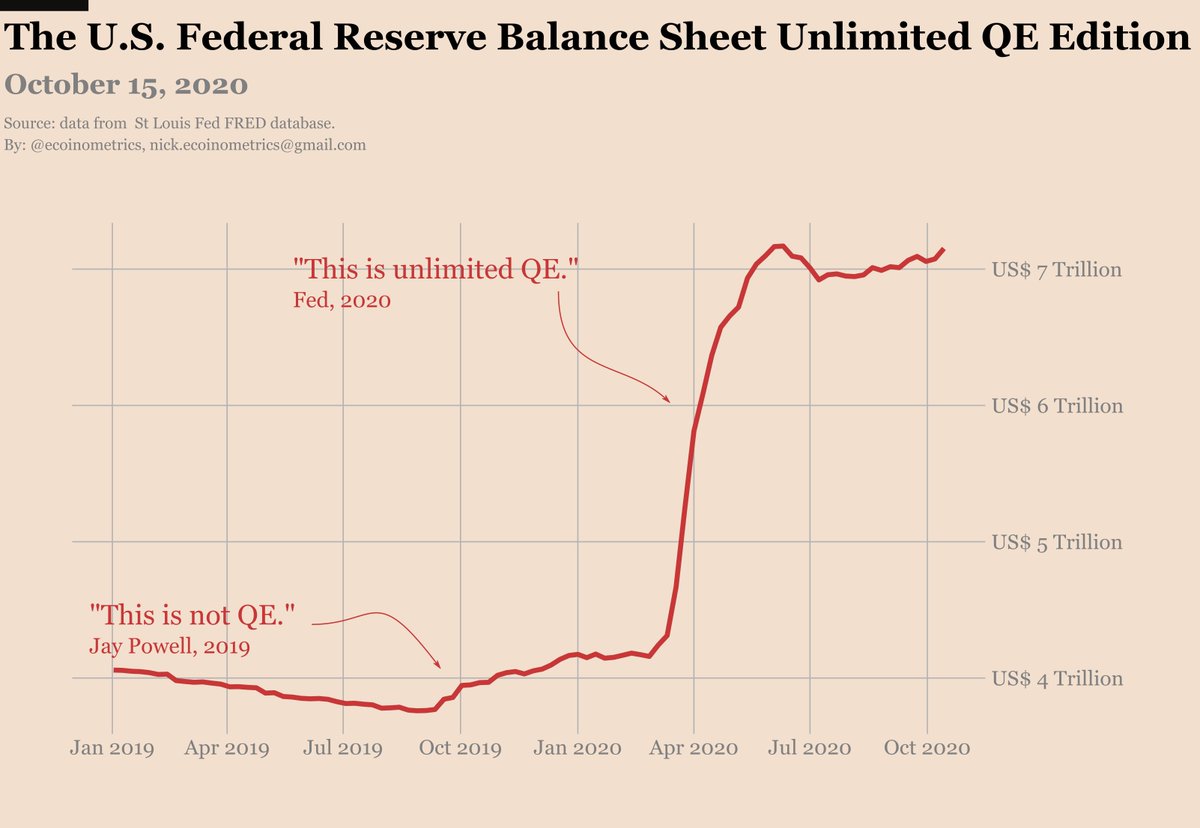

Year to date #Bitcoin has easily outpaced gold in terms of growth.

This trend is accelerating, so naturally it is time for a quick thread 👇👇👇

This trend is accelerating, so naturally it is time for a quick thread 👇👇👇

1/ When you zoom out the long term trend is hard to miss.

But gold is not yet at its lowest point against #Bitcoin.

But gold is not yet at its lowest point against #Bitcoin.

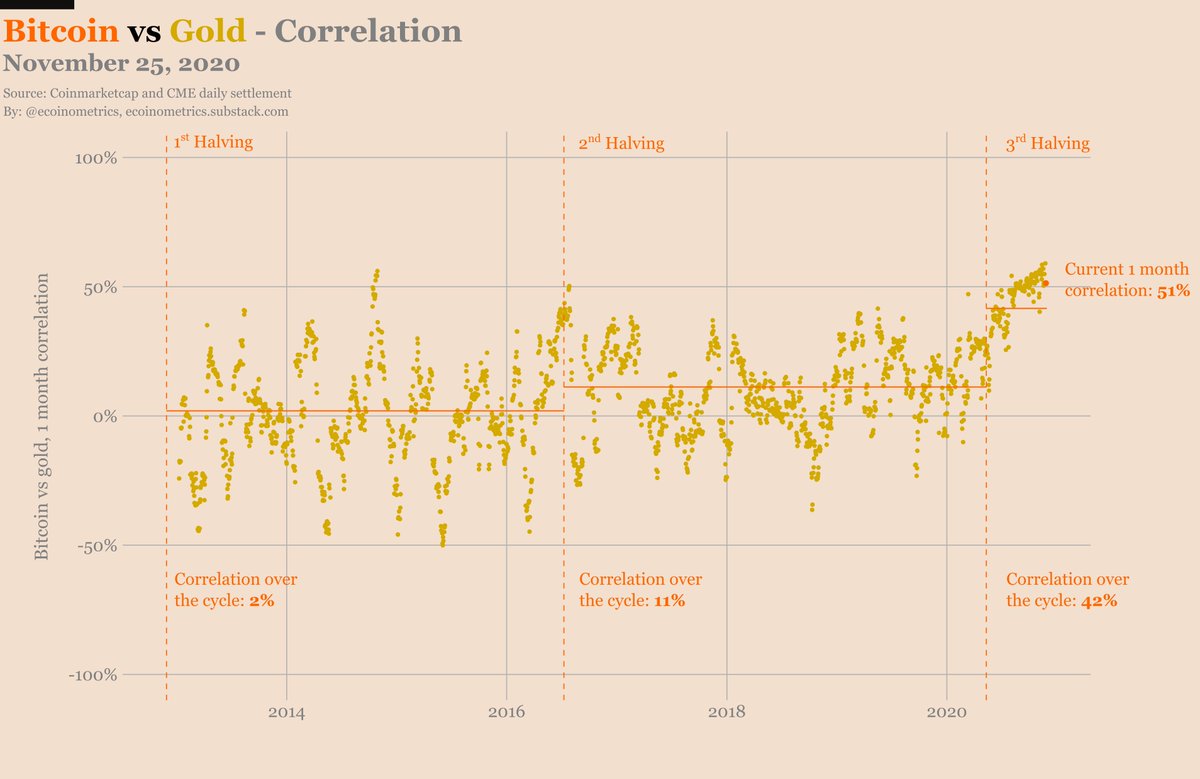

2/ The real #Bitcoin breakout is still recent so the correlation with gold remains high.

But as the trend develops we should see it decrease over time.

But as the trend develops we should see it decrease over time.

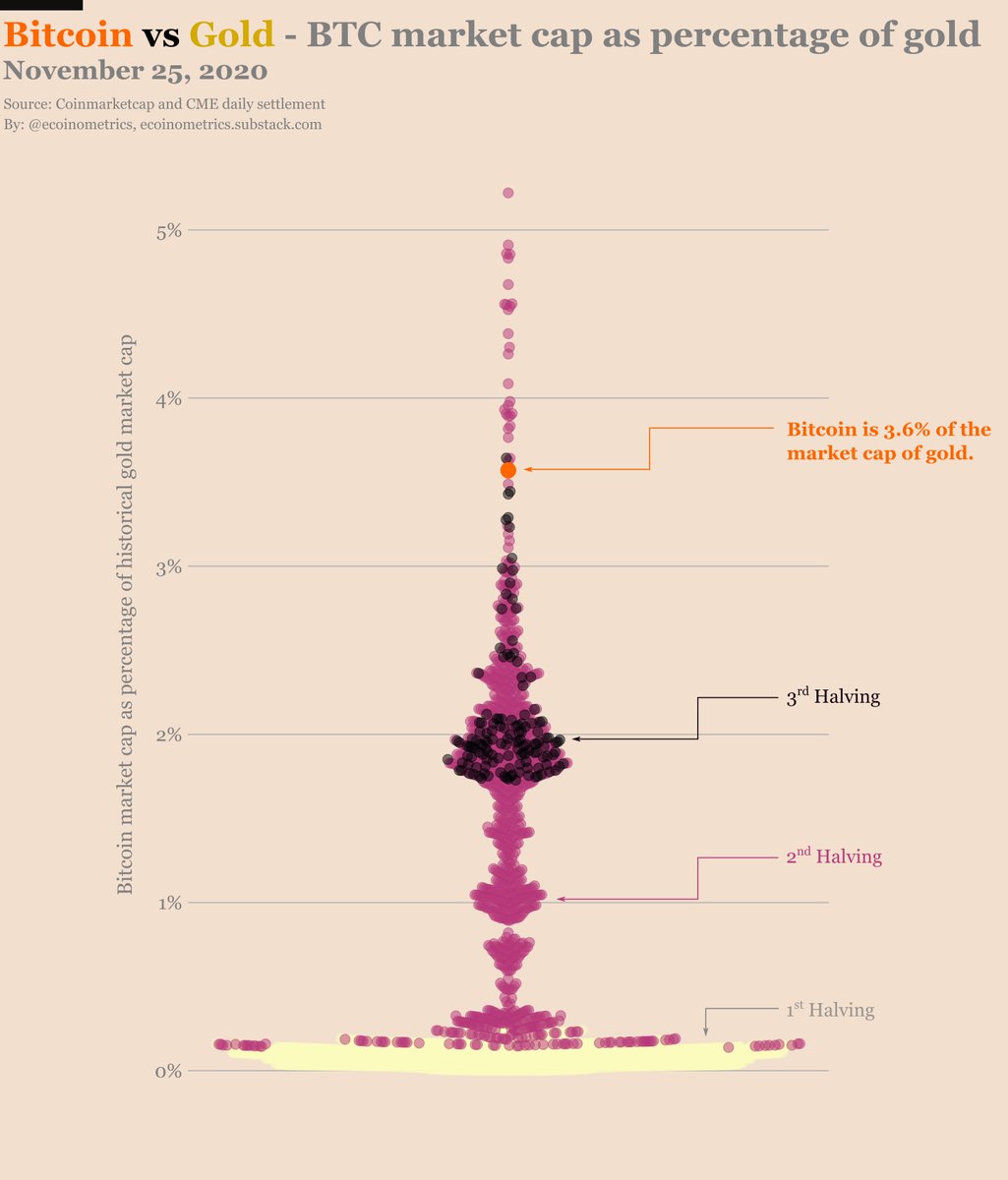

3/ The #Bitcoin market cap continues to grow as a percentage of the gold market.

But at 3.6% of the gold market size #BTC is still short of the 5% top reached during the last cycle.

But at 3.6% of the gold market size #BTC is still short of the 5% top reached during the last cycle.

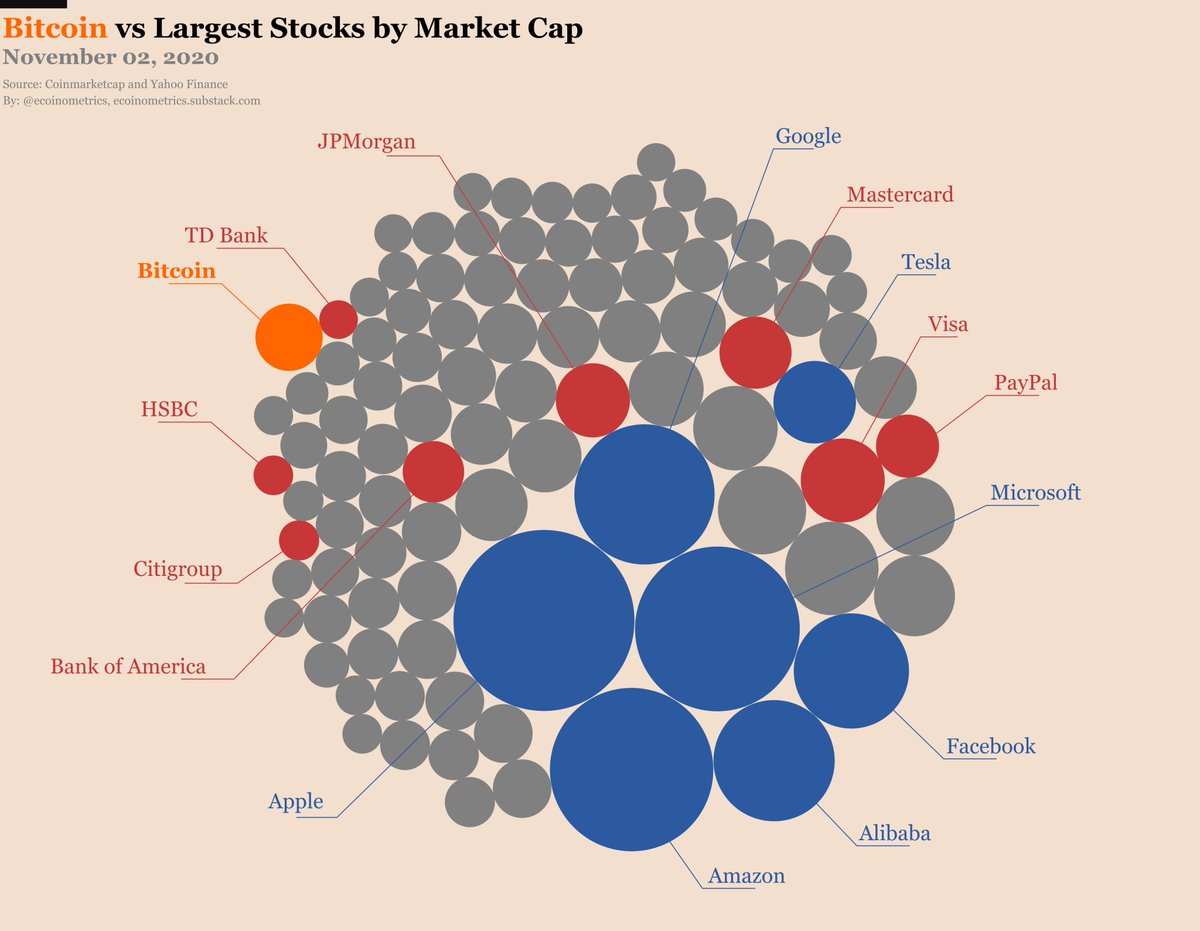

4/ We are only at the start of the exponential growth phase of the 3rd halving.

That means we haven’t seen anything yet…

#BTC 🔥🔥🔥🚀

If you want to learn more about gold vs Bitcoin head over here and subscribe to the Ecoinometrics newsletter.

ecoinometrics.substack.com/p/ecoinometric…

That means we haven’t seen anything yet…

#BTC 🔥🔥🔥🚀

If you want to learn more about gold vs Bitcoin head over here and subscribe to the Ecoinometrics newsletter.

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh