The #Fed Playbook

Oct. 17, 2020

The Federal Reserve is back in business.

So I guess it's time for a thread. 👇👇👇

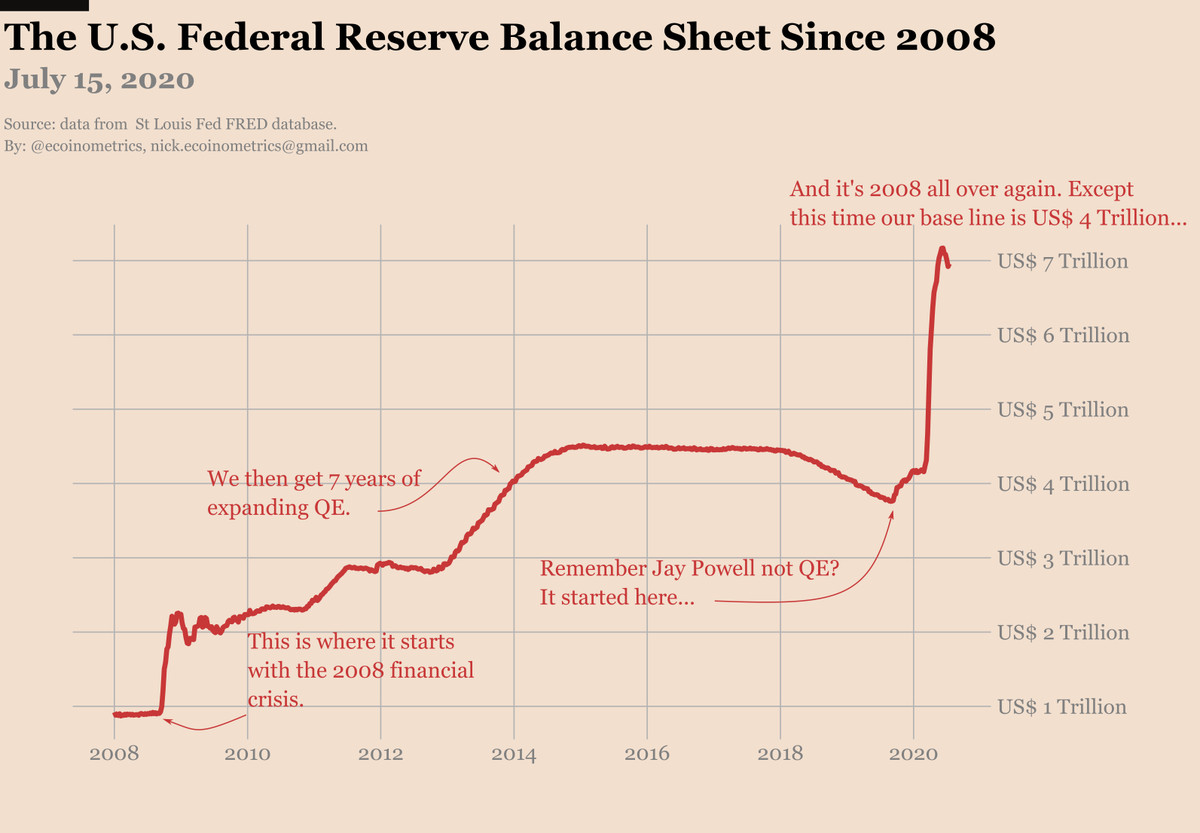

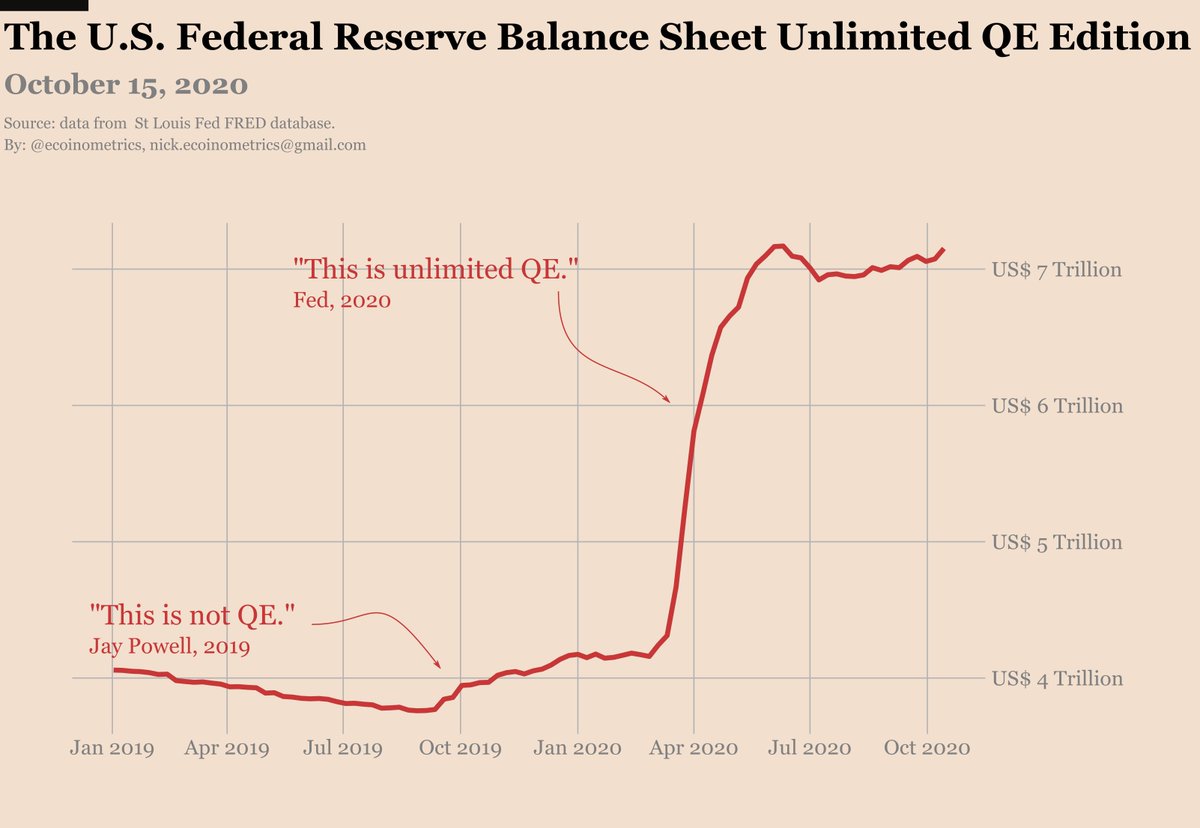

1/ This week the balance sheet stands at $7.15 trillion which is close to its all time high.

But new records are incoming.

Oct. 17, 2020

The Federal Reserve is back in business.

So I guess it's time for a thread. 👇👇👇

1/ This week the balance sheet stands at $7.15 trillion which is close to its all time high.

But new records are incoming.

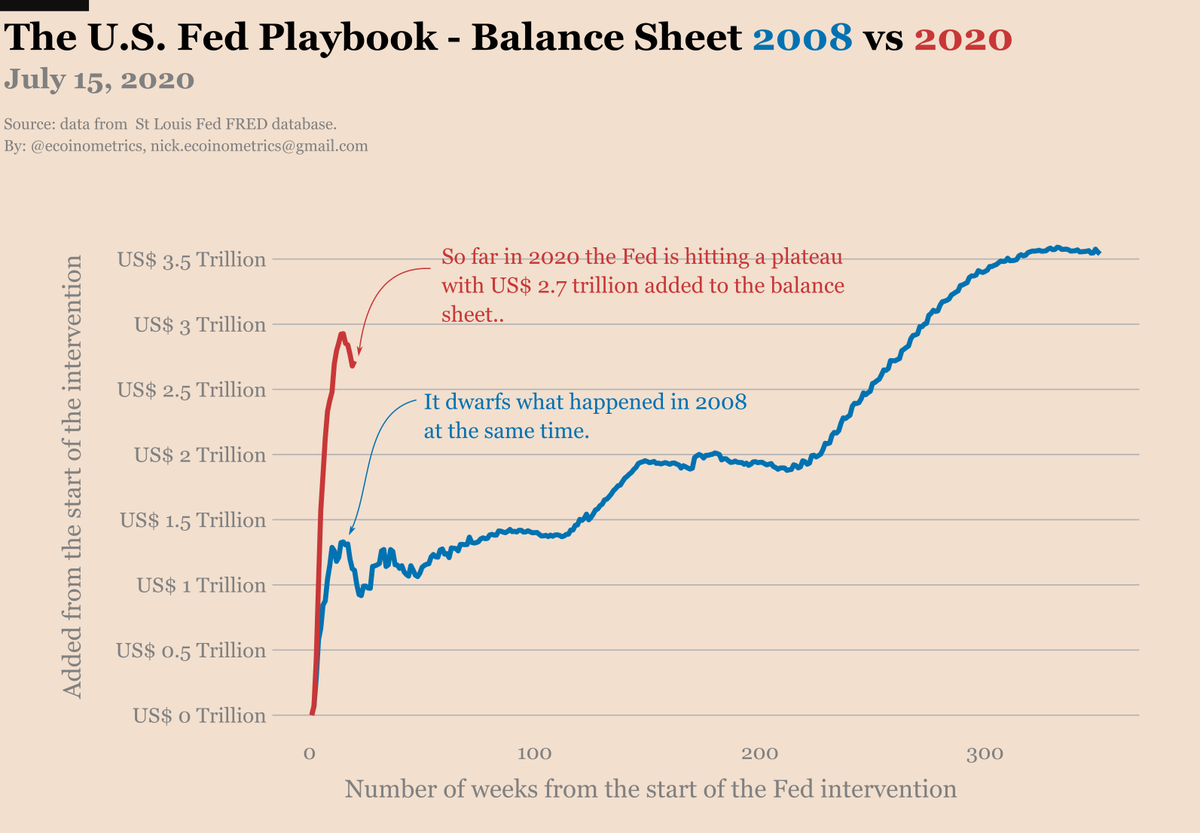

2/ Since the start of the #Fed intervention this year they have added $2.9 trillions to the system.

Looks like a lot but in percentage terms it is a much smaller expansion than in 2008.

Looks like a lot but in percentage terms it is a much smaller expansion than in 2008.

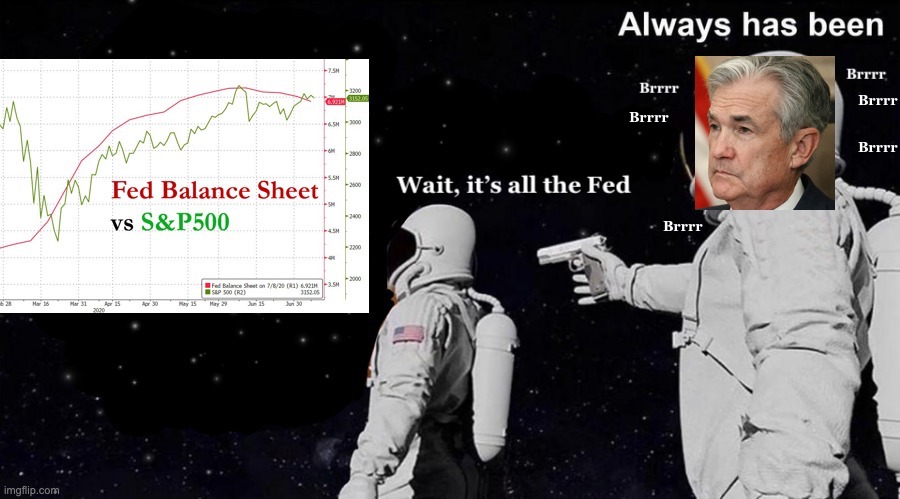

3/ After 2008, all that money added to the system has inflated the valuation of various financial assets but most of all the stock market.

4/ This time is more of the same except that we have a new tool on our side: Bitcoin!

Problems: #FOMC #QE #CentralBanks

Solution: #Bitcoin

Problems: #FOMC #QE #CentralBanks

Solution: #Bitcoin

5/ #Bitcoin is a store of value, a hedge against inflation and an asymmetric bet.

Going by its current market cap it has the potential to grow 10x to 50x in the next decade in order to just catch up with gold.

Going by its current market cap it has the potential to grow 10x to 50x in the next decade in order to just catch up with gold.

6/ #Bitcoin is the asset that is most likely to be able to keep up with the expansion of the Fed in the years to come.

Public companies are waking up to that with @MicroStrategy and @Square leading the way.

Don't miss the boat.

ecoinometrics.substack.com/p/ecoinometric…

Public companies are waking up to that with @MicroStrategy and @Square leading the way.

Don't miss the boat.

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh