1/ as crypto markets continue to rally, a few observations on the funding landscape

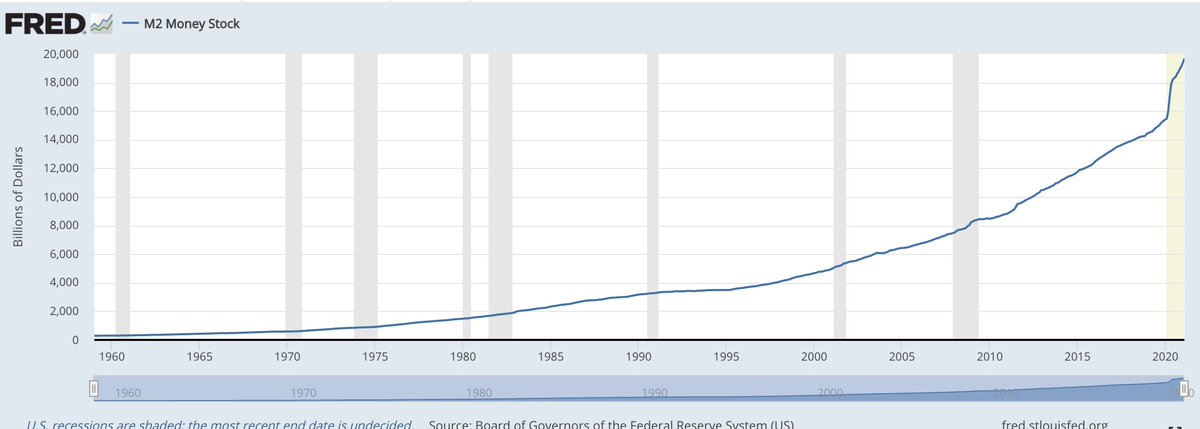

it continues to change *dramatically* as more capital floods into the space and more individuals in crypto become institutions in their own right

as they say, mo' money, mo' problems...

it continues to change *dramatically* as more capital floods into the space and more individuals in crypto become institutions in their own right

as they say, mo' money, mo' problems...

2/ the smartest founders i know are designing their own round.

they start with an idea of what type of folks they want on the cap table and what they need help with.

they then work with existing investors, like me, to fill out the round and curate the best group possible.

they start with an idea of what type of folks they want on the cap table and what they need help with.

they then work with existing investors, like me, to fill out the round and curate the best group possible.

3/ founders want builders, not LARPers

i see crypto founders, operators, and execs on cap tables, especially in the early stages

some have become prop firms ie @cmsholdings @nascentxyz @sinoglobalcap and some are prolific angels @theklineventure @rleshner @StaniKulechov

i see crypto founders, operators, and execs on cap tables, especially in the early stages

some have become prop firms ie @cmsholdings @nascentxyz @sinoglobalcap and some are prolific angels @theklineventure @rleshner @StaniKulechov

4/ funds are still a very mixed bag, and still in the early years of building their platform.

no fund has a big platform team... yet, outside @a16z whose platform is more traditional VC than crypto, but smart funds are investing in developing specific core platform competencies

no fund has a big platform team... yet, outside @a16z whose platform is more traditional VC than crypto, but smart funds are investing in developing specific core platform competencies

5/ in crypto VC, "platform" is hard to define since a protocol has v different needs than a co.

funds tend to be under-staffed and over-allocated, with 1 person covering 20-30 deals.

a $100M fund writing $1-2M checks just can't make the economics work, yet.

funds tend to be under-staffed and over-allocated, with 1 person covering 20-30 deals.

a $100M fund writing $1-2M checks just can't make the economics work, yet.

6/ some funds are really differentiating themselves. in both good and bad ways!

the best investors tend to be angels and prop firms because they have more skin in the game bc its their capital... and they don't need to fundraise or do investment by consensus!

the best investors tend to be angels and prop firms because they have more skin in the game bc its their capital... and they don't need to fundraise or do investment by consensus!

7/ i spent 3 years building platform at @DCGco for 150+ companies and it was insanely hard. also worked on the @VCPlatform community with @br_ttany @dfkoz @mariabrw @jerseejess @steph_manning07 and dozens of other NY VCs

it's now a huge community vcplatform.com

it's now a huge community vcplatform.com

8/ i'm excited to see platform and "value add" evolve in the crypto space beyond "put logo on page"

founders - if you want to talk about your round, hit up my team @CoinSharesCo - investments@coinshares.com

investors - please invest in platform! show your portfolio some love!

founders - if you want to talk about your round, hit up my team @CoinSharesCo - investments@coinshares.com

investors - please invest in platform! show your portfolio some love!

9/ lastly, the rise of *individuals as institutions* is tremendously exciting and introduces a whole new dynamic to the investing landscape

@naval @chamath @DavidSacks @Jason and others created the blueprint

a new generation of investors is taking it to the next level w crypto

@naval @chamath @DavidSacks @Jason and others created the blueprint

a new generation of investors is taking it to the next level w crypto

• • •

Missing some Tweet in this thread? You can try to

force a refresh