A classic early sign of a commodity cycle.

Mining industry nonfarm payrolls near historical lows.

This happened in early 1970s & 2000s.

Both marked the onset of a commodities bull market.

Labor & capital constraints are the amplifiers of bull market in resource stocks.

👇👇👇

Mining industry nonfarm payrolls near historical lows.

This happened in early 1970s & 2000s.

Both marked the onset of a commodities bull market.

Labor & capital constraints are the amplifiers of bull market in resource stocks.

👇👇👇

Energy & soft commodities are obviously not mining related.

See below the nonfarm payrolls for oil & gas extraction which is also at historical lows.

To recall:

The green agenda hasn’t even started.

See below the nonfarm payrolls for oil & gas extraction which is also at historical lows.

To recall:

The green agenda hasn’t even started.

The decline in agricultural workers look even more severe.

To be fair, this is not a domestic problem.

We’re are experiencing similar issues worldwide.

To be fair, this is not a domestic problem.

We’re are experiencing similar issues worldwide.

This pandemic has truly magnified a long-term trend of labor reduction and under investments in the commodities space.

Resource companies have been facing a deep recession for some time now with not enough workers willing to enter this industry.

Resource companies have been facing a deep recession for some time now with not enough workers willing to enter this industry.

On top of it:

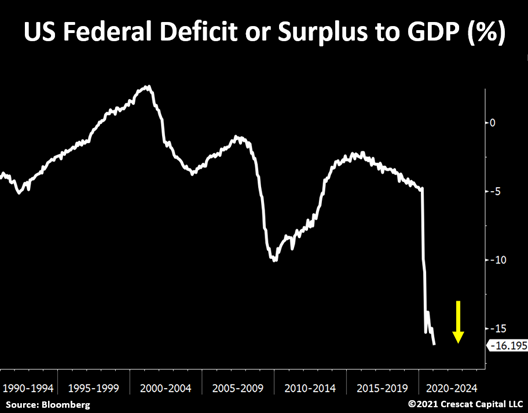

Government policies seem to be discouraging folks from return to the labor market.

People continue to leave the labor force like never before.

Government policies seem to be discouraging folks from return to the labor market.

People continue to leave the labor force like never before.

The supply shortage problem is much more permanent than most realize.

This upward pressure in consumer prices is probably just getting started.

This upward pressure in consumer prices is probably just getting started.

See a few examples:

“Coke Cola will raise prices to offset higher commodity costs”

cnbc.com/2021/04/19/coc…

“Coke Cola will raise prices to offset higher commodity costs”

cnbc.com/2021/04/19/coc…

“Higher commodity costs lead to price hikes from Kimberly-Clark and other consumer giants”

cnbc.com/2021/03/31/hig…

cnbc.com/2021/03/31/hig…

More broadly:

“Finance chiefs look to price increases to offset higher commodities costs”

wsj.com/articles/finan…

“Finance chiefs look to price increases to offset higher commodities costs”

wsj.com/articles/finan…

• • •

Missing some Tweet in this thread? You can try to

force a refresh