Some staggering data & commentaries from the Dallas Fed Manufacturing report.

Let’s dive in

👇👇👇

Let’s dive in

👇👇👇

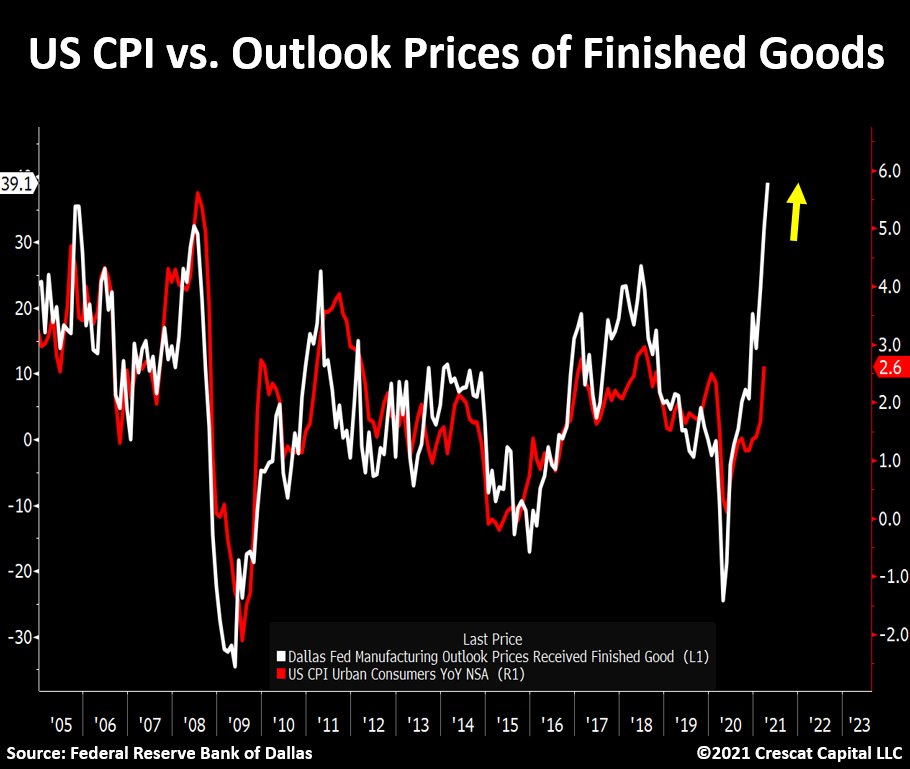

If we overlay this data from April versus the Consumer Prices Index from March, it suggests that CPI will likely be running a lot hotter than the extra 70bps increase from base effects that most expect.

Another interesting survey.

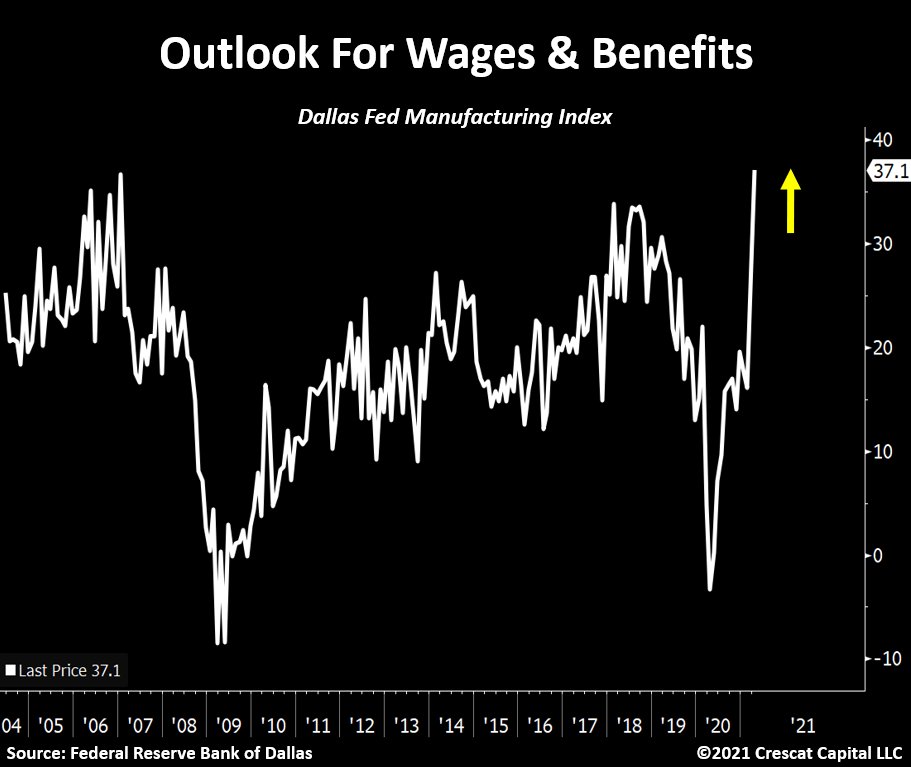

The outlook for wages & benefits just hit all-time highs.

In fact, this was the largest 2-month increase in the history of the data.

By far.

The outlook for wages & benefits just hit all-time highs.

In fact, this was the largest 2-month increase in the history of the data.

By far.

Finally, my favorite part.

The commentaries were staggering. Here are some highlights from different parts of the economy.

The commentaries were staggering. Here are some highlights from different parts of the economy.

Nonmetallic Mineral Product Manufacturing:

“It is very difficult to find employees to handle the significantly increased demand. We have never had this problem before in our 44-year history.”

“It is very difficult to find employees to handle the significantly increased demand. We have never had this problem before in our 44-year history.”

“Our human resources department reports that even at a starting pay for non-skilled-level workers of $14 per hour, we cannot fill our 20-plus open positions.

People don’t want to go to work when they can stay home and collect $400 or more per week in unemployment.”

People don’t want to go to work when they can stay home and collect $400 or more per week in unemployment.”

“We are experiencing rapid increases in the price of steel, lumber and cement.

This is increasing costs of production and will lead to higher prices eventually.

We are also having shortages at various times in getting these materials.”

This is increasing costs of production and will lead to higher prices eventually.

We are also having shortages at various times in getting these materials.”

Other important comments from primary metal manufacturing:

"We are having raw material supply constraints and rapidly increasing costs occurring, leading to concern regarding inflation."

"We are having raw material supply constraints and rapidly increasing costs occurring, leading to concern regarding inflation."

Transportation Equipment Manufacturing:

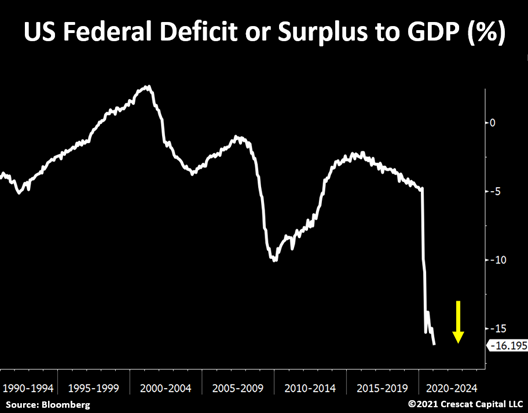

“Material shortages are crippling.

Government payments are damaging the job market. Unchecked government spending is a time bomb.

Unfulfilled demand is the only positive, and it will dissipate.”

“Material shortages are crippling.

Government payments are damaging the job market. Unchecked government spending is a time bomb.

Unfulfilled demand is the only positive, and it will dissipate.”

Food Manufacturing:

“Freight costs have risen dramatically, having a dramatic impact on the cost of moving goods both in and out.

Ocean freight has gone up four to five times in cost.

Trucking supply is increasingly tight.”

“Freight costs have risen dramatically, having a dramatic impact on the cost of moving goods both in and out.

Ocean freight has gone up four to five times in cost.

Trucking supply is increasingly tight.”

“Government stimulus money given to individuals has drastically reduced the number of people seeking a job and reduced the incentive to show up and do their job.

Labor is becoming a real problem as a direct result of the handouts.”

Labor is becoming a real problem as a direct result of the handouts.”

Machinery Manufacturing:

“We need to hire people, but it’s difficult when people are making $15 per hour to stay at home on unemployment.

We are seeing material inflation—prices for raw goods (steel) are rising dramatically.”

“We need to hire people, but it’s difficult when people are making $15 per hour to stay at home on unemployment.

We are seeing material inflation—prices for raw goods (steel) are rising dramatically.”

Wood Product Manufacturing:

“The increase in business, both organically and from new business, is putting a huge strain on the supply chain in building products across the whole spectrum.”

“The increase in business, both organically and from new business, is putting a huge strain on the supply chain in building products across the whole spectrum.”

Printing and Related Support Activities:

“Inflation is real; raw material prices are going goofy, and everyone is blaming it on COVID-19 and the freeze. It sounds like a good time to raise my prices then as well.”

“Inflation is real; raw material prices are going goofy, and everyone is blaming it on COVID-19 and the freeze. It sounds like a good time to raise my prices then as well.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh